loops7

If the Sony lithium-ion battery technology had not arrived in 1991, portable computing would never have gotten off the ground, and forget about cell phones. Anyone remember some of the first Apple (AAPL) Powerbooks with NiMH brick batteries! That tech was not going to be adopted by the masses; fast-forward 30+ years, and we’re now at a breakpoint where 1) you can’t get anymore power out of lithium-ion batteries without increasing their size, 2) thermal runaway is still a major hazard in the battery industry, and 3) the masses all have cell phones and other increasingly power-hungry gadgets. A product that could both double the power of current battery tech using the same form factor, and solve thermal runaway, would surely be revolutionary; it also would save many lives, since batteries would be safer than ever before, and EV adoption would be much more attractive.

EV battery-caused fires (AFP via Getty Images)

Would you be more inclined to buy an EV whose battery can’t catch fire or blow up and has double the range of current models? If this piques your interest, then please read on about a novel company called Enovix (NASDAQ:ENVX), led by legendary Silicon Valley pioneer, TJ Rodgers, in Fremont, California, that has the battery product the world needs now.

Einstein holding Enovix 100% silicon cell lightyears ahead of competition (scholastic.com)

Enovix is lightyears ahead of its competition.

Enovix has invented a revolutionary battery architecture, one that will cause the next step-change in battery technology, much like the one that occurred with Sony’s (SONY) lithium-ion battery in 1991. Enovix is the only company that has succeeded with a 100% active silicon battery because their unique architecture makes it possible, and they’ve taken it from R&D to commercial production just this past quarter; most battery companies never make it out of R&D, but Enovix has by achieving this “major milestone“; without their battery architecture, a 100% active silicon anode would have been impossible. Enovix competitors are now at a major disadvantage because they all use carbon; even if they use silicon-coated carbon like Panasonic (OTCPK:PCRFY), they still cannot compete with Enovix; their battery architecture with carbon anodes is inferior. Enovix management estimates they’re 5 years ahead of competitors, so that is lightyears in this industry.

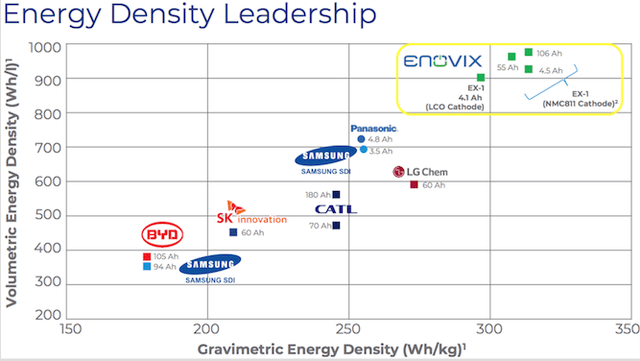

Enovix battery superiority over competitors (Enovix Investor Presentation, Nov. 2022, slide #5)

TJ Rodgers stepping in at Enovix is like Enphase 2.0.

Back in 2017 when CEO Paul Nahi and his team were driving Enphase Energy (ENPH) into bankruptcy, it was TJ Rodgers who swooped in with his Cypress crew and saved the company, eventually making it the leader in residential energy systems. The recent news of Rodgers stepping in at Enovix seems very similar for sure. In less than a week since Rodgers was named Executive Chairman, Enovix named a new COO, AJ Marathe, who is a “known Silicon Valley industry figure“; this news is comparable to Badri Kothandaraman being chosen from Cypress India to usher in operational excellence at Enphase Energy. News of the new COO represents a high-level management change guided by someone who knows how to run a company and has a proven track record of success — TJ Rodgers.

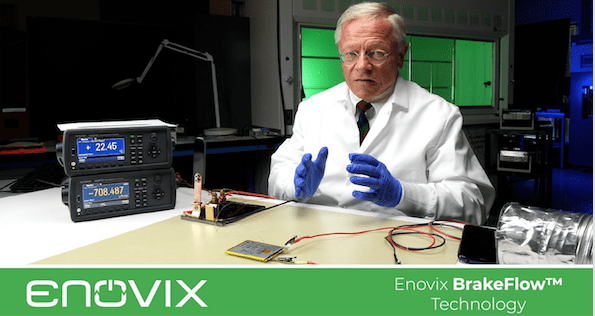

Enovix Exec Chairman, TJ Rodgers demonstrating BrakeFlow™ superiority over conventional batteries. (Enovix.com)

Besides Rodgers’ proven track record at Cypress Semiconductor (OTCQX:IFNNY), SunPower (SPWR), and Enphase Energy, he also has powerful connections like Isadoro Quiroga from South America’s Lithium Triangle. Mr. Quiroga invested in Enphase making 40x his initial investment thanks to Rodgers. If more Enovix funding is ever needed, investors like Quiroga are likely candidates; Quiroga “plans to continue investing in new technologies after his success with Enphase Energy, and is said to be considering moves in Silicon Valley”. Thus, with TJ Rodgers at the helm, I seriously doubt investors need to worry about any dilution of their investment. Investors should be very excited that “within a few weeks, [Rodgers] will bring investors up to date [on Enovix] with a special presentation“.

Enovix is in great shape financially.

TJ Rodgers stated that Enovix has $349 million cash; Enovix will use some of this to increase their production capabilities ~10x to make them profitable. In their latest Shareholder Letter, management stated the “complete Gen2 Autoline will cost between $50- to $70-million of CapEX and produce over 9-million cells annually”; it is slated for completion in H2-2023 with sales at an estimated “50% gross margin“.

Regardless of the company’s health, the market was unkind to Enovix this past earnings call; the stock took a ~40% dive basically due to negative FUD, or as Rodgers put it, a “lack of clear and transparent investor communications“. Investors witnessed growing pains of a young company on the last call, but with Rodgers stepping in to play an active role, investors should be energized. Enovix is a Cinderella story in my opinion, and any speed-bumps encountered along the way will not be critical. Once Enovix or a major licensee is manufacturing and shipping large numbers of product, the share price should increase substantially; Enovix already has “the world’s biggest customers” with multiple “Strategic Accounts (mega-cap technology companies with multiple portable electronics product applications)” that are waiting for production to come up to par; that is the crux, so focus for the investor should be ~18-months out. Regardless of the exact timeframe, in the long term, investors should be rewarded handsomely.

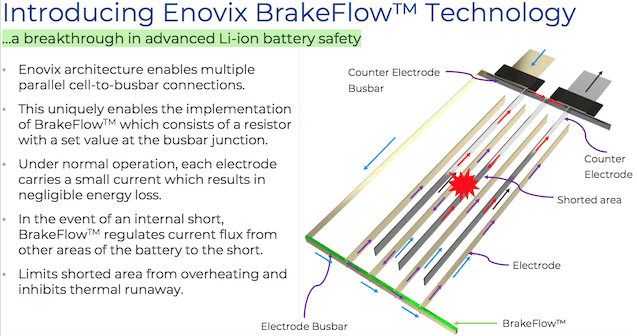

Enovix solves #1 battery industry problem: thermal runaway.

Consider decentralized versus centralized power; decentralized power is safer and more reliable. When Enphase Energy debuted in 2010, it was their decentralized power topology that made solar safer and more reliable. Basically, an army of Enphase microinverters producing AC electricity versus a lone central string inverter doing the same, is superior because if the central string inverter fails, the whole solar system fails; if a microinverter fails, just a single solar panel becomes inoperable, and the rest of the system continues to operate.

That simple idea of decentralized power is exactly what Enovix has come up with in their battery product. No other company has this type of technology, and as stated earlier, Enovix is light years ahead of its competition. Enovix has designed a battery architecture that integrates an army of resistors inside a single battery cell instead of a single resistor; this integration would be impossible in a competitor’s battery and is only possible with Enovix’s battery architecture. With an army of resistors, thermal runaway becomes practically impossible; the video on BrakeFlow technology by TJ Rodgers helps one understand just how major a technological innovation this is, and should be mandatory viewing by investors.

BrakeFlow™ technology (Enovix Investor Presentation, Nov. 2022, slide #25)

The futuristic world envisioned is to run on solar and batteries, and batteries are most definitely the Achilles’ heel. Solar has no moving parts, and 240-Volt AC microinverters won’t kill you, but batteries can catch fire, blow up and create a dangerous hazard; the $5.3B fine levied on Samsung for its dangerous Galaxy Note 7 in 2016 is a prime example of how seriously expensive an issue thermal runaway can be. Fires are a big problem for lithium batteries and have been for decades. With the arrival of Enovix, this major problem plaguing the battery industry may have finally been solved. When an electrical short does occur in an Enovix battery, the BrakeFlow technology brakes the flow of that electricity to prevent a thermal runaway. BrakeFlow is an addition to the Enovix battery architecture that will save many lives.

Futuristic world — solar PV + storage batteries (SolarKings)

Elon Musk endorses 100% silicon as technology needed.

Elon Musk of Tesla (TSLA) recently endorsed the 100% active silicon anode lithium-ion battery technology as what is needed, and no other company has successfully invented it except Enovix; Elon Musk’s statement shows the possibility that he doesn’t know that Enovix already has the technology.

Elon Musk endorsing 100% active silicon (TorqueNews, Jun. 4, 2022, by Tinsae Aregay)

Investors should keep in mind that Enovix is right down the road from Tesla. It might be good karma for the two billionaire leaders to get together, enlighten Elon, and make a deal. Surely what Enovix now possesses would save Tesla boatloads of R&D money rather than try to reinvent the wheel. Plus, you already have synergy with Director Greg Reichow on board at Enovix who helped build some of Tesla’s manufacturing plants, and the Reno Gigafactory is just 4 hours away.

Driving directions from Enovix to Tesla in Fremont, California. (Google Maps)

Elon Musk is now working 7-days a week to protect his Twitter investment, and TJ Rodgers is now playing an active role at Enovix. In my opinion, this is true leadership and a sign of management excellence; both are American legends hailing from Silicon Valley. Musk has created American icon Tesla, and Rodgers has the only US battery company left. For a Tesla-Enovix deal to be hatched, it is not that far-fetched of an idea, especially with the 2024 elections approaching where Save America patriotic bread-n-circus fervor will be pitched to bring back the economy; what better microcosm of that propaganda than to have a Tesla with an Enovix battery taking over the global EV market and becoming a national treasure made in the USA.

Enovix is up against some mighty global competitors, too — Panasonic, LG Chem, Samsung SDI, BYD, CATL , SK Innovations et al. Most recently, a major defection from Samsung occurred by Patrick Donnelly, which suggests Enovix superiority with their battery technology; for 7 years as VP at Samsung, Donnelly “led a commercial team that secured several multibillion-dollar contracts with customers such as Stellantis (STLA), Ford (F) and Rivian (RIVN)“.

Enovix battery architecture vs. competition. (Enovix Investor Presentation, Nov. 2022, slide #10)

In summary, investors may look back at the current share price as a gift; they should remember that in December, 2021, Craig-Hallum put Enovix at $32, and Cowen put them at $50; in August, 2022, Loop Capital put Enovix at $100! Enovix is much lower than those valuations currently, and we’re almost in tax-loss selling season, so it presents a potential buying opportunity. Investors should know that TJ Rodgers bought 400k shares at ~$8.89 each in May, the recent stock drop hit $10.74 and my last Enovix SA article debuted at $10.94. I continue to add on the dips because Enovix has the technology the world needs now that no other competitor has, and BrakeFlow is truly revolutionary; tech articles on thermal runaway describe the problem with preventative measures, but none mention Enovix as the solution because as TJ Rodgers stated in his BrakeFlow video, this technological innovation “is just not that clear to the public” yet. Enovix is an Enphase 2.0 in my opinion, probably even bigger, considering the multitude of products their batteries will be used in. Of course, do your own due diligence, and good luck.

Be the first to comment