ElementalImaging

Energizer Holdings (NYSE:ENR) has a great collection of brands. But the company carries high debt levels and does not generate enough cash to pay down the debt quickly. It offers a good dividend, but the company dividend increases may be muted due to its debt load. Inflation may settle at 4% or higher, forcing the Federal Reserve to keep rates higher for longer. The company’s debt servicing costs may increase substantially due to these high-interest rates. Investors owning the stock may be better off taking some profits. It is not prudent to buy Energizer holdings at current prices during these uncertain times.

Slowing revenue growth

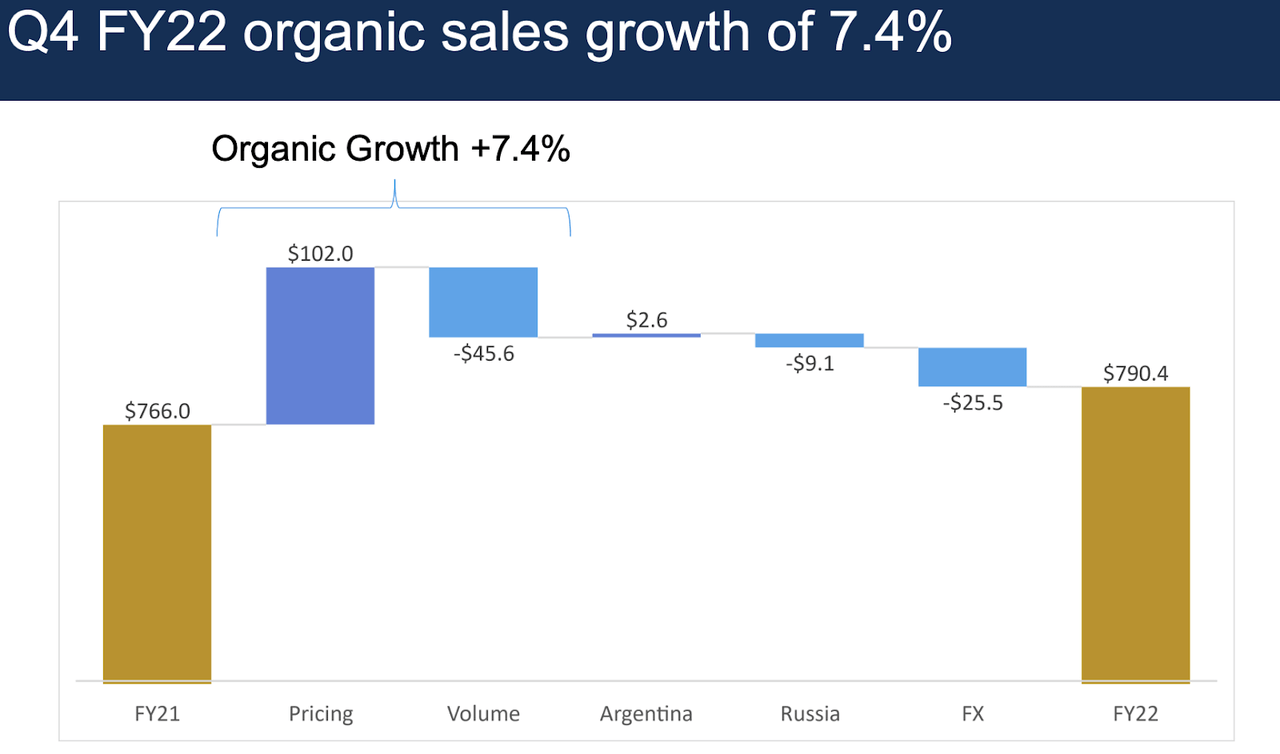

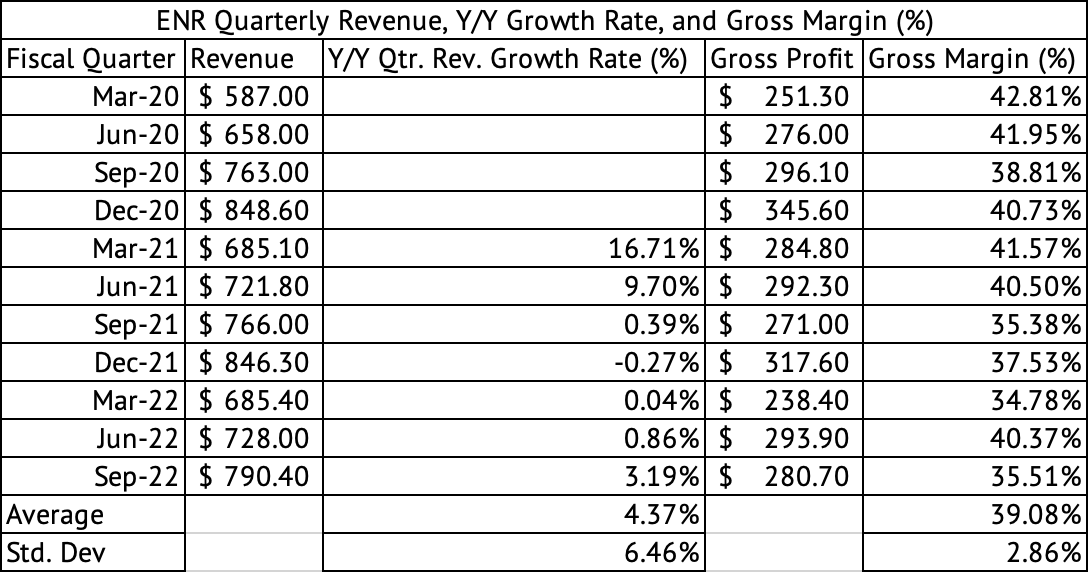

The company’s quarterly revenue growth is slowing from the frenzied pace of the first half of 2021 (Exhibit 2). In Q4 2022, price increases were the most significant contributor to the revenue growth, contributing a $102 million increase in revenue (Exhibit 1). But, a decline in volumes reduced revenues by $45.6 million. The strength of the U.S. dollar reduced revenues by a further $25 million.

Exhibit 1:

Energizer Holdings Q4 FY 2022 Revenue Growth Drivers (Energizer Holdings Investor Presentation)

Exhibit 2:

Energizer Holdings Quarterly Revenue and Growth Rate (May 2020 – Sept 2022) (Seeking Alpha, Author Compilation)

The company has benefitted from inelastic demand in the face of price increases. The company is implementing a cost-saving initiative called Project Momentum, which aims to reduce working capital requirements by $100 million. But, much may depend upon demand holding up. The company has seen its gross margin erode to 35% in the September 2022 quarter. Gross margin has been well below 40% in four recent quarters (Exhibit 2).

Many companies in the consumer staples sector were surprised by the inelastic demand in the face of double-digit price increases. This pricing strength may not continue in the coming quarters, and volumes may decline even if the company stops raising prices, with elasticities returning to more normal levels. A significant positive for the company is that consumers use 15% more batteries than they did in the pre-pandemic period.

High inventory costs depress operating cash flows

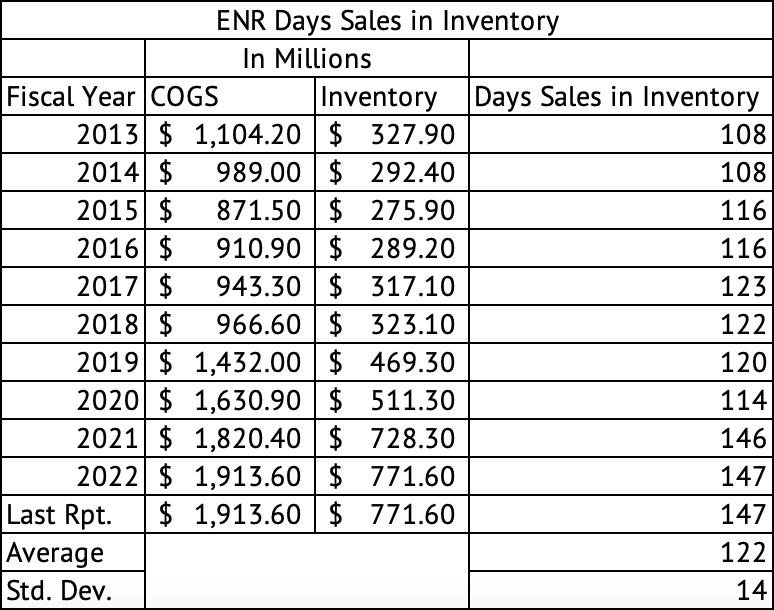

The company is carrying 147 days’ worth of sales in inventory, compared to its average of 122 days of sales since 2013 (Exhibit 3). The standard deviation is 14 for the days’ sale in stock, giving a range of 108 to 136 for one standard deviation away from the mean. The current 147 days’ sales in inventory are well above the one standard deviation from the mean. The increase in stock in 2021 and 2022 has depressed operating cashflows. Operating cash flow has dropped from $376.4 million in 2020 to $179.7 million in 2021 and a steep drop to just $1 million in 2022.

Exhibit 3:

Energizer Holdings Days’ Sales in Inventory (Seeking Alpha, Author Calculations)

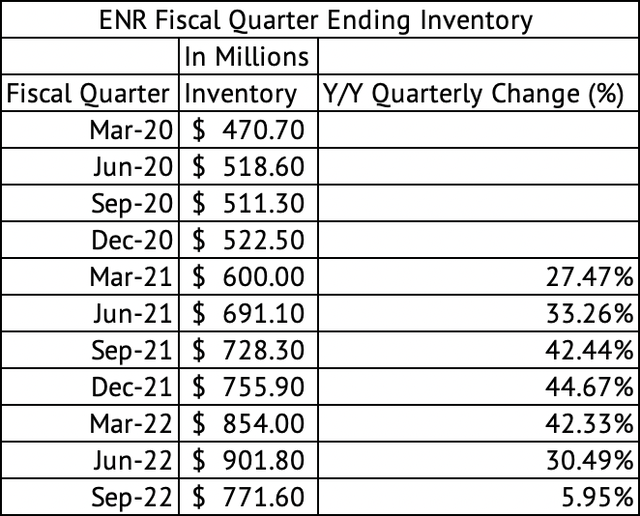

The company’s inventory continued to increase in 2022, touching a high of $900 million in the quarter ending June 2022 (Exhibit 4). In the latest quarterly report, the company carried $771 million in inventory. The company mentioned that it has invested in safety stock due to the volatility in the global supply chain. Still, inventory costs may be at a point where it could become a significant headwind to profits and cash flows.

Exhibit 4:

Energizer Holdings Quarterly Reported Inventory (Mar 2020 – Sept 2022) (Seeking Alpha, Author Compilation)

Debt and dividend

The company has a high debt load (short-term and long-term) of $3.4 billion. The pressure on operating cash flow is a concern that may continue for the upcoming quarter due to high inventory costs. The company paid $93 million in common and preferred stock dividends for the fiscal year 2022. The current dividend yield is 3.34%, less than the 2-year U.S. Treasury yield of 4.17% and much better than the yield of 1.6% offered by the Vanguard S&P 500 Index ETF.

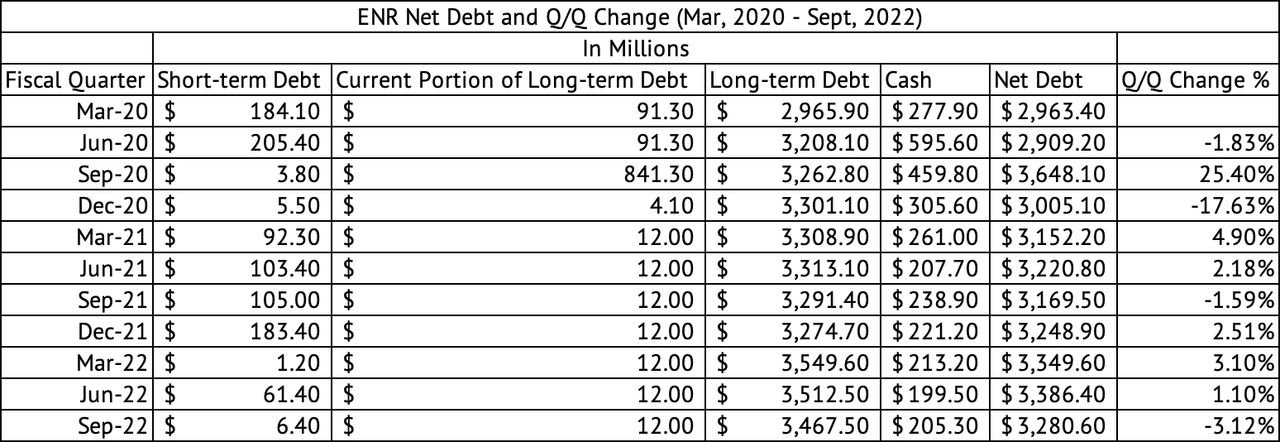

Due to this pressure on operating cash flows, the company cannot pay down its debt quickly, in my view. In the quarter ending September 2022, the company reduced its debt by 3% compared to the previous quarter (Exhibit 5). In my article published in January 2022, I stated that it is all right to own Energizer for the short term. I pointed to its high debt load as a primary concern. The company has yet to make much progress in paying down its debt. The debt is a primary reason for investors to watch this holding closely and take some profits at opportune times.

Exhibit 5:

Energizer Holdings Net Debt and Q/Q Change (Mar 2020 – Sep 2022) (Seeking Alpha, Author Calculations)

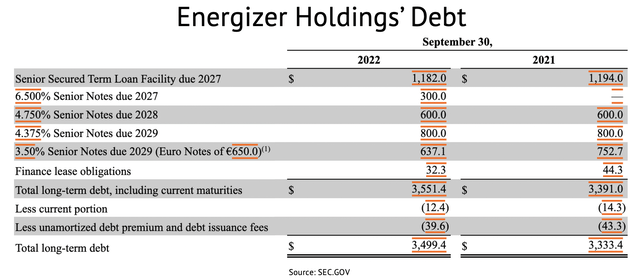

Fortunately, most of the company’s debt is due in 2027 or later (Exhibit 6). So, the company has some time to fix its debt issues, but the sooner it pays down the debt, the better it will be in the long run. The company has debt covenants that could limit its ability to increase its dividends. If profits deteriorate further, debt covenants may be activated, triggering an accelerated debt payment or other adverse effects.

Exhibit 6:

Energizer Holdings Debt Schedule (SEC.gov)

Inflation remains a concern, and there’s a possibility that inflation may stay at 4% for a long time. If inflation stays high for much of this decade, that could spell significant trouble for companies with a high debt load and poor operating cash flows.

Energizer is cheap based on valuation metrics for a reason

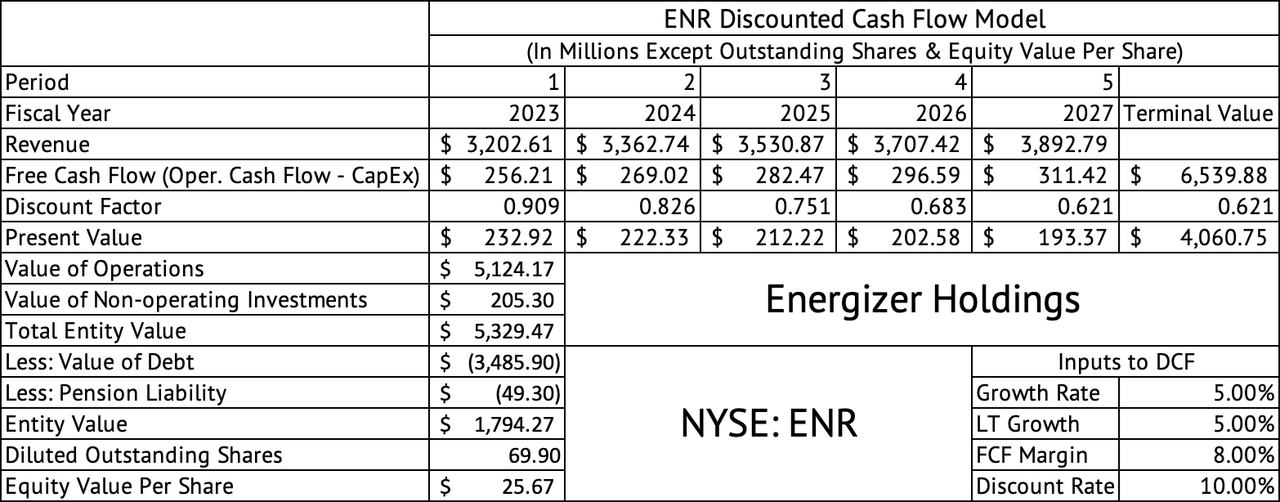

The company is trading at an 11x forward Non-GAAP PE, compared to its five-year average of 13.8x and the sector median P.E. of 18.7x. Although the company looks cheap based on the valuation metrics, it does not look cheap based on a discounted cash flow model.

The discounted cash flow model assumes an annual revenue growth rate of 5% (Exhibit 7). If inflation drops to the Fed’s target of 2%, the 5% growth rate may be an optimistic assumption. But, if inflation settles at around 4%, a 5% growth rate is reasonable. The company averaged a 7.7% free cash flow margin (Operating cash flow – CapEx) between 2013 and 2022. The model assumes a free cash flow margin of 8%. Even with these optimistic projections, the model yields an equity value of $25; the stock is trading at $35.92.

Exhibit 7:

Energizer Holdings Discounted Cash Flow Model (Seeking Alpha, Author Assumptions, and Calculations)

Try selling using covered calls

I own some consumer staples and industrial stocks for the long term, but I am not looking to own Energizer for the long term. On January 6, 2023, I sold a February 17, ’23, $40 strike price covered call for $0.60, for a 1.5% yield. The total premium was about $60 minus the commission. The stock has returned an impressive 33% over the past three months. But, since the first week of the year, the stock’s momentum has faded and pulled back from $37 to below $36.

The S&P VIX Index (VIX) has been dormant since the beginning of the year, with a value below 20, indicating low volatility (Exhibit 8). Investors seek shelter in the consumer staples sector during times of volatility; if volatility increases in the coming weeks, the sector may attract more capital and thus allow investors to take some money off the table in this stock. Selling a covered call may be an excellent way to generate some extra income while looking to sell the stock. An investor can rejoice if the call gets assigned.

Exhibit 8:

Investors should closely watch the company’s cash flow generation and debt levels in the coming quarters. Energizer carries high inventory levels when sales volumes are declining in the face of price increases. In other words, demand erosion may accelerate in 2023. Investors should seek to lock in profits after this huge run over the past three months.

Be the first to comment