onurdongel

One of the most popular investment vehicles for individuals that are seeking income is master limited partnerships. This is a sector that has proven to be quite volatile over the past few years, though, as most saw substantial market declines back in 2020. But since then, the sector has come roaring back. Indeed, over the past year, the Alerian master limited partnership index is up 8.09%, which makes it one of the few sectors that delivered a positive return over the period.

Despite the volatility, though, the sector tends to enjoy remarkably stable cash flows regardless of the events in the broader economy, which lends itself well to market-beating yields. However, it can be difficult for an investor to put together a diversified portfolio of these companies without having access to a considerable amount of capital. One potential solution to this problem is to invest in a closed-end fund (“CEF”) that specializes in these assets. These funds provide easy access to a diversified portfolio of master limited partnerships that is managed by a professional team. In many cases, the funds can also deliver a return that is substantially higher than any of the underlying partnerships possess.

In this article, we will discuss one such fund, ClearBridge Energy MLP Opportunity Fund Inc. (NYSE:EMO). This fund is not quite as well-known as some others, but it still boasts a very attractive 7.32% yield at the current price, which will undoubtedly appeal to anyone that is seeking income. Therefore, let us investigate and see if the fund deserves a place in your portfolio.

About The Fund

According to the fund’s webpage, ClearBridge Energy MLP Opportunity Fund has the objective of providing investors with a high level of total return with an emphasis on cash distributions. This is hardly surprising for a common equity fund, since equities are a total return instrument. After all, they deliver their returns through both capital appreciation and the distributions that they pay out. This is particularly true with master limited partnerships since they tend to pay out a considerable percentage of their cash flows through distributions.

As the name of the fund implies, the EMO fund seeks to achieve its objective by investing in a portfolio of midstream master limited partnerships. Unfortunately, the fund does not specifically state whether it invests only in common equities or includes the preferred units issued by these partnerships. This is important since preferred equities tend to be more stable than common because they have a fixed claim to the company’s cash flows and do not vary their distribution based on the performance of the underlying company.

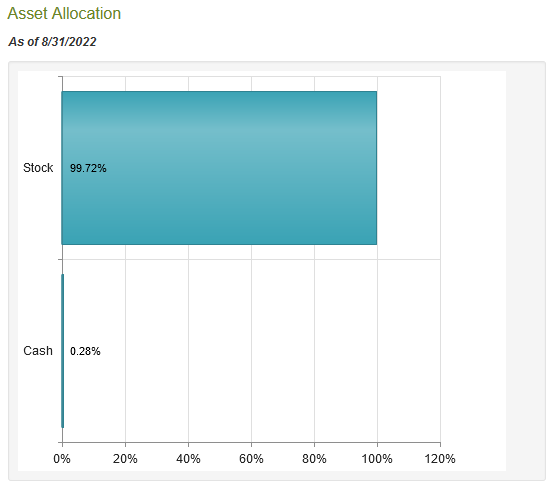

In many cases, preferred units will have higher yields than the common units issued by the same company but this is often not the case with midstream companies. Although including preferred units issued by these companies may make the portfolio more stable, it will likely reduce income somewhat compared to an exclusive focus on common equity. With that said, the fund does not currently appear to be holding any preferred equity:

CEF Connect

It is important to note, though, that just because the fund is not currently holding any preferred equity, it does not explicitly state that it cannot do that. Thus, we might see it buying these securities should management believe that they are a better holding to maintain the stability of the fund’s assets. This could happen in an oil price collapse, such as what we saw back in 2020. It is possible that we might see a short-term decline in energy prices, particularly if the economic problems in the United States continue to worsen. In the first half of 2022, the nation saw two consecutive declines in the gross domestic product, which is the historical definition of a recession.

As I pointed out in a recent article, it is likely that the nation will see a gross domestic product decline in the third quarter as well. The price of both oil and natural gas tends to decline during recessions so we may see a short-term decline in the unit prices of companies in the midstream sector. As we will see later in this article, however, any decline is likely to be short-lived.

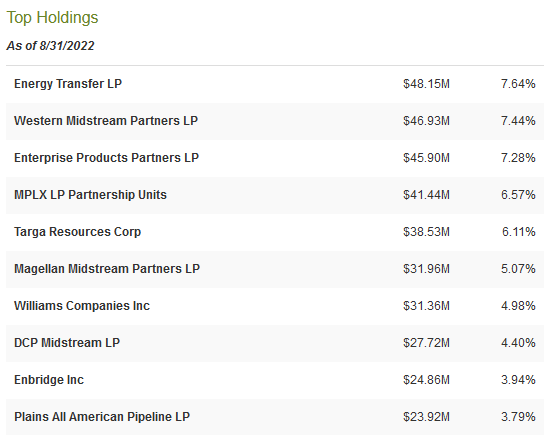

As my regular readers are no doubt well aware, I have devoted a great deal of time and effort to discussing various midstream companies here at Seeking Alpha. As such, the largest positions in the fund are likely to be familiar to most readers. Here they are:

CEF Connect

We see here many of the largest names in the industry like Energy Transfer (ET), Enterprise Products Partners (EPD), MPLX (MPLX), and Magellan Midstream Partners (MMP). We also see a few companies that are somewhat uncommon to see among the largest positions of a midstream fund, like Western Midstream Partners (WES). This is nice, because it helps to reduce concentration risk. Concentration risk refers to the tendency of different funds to include the same assets. Thus, an investor in multiple funds might think that they have a diversified portfolio but they actually do not because all of the funds are holding the same assets. The fact that ClearBridge Energy MLP Opportunity Fund Inc. has some different assets than peers helps to reduce this risk somewhat, and it is, therefore, nice to see because it should help the fund fit in with a portfolio that includes other midstream funds.

As my long-time readers on the topic of closed-end funds are likely well aware, I do not generally like to see any single position in a fund account for more than 5% of a fund’s assets. This is because this is approximately the point at which a position begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is the risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification, but if the asset accounts for too much of the portfolio then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market as a whole does not and the asset could end up dragging the entire fund down with it if it accounts for too much of the portfolio.

As we can see above, there are five positions that each individually account for more than 5% of the EMO portfolio. This is not especially atypical for a midstream fund, though, as most of them are very heavily weighted to only a few positions. In fact, this one is not nearly as bad as some funds. The First Trust MLP and Energy Income Fund (FEI) has a 10.48% weighting to Enterprise Products Partners, for example. Despite the fact that ClearBridge Energy MLP Opportunity Fund Inc. appears to be more diversified than some of its peers, potential investors should ensure that they are willing to be exposed to a few of the largest companies in the industry individually before taking a position in the fund.

The fund’s description specifically states that it targets master limited partnerships with predictable cash flows and limited direct commodity exposure. This applies to most midstream companies due to the business model that these companies use. In short, a midstream firm will enter into a long-term (typically five to ten years in length) contract with a customer under which the customer is able to send its products through the pipelines and other infrastructure owned by the midstream company. In exchange, the customer compensates the midstream company based on the volume of transported goods, not on their value. This provides a great deal of insulation against changes in commodity prices. At this point, some readers might point out that upstream exploration and production firms tend to reduce their production when oil prices decline, which would result in a drop in volumes moving through a midstream company’s infrastructure.

Midstream companies have a way to protect themselves against this, though. Basically, the contracts that the midstream firm will have with their customers include something called minimum volume commitments. These commitments specify a certain volume of resources that the customer must send through the midstream firm’s infrastructure or pay for anyway. These minimum volume commitments, combined with the volume-based business model, ensure that midstream companies enjoy incredibly stable cash flows regardless of events in the broader economy. The fund is therefore succeeding in its objective to invest in companies with predictable cash flows and limited exposure to commodity prices, despite the fact that their unit prices tend to trade in line with crude oil prices.

The fact that the companies that ClearBridge Energy Midstream Opportunity Fund invests in enjoy stable cash flows helps provide a great deal of support for the distributions that they pay to the fund. This makes sense since it is much easier for a company to pay out a large percentage of its cash flow when it is reasonably certain that a similar amount of money will be coming in the next quarter or next year. As the fund emphasizes current distributions (and this is the reason why investors purchase midstream companies), this is something that is very nice to see for our purposes as income investors.

Fundamentals Of Midstream

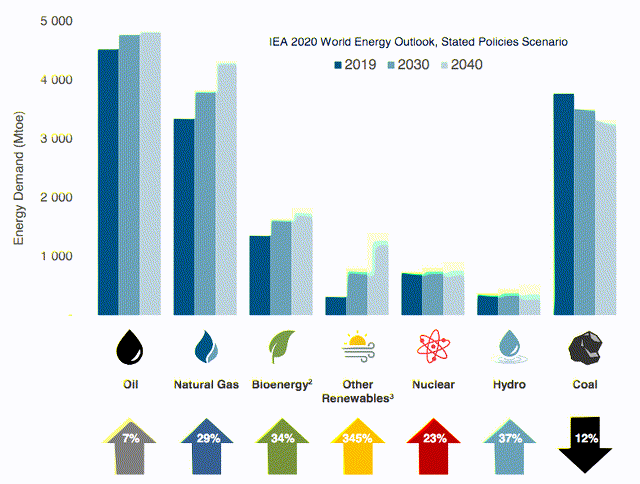

As midstream companies make their money by transporting crude oil, natural gas, and related products, it may be a good idea to take a look at the fundamentals of these products before investing in the fund. Fortunately, the fundamentals are quite good, particularly for natural gas. This may be surprising to many readers given that we are seeing many governments throughout the Western world actively attempting to suppress the use of crude oil and natural gas. However, it is unlikely that they will be completely successful as the fundamentals point to growing resource volumes going forward.

We can see this very easily by looking at the demand projections for hydrocarbon products. According to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2022 World Energy Outlook

The demand growth for natural gas is being driven by global concerns about climate change. As everyone reading this is no doubt well aware, these concerns have induced governments around the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common of these strategies is to encourage utilities to retire their old coal-fired power plants and replace them with renewable energy sources. Unfortunately, renewable power is quite unreliable. After all, solar power does not work effectively when the sun is not shining and wind power does not work when the air is still (or ironically when it is blowing too quickly).

Thus, utilities are forced to look for other options to ensure that the electrical system maintains the reliability that we all expect in modern society. The usual option that is being employed is to supplement renewables with natural gas turbines. This is because natural gas burns cleaner than any other fossil fuel and is a reliable source of electric generation that can meet the needs that we have in today’s world. This is why natural gas is frequently referred to as a “transitional fuel,” since it provides a method to reduce carbon emissions and still ensure that the grid can reliably supply homes and businesses with electricity.

The case for crude oil demand growth may be more difficult to understand, particularly considering the campaign against its use being waged in many developed nations. It is a very different story if we look at the various emerging economies around the world, though. These nations are expected to benefit from tremendous economic growth over the projection period, which will naturally have the effect of lifting the citizens of these countries out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is closer to that of their counterparts in the developed nations than their lifestyles today. This will require an increase in energy consumption, including energy derived from crude oil. As the populations of these nations are significantly higher than those of the developed nations, the growing crude oil demand from the world’s emerging nations will more than offset the stagnant-to-declining demand in the world’s developed economies.

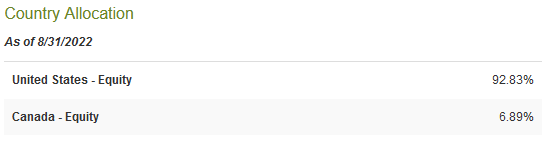

The United States is one of the only nations in the world that can increase its production of crude oil sufficiently to meet this demand. ClearBridge Energy MLP Opportunity Fund Inc. is positioned to take advantage of this because nearly all of its portfolio is invested in American midstream companies:

CEF Connect

American midstream companies should benefit from rising domestic hydrocarbon production even though they do not produce any resources themselves. This is because the produced resources will need to be transported from the oil fields to the market where they can be sold. This is exactly the business that midstream companies are in so they should see increases in transported volumes. As we already discussed, midstream companies make their money based on resource volumes. Thus, they should benefit from growing cash flows as this scenario plays out. It should be fairly easy to see how this would benefit investors in the fund.

Distribution Analysis

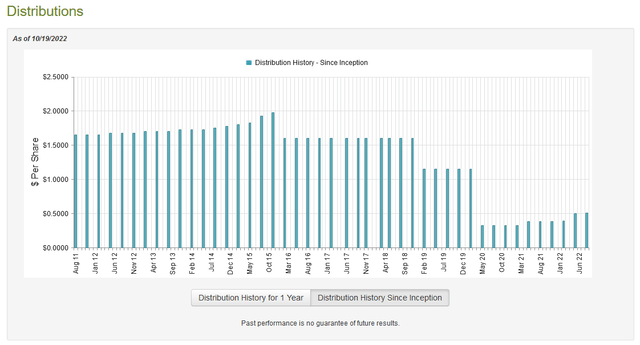

As stated a few times throughout this article, one of the biggest reasons why investors purchase partnership units of midstream companies is the incredibly high yields that many of these assets possess. In addition, the stated objective of the fund is to deliver a high level of total return with an emphasis on distributions to shareholders. Thus, we can conclude that the fund pays out a reasonably high distribution yield. This is indeed the case as ClearBridge Energy MLP Opportunity Fund Inc. pays out a quarterly distribution of $0.51 per share ($2.04 per share annually), which gives it a 7.32% yield at the current price. Unfortunately, the fund has not been particularly consistent with this distribution over the years and has in fact cut it multiple times:

It has recently begun to increase the distribution following the cut in 2020, which is nice to see. It is also not particularly concerning to see the fund cut its distribution so drastically during that year. The COVID-19 lockdowns in 2020 resulted in a great deal of uncertainty across the industry, which caused many energy companies to cut back on their ambitions for production growth. This rendered many of the projects that midstream companies were working on no longer necessary so they canceled or deferred many of their own projects. In addition, accessing capital became more difficult for most firms in the industry so many suspended or reduced their own distributions in order to improve the strength of their balance sheets. It, therefore, makes a great deal of sense that a midstream company would reduce its distributions because it is receiving less money from the companies in which it is invested.

I have frequently admonished funds that pay out more than they can afford so it is nice to see that this one is generally being sensible. The fact that it has begun to increase its distributions along with some of the underlying midstream companies doing so is likewise quite nice to see as it allows shareholders to better share in the profits. The fund’s past is not really that important to anyone purchasing today, though, since new money will receive the current distribution at the current yield. Thus, we want to determine how well the fund can maintain its current distribution.

Fortunately, we do have a very recent report to consult for that purpose. ClearBridge Energy MLP Opportunity Fund Inc.’s most recent financial report corresponds to the six-month period ending July 31, 2022. This is nice to see since it should give us a good idea of how well the fund performed during the incredibly strong market for energy companies that we experienced during the first half of 2022. During the six-month period, the fund received $19,864,288 in dividends and distributions along with $4,523 in interest from the investments in its portfolio.

However, it is important to keep in mind that the distributions received from partnerships are considered to be a return of capital and not income. As a result, we have to net these out to determine the fund’s actual investment income. When we do that, it had a total of $3,407,548 in income with which to cover its expenses. It did this, leaving it with a negative $2,417,373 available to investors. This is discouraging on the surface as it is not nearly enough to cover the $11,597,913 that the fund paid out to its investors during the period.

However, there are two things to keep in mind here. First, the fund received $16,292,651 from the master limited partnerships that it invested in. That is not included as investment income and that figure alone is more than enough to cover both the distributions that the fund paid to investors and the entire net investment loss. The fund also delivered very large capital gains due to the strength in the energy sector during the first half of 2022. ClearBridge Energy MLP Opportunity Fund Inc. realized $29,700,496 of capital gains and had another $115,326,556 of unrealized capital gains during the period. Clearly, that is more than enough to cover the distributions that it paid out during the period. In fact, the fund had more than enough money left over to conduct a small share buyback, but it still saw its assets increase by $123,855,118 after accounting for all outflows. Therefore, it appears that the fund made more than enough to cover its distributions, which is probably the reason why it recently increased its distribution slightly. Overall, we should not have to worry about a distribution cut here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like ClearBridge Energy MLP Opportunity Fund Inc., the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them for a price that is less than net asset value. That is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. This is fortunately the case here. As of October 19, 2022 (the latest date for which data is currently available), ClearBridge Energy MLP Opportunity Fund Inc. had a net asset value of $33.14 per share but the fund only trades for $27.88 per share. This gives the fund a 15.87% discount on net asset value.

This is a very attractive price for any fund, especially one that is in a sector that has been performing fairly well this year. It is, however, not quite as attractive as the 16.91% discount that the fund has had on average over the past month. With that said though, given the size of this discount, I would still be willing to buy the fund even if it has had a more attractive price in the recent price.

Conclusion

In conclusion, midstream companies have a lot to offer income-focused investors. These companies enjoy remarkably stable cash flows and high distribution yields. These qualities are extended to this fund, which is one of the few closed-end funds that has delivered substantial capital gains during the first half of 2022. The future of the industry is fairly positive too as growing demand for both oil and gas should stimulate midstream volumes and by extension cash flow growth. The fact that the fund is trading at an enormous discount to net asset value is icing on the cake. Overall, ClearBridge Energy MLP Opportunity Fund Inc. looks like a good way to get a 7.32% yield today.

Be the first to comment