eyegelb

Despite last week’s rally, it’s still been a rough year thus far for investors in the Gold Miners Index (GDX), with the ETF suffering a more than 30% drawdown, extending its bear market decline to 53% from its Q3 2020 peak. However, for those willing to embrace downside volatility, severe declines of this magnitude open up the best buying opportunities for patient investors, with one clear caveat. It’s always best to focus on quality, especially in a complex business like mining where the losers don’t just underperform but can find themselves down over 90% from their highs or de-listed altogether.

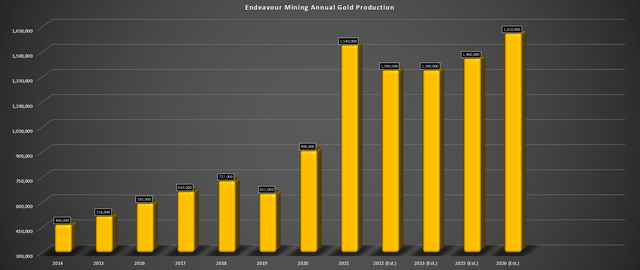

Fortunately, this correction in the Gold Miners Index has spared almost no miners, and even some of the best businesses that are returning their most capital in years to shareholders have declined over 45% from their 2020 highs. One example is Endeavour Mining (OTCQX:EDVMF), which will meet or beat guidance for its 10th consecutive year in 2022 and has an attractive growth pipeline to boost future production to ~1.60 million ounces. Today, the stock can be bought for barely ~5.0x FY2023 cash flow, a valuation that makes little sense for a producer with industry-leading margins. Let’s take a look at its Q3 results below:

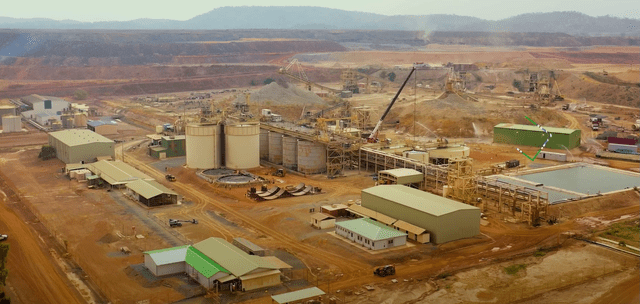

Sabodala-Massawa Operations (Company Presentation)

Q3 Production & Sales

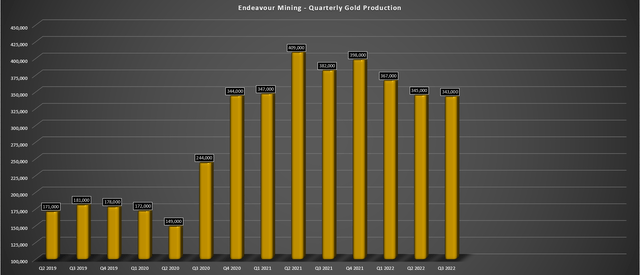

Endeavour Mining released its Q3 results last week, reporting quarterly production of ~343,000 ounces, a 10% decline from the year-ago period. This decline was attributed to lower production at Boungou, Mana, Sabodala-Massawa, and Waghnion but mostly related to a ~20,600-ounce headwind from the divestment of Karma which is no longer in the portfolio. On an adjusted basis, production was down just 5% year-over-year despite tough year-over-year comps, with the company coming off a massive quarter at Sabodala-Massawa in the year-ago period (Q3 2021: ~105,900 ounces), where the operation benefited from high-grade fresh ore from the Sofia Main Pit and higher throughput (1.08 million tonnes processed).

Endeavour Mining – Quarterly Gold Production (Company Filings, Author’s Chart)

While this decline in production year-over-year might appear disappointing at first glance, Endeavour is actually tracking ahead of its full-year guidance mid-point of ~1.36 million ounces of gold, with ~1.04 million ounces produced year-to-date (76.8% of guidance). This suggests that the company could deliver at the top end of its guidance range near 1.40 million ounces for FY2022, which would mark the tenth consecutive year of meeting or beating guidance. Equally as impressive, Endeavour has achieved this production with costs in line with its guidance range of $920/oz year-to-date.

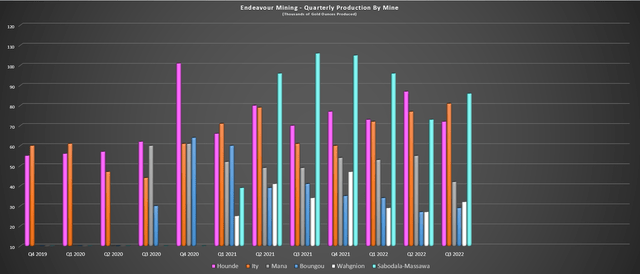

Endeavour – Quarterly Production by Mine (Company Filings, Author’s Chart)

Digging into the operations a little closer, Boungou saw a sharp decline in production (~29,300 ounces vs. ~40,800 ounces) due to lower throughput and grades processed, with full-year production partially impacted by supply chain delays that impacted mining activities. The company noted that FY2022 production is expected to come in below the guided range for the year due to delays in obtaining security escorts for convoys from Fada. Given the sharp decline in production combined with inflationary pressures, costs have been much higher year-over-year, with year-to-date all-in-sustaining costs [AISC] of $1,051/oz vs. $795/oz in the year-ago period.

Fortunately, the softness at Boungou has been made up by a very strong year at its larger Hounde Mine, which had another solid quarter (~72,300 ounces produced) and is on track to produce over 270,000 ounces this year. The higher production was related to the higher throughput of ~1.23 million tonnes processed in Q3, benefiting from an increased proportion of softer oxide and transitional ore from Kari West and Kari Pump. Year-to-date, Hounde is one of the world’s lowest-cost mines due to its outstanding performance, with AISC down year-over-year to $767/oz, with costs of $716/oz in Q3. This was partially related to lower sustaining capital and the increase in ounces sold.

Hounde Operations (Company Website)

Moving to the company’s Ity Mine, Endeavour had a solid quarter here as well, reporting quarterly production of ~80,900 ounces, a significant increase year-over-year due to improved grades and recovery rates. This was helped by higher grades from the Le Plaque and Bakatouo pits vs. lower grades from Daapleu in the year-ago period. Meanwhile, recovery rates benefited from a lower portion of fresh ore in the feed and pre-leach tanks, which were brought online in Q3. Given the strong performance year-to-date, this asset has also enjoyed a phenomenal cost profile, with all-in-sustaining costs of $773/oz in Q3 and $799/oz year-to-date.

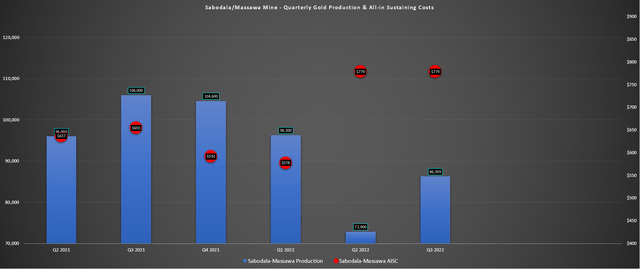

Sabodala-Massawa – Quarterly Production & Costs (Company Filings, Author’s Chart)

Finally, at the company’s new flagship Sabodala-Massawa Mine, production was down year-over-year to ~86,300 ounces, which was attributed to lower throughput (~1.03 million tonnes processed) and lower grades. As noted previously, this was related to mine sequencing and above-average rainfall. However, the decline should not be alarming given that the asset was up against very difficult comps in the year-ago period, and it’s still on track to meet its guidance of 360,000 to 375,000 ounces at industry-leading costs below $725/oz. The real story at Sabodala-Massawa is the planned BIOX plant construction, which remains on schedule and budget and will enable the processing of higher-grade refractory ore from the Massawa deposits.

Costs & Margins

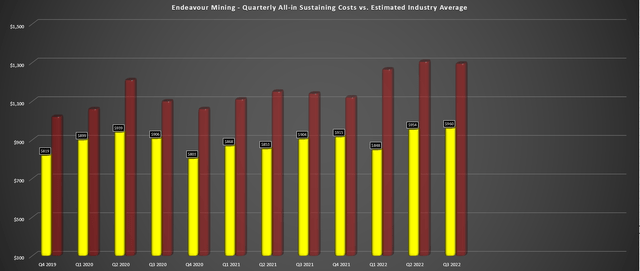

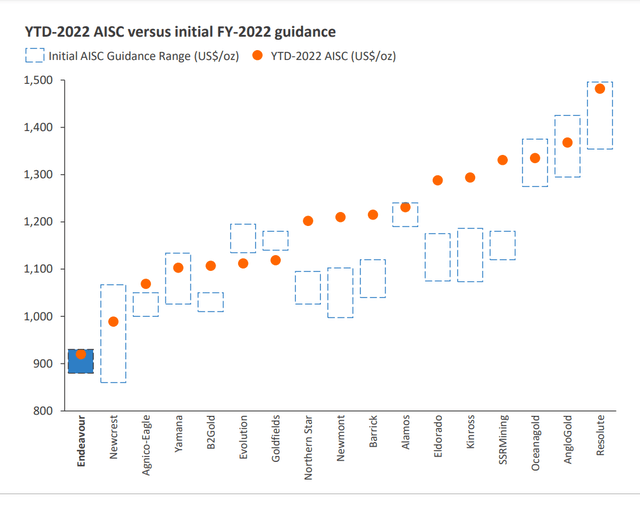

Moving over to Endeavour’s cost profile, its all-in-sustaining costs came in at $960/oz in Q3 2022, up from $885/oz in the year-ago period. While this is a sharp increase year-over-year, it’s below the industry average increase of more than 10% despite a higher cost year than planned at Boungou. The increase in costs is as expected due to sector-wide inflationary pressures, with Endeavour seeing higher prices for fuel and explosives, which was partially offset by the weakness in the Euro vs. the US Dollar, a tailwind for the company with ~60% of costs in Euros. Endeavour also noted that it is in an enviable position from a supply chain standpoint, with 70% of procurement in the country, which reduces supply chain issues.

Endeavour – All-in Sustaining Costs vs. Estimated Industry Average (Company Filings, Author’s Chart)

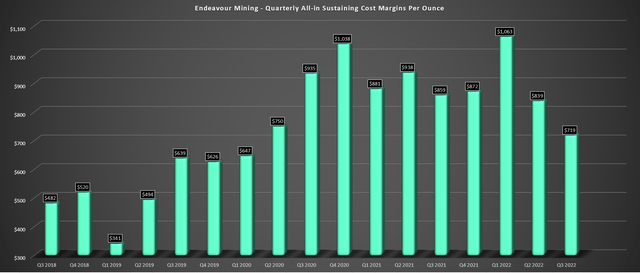

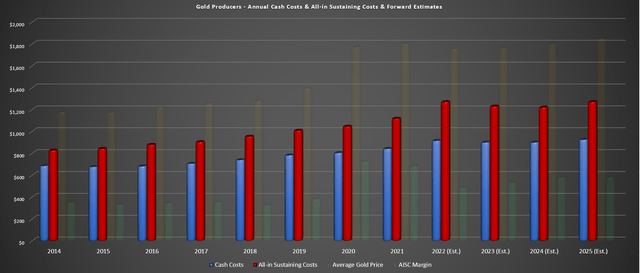

As the chart above shows, Endeavour’s costs may be creeping higher, but they’re clearly below the industry average and are expected to come in within its guidance of $880/oz to $930/oz for the year. This is well below the expected industry average of $1,270/oz+ in FY2022, giving Endeavour some of the highest margins sector-wide. That said, we did see a sharp decline in Endeavour’s margins in Q3, even if they’re miles ahead of most peers, with AISC margins dipping from $859/oz in Q3 2021 to $719/oz. The sharp decline can partially be attributed to the much weaker gold price, which averaged just $1,679/oz in Q3 2022.

Endeavour Mining – All-in Sustaining Cost Margins Per Ounce (Company Filings, Author’s Chart)

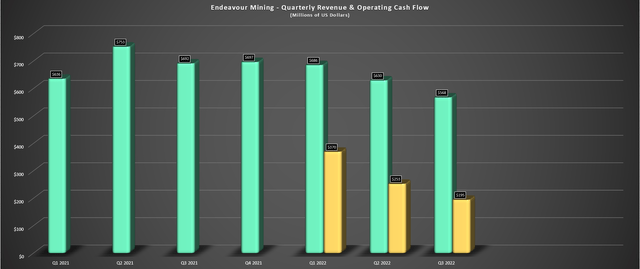

Given the weaker gold price, lower margins, and lower volume of ounces sold, it’s no surprise that Endeavour’s revenue declined sharply year-over-year, dropping from $692 million to $568 million. Meanwhile, operating cash flow before changes in working capital fell from $317.3 million to $195.1 million. This was partially related to increased taxes ($81.5 million vs. $55.5 million) and higher exploration costs. The good news is that despite the higher capital spending this year and lower gold price, Endeavour is in a position to settle its $330 million in senior convertible notes for cash to avoid ~14 million shares of dilution and continues to have a strong balance sheet, with net cash at the end of Q3 2022 of $3 million and $832 million in cash.

Endeavour Mining – Quarterly Revenue & Operating Cash Flow (Company Filings, Author’s Chart)

While this decline in revenue and cash flow isn’t ideal, it’s worth noting that this was in a very weak quarter for the gold price, and this isn’t representative of the business unless one believes sub $1,700/oz gold prices are here to stay indefinitely. Given that the gold price tends to perform its best on a forward 6-month and 12-month basis following periods of extreme pessimism like we had in early November, I don’t see any reason to believe the gold price will average $1,700/oz, and I wouldn’t be surprised if it headed back above $1,850/oz in the next 12 months. Therefore, I’m pleased to see the company taking advantage of its share-price weakness to retire shares through its buyback program (~$80 million in shares repurchased year-to-date).

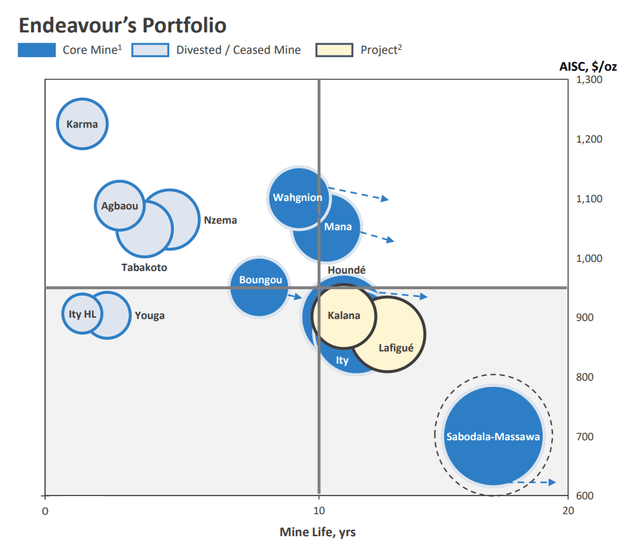

Discipline & Future Growth

Unlike some companies that are hellbent on achieving production growth, even if it comes at the cost of being spread thin or keeping lower-quality assets online, Endeavour is focused on profitability plus asset quality first and growth second. This is evidenced by the company divesting its higher-cost or shorter mine life assets like Agbaou, Karma, Tabakoto, Nzema, and others to focus on low-cost and, in some cases, world-class assets like Ity, Hounde, Sabodala-Massawa, and its future Lafigue Mine. So, while Endeavour may not boast the best growth profile sector-wide, it does boast the best margin profile among senior producers and expects to maintain its industry-leading costs as lower-cost assets come online (Lafigue, Sabodala-Massawa Expansion).

Sabodala-Massawa is expected to provide incremental production of ~194,000 ounces at sub $550/oz all-in sustaining costs in its first five years. Meanwhile, Lafigue is expected to ~203,000 ounces per annum at sub $900/oz all-in sustaining costs.

YTD All-in Sustaining Costs – Sector Peers vs. Endeavour (Company Presentation) Endeavour Mining – Current Portfolio & Divestments (Company Presentation)

Digging into future growth, Endeavour’s consolidated production may be down this year (~1.39 million ounces produced vs. ~1.54 million ounces produced in FY2021), but it’s grown at a very respectable ~14% compound annual growth rate since FY2014. Meanwhile, behind the scenes, its development portfolio has also grown considerably, with multiple assets in the wings that could be developed over the next decade or divested to strengthen the balance sheet if they don’t meet its 20% after-tax internal rate of return [IRR] goal at a $1,300/oz gold price (Kalana, Bantou, Nabanga, Golden Hill). However, while production is down short-term, the production quality is up, and further growth is on deck.

Endeavour Mining – Annual Gold Production & Forward Estimates (Company Filings, Author’s Chart) Gold Miners – Annual Cash Costs & AISC & Forward Estimates (Company Filings, Author’s Chart & Estimates)

These near-term opportunities are the company’s Lafigue Project in Cote d’Ivoire at its Fetekro Property and a significant expansion at its largest Sabodala-Massawa Mine with the construction of a BIOX plant with modest upfront capex of $290 million and a 72% internal rate of return even at a conservative $1,500/oz gold price. These two projects combined are expected to add approximately 405,000 ounces of annual production between Q4 2024 and Q4 2029 at ~$750/oz AISC. This should push annual production to at least 1.6 million ounces of gold and help the company to maintain its ~$900/oz AISC profile, which sits 30% below the estimated FY2025 industry average (~$1,300/oz).

This growth may not seem that significant for those unfamiliar with the sector, but it’s well above the sector average, and it’s highly attractive growth, given that it’s at lower costs than Endeavour’s current cost profile. In addition, this growth is relatively low capex (~$7 compared to other major projects sector-wide, such as the ~1.9 billion capex bill that Iamgold (IAG) is undertaking to build its share of Cote, a project expected to produce just ~270,000 attributable ounces per annum over its mine life. This reaffirms the company’s rigid discipline to pursue growth only at attractive economics and conservative prices without stressing its balance sheet.

Valuation

Based on an estimated ~246 million shares at year-end and a share price of US$20.15, Endeavour trades at a market cap of ~$4.96 billion. This is a very reasonable valuation for a company generating $1.0 billion in annual cash flow from operations, which should generate at least $400 million in free cash flow this year. Based on what I believe to be a conservative multiple of 8.25x cash flow, given Endeavour’s industry-leading margins, growth, discipline, and diversification, I see a fair value for the stock of US$31.80 (FY2023 cash flow estimates: US$3.85). If we measure from a current share price of US$20.15, this translates to a 58% upside, or closer to 63% upside on a total return basis (~5.0% returned to shareholders through buybacks/dividends per annum).

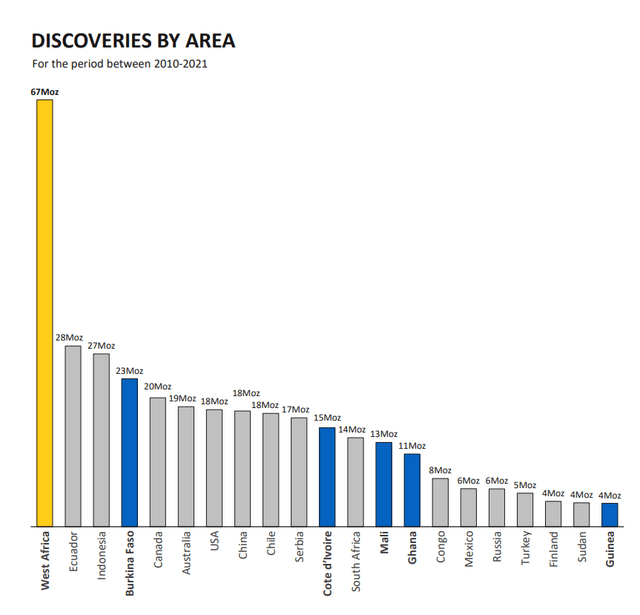

Obviously, Endeavour is not without risk, given that it operates in less favorable jurisdictions (West Africa). Still, I believe this discount is more than priced into the stock at ~5.2x FY2023 cash flow estimates. This is especially true given that Endeavour is spread across multiple countries in West Africa (Senegal, Burkina Faso, Cote d’Ivoire) and could expand into a fourth country later this decade with its Kalana Project in Mali. It’s also worth noting that while Burkina Faso may receive criticism for security risks, its positives are often ignored, which are strong support from governments and unparalleled geological potential and cost to add ounces, with industry-leading finding costs per ounce and a leading number of discoveries over the past decade.

Gold Discoveries By Area (Company Presentation, S&P Global Market Intelligence)

This doesn’t mean that I would rather invest in a West African producer than a producer in Tier-1 jurisdictions assuming both had similar costs, but I think it’s important to balance the negatives against the positives. From a positive standpoint, it’s hard to beat a $25/oz discovery cost, especially when Endeavour pulls these ounces of the ground for less than $1,000/oz. Plus, with a massive development pipeline with dozens of exploration projects and multiple development projects with relatively low upfront capex, Endeavour could grow into a 1.95 million-ounce producer by 2030 without needing to make any acquisitions. Hence, I believe it would be a mistake to overlook Endeavour as an investment simply due to its less favorable jurisdictional profile.

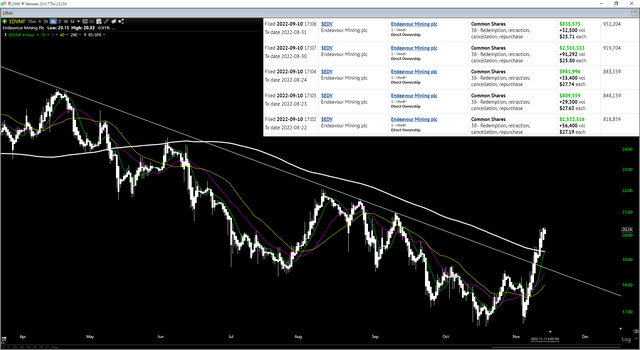

Technical Picture

Moving to the technical picture, Endeavour has broken out from a steep downtrend, and momentum is finally back in its favor, with the stock above all of its key short-term moving averages. While this doesn’t preclude a pullback, I would argue that there’s a high probability of any sharp pullbacks being bought up, with the US$18.50 level likely to be the floor for the stock on any pullbacks. So, if I were looking to start a position in the stock, this looks to be a low-risk area where the stock is likely to find support, further supported by the fact that the company has had a healthy appetite for its shares in this area (C$25.70 – C$27.75 = US$19.00 – US$20.60).

EDVMF 9-Month Chart & Insider Buying (TC2000.com, SEDI Insider Filings)

Meanwhile, from a longer-term standpoint, Endeavour has reached its most oversold levels in the past six years, with the previous three instances leading to 6-month forward draw-ups that averaged ~48%. History doesn’t repeat, but it often rhymes, and human nature never changes. From extreme oversold conditions and panics, we often see rallies just as sharp in the other direction, as shown in past instances. Assuming this were to play out in line with historical averages and measuring against Endeavour’s low of US$16.50, we could see the stock rally to US$24.40 per share by late April, translating to over 21% upside or nearly 50% annualized from current levels.

Summary

Endeavour Mining had another solid quarter in Q3 and is on track to deliver into the top end of guidance and within its cost guidance range. This highlights the company’s ability to deliver on its promises even under difficult operating conditions against a backdrop of supply chain headwinds and inflationary pressures. Given this unique combination of growth, industry-leading margins, and very generous shareholder returns, I see Endeavour Mining as a top-10 producer sector-wide and a Buy on dips.

Be the first to comment