tadamichi

Introduction

Despite a surprise corporate restructuring late in 2021, sadly the numbers are not still stacking up for the dividends of Enviva (NYSE:EVA) and thus as my previous article warned, it leaves their moderate yield of 5.41% very risky. Whilst their dividends were sustained throughout the last few months, there are two critical upcoming tests to pass during the second half of 2022 to see them sustained heading into 2023, as discussed within this follow-up analysis that also reviews their subsequently released results for the second quarter of 2022.

Executive Summary & Ratings

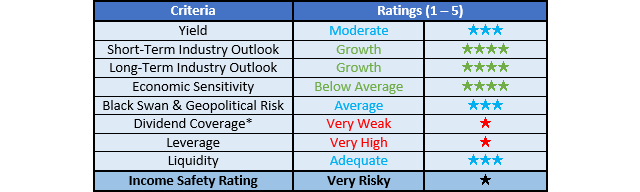

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

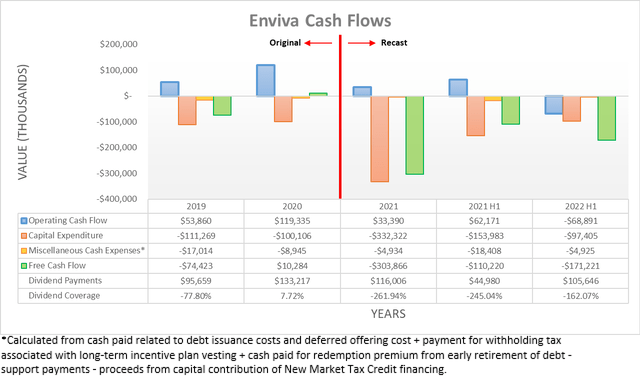

Following the first quarter of 2022 seeing operating cash flow of negative $42.9m, disappointingly, it continued during the second quarter with their result for the first half now down to negative $68.9m and thus leaving a result of negative $26m for the second quarter. Similar to the first quarter, this means that they endured a cash burn to merely operate their company, let alone fund any investments. If considering these, their capital expenditure of $97.4m and $4.9m of relatively minor miscellaneous cash expenses as listed beneath the graph included above, it ultimately leaves their free cash flow at negative $171.2m for the first half and by extension, their dividend payments of $105.6m are oversized.

Admittedly, if digging deeper there are some green shoots, although relatively speaking, they appear far too small to rectify this problem. If removing their temporary working capital movements from their operating cash flow, it sees their underlying operating cash flow for the second quarter at $20.1m, as they saw a working capital build that weighed down their surface-level results. This is clearly better than the first half that saw an equivalent result of negative $16m but alas, even $20.1m per quarter of operating cash flow is relatively insignificant versus their capital expenditure and dividend payments. When looking ahead into the second half, it will be very interesting to see if their operating cash flow scales higher with their accrual-based earnings that are forecast to accelerate, as the graph included below displays.

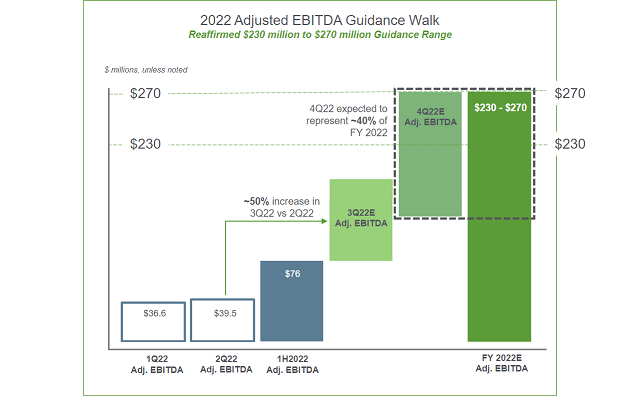

Enviva Second Quarter Of 2022 Results Presentation

When examining the breakdown of their adjusted EBITDA guidance for 2022, it sees the third and fourth quarters accelerating versus the first and second quarters. The first of their two critical upcoming tests centers around the extent this translates into higher operating cash flow and whether it can exceed their dividend payments for the full year. As a reminder, to pass this test at the barest minimum, across the full year they need to generate enough operating cash flow to at least slightly exceed their dividend payments. Whilst dividend coverage would normally be assessed via free cash flow, given this special situation, it is more important that they first pass this easier test.

No company, regardless of their industry can safely return more cash to shareholders than their operations generate, as the resulting debt funding to bridge the gap is guaranteed to result in higher leverage. Whilst the prospects for their financial performance to accelerate during the second half of 2022 are positive, thus far their results indicate that it would still be insufficient. If their underlying operating cash flow of $20.1m during the second quarter is compared against their adjusted EBITDA of $39.5m, it shows a cash conversion rate of roughly half, absent of temporary working capital movements. Unless this dramatically improves during the second half, even the $270m upper end of their adjusted EBITDA guidance would only equal operating cash flow of circa $135m, assuming no material working capital builds or draws. Since their dividend payments were $105.6m during the first half, naturally, the full year is going to see these north of $200m and possibly more, depending on whether they issue more equity as was routinely been the case in the past.

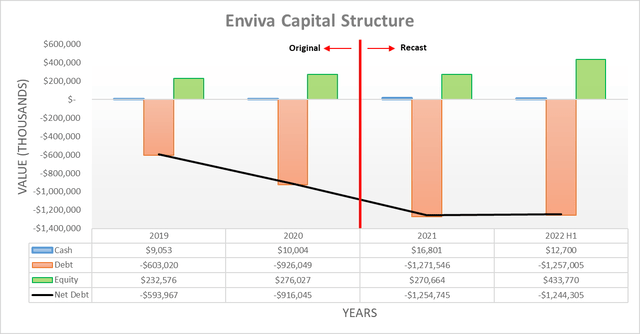

Despite their underlying cash flow performance improvement during the second quarter of 2022, their oversized dividend payments made higher net debt unavoidable with it landing at $1.244b and thus 13.91% or $151.9m higher than its level of $1.092b when conducting the previous analysis following the first quarter. This is a particularly large increase to see from only one quarter and whilst this is merely back to essentially its same level at the end of 2021, the only reason it decreased during the first quarter of 2022 was due to a $333.6m equity issuance, which is now already been depleted, as was broadly expected when conducting my previous analysis. Unless they see dramatically higher cash flow performance during the second half of 2022, this could deplete their remaining capital very fast, as subsequently discussed, which is a very concerning prospect as monetary policy tightens and their bond yields rise significantly, as the graph included below displays.

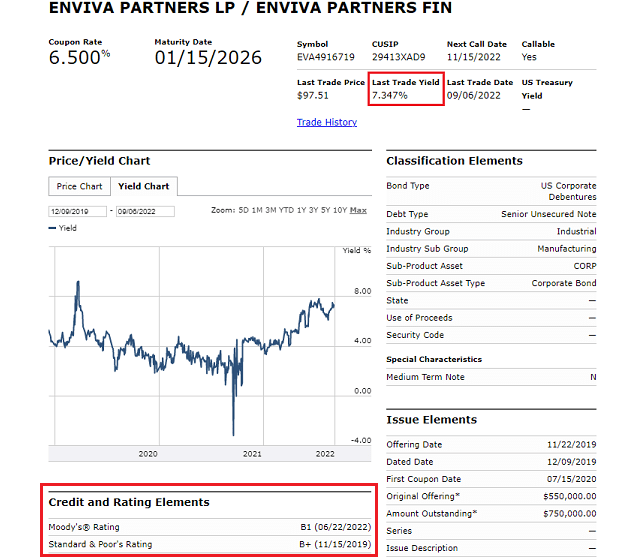

Finra Markets Via Morningstar

It can be seen that the tighter monetary policy of 2022 is not being kind to their bonds, which have endured a sell-off that leaves their yield pushing towards heights not seen since the panic of 2020 when the Covid-19 pandemic rocked the financial system. Even though their yield at slightly over 7% is not too high in the grand scheme, its direction is nevertheless still concerning given their likely requirement to source new external capital, especially since central banks are very likely to further tighten monetary policy. The fact that their credit rating is also only B+ as seen above, it makes this situation even more precarious, as anything below BBB- is non-investment grade and commonly referred to as “junk”. If they lean upon issuing equity, this would obviously make their already oversized dividend payments even more burdensome and thus not rectify anything.

Similar to the previous analysis, as their operating cash flow is negative and remains barely positive even after removing their working capital build, it would be rather pointless to assess their leverage in detail. If viewing their gearing ratio, their equity of $433.8m sees it currently standing at 74.15% and thus unsurprisingly, it once again represents another increase versus its result of 68.55% when conducting the previous analysis following the first quarter 2022, thereby further pushing pass the threshold of 50.01% for the very high territory.

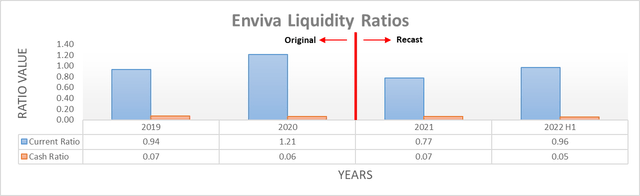

Even though their liquidity was not been an area of concern in the past, if nothing else, it was positive to see it improving during the second quarter of 2022. Thanks to their working capital build, their respective current and cash ratios climbed to 0.96 and 0.05 versus their results of 0.79 and 0.02 when conducting the previous analysis following the first quarter. Whilst this once again ensures their liquidity is adequate, since monetary policy is widely expected to further tighten it will be important to monitor going forwards given their history of requiring external capital as a result of their oversized dividend payments.

At the moment, their credit facility retains a further $135.6m of availability but considering their cash burn was circa $150m during the second quarter of 2022 alone, relatively speaking, this is not much capital and thus could be depleted very fast. Since their credit rating is already well into the “junk” territory and their bonds have seen a sell-off, their ability to access debt markets presents the second critical upcoming test.

Conclusion

It was positive to see green shoots within their underlying cash flow performance during the second quarter of 2022. Although without a dramatic improvement during the second half, they are unlikely to pass the first of their two critical upcoming tests whereby their operating cash flow at least slightly exceeds their dividend payments. Only time will tell how they fare with their second critical upcoming test as their ability to access debt markets in this era of tighter monetary policy is partly outside of their control and thus when wrapped together, I believe that maintaining my sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Enviva’s SEC filings, all calculated figures were performed by the author.

Be the first to comment