Alexander Sharganov/iStock via Getty Images

Enerplus Corporation (NYSE:ERF) is focusing its development efforts on its Bakken assets where it expects well paybacks in around three to five months at $80 to $100 WTI oil. It looks capable of generating over $800 million in positive cash flow in 2022 at current strip prices, allowing it to reach a net cash position by the end of the year while also completing its share repurchase program.

If commodity prices remain at elevated levels in 2022 and 2023 before returning to long-term prices of around $70 WTI oil, then I’d estimate Enerplus’s value at approximately US$16 per share.

Reporting Changes

Enerplus changed its reporting currency from Canadian dollars to US dollars, while also changing its reported production volumes to a “net” basis. Since Enerplus’s average royalty rate is around 20%, this has the effect of reducing its reported production volumes by 20%, while increasing its per BOE costs by 25%.

This is just a reporting change though, and Enerplus’s net margins (in total dollars) at various commodity prices remain unchanged.

The decision to change its reporting is due to most (93%) of Enerplus’s production coming from the US now, while it is also attempting to divest its remaining Canadian assets.

Bakken Focus

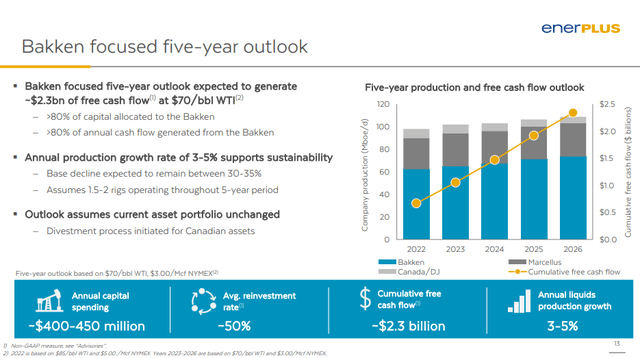

Enerplus is devoting most of its efforts to developing its Bakken assets. Around 83% of its 2022 capex budget is allocated to the Bakken and it anticipates a similar (80+%) allocation during the next five years. This is expected to help Enerplus generate 3% to 5% annual liquids production growth during this period as well as generate $2.3 billion in free cash flow at $70 WTI oil.

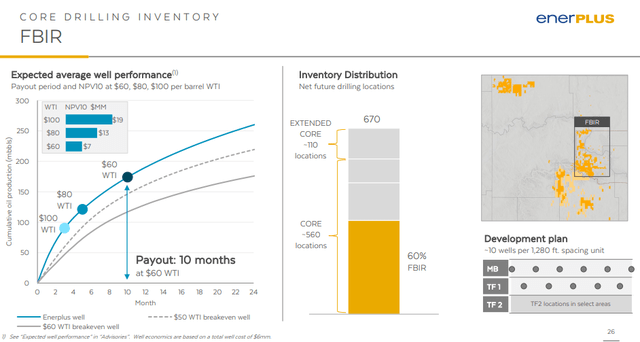

Enerplus’s main position in the Bakken is located in the Fort Berthold Indian Reservation [FBIR], where it expects its average well to pay back in around ten months at $60 WTI oil. At $80 WTI oil payback could occur in around five months, while at $100 WTI oil, payback could occur in as little as three months.

Updated 2022 Outlook

Under its new reporting method, Enerplus expects to average 98,000 BOEPD in production during 2022, including around 60,000 barrels per day in liquids production.

At current strip prices (high-$90s WTI oil and around $6.50 NYMEX gas), Enerplus may be able to generate $2.407 billion in oil and gas revenue. Enerplus’s hedges have around negative $392 million in estimated value at those commodity prices.

|

Units |

$ Per Unit |

$ Million USD |

|

|

Oil |

18,724,500 |

$97.00 |

$1,816 |

|

NGLs |

3,175,500 |

$42.00 |

$133 |

|

Natural Gas |

83,220,000 |

$5.50 |

$458 |

|

Hedge Value |

-$392 |

||

|

Total |

$2,015 |

At high-$90s WTI oil, Enerplus may be able to generate $843 million in positive cash flow in 2022 after dividends. This also assumes that Enerplus maintains its current quarterly dividend of US$0.033 per share. Changes to Enerplus’s dividend and share count would affect the amount it spends on dividends in 2022.

|

$ Million USD |

|

|

Production Taxes |

$179 |

|

Operating Expenses |

$358 |

|

Transportation |

$148 |

|

Cash General And Admin |

$45 |

|

Cash Interest |

$20 |

|

Capital Expenditures |

$400 |

|

Dividends |

$32 |

|

Total Expenses |

$1,172 |

Debt And Share Count

Enerplus had $640 million in net debt at the end of 2021. It is expected to generate $843 million in positive cash flow in 2022 after current dividends and also has around $142 million to spend in 2022 with its current share repurchase plans. Thus it could complete its share repurchase plans and end up with a bit of net cash on hand at the end of 2022.

Enerplus may end up with approximately 234 million shares outstanding by the time it completes its current share repurchase plan.

Valuation

The strength in near-term commodity prices pushes Enerplus’s estimated value up to approximately US$16 per share at long-term $70 WTI oil and $3.50 NYMEX gas. This assumes that commodity prices average around current strip for 2022 and 2023 before reverting back to longer-term prices after 2023.

Enerplus only has a limited amount of hedges for 2023 (at least with a ceiling under $107), so at current strip, it could also generate over $800 million in positive cash flow in 2023 as well.

Conclusion

With current oil strip nearing $100 for 2022, Enerplus may be able to generate over $800 million in positive cash flow after covering its current dividend. This would allow it to eliminate its net debt by the end of 2022 while also completing its current share repurchase plans.

Enerplus’s well-level economics in the Bakken are excellent and could result in well paybacks in three months at $100 WTI oil and around five months at $80 WTI oil.

Be the first to comment