Maria Vonotna

Thesis

Omega Healthcare Investors, Inc. (NYSE:NYSE:OHI) is a leading triple-net lease REIT focused on long-term secular trends in nursing facilities. It derives most of its revenue (71.9% as of Q2) from Skilled Nursing Facilities and Senior Housing (21.1% of Q2 revenue).

Omega’s portfolio was also impacted by the COVID-19 pandemic, as its operators have yet to recover their occupancy rates fully while facing elevated labor costs related to shortages. As a result, OHI stock was battered from April 2021 highs to May 2022 lows, losing nearly 40% of its value. However, OHI has recovered remarkably from its May lows, even as it’s still reeling from ongoing restructuring discussions with its operators.

Furthermore, management’s commentary from its Q2 earnings call provided much-needed clarity relating to Agemo, which is critical for its portfolio, as it accounted for about 6% of its contracted rental base.

We deduce that OHI’s valuation seems relatively well-balanced now, after its remarkable recovery from its May lows. While we don’t consider it overvalued, we believe OHI could continue to face near-term downside risk and is unlikely to revisit its April 2021 highs anytime soon. Despite that, management’s confidence in maintaining its dividend payout should lift buying sentiment. Therefore, a collapse back to its May lows seems unlikely unless unforeseen downside surprises from its operators delaying rent further occur.

Hence, we believe it’s appropriate to wait on the sidelines for well-needed digestion from its August highs to provide a higher potential for outperformance moving ahead from a total return framework (capital appreciation + dividends).

The Worst Seems Over For Omega Healthcare

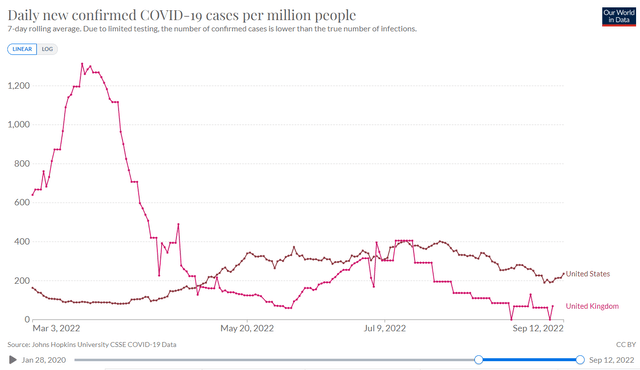

COVID cases in the US and UK (7-Day rolling) (OWID)

Management stopped short of declaring an all-clear for Omega investors. However, it appears that the surge in COVID cases has stabilized. Furthermore, it has also been trending down, as seen above. Therefore, we are confident that the caseload that has hampered the occupancy rates in Omega’s operators should subside moving forward.

Management also seems confident, despite near-term headwinds relating to the restructuring plans with Agemo and other operators. Management articulated:

So [Agemo’s restructuring] has not been completed. We’re still working through it. It does involve asset sales, and we really can’t lay out the details until that’s really done. But it is similar to the Guardian situation in terms of we are selling and/or releasing a pretty fair number of facilities. We expect any cut to the pre-contractual rent to be modest at best or worse. (Omega FQ2’22 earnings call)

Therefore, we surmise the market had anticipated a continued recovery from OHI’s May lows with more visibility on the delays with its leading operators. Consequently, it should help lift the earnings visibility for Omega through FY23, as it laps comps without the contribution from its troubled operators. Therefore, we believe the positive recovery in OHI has justifiably reflected its near-term upside.

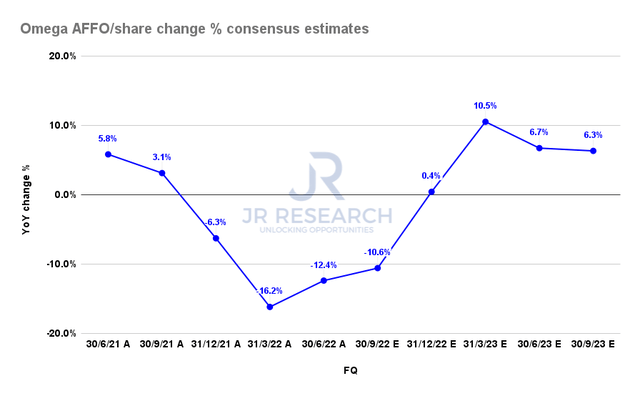

Omega AFFO per share change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) concur with management’s and the market’s optimism. Moreover, its estimates suggest that the growth in Omega’s AFFO per share should continue to improve through FY23. Therefore, we deduce that less challenging comps, coupled with the potential recovery in contribution from its leading operators, have helped undergird buying sentiments in OHI.

Notwithstanding, the growth momentum is expected to level off toward H2’23. Therefore, we believe a material re-rating in the medium-term hinges upon Omega’s accretive investment cadence in lifting its bottom-line growth prospects. In addition, investors are justifiably cautious amid structural labor challenges its operators face, given the cost headwinds.

Is OHI Stock A Buy, Sell, Or Hold?

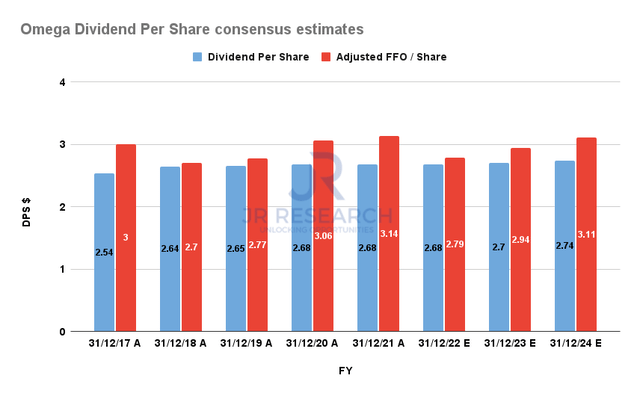

OHI Dividend per share and AFFO per share (By FY) consensus estimates (S&P Cap IQ)

The consensus estimates project the recovery in Omega’s AFFO per share through FY24 should be more than adequate to cover its current dividend strategy, with potential upside. OHI last traded at an NTM dividend yield of 8.16%, in line with its 10Y mean of 8.15%.

On a total return framework, OHI’s returns over the past ten years have been driven mainly by its dividend yield, as OHI posted a 10Y total return CAGR of 10.6%. Therefore, we believe its robust dividend yield remains fundamental to supporting the market’s confidence in its stock.

OHI last traded at an NTM AFFO per share multiple of 11.16x, in line with its 10Y mean of 11.43x. Therefore, we postulate that its near-term upside has been reflected, given the marked recovery from its May lows.

Hence, we believe OHI’s valuation seems well-balanced, but a medium-term re-rating seems unlikely unless the structural challenges on its operators are resolved expeditiously.

As such, we rate OHI as a Hold for now.

Be the first to comment