RHJ/iStock via Getty Images

Investment Thesis

Energy Fuels (NYSE:UUUU) engages in the extraction, exploration, and sale of uranium in the US. As Western countries start to view uranium as a clean, carbon-free, and affordable baseload for electricity, this has led to the price of uranium in the spot market to increase.

There are many different dynamics at play that are culminating in uranium prices in the spot market moving to a 10-year high.

After a multi-year uranium bear market, uranium prices are likely to soon cross above the prices set at the time of the Fukushima disaster of 2011.

There’s a lot to be compelled towards this space.

Why Energy Fuels? Why Now?

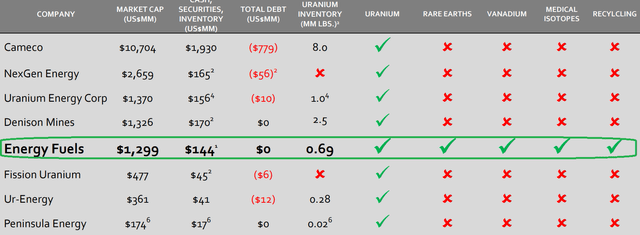

Energy Fuels is a uranium extraction and recovery company. Furthermore, in 2021, Energy Fuels ramped up its commercial production of rare earth element (“REE”) carbonate.

Thus, while the main driver of the opportunity here is uranium, Energy Fuels isn’t a pure-play uranium producer, as the company has operations focused on rare earth elements and rare earth element separation initiatives.

Energy Fuels investor presentation

Said another way, while the company has a big focus is Uranium, it’s not its only focus. That’s something to keep in mind.

Uranium’s Opportunities

There are three major themes at play for Uranium. Russia, clean energy, and Sprott Physical Uranium Trust (OTCPK:SRUUF). Let’s take these in turn.

Russia is a major supplier of uranium and nuclear fuel to U.S. and European customers. From Energy Fuels’ perspective, they would hope that utilities that use uranium to power their electricity plants would no longer source cheap uranium sources from Russia.

For context, 1 out of every 5 houses in the US is powered by Russian uranium. However, for now, electricity companies have been able to get waivers on sanctions to source Russian uranium.

That being said, there’s inherent difficulty sourcing Russian uranium, as it gets sourced from Kazakhstan, but it goes out of St. Petersburg, in northern Russia. This has the potential to get some disruption as ship operators may become unwilling to travel to St. Petersburg in Russia to pick up uranium cargo.

Further out, another positive driver is the global efforts to reduce carbon emissions. The UK noted its intention to build 8 new nuclear reactor plants. Clearly, these are lengthy projects that could take more than 15 years to get going in earnest.

The point here is to emphasize that this was a sector that was left for dead. And all of a sudden, there’s meaningful interest in this space. That has galvanized the price of uranium in the spot market.

Trading Economics, price of uranium

As you can see above, in the past 6 months, the price of uranium has increased by 100%. Think about this for a moment. Does this strike you as an energy source that has been left for dead? Clearly not.

Was this dynamic underway before the Russian invasion of Ukraine? Yes, clearly. Even if Russia’s invasion of Ukraine put an accelerant on this market dynamic, we can observe above that these elements were already in place.

Next, we have to keep in mind that Ukraine has fifteen operating nuclear power plants. With Ukraine at war right now, will these power plants be operating at maximum capacity? I don’t believe that’s the case.

Finally, the element that’s providing even more steam here is Sprott. Sprott is an ETF whose goal is to sequester Uranium. This means that it’s a financial vehicle that is intent on cornering the uranium market to push prices higher.

Starting in mid-August 2021, SPUT launched an at-the-market (”ATM”) offering program that started acquiring and holding physical uranium.

UUUU Stock Valuation – Difficult to Quantify

As it stands, Energy Fuels is debt-free with approximately $110 million of cash and equivalents. This means that Energy Fuels has a significant amount of ”staying power”.

On the other hand, we have to keep in mind that despite Uranium prices increasing, Energy Fuels doesn’t generate positive cash flows.

For both 2020 and 2021, Energy Fuels’ cash flows from operations have reported around negative $30 million.

On the other hand, there’s the hope that with utilities purchasing approximately 76% of their uranium needs under mid- and long-term contracts, once utilities start contracting uranium contracts, this will meaningfully push uranium prices higher.

In sum, there are mixed considerations to bear in mind for the bull thesis.

The Bottom Line

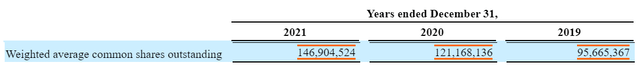

Energy Fuels 10-K

For now, the only thing going up and to the right for Energy Fuels is the total number of shares outstanding. In the past 2 years, the total number of shares outstanding has increased by more than 50%.

One could then counter this by asserting that even if that’s the case, with the price of Uranium in the spot market increasing so dramatically, it’s only a matter of time before Energy Fuels turns meaningfully profitable.

What’s more, in the past 2 years, on average, the share price is already up more than 400%. Thus, clearly, the business is doing something right. Personally, I’m very keen to seek exposure in this space, even if Energy Fuels isn’t my chosen investment. Whatever you decide, good luck and happy investing.

Be the first to comment