onurdongel

(Note: This article appeared in the newsletter on August 3, 2022.)

Enterprise Products Partners L.P. (NYSE:EPD) was often cited as one of those dull “three yards and a cloud of dust” type companies. The partnership would be boring and never, ever going to be a big winner. But companies that hit a lot of doubles and singles are far more likely to hit that desired “home run” while providing sustainable long-term returns that are above average.

So, many investors go for “recovery potential” and highly leveraged companies because “obviously” that is going to allow them to retire early. Some actually accomplish their goals. But the large majority of investors appear to average an 8% or so return that is largely driven by dividends. Therefore, the typical “homerun” strategy just does not deliver the results that investors anticipate.

Leveraged Play Example

Some of this is due to the “casino atmosphere” of these higher risk stocks. I covered California Resources (CRC), for example, when the stock ran from single digits to close to $50 back around 2018. From the comments in my articles, obviously when the stock lost about 80% of its value and then ran up back in to the $20’s or so, it was obviously time to “back up the truck.” The problem was, it never ran up again to that extent because 2020 arrived along with a bankruptcy filing.

If my mailbox was any indication, then in true casino fashion a lot of disgusted investors “gave up” because all their money was gone. But hope springs eternal, and there are just enough of these to keep that casino atmosphere in business. So, despite the average long-term returns shown above, the average investor keeps trying for an outsized return not realizing the damage that one of these failures causes to long-term portfolio returns.

Enterprise Products Partners

On the other hand, a well-run company purchased at a reasonable price should be expected to beat the long-term averages considerably. It does not take a whole lot of above average performance to make a considerable long-term wealth difference.

| Compounded Returns | |||||||

| 8% Return | 10% Return | 12% Return | |||||

| Year | |||||||

| 0 | 100 | 100 | 100 | ||||

| 1 | 108 | 110 | 112 | ||||

| 2 | 117 | 121 | 125 | ||||

| 3 | 126 | 133 | 140 | ||||

| 4 | 136 | 146 | 157 | ||||

| 5 | 147 | 161 | 176 | ||||

| 6 | 159 | 177 | 197 | ||||

| 7 | 172 | 195 | 221 | ||||

| 8 | 186 | 215 | 248 | ||||

| 9 | 201 | 237 | 278 | ||||

| 10 | 217 | 261 | 311 | ||||

Source: Author

Notice that for an extra 4% return, the money makes nearly 50% more over a 10-year period. That is one of the things about compounding. Similarly, a setback like a bankruptcy or a big decline in a position can take several years to “make-up.”

In the case of Enterprise Products Partners, the distribution king status really advertises the steady forward progress even if the company should report a down year. That is what investors need to go for.

The company distributions to unit holders has gone up for decades. Midstream is not completely immune to the cyclical nature of upstream. But earnings are not nearly as volatile, either. The overall result is steady earnings progress that is likely to continue for the foreseeable future. That distribution growth likely demonstrates that any annual setback will be more than overcome in the future to continue to provide a return averaging in the teens.

A Material Setback Comparison

Compare this to recovery favorite Energy Transfer (ET). This is a company that is widely regarded as “too big to fail.” But you do not need the company to fail in order to suffer a long-term portfolio appreciation setback. All you need is challenges that cost the company, and this one has had them in the past and the future appears full of potential pitfalls.

Much has been made of the latest distribution increase. But even with that increase, the distribution is still not back to where it was before the distribution cut. In comparison to a company like Enterprise Products Partners, the long-term record here is still one of “catching up” to that distribution cut. Furthermore, there are future challenges that may result in a significant setback. That quite possibly means these common units deserve the current price because the future is not all that certain.

As a trading opportunity, a profit could possibly be made on these distribution increases. But if my emails are any indication, many do not know when to take a profit and walk away from a company like this. So, rather than posting profits on the investment position, many run the risk of losses from a potential future setback that brings the long-term portfolio return to average or worse.

The Future

A conservative company like Enterprise Products Partners provides a well-covered distribution with virtually no future threats of a distribution cut. The table above demonstrates that an investment setback that pushes the investor to a lower rate of return makes a big difference in wealth accumulation after 10 years.

The Enterprise Products Partners common units are likely to head to higher ground with considerably below-average risk. Energy Transfer Partners common units may head to higher ground. But there are several challenges ahead that could delay progress.

The common units of Energy Transfer declined on the distribution cut (even though that distribution was considered to be well-covered before the cut). The units have yet to come back from that decline. They are unlikely to make progress until a few of the future challenges are resolved to the satisfaction of the market.

For the buy-and-hold (with forgetting to keep an eye on) investor, clearly Enterprise Products Partners is the superior choice.

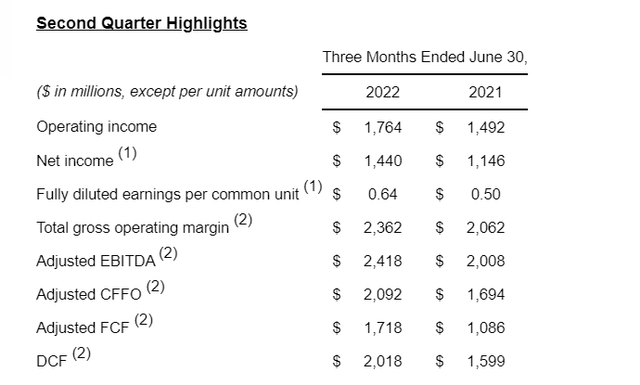

Enterprise Products Partners Second Quarter 2022, Operations Summary (Enterprise Products Partners Second Quarter 2022, Earnings Press Release)

This boring company just released a very strong second quarter 2022, earnings report. While a lot of riskier investments continue to recover from setbacks, this company is moving forward at an unexpectedly robust rate.

Then again, good managements tend to surprise on the upside. The upstream activity is unlikely to be declining anytime soon. Management did report that the firm backlog of projects increased. That means there is more growth from the current level of activity in the future even if it is not as large as the current report.

That is the key here. Steady growth often does much better than the flashier “hot stocks” of the current time because many investors do not know when to quit. A company like this is likely to sustain any pricing gains made.

Investors still have to watch for periods of over-pricing. But a buy-and-hold investor is unlikely to be disappointed holding a stock like this for the long term because the steady performance should lead to long-term appreciation with minimal risk (at least compared to upstream). At the end of 30 years when many are looking to retire, these units will have been far more rewarding unless one is a disciplined trader that can handle fast moving trading situations with the discipline to “walk away” with profits.

Be the first to comment