nd3000/iStock via Getty Images

A Quick Take On Endeavor Group

Endeavor Group Holdings (NYSE:EDR) went public in April 2021, raising $511 million in an IPO that was priced at $24.00 per share.

The firm operates as a prominent agency for live events, celebrities and major brands worldwide.

While EDR may indeed present a potential opportunity for risk-on investors, my base case is for economic contraction in the coming quarters and a reduction in consumer spending on premium content and live experiences.

I’m on Hold for EDR in the near term.

EDR Overview

Beverly Hills, California-based Endeavor was founded in 1995 as a global celebrity sports, and brand agency.

Management is headed by CEO Ariel Emanuel, who was previously Senior Agent at International Creative Management.

Besides providing access to talent, such as actors, musicians, models, athletes and writers, Endeavor also provides access to various consumer product companies, sports federations and properties, global broadcasters, digital companies, television shows, films, books, podcasts as well as video games.

The firm’s assets include UFC, Professional Bull Riders, as well as the Miami Open and Frieze.

Endeavor’s Market & Competition

According to a 2018 market research report by IBISWorld, the US celebrity and sports agents market was expected to reach $11 billion in 2018, growing at a CAGR of 5% between 2013 and 2018.

The main factor driving market growth is the increase in disposable income from consumers of media and products.

The market depends on the vitality of many entertainment and sports industries, which depends on the aggregate consumer spending on various disposable items, such as movie and sports tickets as well as artist merchandise.

Major competitors that provide talent management services include:

-

Creative Artists Agency

-

United Talent Agency

Endeavor’s Recent Financial Performance

-

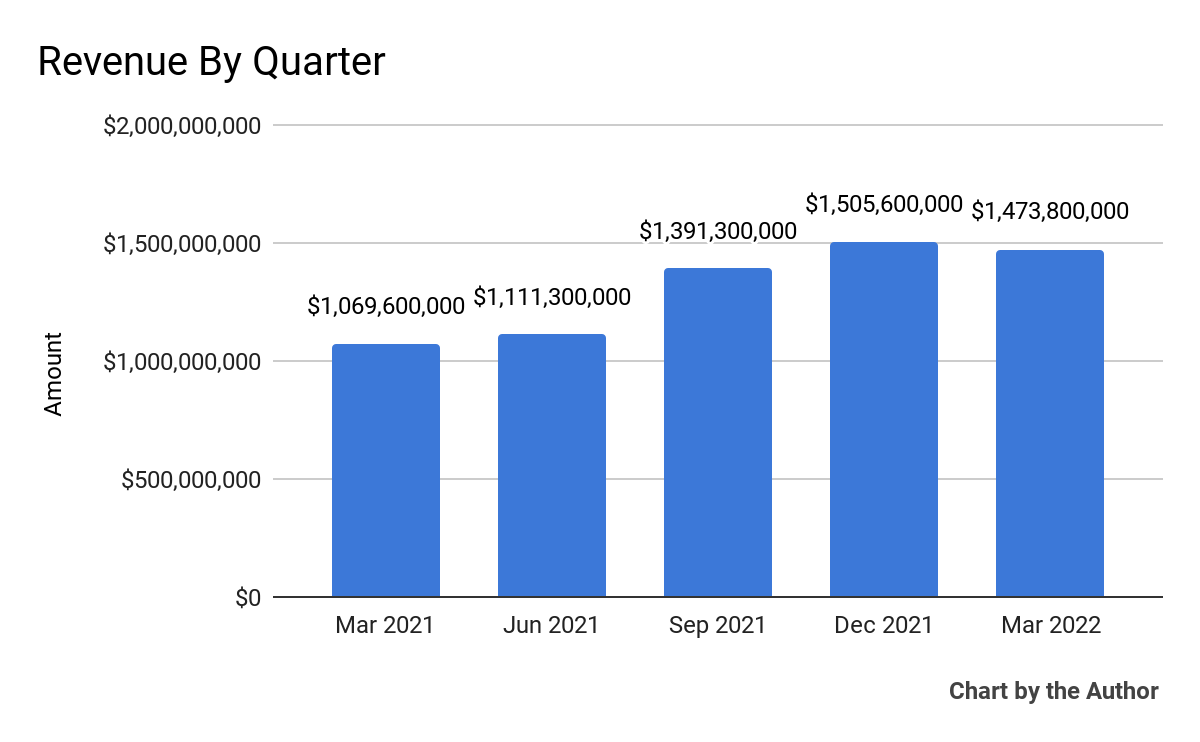

Total revenue by quarter has grown significantly over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

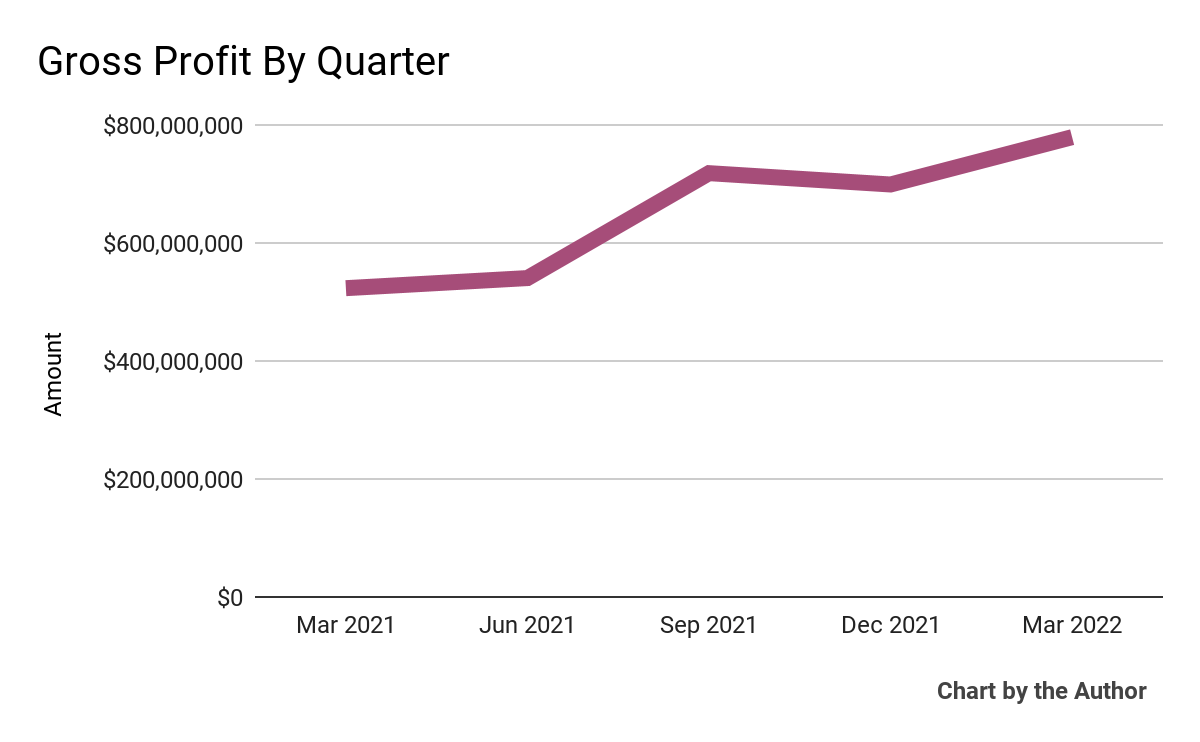

Gross profit by quarter has also risen impressively:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

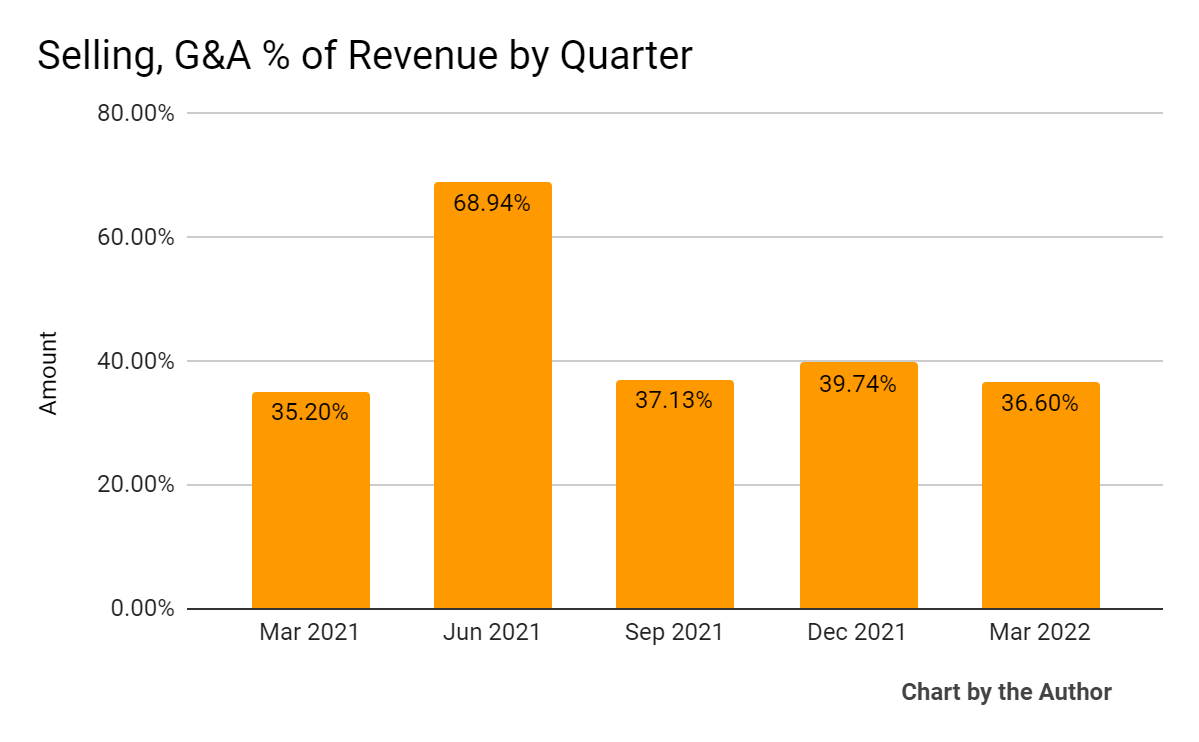

Selling, G&A expenses as a percentage of total revenue by quarter have stabilized in recent quarters:

5 Quarter Selling, G&A % of Revenue (Seeking Alpha and The Author)

-

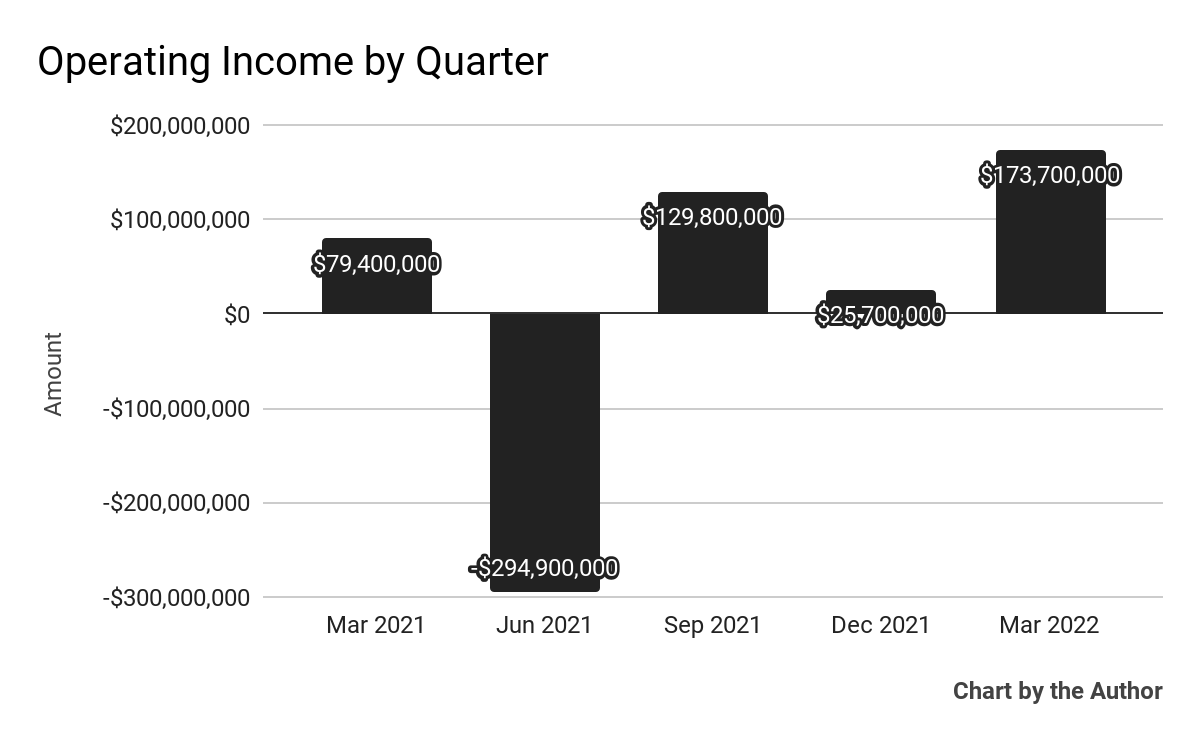

Operating income by quarter grew sharply in Q1 2022:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

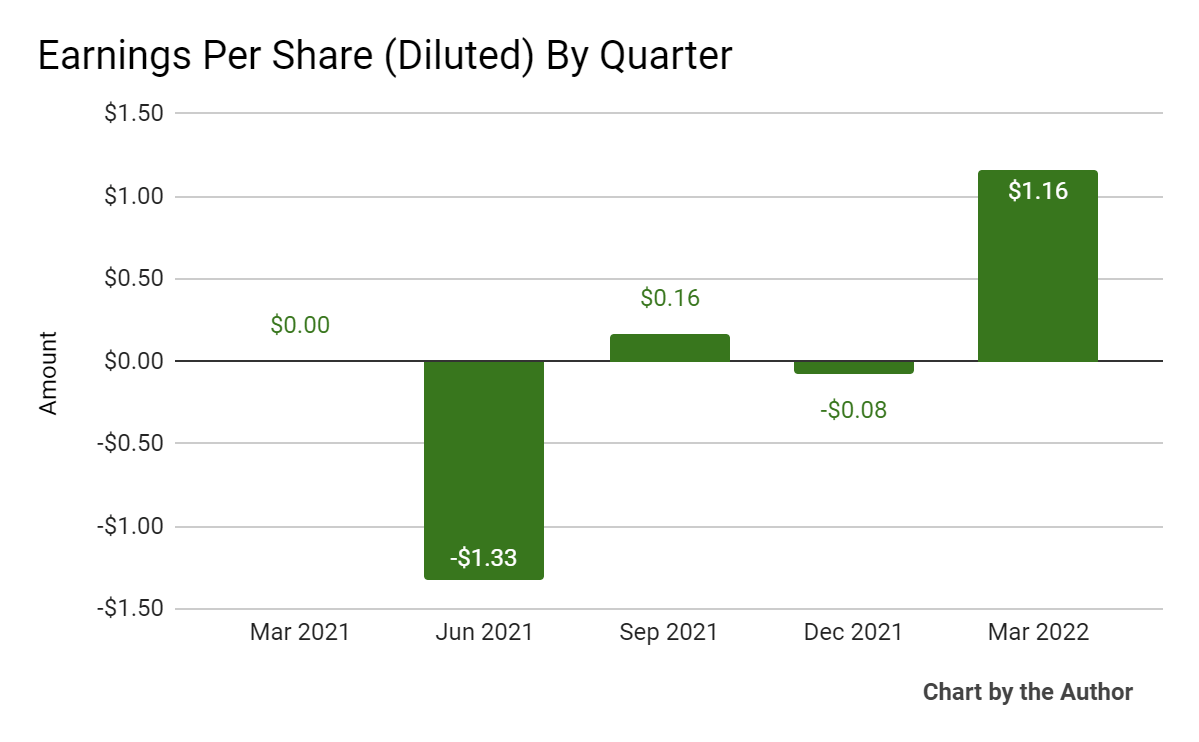

Earnings per share (Diluted) have also risen significantly in Q1 2022:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

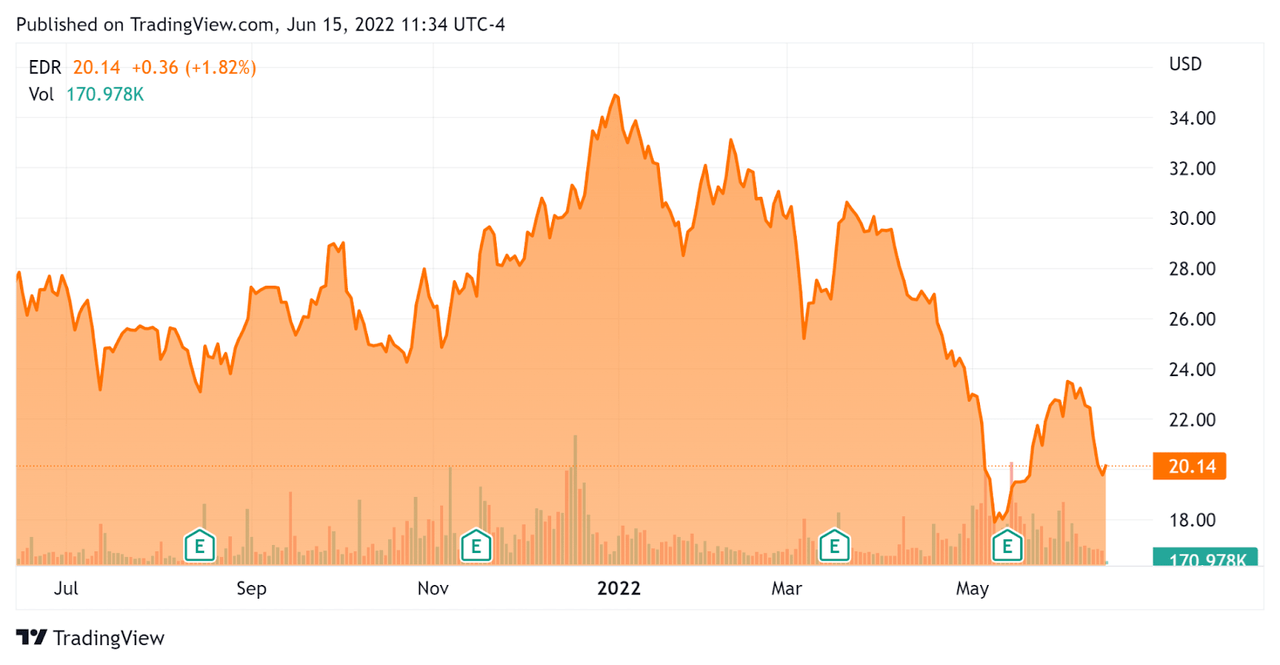

In the past 12 months, EDR’s stock price has fallen 26.4 percent vs. the U.S. S&P 500 index’s drop of 11.2 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Endeavor

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$10,020,000,000 |

|

Enterprise Value |

$11,120,000,000 |

|

Price/Sales (TTM) |

0.96 |

|

Enterprise Value/Sales (TTM) |

2.07 |

|

Operating Cash Flow (TTM) |

$346,330,000 |

|

Revenue Growth Rate (TTM) |

63.25% |

|

CapEx Ratio |

3.25 |

|

Earnings Per Share |

-$0.09 |

(Source)

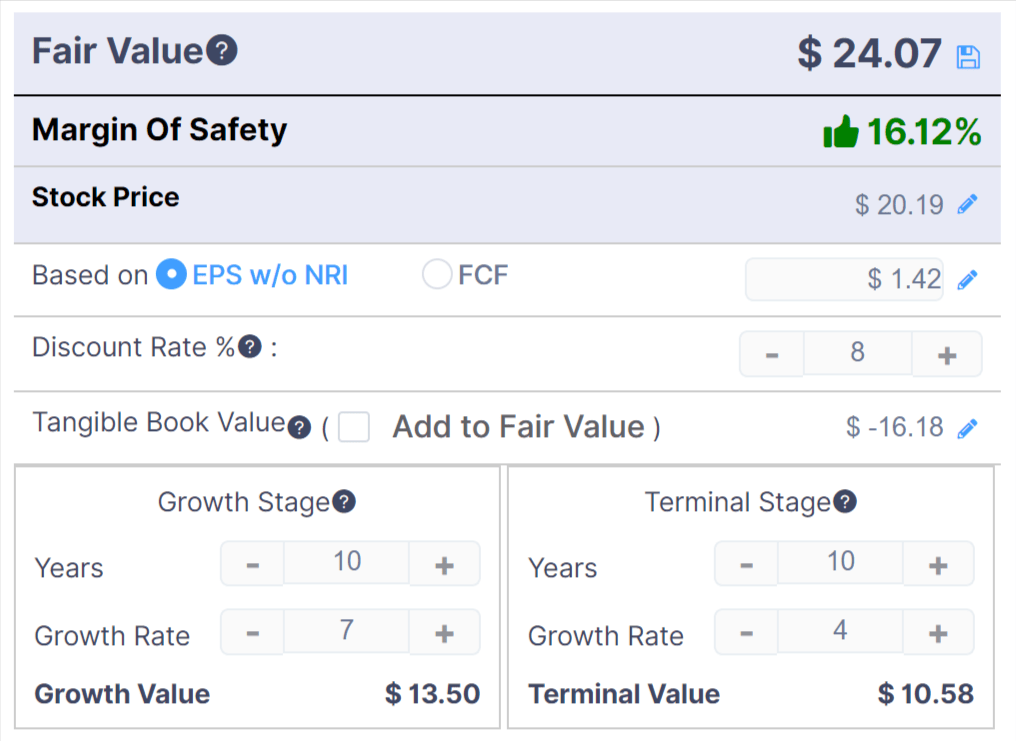

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

EDR DCF Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $24.00 versus the current price of $20.28, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Endeavor Group

In its last earnings call (transcript), covering Q1 2022’s results, management highlighted strong growth from its owned sports properties and increasing participation in live events as the effects of the pandemic continue to wane albeit unevenly.

The company’s representation business also showed growth during the quarter, with revenue growing at 44% due to ‘increased brand marketing spend and continued strong demand for our talent.’

EDR’s talent roster includes over 7,000 clients and its live event portfolio is more than 1,700 events and experiences.

As to its financial results, total revenue grew by 38% year-over-year and adjusted EBITDA increased by 58%.

Notably, EDR isn’t seeing a reduction in spend on premium content, despite the drop in Netflix (NFLX) subscription growth, with 2022’s spend expected to be the highest on record.

Of course, that could change as the threat of a recession looms large, which may reduce appetite for premium products.

Looking ahead, management again raised its revenue guidance, expecting a midpoint revenue target of around $5.37 billion for 2022.

Adjusted EBITDA is now guided to $1.125 billion for 2022, which, if that target is achieved, will equal a 28% growth year-over-year.

Regarding valuation, the market is valuing EDR at around a 2.1x EV/Revenue multiple and a DCF with generous forward earnings assumptions points to a potential value for EDR at its current price of around $20.28.

The primary risk to the company’s outlook is the increased likelihood of a recession in the U.S. and other major countries due to sharply increased interest rates as a result of high inflation.

While EDR may indeed present a potential opportunity for risk-on investors, my base case is for economic contraction in the coming quarters and a reduction in consumer spending on premium content and live experiences.

I’m on Hold for EDR in the near term.

Be the first to comment