ErikMandre/iStock via Getty Images

Investment thesis

There are several micro cap companies in the oil and gas industry whose market valuations have increased significantly since the Russian invasion of Ukraine began and I’ve already covered two of them on SA – Nine Energy Service (NYSE: NINE), and Houston American Energy (NYSE: HUSA). In my view, the share prices of these companies are soaring due to retail investor interest stemming from high oil and gas prices in the first days of the conflict and this potentially creates good short selling opportunities as the fundamentals of the businesses haven’t changed much. Today, I’m taking a look at another such company – Enservco (NYSE: NYSE:ENSV). It reminds me a lot of U.S. Well Services (NASDAQ: USWS) because it’s an oilfield services company whose best days seem to be far behind it. Also, it likes to use EBITDA figures in its presentations just like U.S. Well Services, which I think is a bad way to determine the intrinsic value of a business with high depreciation and amortization costs. Let’s review.

Overview of the business and operations

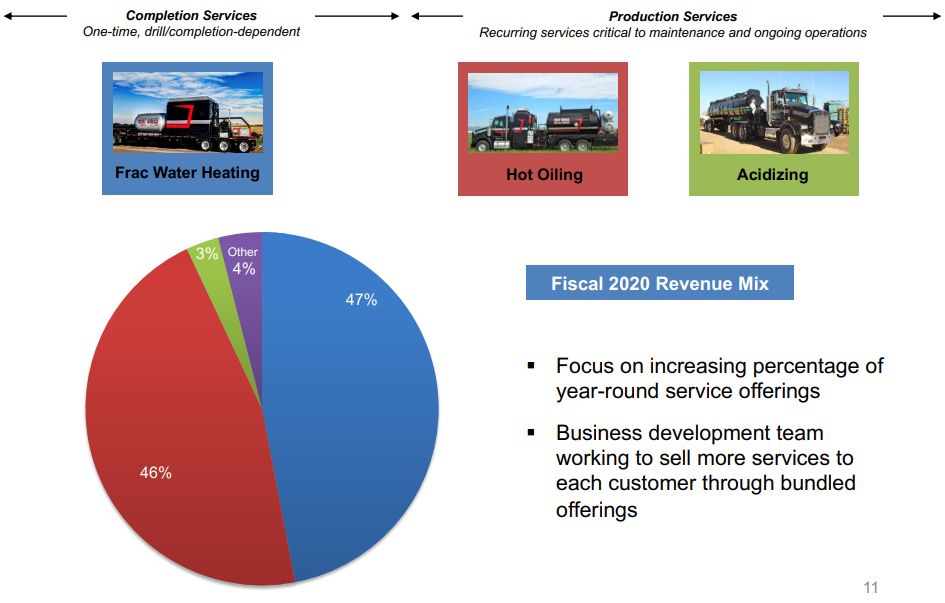

Enservco owns Heat Waves Hot Oil Service, which is involved in the provision of frac water heating, hot oiling, and acidizing services in the USA and its clients include several major conventional and unconventional oil and gas producers such as ConocoPhillips (NYSE: COP), Murphy Oil (NYSE: MUR), and Chesapeake Energy (NASDAQ: CHK). Enservco’s best year was 2014 when it generated revenues of $56.6 million and adjusted EBITDA of 11.5 million.

Enservco

Frac water heating and hot oiling services account for over 90% of Enservco’s revenues. Frac water heating is used during the completion of oil and gas wells, while hot oiling is used to remove paraffins from wellbores, pipes, and vessels. According to the company’s latest presentation, its frac water heating business has an annual revenue potential of $23 million, while its hot oiling operation has a revenue potential of $16 million.

Enservco

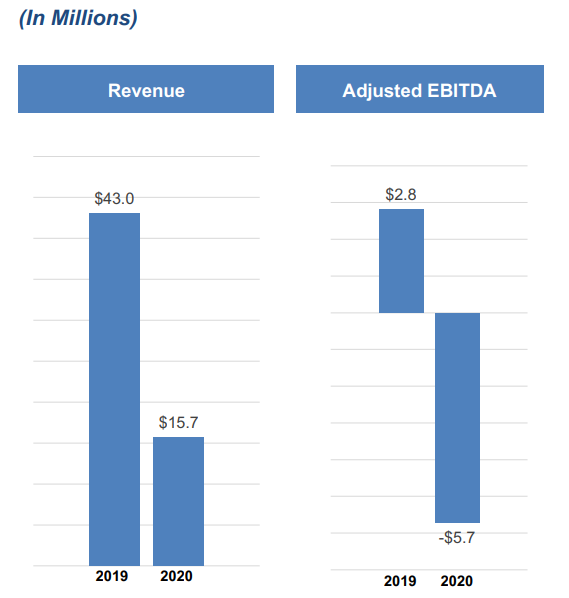

Turning our attention to the financials of Enservco, you can see from the graph below that the company was significantly affected by the COVID-19 pandemic and low oil prices as revenues dropped to $15.7 million in 2020 while adjusted EBITDA was negative.

Enservco

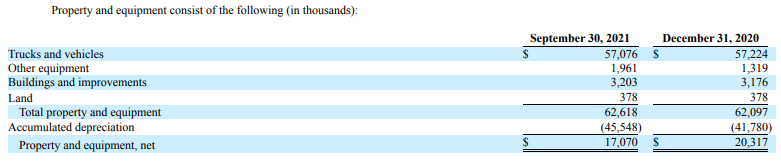

The situation looks even worse when you take into account that depreciation and amortization expenses came in at $5.3 million in 2020. You see, trucks account for the majority of the book value of the company and this is why I think you shouldn’t pay too much attention to EBITDA here.

In my view, net income is a better indicator of how well capital-intensive businesses are doing and I think that Enservco’s figures in that regard look underwhelming. Even in the record 2014 when the company booked EBITDA of $11.5 million, the net income was just $4 million.

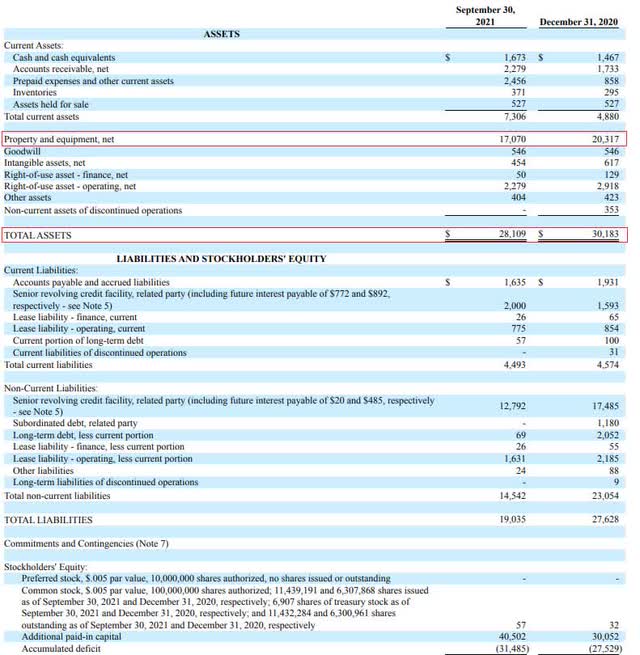

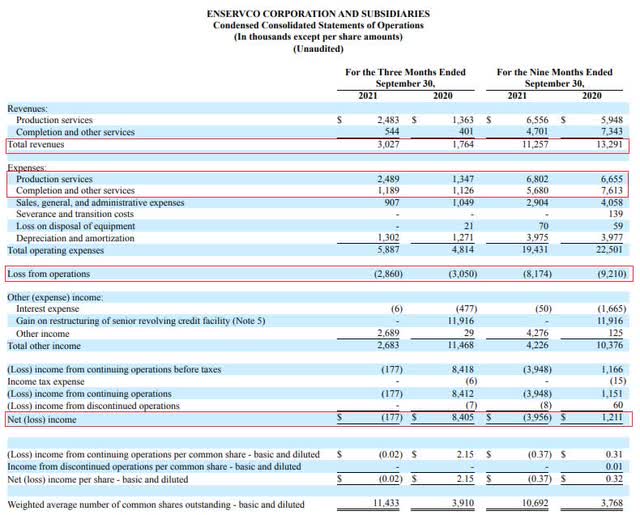

In Q3 2021, Enservco generated revenues of $3 million and booked a loss despite $2.7 million gains on forgiveness of a PPP loan and employee retention credits. As you can see from the table below, even the gross margins are now negative.

Looking at what to expect in the future, the fourth and first quarters constitute Enservco’s heating season, which is when the company usually generates a large part of its revenues and I expect losses to be lower. However, Enservco is a long way from its good days and I expect the business to need a few more quarters of high oil prices to recover to where it was before the pandemic and return to profitability.

Overall, I think that Enservco should be worth maybe around $15 million considering it has a $14.8 million senior revolving credit facility and its business has been barely profitable for most of its history. Yet, the company has a market valuation of $41.7 million as of the time of writing and you can see from the chart below that the trading volume and share price started soaring around the time Russia invaded Ukraine. Over 110 million shares changed hands on March 8 alone, which I find remarkable considering there are just 11.4 million shares issued.

Seeking Alpha

My theory is that the share price and trading volume could be soaring as a result of high retail investor interest. Enservco has been among the top trending micro cap stocks on Fintwit over the past month as there are a large number of posts about the company on websites like Twitter, and StockTwits. On YouTube, Enservco is being covered by several channels, including ClayTrader, Bulldog Trading, StocksToTrade, Hot Trades, Beginner Trading, The Stock Queen, Relentless Trader, and Daytrading with Jtrader. Several of the videos have more than 1,000 views each. Note that the company isn’t doing the promotion of its business or shares itself, but this is being done by a considerable number of private investors and traders.

In my view, retail investor interest is likely to fade off in the next month or two and the share price is likely to return to levels of around $0.60. I think the recent share price spike has created a good short selling opportunity. However, data from Fintel shows that the short borrow fee rate stands at 207.3% as of the time of writing. Unfortunately, there are no put options for Enservco.

Investor takeaway

I view Enservco as a small oilfield services company that has been having a rough time since the start of the COVID-19 pandemic. The company has never had a high net profit margin and I think that its business should be worth maybe about $15 million at the moment.

Enservco’s market valuation has been soaring over the past few weeks and I think the reason for this could be high retail investor interest. I expect the share price to return to around $0.60 as this interest eventually declines. However, the short borrow fee rate is above 200%, and there and no put options available. In my view, it’s worth following Enservco with the idea of perhaps opening a small position if the short borrow fee rate drops to double-digit percentage figures.

For risk-averse investors, I think it could be best to avoid Enservco.

Be the first to comment