onurdongel

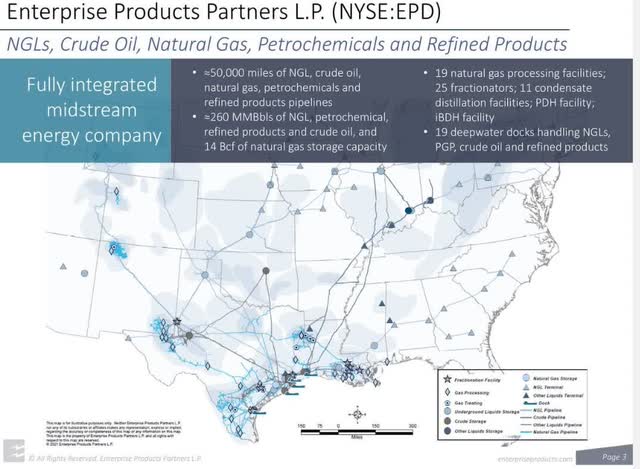

Enterprise Products Partners (NYSE:EPD) is one of the largest pipelines in the US. With more than 50,000 miles of pipelines, it covers great swaths of the United States with pipelines, storage facilities, and processing capabilities in all the key areas.

In addition, it has increased its distribution every year for the last 23 years, ever since its IPO in 1998.

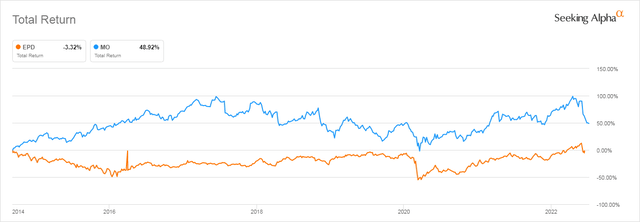

In spite of all that, EPD’s Total Return is a negative 3% since September 9, 2014.

I wrote about this issue last year “Enterprise Products Partners: Slow But Steady Loses The Race” and in spite of excellent results from EPD since then, the price has continued to drop.

That particular article set a record for me with more than 500 comments.

In this article, I will look at the share price issues with EPD and virtually all the other MLP pipelines.

Financial metrics, then and now

Looking at EPD’s financial metrics, we can easily see that it is much more financially stable now than in 2014 in spite of the significant price decline of 39% (Line 1) over the 7-year period.

Note: Revenue decreased because EDP sold some Gulf of Mexico Assets in 2015.

Seeking Alpha and author

From an investor’s standpoint, everything looks better except the share price.

Gross margins are up (line 4), earnings are up (Line 10) and Debt/EBITDA (line 14) is down.

The most impressive number, however, may be the Free Cash Flow (Line 15) which is up 385% lowering the Price/FCF to a very healthy 8.6x. And every year the distribution went up increasing by a total of 26% over the 7 years.

There is absolutely nothing not to like in the comparison.

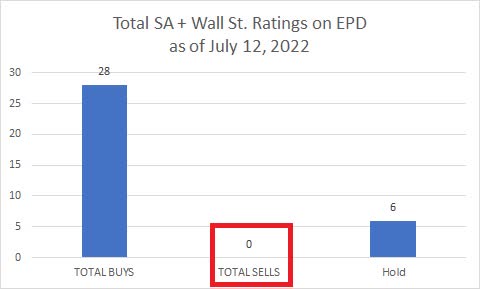

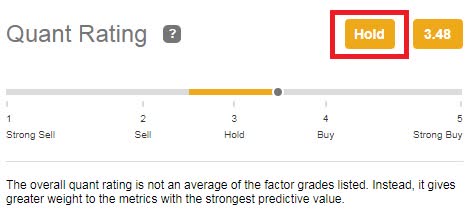

Analysts’ ratings are Buy while Quant ratings are Hold

When you combine the rating numbers from Seeking Alpha contributors and Wall Street analysts, you have a very strong Buy signal with zero Sells and only 6 Holds out of 34 ratings.

Seeking Alpha and author

On the other hand, Quant ratings are Hold making one wonder what the quants see that the rest of us don’t.

Seeking Alpha

Interestingly back in January, Seeking Alpha contributors had EPD with 8 Buys, 4 Holds, and zero Sells and EPD’s price has risen since then from $23.79 to $25.04 so perhaps the turnaround has begun.

Are oil pipelines the new cigarettes?

In some ways, anything related to oil is tarnished by the lack of support by various and sundry ESG (Environmental, Social and Governance) rules concerning investment criteria. If you have a business that has anything to do with fossil fuels, you are subject to investment avoidance.

Cigarette manufacturers like Altria (MO) have had that issue for decades and in spite of constant government attacks have shown significantly better total returns since 2014 than EPD.

Interestingly, both MO and EPD have massive and growing dividends of 8.7% and 7.3% respectively.

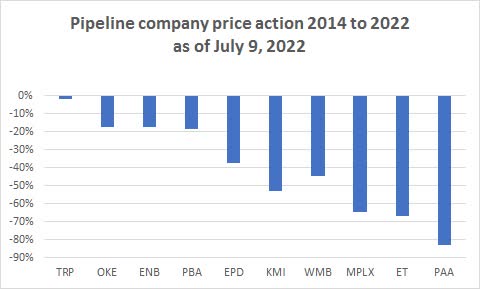

EPD is not the only pipeline taking a beating since 2014

Looking at other major pipelines, you can easily see that decreases in share price have been across the board. EDP is right in the middle of the group, down 38% since 2014.

NASDAQ and author

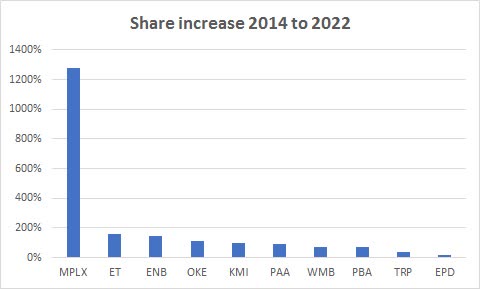

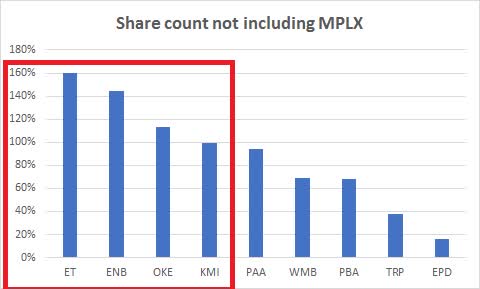

But low and behold, the other key data point, shares outstanding since 2014 gives some logic to the price drops.

Every single pipeline company shown in the above price chart has increased its share count from a little to a lot.

Seeking Alpha and author

MPLX’s change in share count is so immense it distorts the other ones on the list so here’s what it looks like without MPLX.

Seeking Alpha and author

That’s a lot of extra shares over a fairly short period of time, showing the “expand at all cost” mentality during that period as companies exchanged shares for more assets.

Going back to our cigarette company comparison, Altria’s share count decreased by 7% since 2014. I wrote an article about MO that is very similar to this one about EPD “Is Altria Stock A Buy During The Current Dip? Yes, JUUL Being Gone Is A Good Thing“.

What does ESG have to do with it?

I am convinced that the prevalence of ESG investment restrictions has had a negative effect on all fossil-fuel-related companies, even those like Exxon (XOM) that have increased in price significantly over the last year.

It is clear that every dollar invested in ESG-approved sectors such as wind and solar is a dollar unavailable to be invested elsewhere in the fossil-fuel energy market.

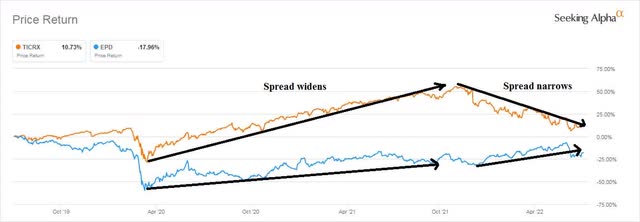

This can be easily seen by comparing the TIAA-CREF Social Choice Equity Fund Retail Class Adv (TICRX) price with EPD’s price.

Notice that beginning during the depths of COVID-19 effects on the market until the winter of discontent beginning last December, the gap in value between EPD and green investments like TICRX widened considerably.

But beginning last winter, as Russia was massing troops at the Ukrainian border, the gap between TICRX and EPD began to close.

This could also be seen in the European Union’s recent announcement that natural gas would from now on be considered “green energy”.

Perhaps this is the turnaround point for EPD and other pipelines as politicians finally accept the fact that fossil fuels are going to be required in ever-increasing amounts for decades to come. Much of that European gas will be delivered to LNG facilities by EPD.

Conclusion

So how do I answer the question I posed in the title “How Can A Great Company Have Zero Total Return Since 2014?”?

It happens when external political forces beyond the company’s control wreak havoc on vital industries that happen to be out of favor. But eventually, perhaps after 7 years, common sense and logic prevail, chasing the bogeyman of bureaucratic nonsense to the sidelines.

I think that time has come for EPD and in fact, I think the YTD bottom has been seen, and going forward EPD will move up.

Enterprise Products Partners is a strong buy for those investors looking for steadily increasing dividends/distributions and modest capital gains.

Be the first to comment