MCCAIG/E+ via Getty Images

Introduction

When last discussing Enbridge (NYSE:ENB) earlier in 2022, their move towards a new more self-funded model made it appear that higher dividend growth is coming in future years, as my previous article explained. The following months have seen fears of high inflation or a recession grip the market and make selecting investments even more difficult than normal. Thankfully options still exist with investors able to buy this 6.46% dividend yield either way, as discussed within this follow-up analysis that also reviews their subsequently released results for the first quarter of 2022.

Executive Summary & Ratings

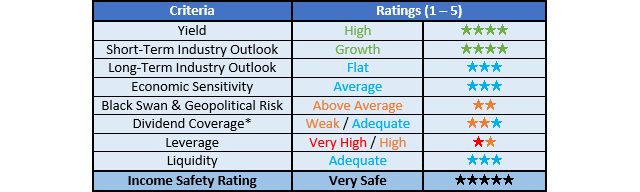

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

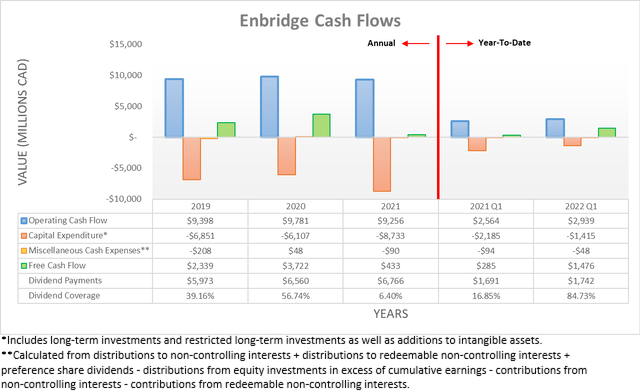

It seems that 2022 is building upon the strength of 2021 with their financial performance starting the year on a strong note, which saw their operating cash flow increase 14.63% year-on-year to C$2.939b during the first quarter, versus their previous result of C$2.564b during the first quarter of 2021. To be fair, half of this increase was due to temporary working capital movements that if removed from both results, sees their underlying operating cash flow during the first quarter of 2022 at C$3.191b and thus only 7.00% higher year-on-year versus their equivalent previous result of C$2.982b, which is still solid and broadly in line with the expected increase when conducting my previous analysis.

Despite this solid cash flow performance, their free cash flow of C$1.476b during the first quarter of 2022 was insufficient to provide adequate coverage to their dividend payments of C$1.742b, thereby technically leaving their coverage at a weak 84.73%. Although if once again removing the impact of their C$252m working capital build, their underlying free cash flow was C$1.728b and thus essentially equal to their dividend payments, thereby essentially providing adequate coverage. Whilst an overall positive start to 2022, this is nevertheless once again broadly in line with the expectations from my previous analysis and thus the more interesting consideration right now is their ability to navigate the current macroeconomic risks, both current and potentially on the horizon.

The world of investing is never free from risks and worries with the often quickly evolving landscape posing fresh hurdles every year, sometimes even multiple conflicting hurdles, such as the current difficult macroeconomic environment. On one hand, inflation is surging to its highest level since the 1980s with few signs of abating in the short-term, whilst on the other hand, fears of a recession have gripped the market and sent share prices tumbling but unfortunately, the easy go-to ways of handing these risks are largely at odds with each other. If inflation were the only risk, the answer would be fairly easy, simply buying shares of commodity producers such as oil and gas companies, as commodity prices perform best during these periods and thus offer protection to their investors. Alternatively, if a recession was the only risk, the answer would be just as simple, sell shares and sit on cash but alas given the high inflation, taking this path erodes the real value of the cash and thus effectively still imposes losses, especially if this inflation proves persistent for years.

Thankfully this conflicting scenario is one where their shares offer a desirable middle-of-the-road option that offers both protection from inflation and minimal downside risk from a recession. At the moment, no one knows exactly how long this high inflation will persist given it primarily stems from supply-side constraints but thankfully, they are well-positioned regardless of how long it lasts, as per the commentary from management included below.

“We’re well protected against inflation. As a reminder, 80% of our revenue has some form of inflation protection through our various tolling mechanisms. Revenues are adjusted through regular rate filings or directly through embedded contractual inflation escalators. Our secured capital has been largely contracted for 2022, which provides good protection against capital cost increases, and we continue to manage our capital programs through active supply chain procurement and fixed price EPC contracts.”

-Enbridge Q1 2022 Conference Call.

It can be seen that management guides that 80% of their revenue is protected from inflation, whilst the majority of their capital expenditure for 2022 is already been locked through contracts, thereby lowering the extent of any cost blowouts, at least in the short-term. Even if their capital expenditure and operating expenses see costs increase during 2023 and beyond, thankfully with their revenue scaling with inflation, it should offset this pain and thus protect shareholders.

Whilst the remaining 20% of their revenue is not necessarily protected from inflation, there is another aspect to consider that should help close the remaining gap. If this high inflation persists well into the future for multiple years and thus becomes a more significant problem, it would likely be on the back of the current energy shortage across the globe following the Russian invasion of Ukraine. This would increase the likelihood of higher oil and gas production in North America, thereby leading to further demand for their midstream operations and possibly new growth options that boost their financial performance.

If inflation ultimately proves to be a fleeting problem that was confined to 2022, there is a very real possibility that it ends in a recession, especially given the recent fears on the back of the Federal Reserve increasing interest rates at the fastest pace in decades. Thankfully this is where their resilient financial performance would come into play because even during 2020, which saw arguably the most severe economic crisis in a generation with plunging oil and gas prices, their operating cash flow still recorded a result of C$9.781b and thus 4.08% higher year-on-year versus their previous result of C$9.398b during 2019. This is not suggesting that they would benefit from a recession, rather their resilient financial performance should not suffer and thus if a recession transpires, any loss of share price should be both relatively minor and only short-term, thereby limiting the downside risk for investors whilst still offering desirable protection if this high inflation proves persistent.

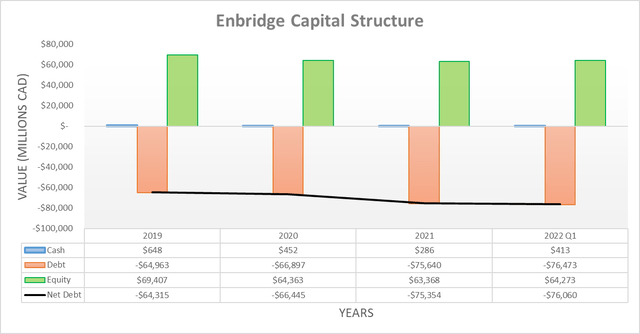

When turning to their capital structure, rather unsurprisingly it remained broadly unchanged following the first quarter of 2022 with their net debt only seeing a relatively small increase to C$76.06b versus its previous level of C$75.354b at the end of 2021. Whilst C$266m of this increase is attributable to their relatively minor use of debt to bridge the gap between their free cash flow and dividend payments, the majority of the increase was attributable to redeeming C$750m of preferred shares with the remainder of the variation resulting from foreign currency exchange rate translations. If looking ahead into the remainder of 2022, barring any surprise acquisitions or divestitures, their capital structure should continue to see only relatively small changes given the outlook for broadly equal cash inflows and outflows. This makes it redundant to reassess their leverage and liquidity in detail, especially given the only relatively small changes following the previous analysis.

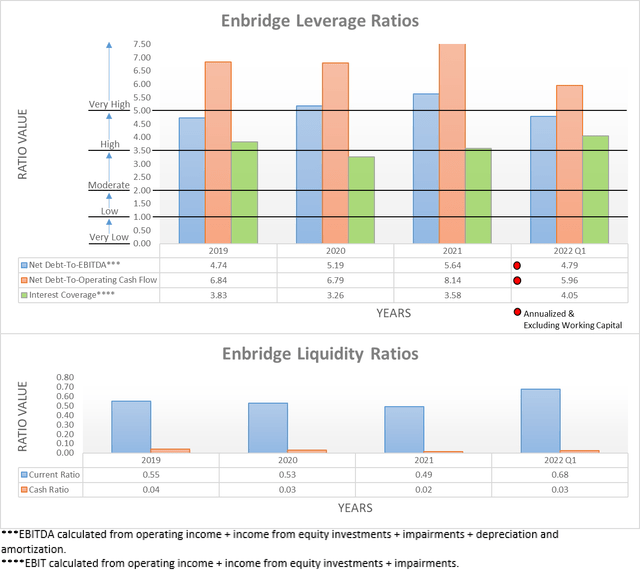

The two relevant graphs have still been included below to provide context for any new readers, which show that thanks to their strong financial performance, their leverage decreased slightly versus their respective net debt-to-EBITDA and net debt-to-operating cash flow of 5.64 and 8.14 at the end of 2021. Although it nevertheless remains across the high and very high territories given their current respective net debt-to-EBITDA and net debt-to-operating cash flow of 4.79 and 5.96 are still sitting on each side of the threshold of 5.01 for the very high territory. Meanwhile, their liquidity improved slightly and thus remains adequate with their respective current and cash ratios increasing to 0.68 and 0.03 versus their respective previous results of 0.49 and 0.02 at the end of 2021. If interested in further details regarding these two topics, please refer to my previously linked article.

Conclusion

The two biggest risks on the horizon for investors to navigate at the moment are inflation and the prospects of a recession, which makes selecting investments particularly difficult because the easy go-to ways of handling these risks are largely at odds with each other. Thankfully their shares offer a very desirable mixture of protection from high inflation, whilst also remaining resilient to see only minimal downside risk if a recession were to strike the economy. When considering they also sport a desirable high dividend yield, I believe that upgrading to a strong buy rating is appropriate on the back of this recent sell-off across the energy sector.

Notes: Unless specified otherwise, all figures in this article were taken from Enbridge’s SEC filings, all calculated figures were performed by the author.

Be the first to comment