gorodenkoff

Overview

EPAM Systems (NYSE:EPAM) is a software services provider. More specifically, it has a variety of contractors that it contracts out to firms – primarily for software development, but also for related tasks such as product development. While based in the US, it leverages a global base of employees to deliver its services.

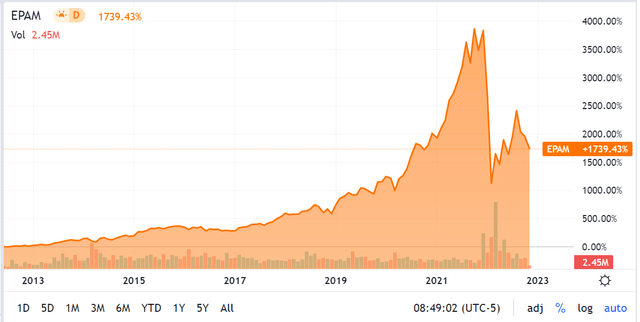

Founded in 1993 and entering the public markets via IPO in 2012, EPAM has performed quite well since then, appreciating to 17x its IPO price:

SeekingAlpha.com EPAM 11.7.2022

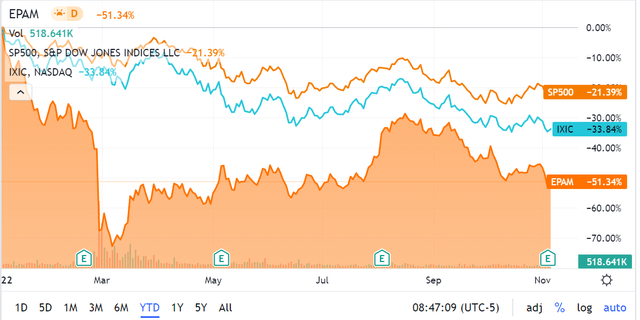

This year has seen significant depreciation for EPAM, where it is currently underperforming both the S&P as well as the NASDAQ composite:

SeekingAlpha.com EPAM 11.7.2022

Also worth noting is that this stock has very high institutional ownership, coming in at 94.14% as of this article. Seemingly, a broad cross section of mutual funds and asset managers seem to like owning this stock. We will investigate the financial picture of EPAM to see if it would also be a good addition to our portfolio.

Financials

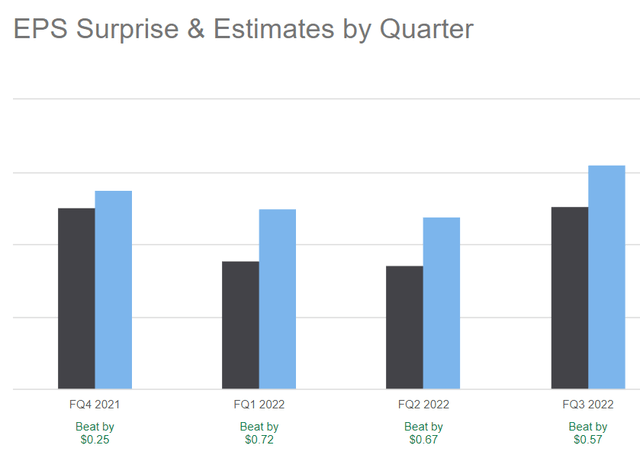

EPAM last announced earnings on 11/3/2022 for Q3 2022. It was able to beat on both GAAP & non-GAAP EPS, as well as revenue. This marks the company’s 4th back-to-back EPS beat; for such an institutionally popular stock, I take this as a good sign.

SeekingAlpha.com EPAM 11.7.2022

A few quarters don’t tell the full story, of course. Since the stock has depreciated far beyond the overall market this year, we should expect that it has been facing headwinds for its business. Starting with revenue, we see that this is actually not the case. Revenues have continued growing at a healthy pace throughout the last 2 years, without a single down quarter:

SeekingAlpha.com EPAM 11.7.2022

The cost of delivering revenue has also appeared steady, notably decreasing in the most recent quarter even as the firm grew its revenues.

Looking into the income side of the books, EPAM also posted a strong quarter of operating income – $44M more than what it generated in Q3 2022 and double what it generated in Q3 2021:

SeekingAlpha.com EPAM 11.7.2022

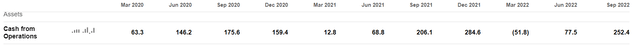

This also came in for what was an excellent quarter as to cash from operations:

SeekingAlpha.com EPAM 11.7.2022

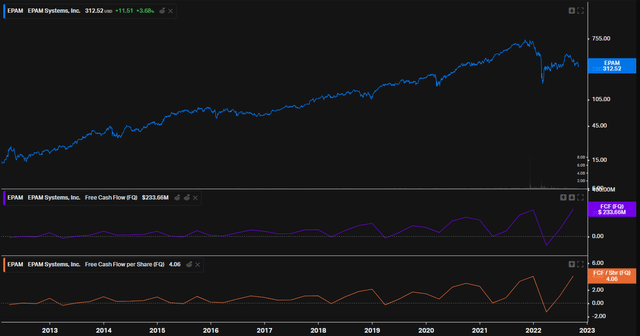

This recent quarters performance allowed EPAM to generate $4.07 cash per share, an excellent indicator. While this cash flow per share is not as steady as some may like, the firm has generated positive cash flow per share in the last 9/10 of quarters.

SeekingAlpha.com EPAM 11.7.2022

Looking at this cash flow generation across the lifecycle of the firm, we see a consistent engine for free cash flow. While recent quarters have been somewhat more volatile, this volatility also extends in the upward direction – with record levels of free cash flow as well as cash flow per share in the last several quarters.

Koyfin.com EPAM 11.7.2022

With this set of metrics, it is fair to call this a robust and steady business. The trendline for cash flow generation is also good to see, and is sensible from an economic perspective.

Since EPAM is in the business of contracting software engineers and related professions, its services may actually be facing increased demand during a period of volatility in the technology sector, as we are now seeing. Instead of bringing on full-time workers, companies can contract out more of their work; this allows them to maintain a much higher degree of flexibility while continuing operations. EPAM, while certainly not unique, is large-scale player in this space and appears to be well-positioned to weather present economic headwinds due to the nature of its offering.

Conclusion

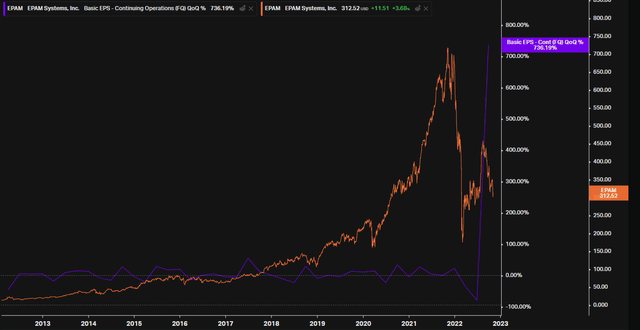

EPAM presents a robust fundamental picture across revenues, earnings, and cash flow generation. Although the stock is not cheap on an absolute level, it has depreciated beyond the major indices this year and may present a buying opportunity. This notion is supported by looking at its price/earnings trendline; while the stock has been down from historical highs, its basic EPS (EPS from operations per share) is significantly up from historical norms.

Koyfin.com EPAM 11.7.2022

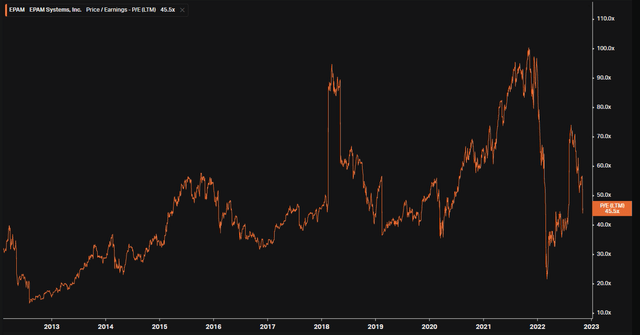

This stock tends to trade at a very high earnings multiple, sometimes as high as 100x. On a rolling 12-month basis, however, it is right in the middle as to historical norms.

Koyfin.com EPAM 11.7.2022

The concern here is that the market as a whole may not return to the levels of buoyancy that we were accustomed to seeing during the times that it traded that those multiples. It is difficult to say when exactly we will return to those price levels; the history the markets indicates that it can take a decade or even longer.

Nonetheless, EPAM presents a good opportunity to preserve value and possibly generate appreciation in the current economic context. As mentioned previously, their business of contracting out technology workers should actually benefit from the present labor market volatility within the technology sector. This fact, in addition to what is a strong fundamental picture, makes this stock a buy from my perspective.

Be the first to comment