FG Trade/E+ via Getty Images

Thesis

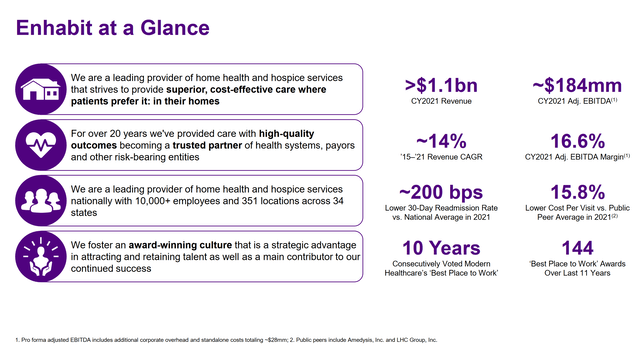

Enhabit, Inc. (NYSE:EHAB) is a recent spinoff from Encompass Health Corporation (EHC). Investors that are distributed shares in a spin-off often will dump their new shares for a myriad of reasons that have nothing to do with the actual value of the underlying business. In addition, these newly spun-off businesses can allocate their resources in a more focused manner. Recently spun-off companies have been shown to create alpha as a group.

While it’s great that spinoffs on average outperform, they are not all winners. Spinoffs are an area of the stock market where fundamental analysis can pay off. Spinoffs don’t have long public operating records or large amounts of analysts following them.

In the case of EHAB, the recently spun-off stock looks cheap on both a relative and absolute basis. Comparing EHAB to publicly traded peers, it looks cheap on a relative basis. Similarly, when projecting out future cash flows based on management’s guidance, EHAB also looks cheap.

Business Plan

EHAB operates in two different but related segments. Home care and hospice care. Both segments utilize skilled professionals to help patients with medical needs in their own homes. Traditionally, the services offered by EHAB have required patients to visit care facilities or live in nursing homes.

Some patients prefer to receive medical care in their own homes. It is also cheaper for patients since they don’t need to pay for the overhead of a health care facility. Due to these advantages, home care is expected to grow 73% between 2020-2028.

For providers, this space offers an attractive capital-light business. Since there is no need for large care facilities providers can treat patients without investing large amounts of upfront capital. EHAB estimates that opening new home care and hospice locations costs between 2 and 3 million each. In 2021, they had 341 locations and generated 154 Million in pro forma EBITDA. Opening a new location generates an 11% – 17% return on invested capital.

Home care is also a recession-proof business since most customers pay with Medicare or Medicaid.

The home care industry is fragmented. A large number of smaller players operate throughout the country. The 4 largest players in the space make up only 22% of the market. 92% of home health agencies make less than 5 Million a year in revenue. EHAB re-invests its cash flows to acquire small players and open new service locations.

Spinoff Dynamics

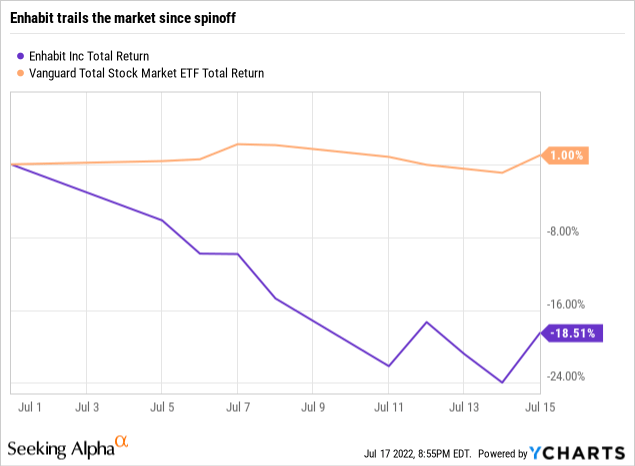

EHAB began trading on July 1st at around 22 a share. Since then, it has underperformed the market by almost 20%.

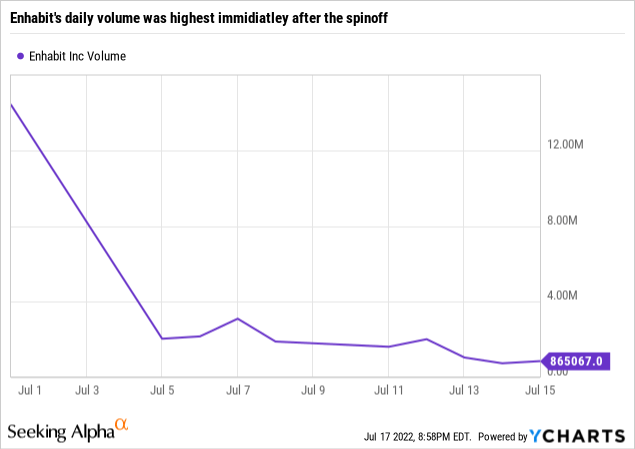

Enhabit traded heavily immediately after the spinoff. I believe the heavy trading was due to non-fundamental based selling.

As an example of the forced selling that has happened, let’s take a look at iShares Core S&P MidCap ETF (IJH). IJH is an ETF that tracks the S&P mid-cap index. It is also the largest ETF holder of EHC shares, owning about 2.9 million shares of EHC. According to their holdings history as of July 14th, they own no shares of EHAB. This suggests IJH has dumped 1.4 Million shares in the past two weeks, or about 3% of EHAB’s overall float. This is just one example, but it is illustrative of the forced selling of EHAB shares.

When investing in a spinoff, I try to make sure the setup makes sense. Ideally, companies aren’t just spinning businesses with no rhyme or reason. In EHAB’s case, I do think the spinoff makes sense. EHC is spinning off its asset-light business model, home case, from its asset-heavy business model, owning and operating care facilities. Depreciation and amortization are real charges for EHC, for EHAB they are largely irrelevant. This spinoff should make the investment story much easier to understand for both EHC and EHAB. Although the businesses are in similar spaces, they were already operating as distinct business units within EHC. So, separating them shouldn’t be painful and they are not losing large integration benefits.

Relative Valuation

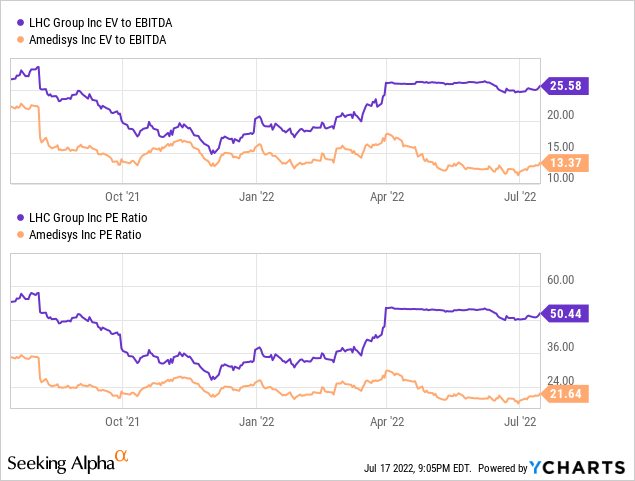

Amedisys (AMED) and LHC Group (LHCG) are two similarly sized peers whose primary businesses are home healthcare. Since they have longer track records as publicly traded companies, I’ll use them to come up with a relative valuation for EHAB.

Homecare businesses are asset-light, and all three peers have leverage. I believe EV/EBITDA is the most relevant valuation metric for this type of business. To calculate EHAB’s EBITDA and debt, I used their 2021 pro forma statements from their S-10 filing. I calculate their EV/EBITDA to be 9.7.

I’ll also take a look at P/E ratio. I believe EV/EBITDA is a better metric for comparison. However, a sanity check on the P/E ratio is worthwhile also. Pro forma EHAB earned $1.47 per share in 2021. This gives us a P/E of 12.6.

As we can see, AMED currently trades at an EV/EBITDA of 13.4. It is also trading near the cheapest it has traded in the last 5 years. LHCG is more expensive. To be conservative, I’ll use AMED’s ratio rather than LHC’s. In order to get an EV/EBITDA for EHAB of 13.4, we’d need an enterprise value of $2066M. To get the implied per share value, we take the implied enterprise value, subtract debt, and then divide by number of shares (2066-537.8) / 49.6 = 30.09 cents per share. EHAB looks similarly undervalued if we do the same calculation with P/E.

Absolute Valuation

While it’s great that EHAB looks cheap compared to its peers. We need to be sure it looks cheap on an absolute basis. We don’t want to end up buying the cheapest option in an overpriced sector.

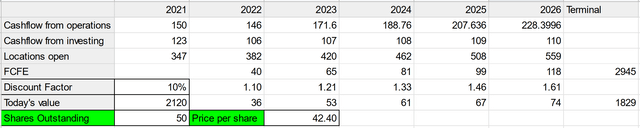

To do this, I used management projections for the next 5 years. I needed to do a bit of reading between the lines to convert their projections into cash flow growth. I also assumed the company was going to re-invest capital to grow for the next 5 years, then stop investing other than maintenance capital. While this isn’t realistic, I believe it gives a reasonable view of the business’ value without needing to project capital allocation beyond management’s guidance. Due to this choice, you’ll notice that the vast majority of the business’s value is in the “terminal” value after year 5.

EHAB discounted cashflow (Author’s work)

I’ll caution that my discounted cash flow (“DCF”) makes a lot of assumptions, as all DCFs do. This analysis estimates that the fair price of a share is north of 40 dollars.

Outside of my cash flow valuation, I’ll note that EHAB generated $106M in Free cash flow in 2021, based on net income + D&A – maintenance CAPEX. This gives us a greater than 10% FCF yield. Intuitively, this feels cheap for a stable business with long-term tailwinds and a long runway to re-invest in its core business.

Risks

EHAB operates in a heavily regulated industry and receives more than 80% of its income from Medicare. It is subject to large changes in the valuation of its business due to changes in laws regarding health care. Overhaul of the U.S. medical system and especially Medicare is a hot-button political issue. When politicians try to control the national debt, Medicare is a common target for cuts, for example, the current Medicare sequestration.

In addition, the price EHAB can charge is largely controlled by Medicare. This means that EHAB may have a hard time passing along its rising costs to the customer. Currently, margins look healthy and the need for home care is growing. But government controlling the ultimate price could still lead to smaller margins over time.

The selling pressure from the spinoff may not be done yet. The traditional view is that selling pressure lasts for about 6 months after the spinoff. Buying now may make you a victim of the same selling pressure that has depressed EHAB’s stock price so far.

Conclusion

EHAB is cheap compared to its peers based on traditional valuation metrics. In addition, it looks cheap compared to my projections of future cash flows. Based on my calculations in both these areas, I believe EHAB’s fair value is around $40 a share.

Outside of the undervaluation, EHAB’s line of business has secular tailwinds. They also have a long runway to reinvest their free cash flow to grow the business at an attractive rate of return. While I wait for the market to realize the value of the business, I should be able to wait for the business to compound.

I plan to open an initial position Monday while leaving some of my maximum investment on the sideline to take advantage of volatility.

Be the first to comment