Akirastock/E+ via Getty Images

Introduction

When last discussing Enviva (NYSE:EVA), I saw two critical upcoming tests that would determine whether their dividends could be sustained heading into 2023 and as my previous article explained, I was skeptical these would be passed. Very interestingly, weeks later that a short-seller firm, Blue Orca Capital released their report that raised various concerns, including their cash generation and thus broadly echoed concerns that my previous analyses have raised. The response from management seemingly alleviated other concerns raised regarding the alleged ESG and accounting issues as their share price bounced back from its initial plunge. Although, even following the subsequent release of their third quarter of 2022 results, they are yet to completely prove the short-sellers wrong regarding their cash generation and by extension, the probability of a dividend cut, as discussed within this follow-up analysis.

Coverage Summary & Ratings

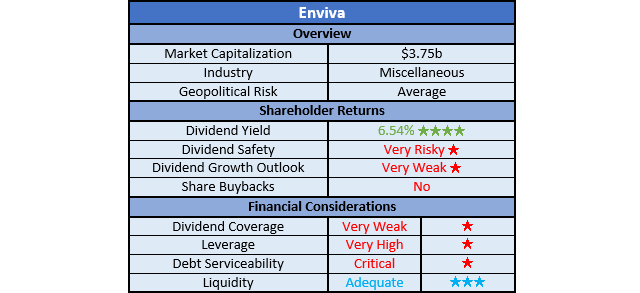

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

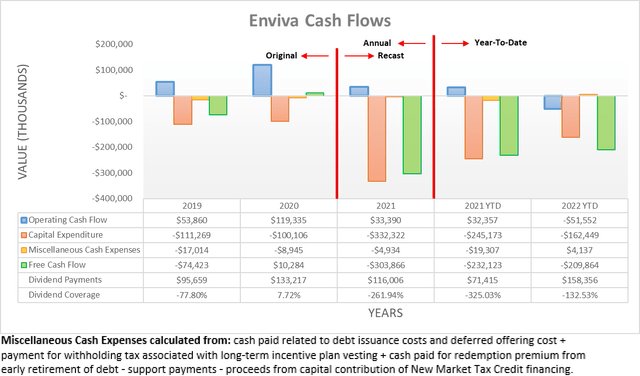

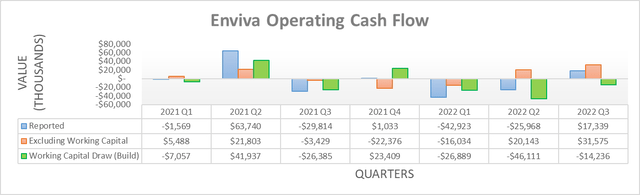

The first half of 2022 was marred by a cash burn, whereby their operating cash flow clocked in at negative $68.9m. Thankfully, the third quarter saw a slight reprieve but as their operating cash flow across the first nine months is still negative $51.6m, this is more so a case of “less bad”. Despite still not reversing their cash burn, they nevertheless sustained their dividends once again, which now sees these payments surge to $158.3m for the first nine months, thereby obviously far outstripping their cash inflows.

When zooming into their quarterly operating cash flow, to their credit, their results have been trending sequentially higher during 2022 with each passing quarter. Although, their $17.3m of operating cash flow during the third quarter still pales in comparison to their dividend payments of $52.8m during the same period of time. Even if removing their working capital build of $14.2m, this still fails to bridge the gap, which in my eyes, is alarming and sees them once again failing the first of the two critical tests that my previous analysis outlined.

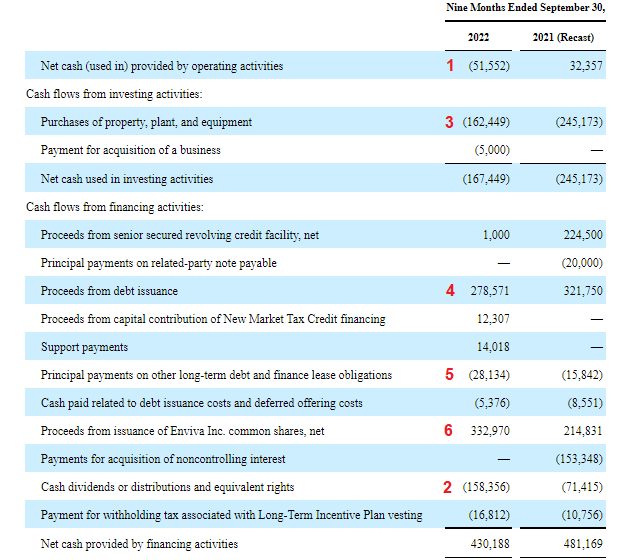

More importantly, in the weeks following my previous analysis, there were numerous issues raised within the short-seller report by Blue Orca Capital. Their report is very detailed and raises a number of issues, ranging from whether their ESG credentials are inflated or faked, as well as concerns regarding the accounting of their non-GAAP metrics, such as adjusted EBITDA. Whilst I personally have no comment on these two legal-related issues, they also raised concerns regarding their cash generation, which I have also raised in the past. Given the importance of this situation, I have included an extract from their cash flow statement to increase clarity for readers, whilst I explain why on this front, they are yet to completely prove the short-sellers wrong, regardless of whether Blue Orca Capital are correct about their other ESG and accounting concerns.

Enviva Q3 2022 10-Q

If interested in viewing the entire cash flow statement that shows the reconciliation of their GAAP net loss into their operating cash flow, you can find it quickly within their Q3 2022 10-Q by searching for any of the phrases or word combinations seen above. The first number is their operating cash flow during the first nine months of 2022, which is negative $51.6m, hence the brackets. Meanwhile, the second number is their dividend payments, which were $158.4m and similarly are within brackets as they represent a cash outflow.

This is not a small difference, the difference is staggering and it does not require an accounting degree to know that negative operating cash flow cannot possibly fund their dividend payments, let alone their accompanying $162.4m of capital expenditure, as denoted by number three. This is not merely an issue driven by their growth strategy but rather, it arises due to a lack of cash generated by their operations. If this were a newly-listed fast-growing tech company, it would not necessarily be concerning but no, this is a company founded in 2004 that currently pays a sizeable dividend, hence their high 6.54% yield as of the time of writing.

If looking back at their cash flow statement one more time, they plugged this massive cash flow gap by issuing $250.4m of debt, net of relatively minor repayments, as denoted by numbers 4 and 5. This was further helped by issuing $333m of equity, as denoted by number 6. Obviously, the latter make their dividend payments even harder to fund and is highly dependent upon their share price remaining sufficiently high.

In the last decade-plus that I have been analyzing investments, both here on Seeking Alpha and elsewhere privately beforehand, not once can I recall seeing one that produced desirable medium to long-term returns whilst making dividend payments greater than operating cash flow. Nor have I ever heard any highly respected investor, such as Warren Buffett, recommend investors seek companies displaying such attributes.

Until their operating cash flow at least matches their dividend payments, they are yet to completely prove the short-sellers wrong, at least in my eyes. To achieve this feat, which as a reminder is very easy for almost every other company, it would not only require their negative operating cash flow during the first nine months of 2022 to turn positive during the fourth quarter but also surge to levels never-before-seen, thereby at least matching their dividend payments.

To place a number on this task, their dividend payments during the first nine months of 2022 were $158.4m with $52.8m of this arising during the third quarter. As their quarterly dividends per share and outstanding share count are broadly static across the third and fourth quarters, their dividend payments for 2022 should amount to circa $211.2m by the time the fourth quarter ends. Plus, they would also have to recoup their negative $51.6m of operating cash flow during the first nine months and thus as a result, it sees a grand total of $262.8m as the minimum to match their operating cash flow to their dividend payments and have any chance of completely disproving the short-sellers. At no point in time have they ever generated such an immense amount of cash, which leaves a dividend cut or even a suspension looking ever more likely, especially given the state of their financial position.

Regardless of the validity of their non-GAAP metrics, companies ultimately live and die on cash. Need to pay a supplier? They want cash, not “adjusted EBITDA”. Interest on debt is due? Once again unsurprisingly, the bank wants cash and not a theoretical number. Obviously, the list goes on and thus in my eyes, until such time as this most basic of a test is passed, it trumps any other concerns raised by Blue Orca Capital.

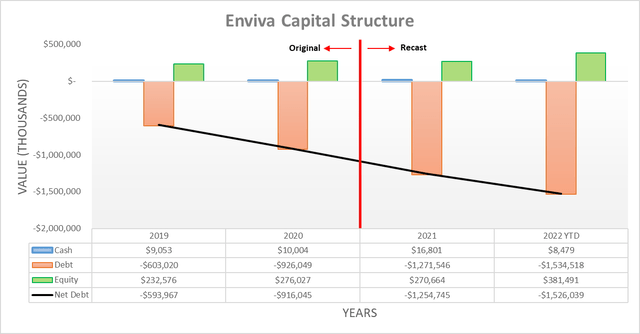

It was a given their net debt would have increased during the third quarter of 2022, although the extent was still quite shocking, as their net debt landed at $1.526b and thus a staggering circa 22% higher versus its previous level following the second quarter, when it landed at $1.244b. Unlike the first half, they did not issue any new equity during the third quarter and thus as a result, their balance sheet was forced to endure this heavy debt load. Once again, this highlights the gravity of their situation because such a large increase during a routine quarter without any material acquisition is very troublesome, especially as their cost of debt continues climbing higher.

If looking at the same bond as when conducting my previous analysis in early September 2022, its yield surged to 8.855% versus its previous level of 7.347%, which is not a positive indicator for the second of the two critical tests that my previous article outlined regarding their ability to access debt markets. Whilst some of this increase is likely down to tighter monetary policy, it nevertheless is clear that debt markets are not loving their outlook and thus risk profile, as the inverse relationship between yield and risk sits at the core of financial markets.

Even more importantly, it also raises issues going forwards because they will require more debt, unless they start matching cash inflows to outflows for the first time ever but given their history to date, such an outcome appears very unlikely. Or alternatively, unless they issue more equity but obviously, this only makes their dividends ever more difficult to fund and would accelerate the dividend cut I expect to be forthcoming.

Once again as when conducting the previous analysis, due to their operating cash being negative across the first nine months of 2022, plus barely positive during the third quarter, it would be pointless to assess their leverage in detail, as it renders their leverage ratios useless with logically invalid negative results. Instead, their gearing ratio can serve as a backup measure, their net debt of $1.526b and equity of $381.5m sees it currently standing at 80.00%, which unsurprisingly represents another increase versus its previous result of 74.15% following the second quarter, thereby further pushing pass the threshold of 50.01% for the very high territory. This same logic also applies elsewhere to their debt serviceability, as negative cash flow performance obviously leaves it critical with interest expense requiring a continued mixture of debt and equity issuances.

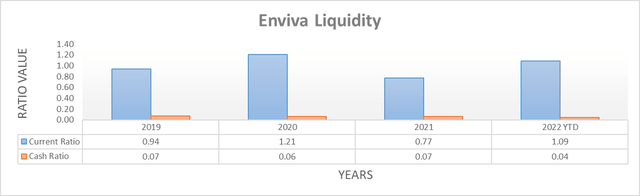

After seeing their net debt surge during the third quarter of 2022, at least it was positive to see their adequate liquidity not change too significantly with their current ratio increasing modestly to 1.09 versus its previous result of 0.96 following the second quarter. When looking into the details of where they sourced their additional debt load, it was primarily from issuing $245.9m of tax-exempt green bonds that do not mature until July 2052 and carry a surprising interest rate of only 6.00%. To give credit where its due, this is a smart move but at the same time, quite a lot has changed within debt markets since their issuance in July 2022 and thus, it remains to be seen whether such a feat can be repeated. During their third-quarter conference call, no mention was made regarding subsequent debt issuances in the weeks following to the end of the third quarter, thereby leaving investors guessing.

Whilst their liquidity appears adequate based on the data currently at hand, this could change quickly unless the fourth quarter of 2022 sees a dramatic turnaround for their cash generation. Since they still funded part of their debt load during the third quarter from their credit facility, its remaining availability dropped to $97.9m versus its previous availability of $135.6m following the second quarter. This further raises the importance of the fourth quarter because without either stronger cash generation or more debt and equity issuances, they will quickly deplete their credit facility and given their cash ratio of only 0.04, they cannot operate without its help.

Conclusion

Love them or hate them, short-sellers still play an important part in the market as allowing both bulls and bears makes for a fairer system. Regardless of whether other investors share this view, if Enviva proves itself to be a solid company, then short-sellers will likely suffer significant losses but if not and the shorts are eventually vindicated, this also is due to Enviva and their strategy. Whether their ESG credentials are inflated is not my biggest concern, nor how they derive their non-GAAP results but rather, their lack of cash generation is my biggest concern. On this front, they are yet to completely prove the short-sellers wrong, as their operating cash flow is nowhere near close to matching their dividend payments and thus makes a cut looking ever more likely, if not a suspension. The mere passage of time will ultimately prove either the bulls or bears correct and since I am obviously in the latter group, I now believe that downgrading to a strong sell rating is appropriate given their continued lack of cash generation, rising debt and higher bond yields.

Notes: Unless specified otherwise, all figures in this article were taken from Enviva’s SEC filings, all calculated figures were performed by the author.

Be the first to comment