Strekoza2/iStock Editorial via Getty Images

Cineworld PLC, Regal Cinemas UK-based parent filed for bankruptcy protection. All that has actually happened is a quickening of a process begun in the late 1990’s – closing smaller theaters.

The Megaplex revolution, started by the AMC Grand 24, forced cinema operators to reinvest in new physical plants to accommodate 18+ screens with stadium seating and modern concessions management. At the same time, most operators could not get out of old leases that were sinking their cash flows without filing for BK protection.

Cineworld/Regal is simply continuing that winnowing process from all the theater acquisitions they have completed while consolidating the U.S. domestic cinema market. If you look at the first list Regal submitted for lease rejections, none are Entertainment Properties (NYSE:EPR) owned. EPR is simply caught in the drama.

Deeper Dive into Cinemas

I learned about theater-level operations and cash flows when I worked for 3 different chains internationally and domestically (Virgin, Landmark and Reading). I bought, sold and modeled theaters for almost 5 years.

Film Zones

You may have noticed the same film doesn’t play across the street in another chain’s theater at the same time. That’s because the distributors along with theater operators define a film zone where only one chain will have the license to show the film for the length of the engagement.

Theaters do not buy copies of the films they show, instead they license on a revenue split that typically gives the distributor 90%+ of box office ticket sales over the first two weeks (except for the very high end theater where the splits are lower to cover higher theater costs) before lowering each week until the theater can retain 50%+ of ticket sales. Most films leave the market well before hitting the best splits for the theater. One notable exception this year has been Top Gun: Maverick – it has long “legs.”

Film zones are a critical component to competition where megaplex theaters dominate their zones. They dominate because megaplexes offer the distributor the most flexible auditorium configurations to capture the most box office sales. A theater with 18+ screens has auditoriums that may range from 500 seats to less than 100. That permits a more optimal screening strategy that works for everyone except the operator of an older multiplex in that same zone. The other operator’s multiplex will systematically be strangled by having inferior product. Meanwhile, multiplexes owned by the megaplex operator in the area do fine – like an aircraft carrier fleet uses support ships to cover its geographic area more completely.

Getting rid of those older multiplexes has challenged the industry for almost two decades and is why I avoided investing in any established chains. Only AMC has avoided having to reorganize under Ch.11, and only barely at that.

Theater Profitability

A well-run megaplex (18+ screens) should earn a better than 25% cash on cash leveraged return on about 35% capacity utilization from my experience. That’s kind of extraordinary when you consider how low the capacity utilization is. For decades, operators have sought ways to fill those vacant times without any systematic success. There are one-off stories like the theaters at UC Irvine that double as classrooms during the day and other schemes like broadcasting operas, but not much more.

Most of the profit comes from concessions, where margins on soda and popcorn are 90%+. Megaplexes very comfortably cover their rent obligations and all the leases have box office overage clauses that generate excess rent when the box office is growing again (COVID has deeply disrupted the box office and it is recovering its pre-pandemic levels).

Bankruptcy and Theaters

When a theater operator like Cineworld files for Chapter 11 protection, the operator submits lists of leases and other executory contracts it is rejecting. Those it accepts, it accepts. Any renegotiation has already taken place before a list is submitted.

A theater operator in Chapter 11 will not reject or even renegotiate a profitable megaplex theater for three reasons:

- Competitors want these megaplexes and will assume the lease as is;

- If the operator loses the lease, it also loses the film zone which will hurt any other theater it has in that zone; and

- Without a critical mass of screens, the operator loses buying power with distributors.

Every theater in the EPR portfolio is a megaplex theater. Cineworld will not reject these leases because they need a critical mass of positive cash flowing theaters just to emerge from Chapter 11 in our experience.

What experience? Chains have been filing for protection for years and years but none have rejected or renegotiated megaplex leases unless that megaplex was a loser. Can a megaplex lose? Sure. Locate it poorly, have demographics moving against you, or simply take a bad deal to protect market share (these things have happened, but not lately).

Point is, over the last 20 years of various chains filing for protection, none were EPR theaters because the EPR portfolio was built by industry insiders who were a part of AMC theaters before EPR was spun out to the public as a REIT. AMC, when it was owned by the Durwood family (they invented the megaplex), was very well respected for its site selection process.

The risk of a theater coming back to EPR is very low.

The Future for Cinemas

Despite the doomsayers over the last 40 years, every new technology has expanded the first run box office. Although attendance has been on a long, slow decline over many, many decades, revenues still outstrip the decline. Even with the price increases, cinema remains among the cheapest per capita per hour entertainment sources competing for our dollars (studies I conducted years ago for a theater chain). Just compare it to amusement parks, bowling centers, mini-golf, water parks, etc.

As long as the Hollywood studios remain strong and produce products the public wants to watch, cinemas will remain a vital social experience. The studios have never been stronger. Ancillary revenue streams have grown so exponentially that a franchise film can power studio profits for many years beyond the box office (Star Wars, James Bond, most Pixar films, etc.).

One last fact – when studios do not launch major films through the first-run cinema market, overall film-related revenues are not as high. This has continued to be demonstrated through COVID-19 and all that streaming capacity. Watching at home is just not the same experience as a properly constructed megaplex filled with strangers all experiencing the same thing at the same time. You can see how studios held back certain franchise films rather than burn them through streaming before a box office run.

Cinemas are fully recovering and will grow as Hollywood gets its product flow back to normal.

Valuation

EPR is hard to compare to other real estate investment trusts (“REITs”) – it mostly focuses on experiential real estate with an education investment tail. Not your typical REIT. But why is it a good REIT deserving of a more market valuation today?

Theater Lease Quality

Theater leases tend to be 20-30 years with options to extend and escalator clauses. Because megaplexes often anchor other entertainment uses, they get favorable lease rates with revenue overage clauses so the landlord can participate in the theater’s success in exchange for a break on the base rent.

While the operator may not be a strong credit, the location and earning power of the theater is the key. It’s key because the brand of the theater doesn’t matter as much as theater quality and the film that is showing. Every chain has its dog theaters and its stars. EPR tends to own the stars – modern physical plants with superior acoustics and equipment.

Other Experiential

These include local ski areas, golf courses, entertainment related properties, lodging etc. None is as dominant as theaters, and only golf represents any real risk. While golf gained popularity during COVID-19, owning golf real estate has not been a good business for many years. I owned a course for 11 years in central Arizona, and we see our former President’s golf courses have mostly sucked wind this last decade, too.

If there is real risk in EPR, it’s in golf, which represented 14.3% of EPR’s 2022 revenue though the first six months. By contrast, AMC and Regal represent 30% of EPR revenues alone over that same time period. However, we are not hearing about golf problems as other REITs like VICI Properties (VICI) enter that market, too. Maybe the cycle is changing for the better. I am not close enough to it anymore to have an insider view.

Education

While a separate reporting segment, it comprises less than 7% of EPR operating revenues. EPR is no longer growing this segment so we give it no special attention in our valuation.

Performance and Numbers

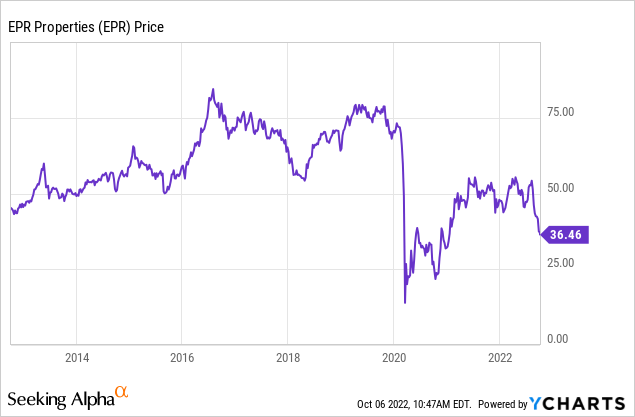

Looking at EPR’s stock price over the past 10 years, we can see how COVID-19 upset its stability and that it has not fully recovered.

The following table compares EPRs current values to the REIT sector in general to see how it is valued today:

| Summary Statistics |

Price/AFFO (NTM) |

| EPR | 7.72x |

| Mean | 12.66 |

| Median | 12.98 |

| High | 20.11 |

| Low | 4.14 |

| Standard Deviation | 3.34 |

Source: TIKR (25 REITs used for summary stats)

Clearly, the market is showing EPR no love based on continued cinema attendance concerns and cinema operator stability by valuing it in the bottom 15%. That has happened in past recessions only to see EPR fully recover:

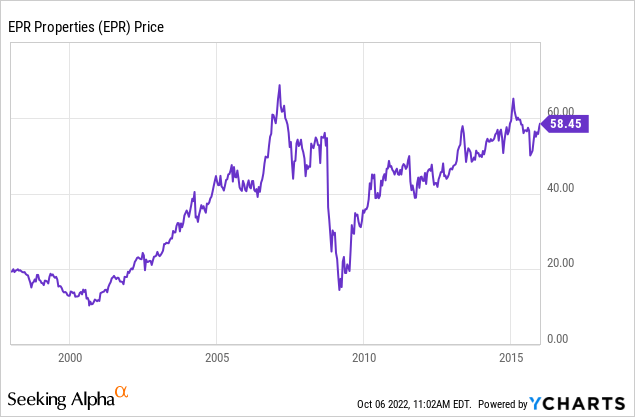

We can see that EPR declined in both the 2001 recession, led by theater bankruptcies at Regal, United Artists, Edwards etc. and during the 2008 Great Recession, when people feared films would suffer from consumer spending pullbacks.

We also see how EPR recovered each time because these events did not cause actual damage to cash flows. The logic around the Great Recession proved wrongheaded because films tend to do better in recessions as a cheap per hour per capita entertainment source. EPR appears not to deserve this discount. But what about relative peer valuations?

I have selected Four Corners Property (FCPT), VICI Properties (VICI) and Gaming & Leisure Properties (GLPI) as relative peers. Four Corners is primarily in restaurants while VICI and GLPI serve the casino industry. These are not like EPR, but they are all experiential and thought to be recession-resistant.

| Ticker | Est. Nav* |

Share Price 10/5/22 |

Discount/ Premium to Est. NAV |

Dividend Yield (NTM) |

LTM Payout Ratio (Diluted FFO) |

Revenue Growth (5 yr. CAGR) |

5 yr. Beta |

| EPR | $50.07 | $37.26 | 65.62% | 8.86% | 82.81% | 2.93% | 1.61 |

| FCPT | 25.74 | 24.02 | 92.84 | 5.54 | 82.61 | 10.75 | .87 |

| VICI | 29.97 | 31.37 | 104.45 | 4.97 | 161,53** | 150.39** | 1.02 |

| GLPI | 47.74 | 47.34 | 99.15 | 5.96 | 93.33 | 5.27 | 1.01 |

Source: SA, TIKR and my calculations.

*TIKR

**2022 MGM acquisition distorts this calculation.

We can see our peer group sits close to its Estimated Net Asset Values based on Wall St. Analysts as compiled by TIKR. Our peers also pay a lower dividend yield with sustainable payout ratios and higher growth rates than EPR. They have also been less volatile over the last 5 years.

EPR is clearly undervalued, but by how much?

Conclusions

EPR is undervalued, but not by as much as it appears. EPR’s growth rate is at best half that of its peers the last 5 years. Therefore, it should rate some discount to NAV for not keeping up with the market. I will assign only a 5% hit because asset quality still rules the roost.

That still leaves the gap between 65.62% of NAV to 95% of NAV, which is partly explained by higher volatility. That volatility is likely a result of the higher dividend payout policy which increases perceived risk as well as most investors not understanding the theater risk inside the EPR portfolio.

Given those two factors, we see there is more room for the EPR stock price to decline as the Fed searches for the top of interest rate rises. In past recessions, we have seen the EPR share price crack 50% or more, which implies we could see an EPR share price in the low $30’s before this is all over. It is not deserved, but it happens and we cannot ignore irrational pricing in recessions.

We rate EPR a strong hold today if you already own it. It’s also a great entry point to begin accumulation if you do not. We will look to double down on our positions if EPR trades around $30 per share.

Be the first to comment