alfexe

Endeavor Group Holdings, Inc. (NYSE:EDR) recently signed new partnerships in Europe, which will likely enhance sales growth from 2022. Besides, management noted that the Owned Sports Properties segment will likely be more valuable over time. In my view, even with changes in consumer trends or recession, if EDR successfully grows like the global events industry market, the upside potential is significant.

Endeavor Group

Endeavor Group presents itself as a global sports and entertainment company making dollars out of media production and distribution, brand licensing, and experiential marketing.

I became interested in Endeavor because of a few acquisitions reported and the estimates given by market analysts. First, management signed the acquisition of the Mutua Madrid Open in Europe and agreements for the UFC, PBR, and Euroleague. In my view, as the revenue of new acquisitions pops up in the income statement, we may see more demand for the stock.

We are proud to add the Mutua Madrid Open and Acciona Open de España to our portfolio. Drawing on our long history in tennis and golf and the MTP team’s expertise, we will build these events into even more unique and remarkable experiences for players, partners, and fans. Source: Press Release

Just as we’ve done for the UFC, PBR and Euroleague, we see tremendous potential to turbocharge these storied Clubs using the scale and capabilities of Endeavor. Source: Press Release

Besides, I believe that I found another beneficial catalyst for the stock. Management noted in a press release that their Owned Sports Properties segment could be more valuable as it is more difficult to own sport events. In the best case scenario, more valuable assets and agreements would push the stock price up:

Opportunities to move into an ownership position of a sport so steeped in history are increasingly rare, and we are confident this will drive meaningful growth in the Owned Sports Properties segment of our company. Source: Press Release

Beneficial Expectations From Analysts

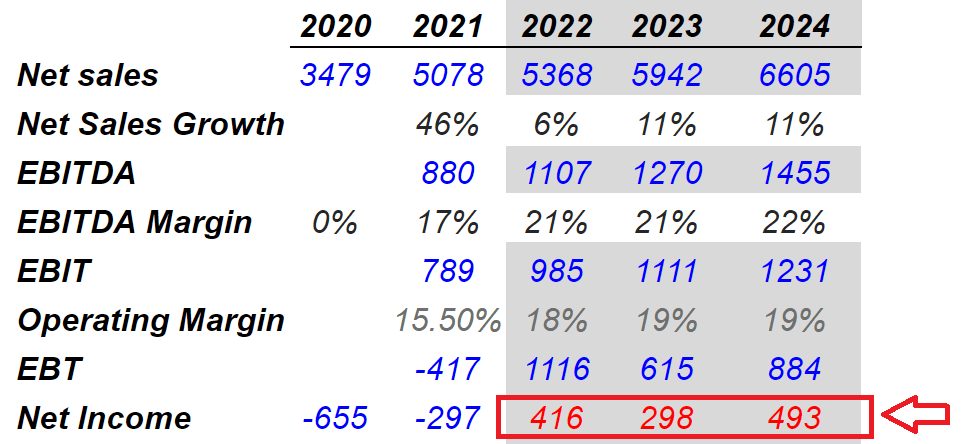

Analysts expect double digit sales growth in 2023 and 2024, and only single digit sales growth in 2022. I believe that the expectations are quite beneficial. Estimates given by analysts include an EBITDA margin of 21% and operating margin around 18%-19%. Finally, I like quite a bit that net income is expected to turn positive from 2022. As a result, I think that many investors will likely start conducting research about Endeavor Group. The demand for the stock could increase.

MarketScreener.com

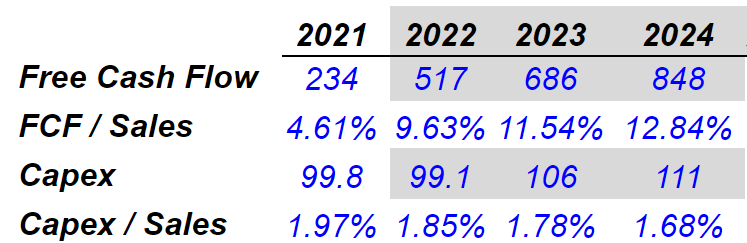

With regards to the free cash flow expectations, they are expected to grow from 4% of sales to around 12%-13%. In my view, as investors see that the free cash flow margin increases, expectations could increase, which would lead to a valuation increase.

MarketScreener.com

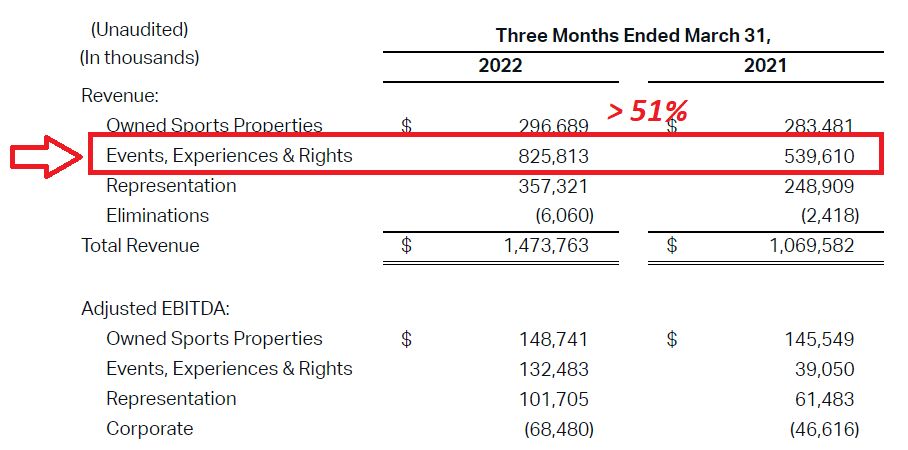

The most recent comments from management also indicate optimism around future guidance as well as an increase in demand for premium content and live events:

Our growth in the first quarter was driven by our ability to respond to the high demand for premium content and live events. We feel great about where we sit relative to the secular tailwinds across all of our businesses, and we’ve raised our guidance for the fourth quarter in a row to reflect our positive outlook for the balance of the year. Source: Endeavor – Endeavor Releases First Quarter 2022 Results

Endeavor Releases First Quarter 2022 Results

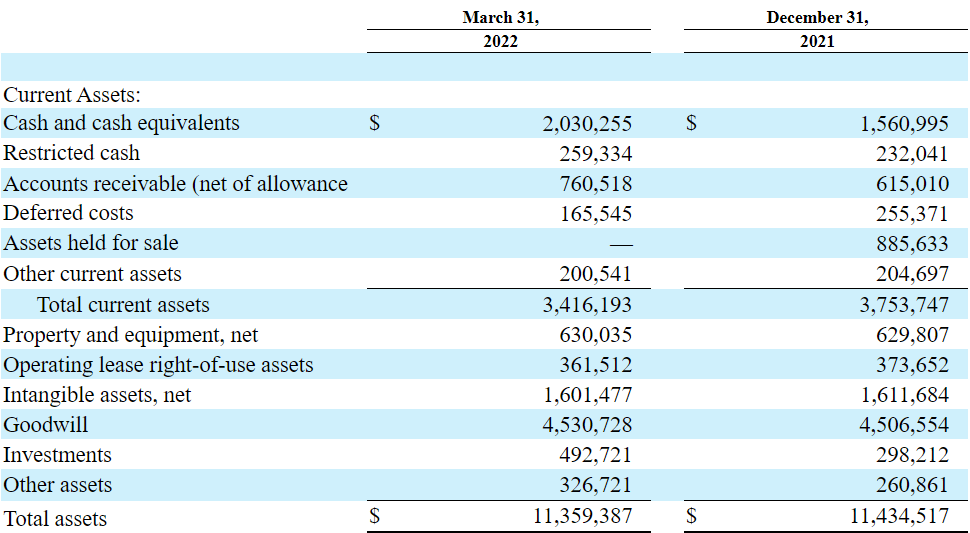

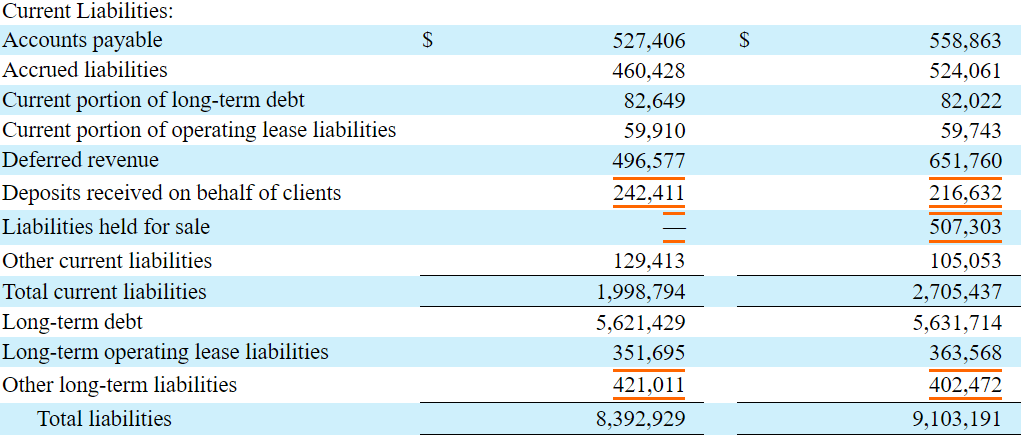

Balance Sheet

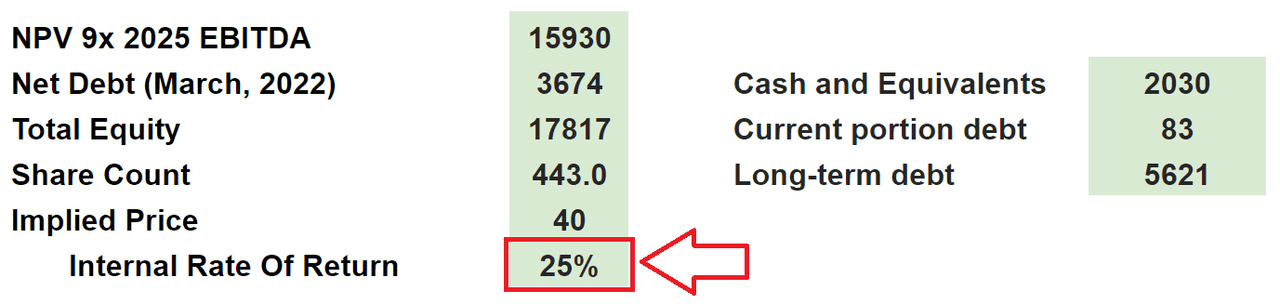

As of March 31, 2022, Endeavor reports a massive amount of cash. Cash and cash equivalents stand at $2 billion. With total assets worth $11.3 billion and liabilities worth $8 billion, the asset/liability ratio is equal to 1x. In my view, the company’s balance sheet appears stable.

10-Q

Endeavor’s financial debt is not small. In the last quarterly report, Endeavor reported $5.6 billion in long term debt. The net debt is close to $3.6 billion. If we assume 2026 EBITDA of $1.3 billion, Endeavor’s net debt/EBITDA is close to 3x. I don’t believe that financial analysts will be afraid of the total amount of leverage.

10-Q

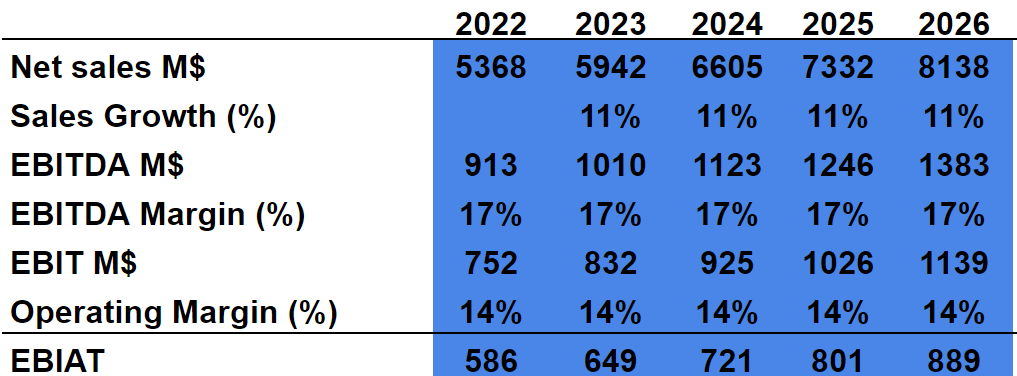

Moderate DCF Model

Under my moderate case scenario, I assumed that landmark partnership deals, sponsorship revenue, and licensing revenue will continue to creep up. Endeavor already owns a significant number of rights over sports events. In my view, as the distribution increases, revenue will likely grow too.

UFC posted its best year ever in 2021, including signing landmark partnership deals with Crypto, and DraftKings. PBR live attendance, sponsorship revenue and licensing revenue are all up significantly since our 2015 acquisition, and the sport has broadened its distribution on multiple fronts, including with a long-term, linear TV deal with CBS and streaming service on PlutoTV. Source: 10-k

It is also relevant noting that sponsorship and hospitality sales related to marquee global events are also increasing. Under this case, I assumed that from 2022, these revenue sources will continue to enhance growth:

In addition to these sports properties, we also own marquee global events including the Miami Open, HSBC Champions, Frieze Art Fair, New York Fashion Week, and Hyde Park Winter Wonderland, which have seen significant increases in sponsorship and hospitality sales generated between 2019 and 2021. Source: 10-k

With an average sales growth of 11% from 2023 to 2026 and EBITDA margin of 17%, 2026 EBITDA stands at $1.3 billion. Finally, the implied 2026 EBIAT would stand at $889 million.

Hohaf

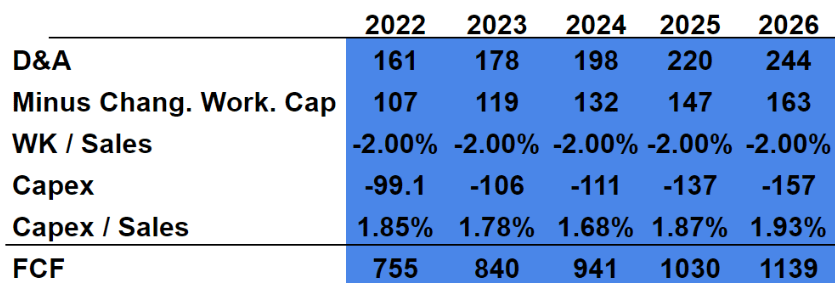

Considering depreciation between $107 million and $163 million as well as capex/sales close to 1.8%-1.9%, Endeavor’s 2026 FCF stands at $1.1 billion.

Hohaf

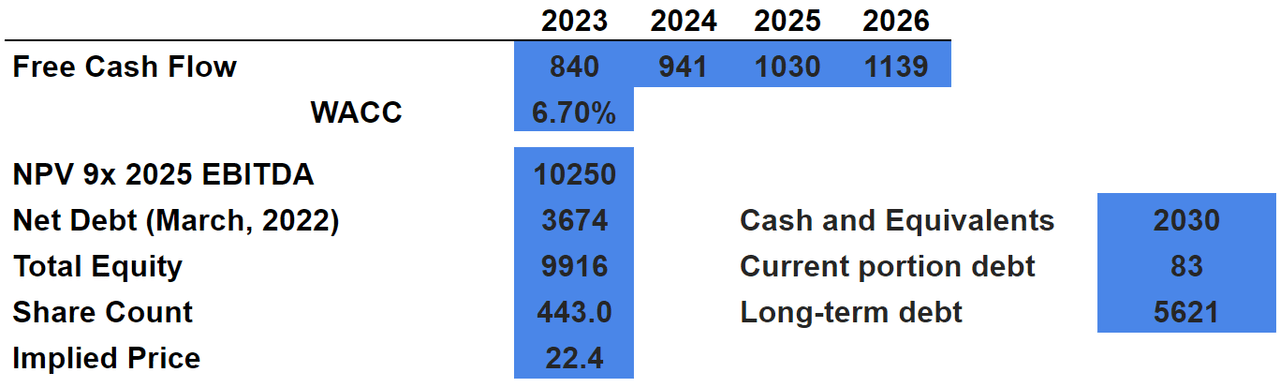

I also included a discount of 6.7%, which is close to the rate used by other analysts out there. The results include total equity of $9.9 billion and an implied price around $22 per share.

Hohaf

My Bearish Case Scenario Includes Recession Risks, Changing Consumer Preferences, And Lack Of Innovation

In the worst case scenario that I forecasted, Endeavor will unfortunately not assess changing consumer preferences. As a result, some of the company’s brands will not see value growth, and revenue expectations could decline. Endeavor did discuss these risks in the last annual report:

Our ability to generate revenues is highly sensitive to rapidly changing consumer preferences and industry trends, as well as the popularity of the talent, brands, and owners of intellectual property we represent, and the assets we own. Source: 10-k

If management does not adapt its offerings to changing technological developments, both revenue growth and EBITDA margins may grow less than expected. In this regard, competitors may be better than Endeavor Group, which could also damage the company’s financial situation:

Our success depends on our ability to offer premium content through popular channels of distribution that meet the changing preferences of the broad consumer market and respond to competition from an expanding array of choices facilitated by technological developments in the delivery of content. Source: 10-k

Finally, with many analysts claiming that a recession is likely, I ran a financial model with a decline in consumer and corporate spending. I do believe that my numbers in this case scenario are not far from what could really happen:

While consumer and corporate spending may decline at any time for reasons beyond our control, the risks associated with our businesses become more acute in periods of a slowing economy or recession, which may be accompanied by reductions in corporate sponsorship and advertising and decreases in attendance at live entertainment and sports events, among other things. Source: 10-k

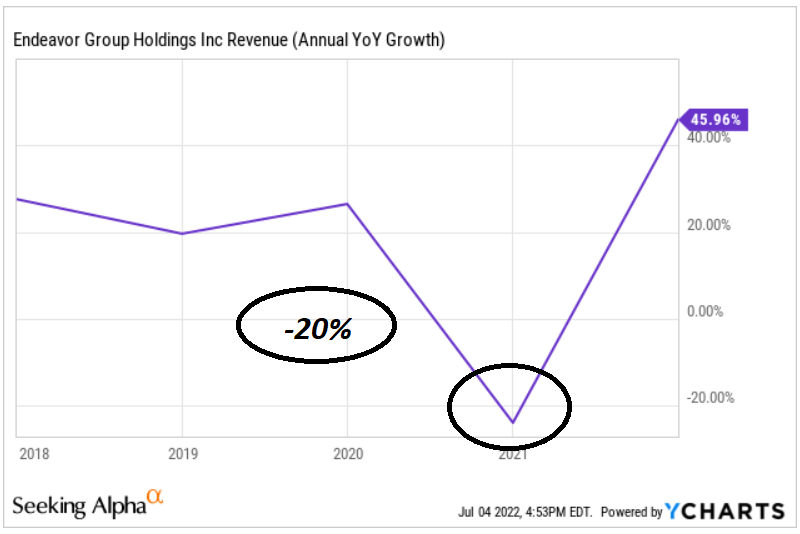

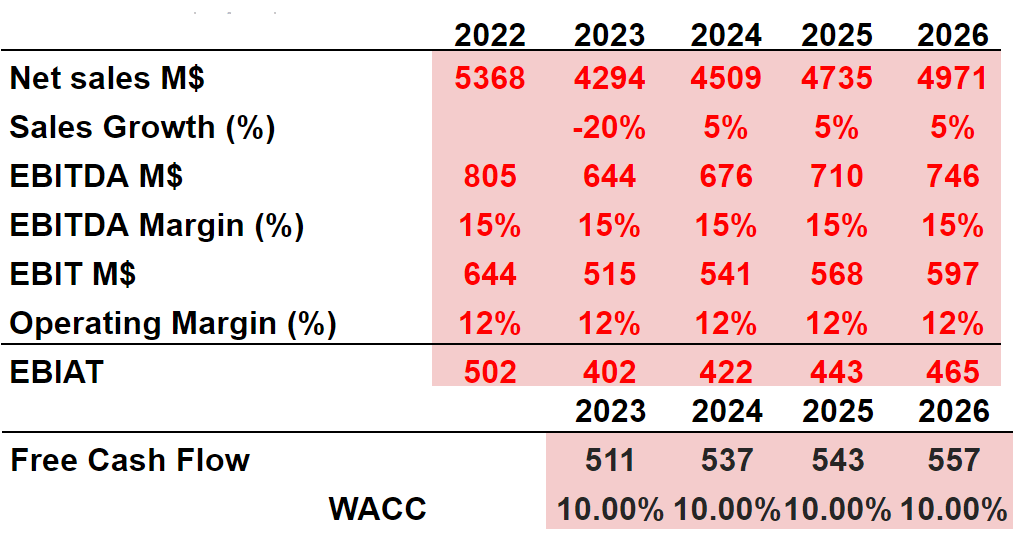

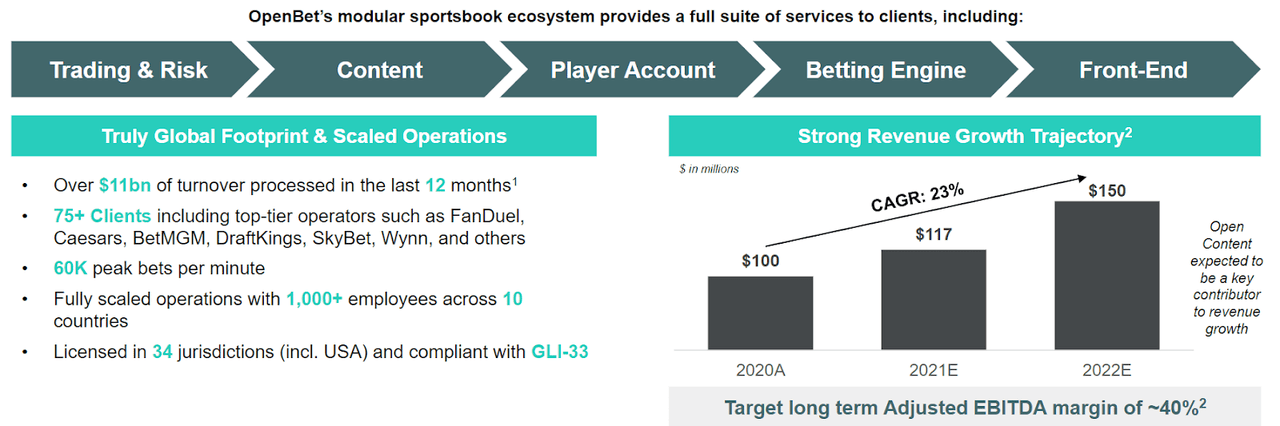

Considering previous declines in sales growth of around -20%, I ran another financial model with bearish assumptions. My numbers include an EBITDA margin of 15% and an operating margin of 12%. 2026 EBITDA is equal to $465 million, and my weighted average cost of capital stands at 10%.

Ycharts Hohaf

Finally, with an exit multiple of 7.5x, the implied equity valuation would be $2 billion, and the implied price is $5.

Hohaf

Best Case Scenario Would Include 23% Sales Growth

Under my best case scenario, I assumed that Endeavor will be able to grow close to the global events industry market growth. Research Dive notes that market growth could stand at close to 23%.

According to a report published by Research Dive, the global events industry market is projected to register a revenue of $1,457.2 million at a CAGR of 23.1% during the forecast period (2021-2028), increasing from $1,134.5 million in 2020. Source: Global Events Industry Market Anticipated to Garner

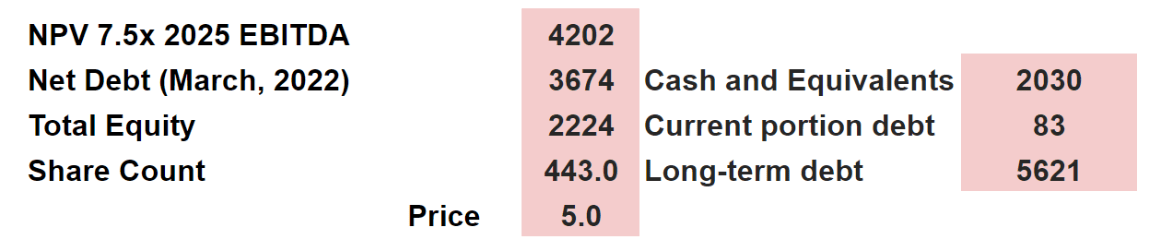

There is another great reason to believe that sales growth could be close to 23%. In the past, Endeavor signed acquisitions like that of OpenBet, in which estimated sales growth stood at a CAGR of 23%. If Endeavor signs acquisitions in growing markets, the company’s sales growth will most likely remain elevated.

Presentation

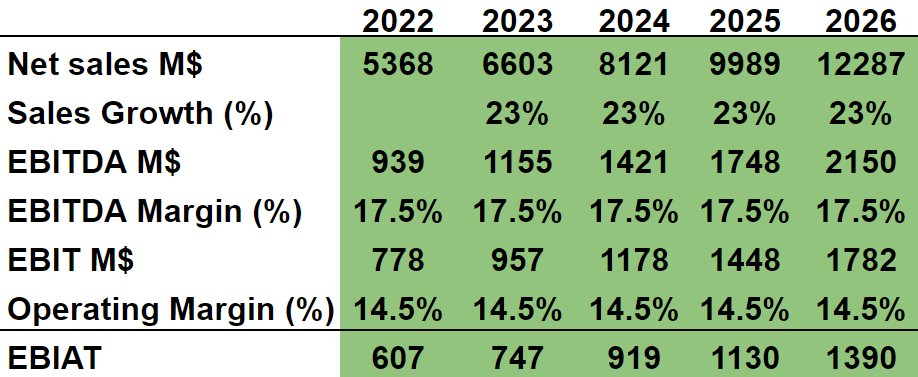

With sales growth around 23%, an EBITDA margin of 17.5%, and operating margin of 14.5%, 2026 EBIAT stands at almost $1.35 billion. Yes, in this case, my numbers are not that moderate. This case scenario is also a bit improbable. Keep in mind that Endeavor Group has a lot of leverage. I would not expect bankers to accept a lot of new acquisitions.

Hohaf

Under this case scenario, the implied equity would be close to $1.785 billion, the fair price could stand at $40, and the IRR would be 25%.

Hohaf

Conclusion

Endeavor Group is signing new partnerships in Europe, and management expects that the Owned Sports Properties segment will be more valuable over time. In my view, if Endeavor enters new markets like that of OpenBet or grows like the global events industry market, the implied upside potential is significant. I do see other risks coming from changes in consumer trends or recession. However, the upside potential appears more significant than the downside risk.

Be the first to comment