xavierarnau/E+ via Getty Images

Enphase (NASDAQ:ENPH) should benefit from the increased push towards energy independence in Europe following the war between Russia and Ukraine. This event has pushed discussions about energy independence to the forefront of many people’s minds. European countries have become very aware of their need to become less dependent on external sources of energy, whether it’s gas or coal. This is why solar stocks rallied on the Russian invasion of Ukraine, and why investors are plowing money into clean energy funds now, as recently reported by CNBC.

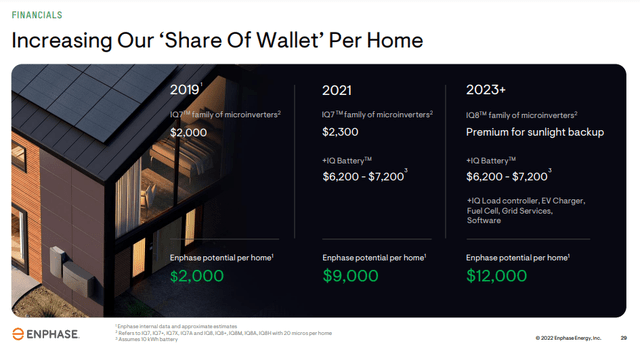

However, the increase to come from a push towards energy independence in Europe and other parts of the world is not the only strong tailwind we see for Enphase. One of the most important drivers of future growth to us is the expansion of the “share of wallet” per home. As can be seen in the slide below, there is an enormous difference between just selling the micro-inverters for a solar installation, to selling the micro-inverter plus a battery, to selling additionally a load controller, EV charger, fuel cell, software and grid services, etc. This can expand the potential sales per home from $2,000 to $12,000.

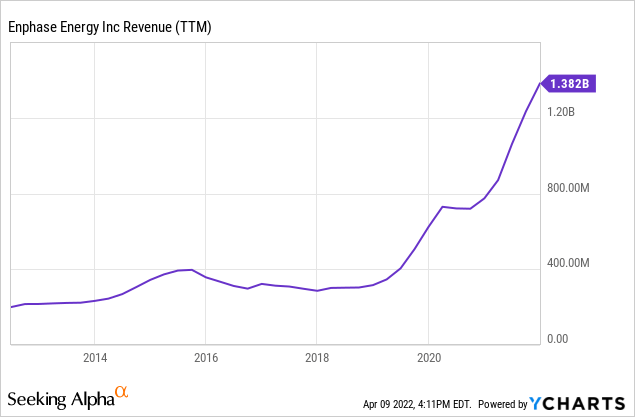

Enphase Energy Financials

Revenue growth has been on fire for Enphase, more than tripling in about three years. We think that given the growing importance for many countries of achieving energy independence, and the increasing affordability of solar power, this trend should continue for at least a few more years.

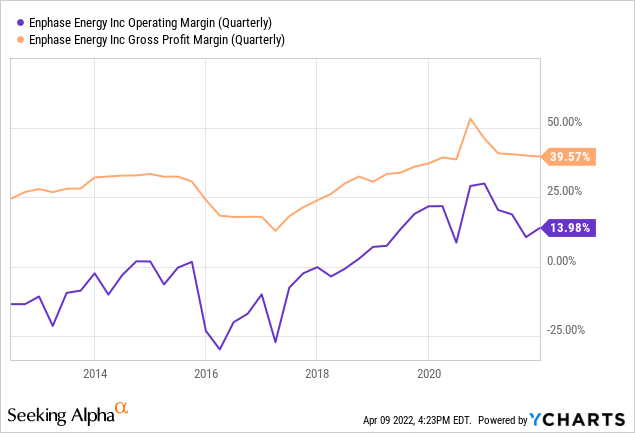

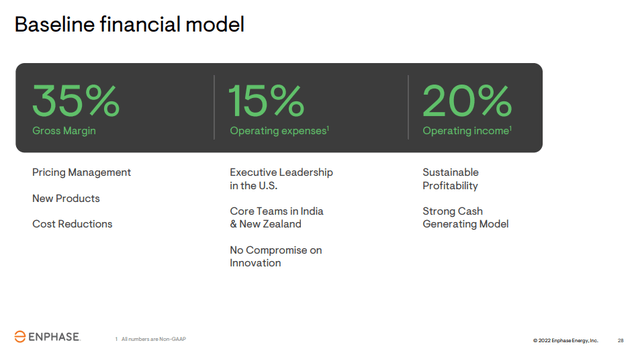

With increasing sales has come operating leverage, but the company has also done a lot of hard work to improve its gross profit margin by optimizing the production cost and reliability of its products. Margins have become pretty decent overall, with operating margin currently around 13.9% and well on its way to management’s target of 20%.

Management’s baseline model calls for ~35% gross margin, and the company is already above this level, but it expects operating leverage to reduce operating expenses as a percentage of sales and take its operating expenses down to ~15%, resulting in the above mentioned 20% operating income margin. This operating margin expansion, coupled with continued revenue growth should significantly increase EPS going forward.

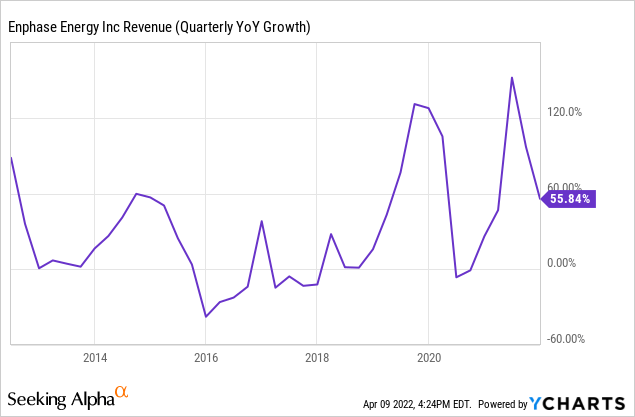

One thing that potential investors in the company should be aware of is the lumpiness of growth. While Enphase has managed to grow revenue at an impressive rate, especially in the last few years, the growth rate has varied a lot as incentives and government policies shift and change around the world. Given the renewed push for energy independence and climate change avoidance, we believe a new period of accelerating growth is just around the corner.

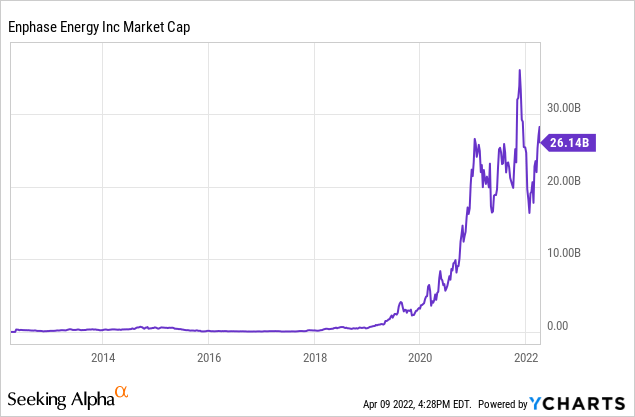

The company is not cheap, with a market cap of ~$26 billion. A lot of growth is already factored in, and should the growth rate disappoint there is a big risk of a significant re-rating downwards for the share price.

ENPH Stock Valuation

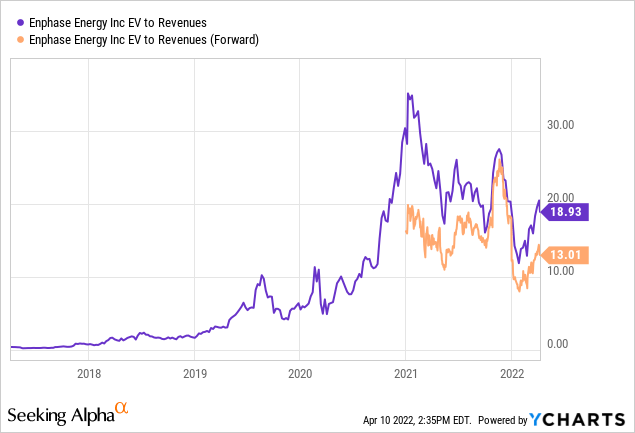

Another sign that the valuation is not cheap is that it is trading at EV/Revenues multiples usually reserved for young fast-growing SaaS companies. With a trailing twelve months EV/Revenues of 18.9x and a forward EV/Revenues of 13x we can quickly see two things, one is that shares are not cheap, the other is that analysts are predicting ~50% revenue growth for the coming year.

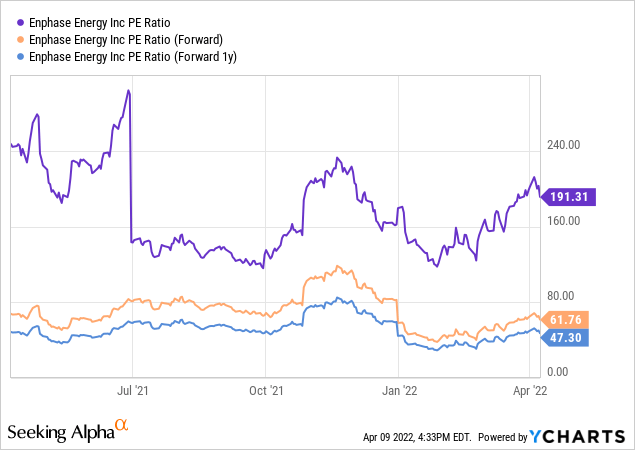

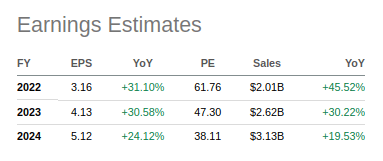

Despite shares not being cheap, we believe they can grow into their valuation if the company is able to sustain its growth rate for at least a few more years. We can see this with earnings estimates from analysts, with the estimated P/E ratio quickly reaching more reasonable levels. The estimated P/E ratio in two years is already down to ~47x, and we think that in two years that would be a very reasonable valuation if the company still has similar growth ahead.

Looking at the earnings estimates table on Seeking Alpha we see that going a bit further to FY24 the P/E multiple is further reduced to ~38x, and sales should have grown by then by more than 50%. This is why we are very confident that even if shares are expensive, as long as the company continues growing at current rates for a few more years it can grow into its valuation and still deliver decent returns for long-term investors.

Seeking Alpha

Growth Opportunities

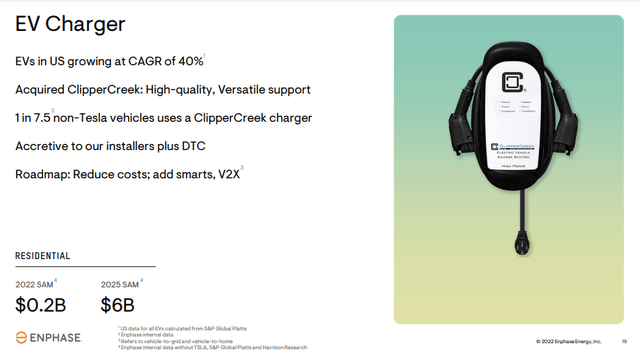

The company is working hard to find growth opportunities beyond its traditional micro-inverter solutions. One good example is the purchase of EV charger company ClipperCreek. One in 7.5 non-Tesla (TSLA) EVs use a ClipperCreek charger, and EVs are growing at a CAGR of ~40% in the US market. This acquisition also accelerates the Enphase roadmap to enable bi-directional charging capability for vehicle-to-home and vehicle-to-grid applications.

Another product Enphase is now offering that can provide growth opportunities is the Fuel Cell they are helping commercialize, made by Upstart Power and powered by IQ8(TM). It adds resilience to the home energy system, is reliable and low-maintenance.

Conclusion

We expect current geopolitical events and the corresponding increase in fossil-fuel prices to motivate many countries into working towards energy independence, especially making a renewable energy push to combat climate change at the same time. This should result in revenue growth acceleration for Enphase, as solar energy starts receiving more incentives and more favorable regulations. We like Enphase as a company very much, but do note that the valuation is not cheap, and that investors buying now might have to wait for the company to catch up with its valuation.

Be the first to comment