Thossaphol

Co-produced with “Long Player”

I spend a lot of my time talking about “The Income Method”. This is my style of investing, which focuses on the current and future income that investments produce. The Income Method helps produce a stream of income, which allows retirees to take out the income they need while reinvesting the excess to ensure the income stream grows year after year.

You’ve probably also heard about “dividend growth investing” or DGI. This style of investing focuses on buying investments that have growing dividends. The problem is that DGI investors often focus on investments with very low yields today. Investors think they need to buy something yielding 2-3% and wait for growth. Such a DGI portfolio might produce a livable income in 20-30 years, but that does little to help investors looking for income today.

Yet the reality is that you are not faced with choosing between high yield and dividend growth. Investors can manufacture their own dividend growth by reinvesting a portion of their dividends. When your portfolio yields 8-10%, it is much easier to earmark 25% for reinvestment. Just as you earmarked a portion of your income for investment when your income came from an employer.

On occasion, you will come across a holding that is the best of all worlds. It provides dividend growth and pays a high yield today!

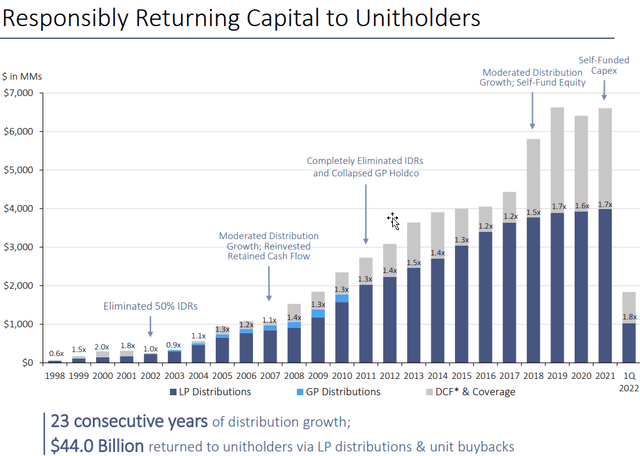

Enterprise Products Partners (NYSE:EPD) is one such investment. EPD has hiked its dividend every year since IPO. This MLP is time-tested through periods where many of its peers have faltered. When other MLPs were cutting their distributions, EPD kept hiking. It now has an impressive 23 years of dividend growth under its belt, with the most recent hike in July – its second raise this year.

EPD has a historically high yield that is not likely to last, as the share price keeps moving higher. This midstream company is well located near some of the hottest basins in the industry that have a history of strong growth. The industry is likely to continue to grow for the foreseeable future. That means that EPD will continue to offer an attractive combination of income and growth.

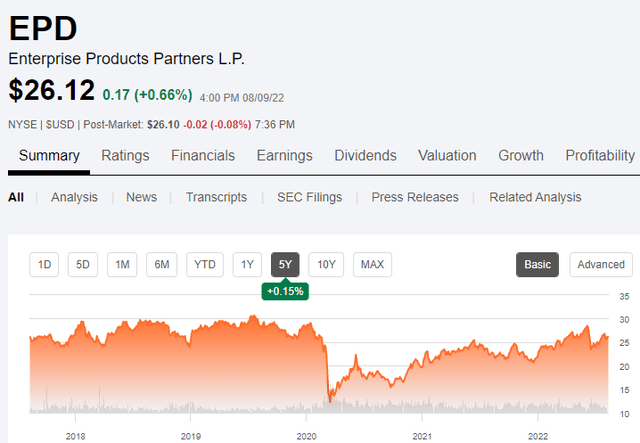

Common Unit Price History

The common units have not yet participated in the recovery as I originally expected.

Part of the reason for this lack of recovery participation is a general feeling that EDP cannot grow. The beginning of any recovery generally involves a lack of expansion projects because production volumes are recovering from an industry downturn. In this case, the fiscal year 2020 downturn was one of the worst on record. Therefore, it will take some time for volumes to recover from the lack of activity in the fiscal year 2020.

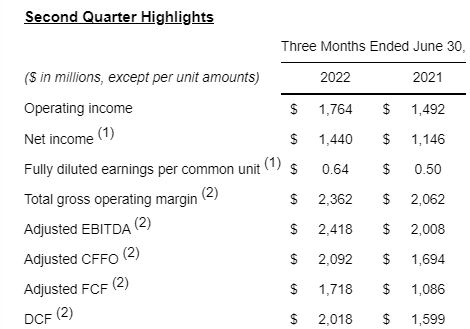

Yet in the second quarter, earnings increased nearly 30% from the year before. This is just the kind of report good management can be expected to have. To have a return that averages in the teens, this company will have some good reports when commodity prices are robust to offset the lackluster comparisons in any downturn. Generally, midstream earnings hold up well in a downturn, but they don’t usually grow much because volumes do not grow.

In the meantime, investors have a roughly 7% yield on a distribution that was recently raised for the second time in the current fiscal year. The combination of distribution increases has exceeded market expectations. There was originally a slew of opinions that the EPD would minimally raise distributions for the foreseeable future due to a lack of capital projects. That opinion is now “out the window”.

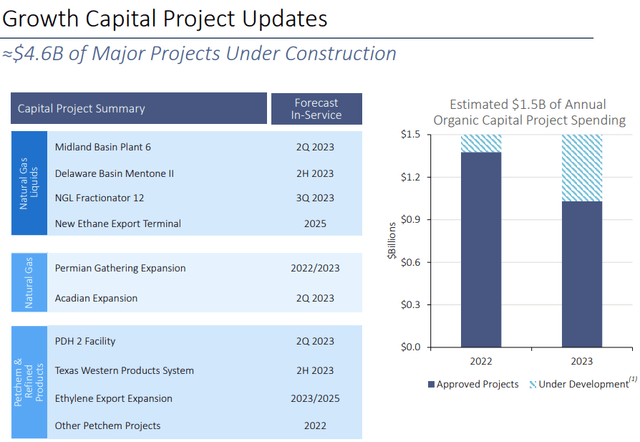

Expansion Growth

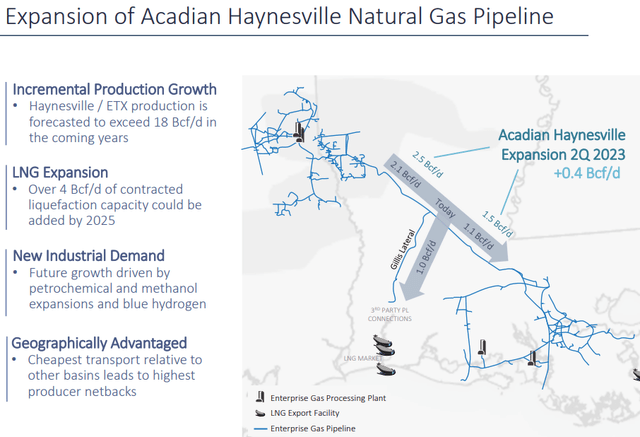

Management and the industry are now beginning to talk about expansion projects in the future. Admittedly, this discussion did not come fast enough for Mr. Market (who was focused on the declining capital budget instead of the increasing free cash flow). That may be about to change as industry volumes continue to increase. (Source: EPD June 23, 2022, Company Presentation)

Enterprise Products Partners June 23, 2022, Company Presentation

Ironically, the first basin that appears to need expansion capacity happens to be Haynesville. I had noted awhile back that discussions for capacity expansion were already underway there. It appears to be that those discussions are now firming up into tangible expansion projects. Management expects to get its fair share of Permian projects once expansion talks turn into actual projects. But in the meantime, the Haynesville expansion projects will likely give the partnership a head-start over many competitors not located in this basin.

Growth is expected to remain cyclical with higher business growth rates during the boom times and lower growth rates during the upstream cyclical down periods. Overall growth during the whole business cycle is likely to remain in the middle to upper single digits because this is now a fairly large partnership.

EPD Q2 2022, Earnings Conference Call

Note that the list of potential growth projects is growing. The market is focused on that $1.6 billion and thinks future growth will be lackluster, but this industry rarely can resist robust commodity prices. The balance sheet repair mode of the industry is ending rather quickly.

So growth within cash flow is likely to be surprising because debt repayments will largely be accomplished by year-end – note that this is nothing new. This cycle has happened many times before.

Management will supplement that growth as it did recently with opportunistic small acquisitions. Those acquisitions add growth at a time when capacity expansion is “out of the question” to provide an overall higher rate of growth. The latest acquisition is widely the reason for the largely unexpected second distribution increase in the current fiscal year. Yet this company has a long history of acquisitions that are clearly not priced into the current unit price.

The Green Revolution

Management also has this company well positioned to participate in the green revolution. EPD signed an agreement with Occidental Petroleum (OXY) to provide transportation of carbon dioxide with the ultimate goal of having less carbon dioxide emissions.

Management also has the company well positioned to participate in the rapidly growing hydrogen market. The very long-term future of this company is not one of demise and extinction as the green revolution takes hold (if that happens). Rather, it is a changing business model as different products are transported in the future.

Natural gas midstream business is EPD’s emphasis. Natural gas is the primary source of hydrogen and ethane used to make many of the materials used in the green revolution. Management has been further expanding its fee business to provide raw materials that many manufacturers can use “right away” without having to do some of these services themselves.

There is a very strong likelihood of transportation requirements for the midstream industry growing in the future even if the switch to green energy succeeds. No matter how fast the green revolution proceeds (or fails), natural gas is likely to be a raw material of choice with growing needs for the foreseeable future. That preference “goes double” for a partnership like this one providing the services needed to make things easier on end-use customers.

Financial Strength

This company has one of the highest financial strength ratings in the industry. Management has built upon that advantage to repaying the debt to some of the lowest levels in the industry. That should allow management to choose to completely finance some projects with debt if the demand for new capacity should cause an unexpected high point in expansion activity.

Similarly, this management is fairly choosy about customers. That provides shareholders additional protection during severe downturns like the one in the fiscal year 2020. Those kinds of customers suffered less than was the case for some competitors and those customers also recovered faster.

The company does protect its business with “take or pay” clauses. There is also some fee-based business as well. But volumes still can fluctuate somewhat during a downturn. Therefore, customer recovery is an important factor when considering an investment in midstream because it does have a long-term effect on distribution growth.

Distribution Growth

This partnership issues a K-1 tax form. Investors need to know all about K-1 issuing partnerships before they invest.

EPD Investor Presentation June 23, 2022.

This “dividend king” has long been raising the distribution in good times and bad. The top-notch financial rating combined with the well-covered distribution ensures that the distribution will be raised in the future.

Management has combined the increasing distribution with common unit repurchases to ensure a margin of safety that assures future distribution increases. The combination of organic growth, common unit repurchases, and the distribution assure shareholder returns in the teens for the long-term unit holder. That is a very good return for an income investor who wants the relatively low risk of a midstream investment.

Midstream companies often follow the cyclical nature of their upstream customers despite the relative stability of the business when compared to upstream. A company of this quality is a good purchase consideration anytime there is a pullback as was recently signaled when the price of oil retreated.

I keep buying these units because the distribution is about equal to the long return of the average investor. Yet the investment grade rating is among the highest ratings in the midstream industry. The debt levels are among the lowest levels for the midstream industry. That margin of safety is not real common in any industry. This is clearly a “sleep well at night” stock with a potentially above-average future return when risk-adjusted.

Furthermore, the company offers a great inflation hedge with its exposure to natural gas and natural gas liquids (‘NGLs’).

Valuation

The relatively high yield of the shares points to an undervalued common unit even before one considers the enterprise value when compared to EBITDA. The distribution is extremely well covered with low debt (and high financial strength). Therefore, at some point, these units should trade at a premium to many in the industry.

EPD Second Quarter 2022, Earnings Press Release

Management shows annual cash flows of roughly $8.8 billion in the preceding 12 months of the fiscal first quarter. The cash flow should exceed an annual rate of $9 billion with the acquisition before the fiscal year ends.

This is a conservatively run company., so it is no surprise that EBITDA is about the same as cash flow. The market cap shown above is $55 billion and management reported about $30 billion in debt at the end of the first quarter. That means that the enterprise value (even including the small amount of preferred stock) is less than 10 times cash flow (a very conservative way of valuing any partnership) or using the more liberal EBITDA measurement.

A company of this quality should trade closer to 15 times EBITDA. That would make provide at least 50% upside potential from the current price, not taking into account any future growth in income. But now cyclical growth is probably “on the way” as the upstream industry sees the need for more capacity. Today’s report of 30% growth over the comparison quarter will only make the future valuation better as growth continues (though probably not at a 30% pace).

The industry has long had low resistance to restraint during periods of high prices. It is in the interest of each individual producer to produce as a group in excess of what the industry needs to grow to maintain decent commodity prices. Therefore, a period of overproduction is in the future of the upstream industry that the midstream producers need to service.

Shutterstock

The Future

This company services the growing natural gas industry that has a bright future as part of the green movement. Oil volumes are not very material here. The partnership also has some highly prized export capacity as well for certain products produced. The export market is a rapidly growing area of the business. So those export terminals will only increase in value as time passes.

Additionally, management is looking to expand the business into services that allow end users to make products important to the green revolution. Turning ethane into ethylene (a source for plastic in the green revolution) would be an example. EPD is set to grow no matter the direction of the upstream industry future because the company has the expertise and the flexibility to adjust.

Even though the common unit price has probably risen a little slower than anticipated, the midstream industry is likely to return to pricing relationships that were last seen at the peak of the last business cycle. That implies some common unit pricing recovery potential as well as continuing distribution increases.

The long-term growth plans of management should provide tax-deferred distributions for years to come (even if the deferrals do not include all the distribution sometimes). Investors should consult a tax advisor before they invest in all the nuances of a K-1, but this is possibly one of the best-run companies in the midstream industry, offering an investment-grade balance sheet, inflation hedge, and fast business growth. The big fat yield is only set to get bigger. EPD could be the biggest winner in your high-yield portfolio!

Be the first to comment