Shaiith/iStock via Getty Images

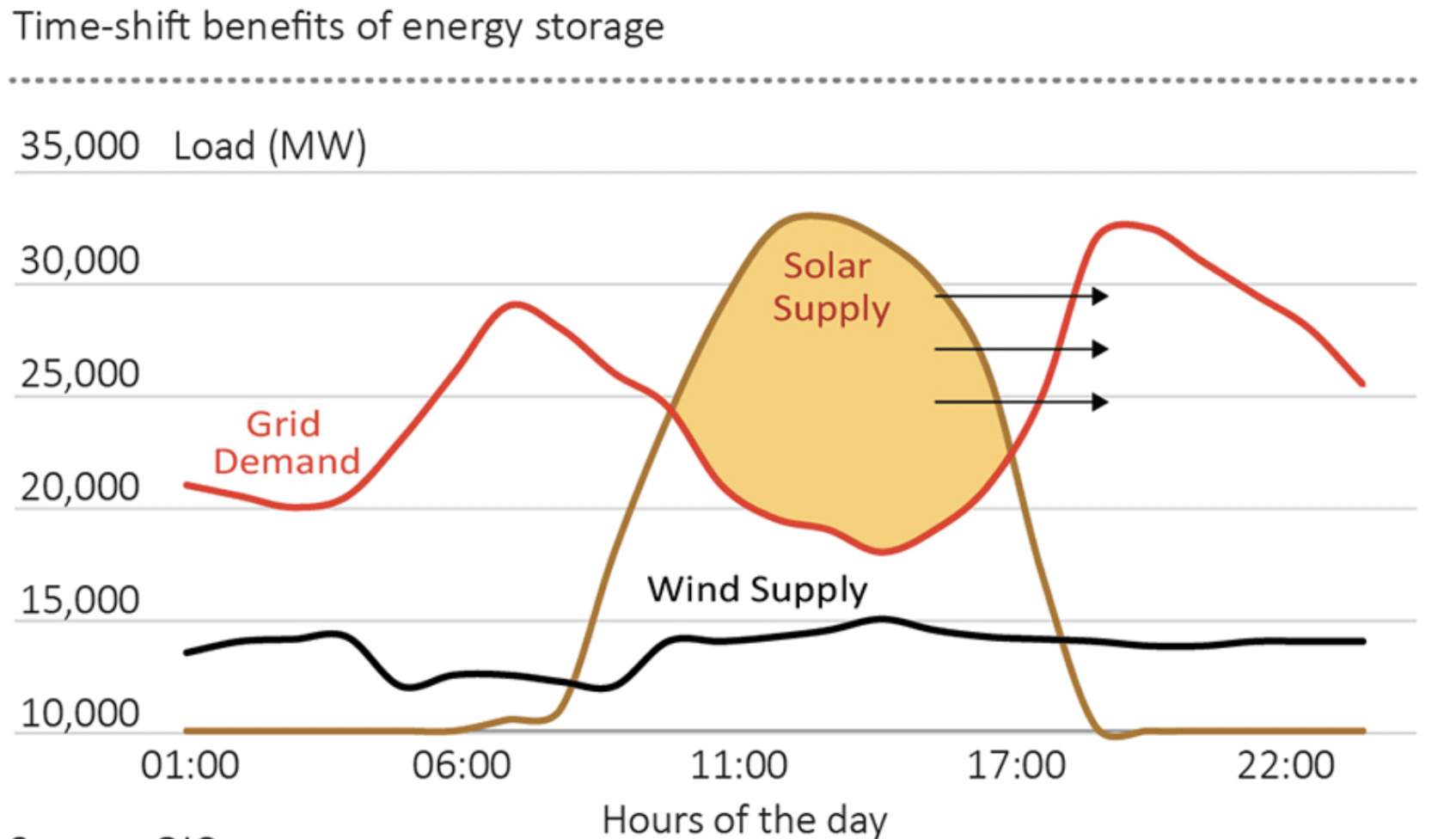

Eos Energy (NASDAQ:EOSE) is building a zinc-based alternative to the current dominant lithium-ion battery chemistry used for utility, industrial, and commercial energy storage applications. The growth of renewable energy as a per cent of the US energy supply mix has led to structural demand for long-duration energy storage to smooth out the intermittency of renewables like solar and wind. This type of energy storage will help supercharge the transition to renewables and makes these sources of clean energy more viable by allowing for excess energy to be stored and then dispatched during periods when the sun is down and when wind speeds are not optimal. Critically, the intermittency of renewables forms a forever bottleneck that can only be solved by the type of utility-scale storage solutions being developed and sold by Eos.

Energy, Climate & Sustainability

The Edison, New Jersey-based company has developed the Eos Znyth battery, a proprietary zinc-based aqueous static battery. Znyth has 3-12 hours of discharge capability and uses more accessible non-precious, non-toxic, and non-flammable raw materials. The battery is also designed to last 5,000 cycles for a 15-year calendar life with no subcooling or pumps required. Further, Znyth has higher availability across a wider temperature range than lithium-ion batteries and has up to 80% efficiency in 100% depth of discharge applications, making it one of the most efficient non-lithium long-duration energy storage solutions.

Battery storage is forecasted to become a $56 billion revenue opportunity by 2027 with the forward momentum already clear with 90% of new interconnection requests being renewables and/or storage since 2019. Further, at least $390 billion is expected to be invested globally in new renewable power generation capacity in 2022 with energy storage sure to form an important part of these zero-carbon power generation stacks. Hence, as Eos commercializes Znyth, it should face quarters of strong growth as most grids have been built on the just-in-time principle. This renders them ill-suited for renewables without material investment in energy storage.

This ramp will be hastened by the recently signed Inflation Reduction Act, which will see the US government allocate $370 billion over the next decade till 2032 to decarbonization initiatives. The Act is set to supercharge an even faster shift to renewables by bringing forward new utility-scale deployments through what is set to be an unprecedented level of government intervention. The Boston Consulting Group has forecasted that the incentives included in the Inflation Reduction Act could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030. This would be up from around 20% of production currently. Indeed, utility-scale solar deployments are set to increase by 40%, around 62 GW, over pre-IRA projections through 2027. Hence, with the US rollout of renewable energy already undergoing a material ramp, the IRA now forms an 800-pound gorilla that will radically catalyse an even greater transition to renewables and will expand out the $56 billion total addressable market being chased by Eos.

Revenue Starts To Build Against Growing Demand From Renewables

The company last reported earnings for its fiscal 2022 second quarter. This saw revenue come in at $5.9 million, up from $600k in the year-ago quarter, and came on the back of booked orders that grew to reach $257.5 million. This was almost 4x higher than the year-ago quarter. Year-to-date booked orders now stand at $324.7 million, with the total order backlog at $457.3 million. Such strong growth proves that customers find the Znyth as a reliable energy storage alternative to lithium-ion batteries.

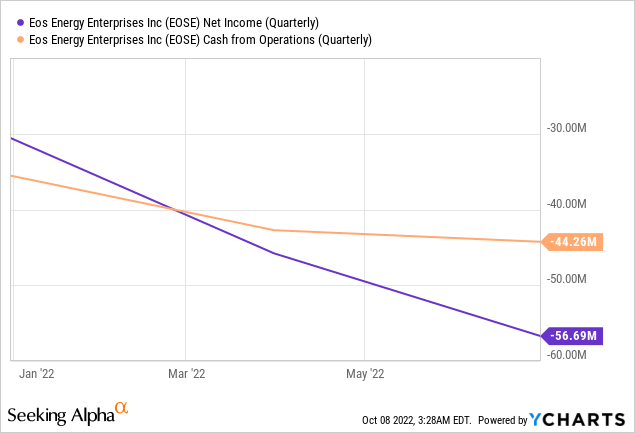

However, the company’s net loss increased to $56.7 million, marginally up from a net loss of $54 million in the year-ago quarter. This saw cash burn from operations come in at $44.3 million. This is a totally unsustainable position, as Eos ended the quarter with cash and equivalents of $16.3 million. Further, the company will soon need to ramp up capital expenditure to realize sales from its order backlog. Capital expenditure stood at $6.4 million during the quarter and will have to rise. Bulls would be right to point out that Eos has a low Capex model, with around $50 million required to build out 1 GWh capacity.

Energy Storage Company For A World In Transition

Built on a dwindling cash balance and hyper cash burn, the bearish trade continues to play out. The company is dangerously low on liquidity at a time when new investments are required to ramp production. Hence, the recently secured $85 million senior term loan facility forms an eleventh hour development that should help expand the runway until more long-term sources of finance can be secured. The loan can also be expanded by an additional $15 million, subject to the lender’s consent. Eos also still has an effective S3 shelf registration filed with the SEC for up to $300 million of common and preferred stock and/or debt securities, and has also applied for a DOE loan and a federal R&D grant. Both of these would be significantly less dilutive and expensive if granted.

As the company continues to grow its order backlog on the back of demand for battery storage capacity rising to match the growth of renewable energy, we could see a reversal of the current downtrend. There will be many different solutions to the intermittency posed by renewables, and Znyth might find itself as one of them if the company fully navigates its liquidity gap. I continue to sit on the sidelines though until the funding situation becomes more clear.

Be the first to comment