Iryna Tolmachova/iStock via Getty Images

As is the case across many zip codes in the United States at the moment, in my hometown there is not a lot of housing inventory available. One of my wife’s colleagues has been frustrated by that fact, as she wants to find a way to move closer to her job, but there is just really not a good selection of homes for sale. On the other hand, I’ve noticed that a house just one block over from mine has been on the market for longer than normal, and I wonder what’s keeping a deal from getting done. I have my suspicions that the combination of it being a larger, nicer home is working against it getting snatched up – the seller probably doesn’t want to drop the price since the market has been so strong for so long, but in a context of rising interest rates and rising inflation, buyers are feeling the squeeze on prices for everything, starting with what is likely the largest purchase most families make. This doesn’t just impact existing home sales, but there is clear evidence that new home construction is slowing down as well.

Like most sectors, what gets thought of broadly as “housing” includes a wide array of supporting industries. Homebuilders like Toll Brothers (TOL), and services for matching buyers and sellers like Zillow (Z), are naturally included, along with the necessary materials for construction and renovations like lumber (LB1:COM), paint and hardware. The financing side of the housing market is its own thing, involving mortgage providers like banks and credit unions along with more dedicated mortgage companies like Rocket (RKT), and extending to underwriters of homeowner’s insurance. The lending business is pretty different from the hardware business, however the health of the housing market is pretty significant to all their results.

Rising interest rates and persistent inflation are clearly contributing to a slowdown in the housing market, but even so the buying and selling of homes via mortgage financing is still a significant part of the US economy. One little corner of this market, mortgage insurance, is a space I’ve evaluated before by looking at Radian Group (RDN), and today I am returning to this topic with a look at Enact Holdings (NASDAQ:ACT).

Overview Of Enact Holdings

Enact Holdings is a mortgage insurance provider, one of the largest, but perhaps still somewhat overlooked due to its fairly recent split from Genworth Financial (GNW), who remains a majority owner, holding nearly 82% of its former subsidiary. For anyone unfamiliar with mortgage insurance as a product, it is basically a form of insurance paid for by a mortgage borrower in order to protect the lender in case of default, for the period that the borrower has paid off less than 20% of the purchase price of the property. Mortgage insurance is normally a requirement of the lender for the borrower to purchase unless the borrower is making a down payment of 20% or more, and the requirement goes away once that threshold has been met.

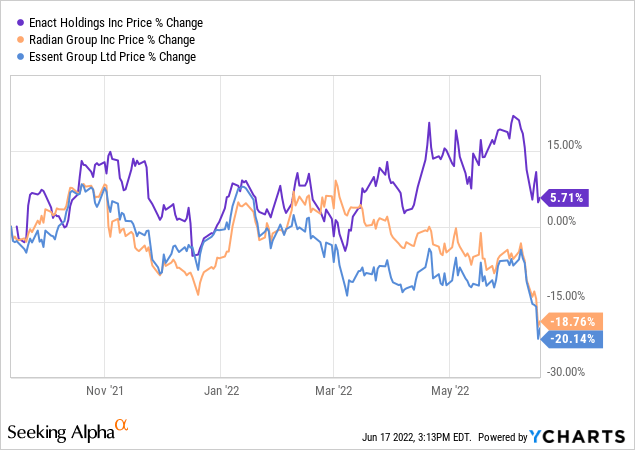

Enact Holdings began trading independently of Genworth in September 2021, and shares have held up reasonably since that time, still over their IPO price in another wise down market. Total return, including a generous special dividend of $1.23 and the initiation of a modest $0.14 quarterly dividend in 2022, have helped it outpace its industry peers such as Radian Group and Essent Group (ESNT), in spite of the headwinds facing the housing sector, although it trading off its recent high as most of the US equity market has retreated.

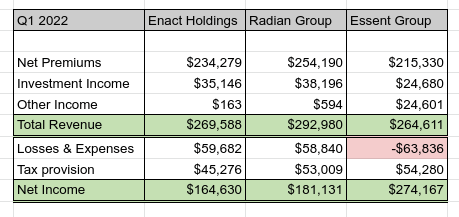

Enact has now reported results through 2 full quarters, and it is possible to start trying to see if there are any specific trends emerging related to the health of the business, and it stacks up reasonably well in comparison to its direct peers. A sort of snapshot of Q1 revenue and net income figures shows this well.

Q1 2022 PMI – net income comps (Company Websites)

Net income for the first quarter of 2022 came in at $165 million off a total revenue figure (premiums plus investment income) of $269.5 million; the net income result was a 32% improvement over the prior year’s $125 million on higher revenues of $288.5 million. For a sense of relative scale and comparison, Radian Group also reported net income in Q1 of 2021 of $125 million, but generated it from some $40 million more revenue for that period. Radian pulled ahead a little faster on the net income measure, bumping up to $181 million for the most recent quarter, but on higher revenues of $293 million. Nevertheless, the figures offer a helpful comparison for grasping that the two firms are suitable for fair comparison. Essent Group is in the same ballpark of size, and outperformed on a net income basis in Q1 due to an unusually strong benefit from its provision for losses.

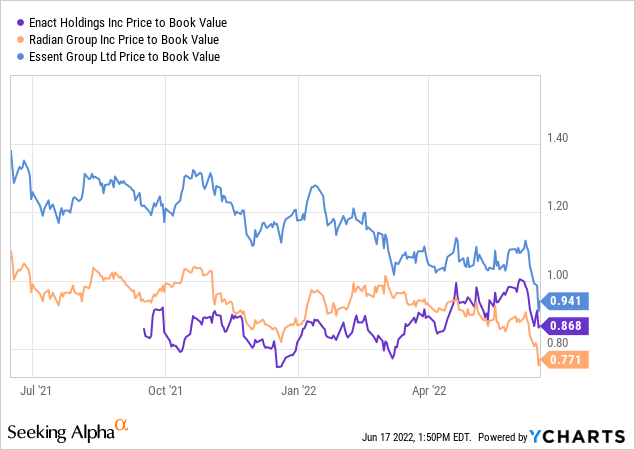

The end result in terms of Enact’s earnings is an EPS of $1.01 for the quarter, making its initiation of a $0.14 quarterly dividend policy easily covered, not just for the quarter but for the year. In other regards, Enacts capital position is solid, with nearly $5.5 billion in investments and cash, versus total liabilities – loss reserves, long term debt, and unearned premiums – all amounting to $1.7 billion. The net of it all amounts to a book value per share of $24.86. While shares have traded above book value at times since the IPO, they are currently around 0.86 price to book.

About That Slow Down In The Housing Market

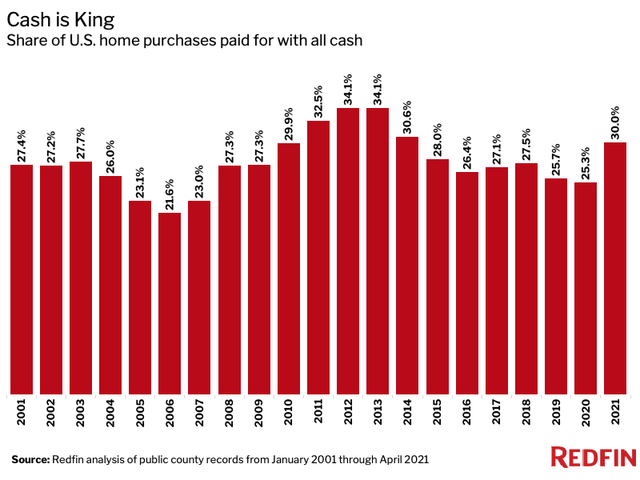

The argument can be made that such a discount to book value is only fair due to the outlook for housing at the present moment. Mortgage originations in Q1 nationally were reportedly 2.71 million in terms of volume (a decline of 32% year over year), and both the Mortgage Bankers Association and Fannie Mae are busy revising their 2022 and 2023 forecasts down. Not only are home sales slowing along with refinancing, but the relative percentage of homes selling for cash instead of by traditional mortgage financing has been near historic highs. Zillow’s research for 2021 showed that more than 30% of home sales were paid for in cash, the highest proportion since 2017. The figure is still around 25% so far in 2022; Zillow’s data is quite consistent with Redfin’s research on the subject.

All cash home purchases by year (Redfin.com (Lily Katz) – used with permission)

With less volume of total mortgage financing and a steady proportion of deals done in cash, obviously there is less volume of mortgage insurance likely to be rolling in on the horizon.

Enact’s management did not offer specific guidance for the rest of 2022, other than an expectation that operating expenses would be approximately $240 million for the year, a statement made by CFO Dean Mitchell on the Q4 2021 earnings call. On the Q1 2022 call, there was little detail offered regarding financial guidance, although Rohit Gupta, the firm’s CEO, offered a general optimism in two regards. In the first, they felt they were still seeing some pent-up short-term demand for originations, even if declining from the high benchmark recent levels. Secondly, while refinancing is undoubtedly declining at a massive pace, there is a silver lining of strong persistency due to lower refinancing activity (persistency is a sort of measure of customer churn – when a mortgage is refinanced there is an elevated risk of the mortgage insurance business going to a different carrier, so less refinancing is less churn, aka higher persistency). Mr. Gupta spoke to the importance of this during the call in response to a question, saying in part why he believes persistency will remain high [edited slightly for clarity]:

we expect persistency to be a tailwind in our ability to grow our portfolio as our $232 billion of insurance in force stays longer. And it gives us an ability to also hedge against any pressure on market originations just from higher interest rates and higher home prices.

Now on borrower-initiated cancels, we believe that it’s at least driven by 2 factors. . . First, for borrower-initiated cancels, which is essentially [when the] borrower goes out, gets an appraisal, submits that appraisal to their servicer to request a cancellation under HPA [Homeowners Protection Act]. GSEs [Government-sponsored enterprises, such as Fannie Mae] have a seasoning requirement, which is a combination of number of years and current loan-to-value requirements. That applies to borrowers to cancel [mortgage insurance] based on updated appraisal and updated home price.

Second . . .it requires an action on borrower’s behalf to spend money, get an appraisal and submit it to their servicer to see if they qualify. So they have to spend anywhere from $200 to $400 on an appraisal, take that initiative and then not have the certainty of that cancellation.

In spite of the optimism, it is undoubtedly a bleaker picture looking forward in the near-term for housing generally. For considering an investment in mortgage insurance such as Enact Holdings, the essential question now comes to whether or a counter-cyclical opportunity exists or if there remains a poor risk to reward challenge from a valuation point of view.

Stacking Up The Valuation

As mentioned previously, shares are trading right now at around a price to book value of 0.85x, where book value is just under $25.00. I like using the price / book ratio for valuation in insurance and financial sector, as the assets of the companies are overwhelmingly financial instruments with reasonable liquidity, and generally low operating expenses relative to their loss provision risks. In Enact’s case, for example, of its $5.79 billion in assets, some $5.43 billion are fixed maturity securities and cash on hand, or 93% of all assets.

So given the headwinds in the sector, is there any reason to expect shares to trade closer to full book value? In the short term, I do not think so; on a relative valuation basis, neither Radian Group at 0.75x nor Essent Group at 0.92x are at full book value, although all three have been at or above book value at various times within the last twelve months. However, the direction for housing is only pointing down for the time being, so I expect a durable period of remaining under book value.

On the other hand, the historic averages tell a different story. Essent Group has traded between a P/B of 1.5x to 2.0x, and only fell under 1.0x in early 2020 with Covid-19. Likewise, Radian rocketed out of the financial crisis years, moving from 0.50x to 2.9x between July 2012 and March 2014, and had pretty consistently maintained a range between 1.0x and 1.5x since 2015, apart from the Covid-19 shock. Of course, those were historically good years in macro terms for housing – low interest rates and a period of reset and recovery after the brutal meltdown from the 2008 era.

Contrarian Conclusion

If there is a new bubble developing in housing, I think it is more likely to deflate slowly than it is to pop suddenly, which appears to be the majority opinion. So in my view, the long play here is premised around contrarian buys in such a cyclical sector – start phasing into a position in well managed companies when the chips are down, collect the shareholder distributions while you wait for the cycle to swing in the other direction and let valuations catch up. In the case of Enact, that regular shareholder distribution will yield you 2.6% right now, and the earnings payout ratio is just 16% of expected 2022 full year earnings (Radian will pay you 4.4% in dividend yield, and Essent 2.35%, both with payout ratios well under 20% of earnings). Mr. Gupta clearly stated an intention to return more to shareholders by year-end 2022, and Dean Mitchell (the CFO) did hint at additional shareholder returns out into 2023, saying on the Q1 call “you should expect our return of capital plan to have multiple component, the quarterly dividend . . .as well as some other form of return of capital, whether that be a special dividend, a share buyback, or a combination of the two.” So with additional shareholder returns for both 2022 and 2023 anticipated over and above the regular dividend, this lines up nicely with a minimum view for how long the housing market could stay somewhat depressed. Over the long-term, I fully expect the price to book values should average out very close to 1.0x, hopefully as a result of market recognition turning positive as opposed to having to take write-downs on book value, so in due course I expect capital appreciation to go along with the yield.

The primary risks to an investment in Enact is the time associated with how long a depressed housing market could last, and uncertainty over how much deeper the slowdown could turn. The medium-term results could turn messy, leaving an investment now to look like “dead money” for several months, and I don’t think there is any reason to rush into a position now versus six months from now (apart from the possible special distributions to shareholders). In the same vein, the Federal Reserve is raising interest rates at a clip not seen for a couple of generations, and has been pretty transparent in telegraphing its plans until the end of 2022. As a result, 2022 and 2023 both look to be tougher years for finding any growth in sectors depending on mortgage loan growth. Furthermore, any broader economic recession that leads to higher unemployment could certainly hurt housing further, and by extension the prospects for Enact in the short term, although that could also be the catalyst to start trimming rates again and sending the cycle back on the upswing.

Any investment now in Enact or any of its peers is a position one should expect to keep for 18 months or more in order to reap the benefits of the cycle in housing turning around, and investors should consider being prepared to average down on occasion throughout or hold more than one of the mortgage insurance providers in a portfolio. I am rating Enact Holdings specifically as a “hold” due to my expectation that it will take more than twelve months for positive trends to kick in, however I may be adding to my own position over the coming year and/or resume a long position in Radian Group.

Be the first to comment