Leonid Ikan

Enerplus Corporation (NYSE:ERF) recently divested its Canadian assets in two transactions worth a combined total of approximately US$289 million (prior to closing adjustments). Enerplus is now focusing primarily on the Bakken, with some secondary investment in the Marcellus.

At current strip prices Enerplus may be able to generate over US$600 million in positive cash flow in 2023. This is down a bit from my previous estimates due to weaker 2023 strip prices and cost inflation. Enerplus appears fairly priced for a long-term low-$70s WTI oil scenario currently, and could have upside to around US$21 with long-term $75 WTI oil.

This report uses US dollars unless otherwise noted, along with an exchange rate of US$1 to CAD$1.36.

Continued Canadian Asset Divestitures

Enerplus entered into an agreement to sell “substantially all” of it remaining Canadian assets to Surge Energy for US$180 million (prior to closing adjustments) with an expected closing date in December 2022.

The divested assets include net production of around 3,000 BOEPD (99% oil) after factoring in the deduction of royalties.

One thing to note is that the effective date for the transaction is May 2022. Surge believes that the final net purchase price will be around US$147 million after the substantial closing adjustments. This consideration will be roughly 82% in cash and 18% in common shares of Surge Energy.

At current high-$70s WTI strip for 2023, the divested assets are expected to generate US$47 million in cash flow from operating activities and around US$35 million in free cash flow in a maintenance capex scenario.

The post-closing adjustment sale price is a relatively modest multiple to free cash flow, as the free cash flow yield would be around 24% at high-$70s WTI oil and around 18% to 19% at $70 WTI oil. However, Enerplus had strategic reasons for divesting the rest of its Canadian assets and the assets have relatively limited remaining inventory (able to hold production flat for an estimated 7 years).

Q3 2022 Results

Enerplus has been performing well operationally. It reported strong Q3 2022 production at 107,808 BOEPD, including 68,382 barrels per day of liquids production. Enerplus expects this strong performance to carry forward into Q4 2022, where it expects production to average 105,000 to 110,000 BOEPS, including liquids production of 64,000 to 68,000 barrels per day. Excluding production from the divested Canadian assets (and assuming a mid-December closing for the Surge Energy transaction), this would be roughly 2% total production growth and -1% liquids production growth (at guidance midpoint) quarter-over-quarter.

The strong operational performance has also allowed Enerplus to increase its full-year production guidance again, despite its divestitures. The production growth has come while Enerplus has spent within budget. Enerplus has now guided for $430 million in capital spending for 2022, within its previous guidance range of $400 million to $440 million.

Enerplus has continued its streak of increasing its quarterly dividend. This quarterly dividend is $0.055 per share for December 2022, up from $0.05 per share in September 2022, $0.043 per share in June 2022 and $0.033 per share in March 2022.

Although Enerplus has been increasing its dividend, it is still focused more on share repurchases. Enerplus reported repurchasing 10.6 million shares for $155.5 million between the beginning of September and November 2, 2022.

2023 Outlook

Enerplus is aiming for around 3% to 5% liquids production growth per year from its continuing assets. This could result in it generating around 97,500 BOEPD production in 2023 along with a low-50s oil cut.

At current high-$70s WTI strip for 2023, this would result in Enerplus generating around $1.867 billion in revenues after hedges.

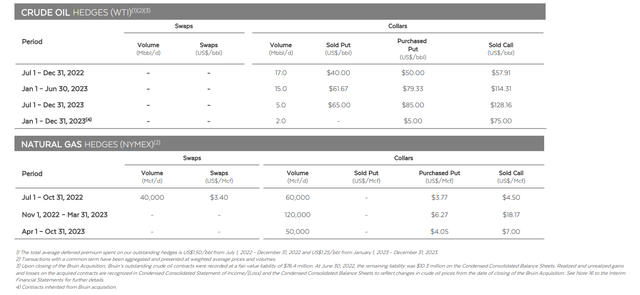

Enerplus’s Hedges (enerplus.com)

Enerplus’s 2023 hedges would have a slightly positive impact at current strip. The floors on its oil puts tend to be a bit above current strip, while it also has deferred put premiums costing around $1.25 per barrel.

|

Units |

$ Per Unit |

$ Million USD |

|

|

Oil |

18,149,625 |

$76.50 |

$1,388 |

|

NGLs |

3,736,688 |

$26.00 |

$97 |

|

Natural Gas |

82,207,125 |

$4.60 |

$378 |

|

Hedge Value |

$4 |

||

|

Total |

$1,867 |

Enerplus is now projected to generate $605 million in positive cash flow in 2023 at current strip and before dividend payments. Enerplus may spend around $500 million on capital expenditures in 2023, compared to $430 million in 2022 due to the effect of cost inflation.

Enerplus previously had projected its North Dakota well costs to be around $6.5 million per well for 2022. It now expects this to average around $6.9 million per well in 2022 and $7.6 million per well in 2023 due to cost inflation.

|

$ Million USD |

|

|

Production Taxes |

$140 |

|

Operating Expenses |

$356 |

|

Transportation |

$153 |

|

Cash General And Admin |

$43 |

|

Cash Interest |

$15 |

|

Capital Expenditures |

$500 |

|

Current Tax |

$55 |

|

Total Expenses |

$1,262 |

Bakken Economics

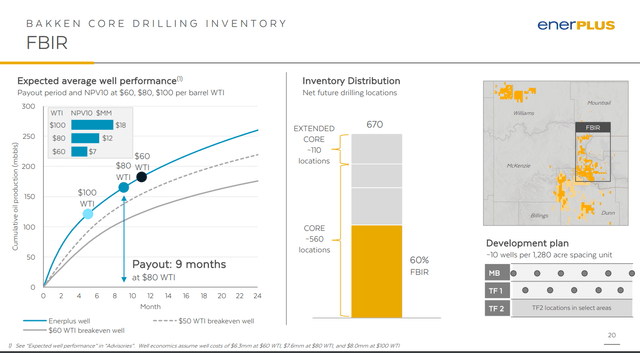

Enerplus believes that it can deliver strong well-level economics from its core inventory. For example, it estimates that its FBIR wells payback in around 9 months at $80 WTI oil and 2023 well costs (at $7.6 million). The FBIR wells account for around 60% of its core inventory, and represent around 7.5 years of inventory based on Enerplus’s 2022 turn-in-lines. Enerplus also has another 4.5 years of core inventory in other areas, along with around 2.4 years of extended core inventory with weaker well-level economics.

Conclusion

Enerplus has divested its Canadian assets and is now a primarily Bakken producer with secondary investment in the Marcellus. It looks capable of generating over US$600 million in positive cash flow in 2023 while increasing production (from its continuing non-Canadian assets) by a few percent.

Overall, Enerplus appears fairly priced for long-term prices of low-$70s WTI oil along with $4.00 NYMEX gas. I believe it could have upside to around US$21 per share in a long-term (after 2023) $75 WTI oil and $4.50 NYMEX gas scenario.

Be the first to comment