niphon

Investment Thesis

EMCOR Group, Inc. (NYSE:EME) had a strong third quarter in terms of revenue and earnings per share growth. The company reported a low-to-mid teens revenue growth rate in the majority of its segments including United States Construction Services and United States Building Services because of the robust demand. The US government policies like the CHIPS Act and the Bipartisan Infrastructure Investment Act should create good prospects for the mechanical & electrical construction segments and increase the revenue growth rate in the upcoming years for EMCOR. Also healthy demand from the Industrial and non-residential construction end-markets point towards a strong pipeline of projects, which creates a growth opportunity for the United States Industrial Services segment.

The operating margin increased sequentially last quarter but was less than the results from the third quarter of 2021. The disruption in the supply chain and inflationary environment were the major headwinds for the operating margin. Looking ahead, I believe the company should slightly improve its operating margin through favorable project mix and better execution. The valuations are also reasonable making EME a good buy.

EME Q3 2022 Earnings

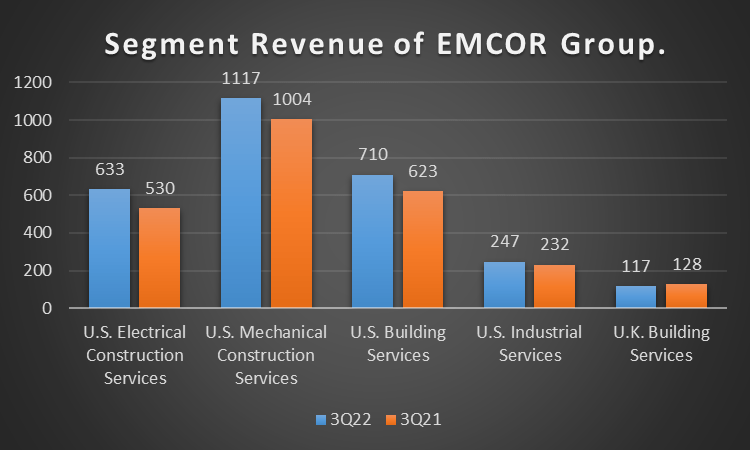

EME Segment Revenue (Company Data, GS Analytics Research)

EMCOR Group recently reported better-than-expected Q3 2022 results. Sales stood at $2.83 billion, an increase of 12.1% Y/Y (organic growth of 10.8%), and were above the consensus estimate of $2.71 billion. The revenue for the United States Construction Services segment (United States Mechanical Construction Services and United States Electrical Construction Services) stood at $1.75 billion, an increase of 14% Y/Y (11.9% organic growth). The revenue for the United States building services segment was $710.7 million, an increase of 13.8% Y/Y. The operating margin stood at 5.31%, which was slightly less (14 basis points) than the third quarter of the previous year, but there has been sequential improvement in the operating margin from the last two quarters. Improved revenue growth and margin expansion resulted in increased EPS, which was $2.16, above the consensus estimate of $2.08.

Revenue Analysis and Outlook

In the third quarter of 2022, the revenue stood at $2.83 billion, an increase of 12.1% Y/Y. Excluding $32.8 million in sales from an acquired businesses, organic sales grew 10.8% in the quarter. The company reported a low-to-mid teens organic growth rate in most of its segments due to the strong demand across its target market. In the United Kingdom building services, the revenue decreased $11.8 million Y/Y due to unfavorable exchange rate movements for the British pound versus the United States dollar.

The United States Construction segment, which accounts for approximately 60% of the total revenue, recorded sales of $1.75 billion, an increase of $215.4 million or 14% Y/Y (11.9% organic growth) in the third quarter. The combined performance of the Electrical and Mechanical Construction segments helped create a new all-time quarterly revenue record.

The revenue of the United States Electrical Construction segment was $633.4 million, an increase of 19.3% Y/Y or 13.1% Y/Y organically. Increased project activity within the commercial market sector, inclusive of the telecommunications and technology submarket sectors, as well as revenue growth from projects supporting both sustainable energy solutions and other traditional energy sources within the manufacturing market sector, were the main drivers of the revenue growth.

The United States Mechanical Construction segment’s revenues of $1.12 billion increased by $113 million, or 11.2%, with the third quarter of 2022. The revenue growth in the quarter was driven by an increase within the commercial, institutional, and water and wastewater market sectors. With respect to commercial sector revenue growth, the company is benefiting from increased project activity for customers within the semiconductor industry as well as customers within the biotech, life sciences, and pharmaceutical industries.

In the third quarter of 2022, the revenue for the United States building services segment stood at $710.7 million, an increase of 13.8% Y/Y. Within its Mechanical Building Services segment, the company is benefiting from the strong demand for HVAC retrofit projects and building automation and control services.

United States Industrial Services segment’s revenue of $247.2 million increased by $15 million, or 6.5% Y/Y. This segment is relatively small and accounts for ~10% of total revenue. Due to seasonality issues in the third quarter, the company was not able to generate a significant growth rate as in the previous two quarters.

Total company RPOs (Remaining Performance Obligation) at the end of the third quarter were $7.1 billion, an increase of 32% from the third quarter of the previous year. The United States Construction Services segment experienced strong project growth Y/Y, with RPOs increasing under $1.5 billion or 34% increase Y/Y. The RPOs of the United States Building Services segment increased by $276 million or 33% Y/Y. The third quarter of 2022 recorded strong bookings, followed by an RPO increase in all sectors except the water and water waste market. In addition to strong demand, the disruption in the supply chain, technical complexity, and labor complexity of the kinds of projects that the company is winning (large projects) are leading to an increase in RPOs.

Looking forward, I believe the company should continue to generate improved revenue through robust demand in most of its segments. The demand for the services of EMCOR Group should be supported by the policies enacted by the US government, such as the CHIPS and Science Act and the Bipartisan Infrastructure Investment and Jobs Act.

Due to the CHIPS and Science Act of 2022, companies like Micron (MU), GlobalFoundries (GFS), and Qualcomm (QCOM) have also announced nearly $50 billion in additional investment in American semiconductor manufacturing. I believe this should create a good revenue growth opportunity for the semiconductor end market in the United States Mechanical Construction Services segment.

Through the Bipartisan Infrastructure Investment and Job Act, the government announced $550 billion in federal investment in roads and bridges, water infrastructure, the internet, resilience, and electric vehicles. The development of the country’s water infrastructure to be more resilient from floods, droughts, etc. should create an opportunity for the water market in the United States Mechanical Construction Services segment, as the federal government has allocated over $50 billion in funds for this sector. Further, the legislation’s investment outlay for clean drinking water should facilitate improve growth prospects in this end market. The legislation also includes investing $65 billion in high-speed internet so that it is accessible to every American citizen. This historic investment in broadband infrastructure development should create better growth opportunities for the electrical construction segment. The government also plans to invest roughly $65 billion in clean energy transmission to facilitate the expansion of renewable energy, which should increase the number of orders in the energy solution market, which is an operating industry of the United States Electrical Construction Services segment.

In the United States building services segment of the company, the supply chain delays resulted in the need to extend the useful lives of existing HVAC equipment as replacements were not available. This increased the growth in service, repair, and maintenance volume, and I believe as long as supply chain constraints continue, the company should generate improved revenue in the upcoming quarters as well.

Most of the indicators for the non-residential sector remain favorable, and the Industrial Production Index is still healthy, which indicates a strong pipeline of projects. The United States Industrial Service segment of the company should benefit from this strong demand in the upcoming quarters.

As the challenging business environment eases, the RPOs to sales conversion rate should increase, which, coupled with strong demand in the majority of the company’s business portfolio, should contribute to increased revenue growth in the upcoming years.

Margin Outlook

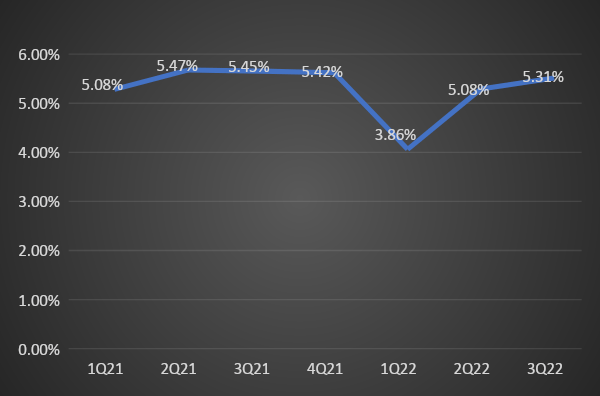

EME Operating Margins (Company Data, GS Analytics Research)

Gross margin for the third quarter stood at 14.6%, a sequential increase from 14.1% but was 50 basis points lower as compared to the third quarter of 2021. The primary reason for the decline is project write-downs within the Electrical Construction segment, which negatively impacted the consolidated gross profit margin by 40 basis points during the quarter. The company continues to manage the challenging labor market, but the shortage of certain skilled laborers is still a persistent headwind for the company.

The operating margin stood at 5.31%, which represents sequential improvement from the previous quarter as well as the first quarter of 2022. However, the operating margin declined 14 bps from the year-ago quarter. Some major headwinds to operating margin were disruptions in the supply chain and an inflationary environment, while a reduction in SG&A as a % of total sales partially offset it. The company had strong SG&A leverage, which led to an improvement of approximately 39 basis points Y/Y.

The United States Electrical Construction Service segment reported an operating margin of 5.6%, which was lower than the year-ago margin of 8.3% due to a less favorable project mix within its market sectors coupled with discrete project write-downs that negatively affected the operating margin by 170 basis points. The operating margin for mechanical construction stood at 8.1%, a slight improvement from 8% Y/Y.

Operating margin for the United States Building Service segment was at 6.4%, which represented a substantial improvement of 110 basis points Y/Y. Both favorable project execution and the impact of certain pricing adjustments were the major tailwinds for the expansion of operating margins in this segment.

The United States Industrial Services segment incurred an operating loss of $1.4 million which represents an improvement of $1.6 million Y/Y. The operating margin of this segment stood at -0.6%, an increase from -1.3% in the year ago quarter. The business seasonality issues led to the operating loss in this segment and the third quarter is always the weakest quarter for this segment.

Looking ahead, I believe the operating margin should improve in both the United States Electrical Construction Service and United States Mechanical Construction Services segments as one time impact of project write-downs should not recur and management is expecting the project mix to improve for both these businesses. Management’s continuous efforts to deal with labor market challenges should also help the company improve its gross margin in the upcoming years. So, I am optimistic about the company’s margin growth prospects.

Valuation

EMCOR is trading at 16.04x FY2023 consensus EPS estimates of $9.09. The company’s EPS is expected to grow 17.45% Y/Y next year. Given the company’s good revenue growth and margin improvement prospects, the company looks attractive and I believe it is a good buy for mid to long-term investors.

Be the first to comment