Torsten Asmus

Investment Thesis

Persistent inflation around the world has resulted in an accelerated pace of interest rate hikes by the Federal Reserve. This has resulted in large sell-off across the fixed income markets. Emerging market debt, including US Dollar denominated debt, has gone down by almost a third of its value in price. As bond prices have come down, investors are starting to get interested in these investments as they offer attractive yields.

The outlook for emerging market debt faces several challenges, ranging from war to inflation. However, there are green shoots that indicate inflation is likely to come down. The mid-term elections in the US could result in a shift in policy towards a peaceful resolution of the Ukraine war. As a result, this is the time to review the EMB, which is the emerging market bond ETF. Prices are reflecting known risks to the market and forward yield is above 8%.

Understanding EMB

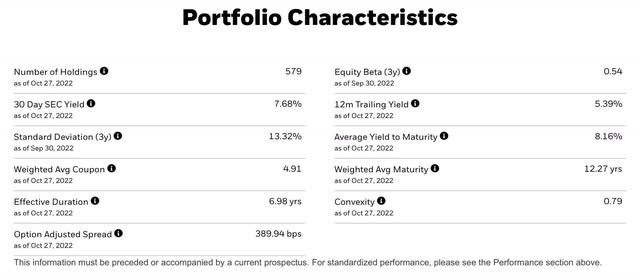

The iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) by BlackRock seeks to track the investment results of an index composed of U.S. dollar-denominated emerging market bonds. The EMB ETF consists of emerging market government bonds and emerging market government-backed bonds issued by emerging market countries. The EMB ETF provides access to the sovereign debt of more than 30 countries with a higher yield than developed market government bonds in a single fund. As EMB was one of the first emerging market debt ETFs to be launched, it has large assets and ample liquidity. Net assets are over $14 billion, with a tight bid-ask spread and more than 6 million shares traded daily. The fund has 579 holdings spread over 30 countries with a 12-month trailing yield of 5.42%, but the average yield to maturity is 8.1%. The fund’s expense ratio is 0.39%.

iShares EMB Portfolio Characteristic (iShares)

Average Yield to Maturity is 8.16% as stated in the iShares documentation.

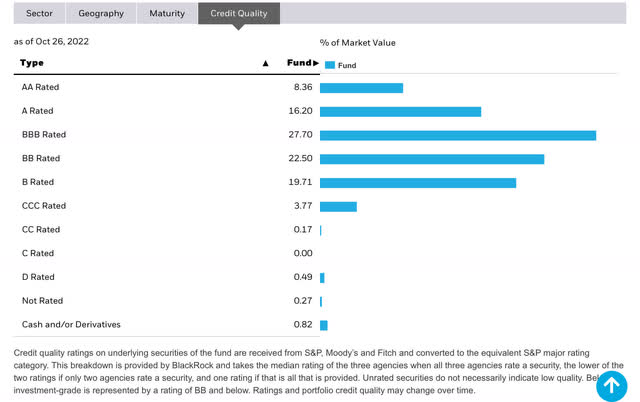

Credit Quality

More than 52% of the issuers rated the bonds BBB or better. This rating is considered investment grade, but we are talking about emerging market bonds. The rest of the portfolio is near default risk. The EMB ETF is a blatantly risky product and should be viewed as such.

Credit Quality (iShares)

Maturity

The weighted average maturity is 12.25 years, though a fairly large percentage of the bonds don’t mature for over 20 years.

Maturity breakdown (iShares)

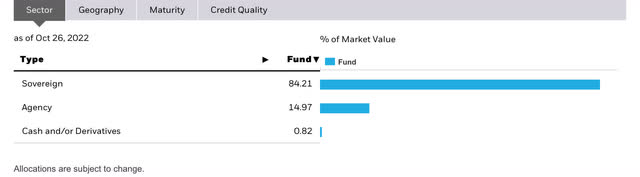

Portfolio composition

84% of the bonds in the fund are invested in emerging market government bonds, and 15% are invested in government-backed bonds. While government bonds are generally considered safer, these are emerging market governments, so the risks are higher.

Sector Breakdown (iShares)

Chart

The prices for EMB ETF has dropped to levels seen during the financial crisis in 2009. While no one knows where prices will bottom, the sell-off is reflecting known risks to the market.

EMB Chart (Author )

Yield

The EMB ETF’s past 12 month yield was 5.42%. The fund has dropped in price, so the forward yield is 8.1%, which is considerably higher than treasuries, which are yielding just above 4%. Due to high inflation in the U.S., the spread between emerging market bonds and treasuries is not high. The spread between emerging market bonds and treasuries is higher during an economic slowdown as investors buy treasuries and sell emerging market bonds. However, we are experiencing a fall in prices for both treasury and emerging market bonds due to Federal Reserve interest rate hikes and quantitative tightening. By the end of 2022, the Federal Reserve should be done with tightening or be close to it, as there are signs of inflation coming down in the price components of leading economic indicators. Once the market senses that the Federal Reserve is nearing the end of the tightening cycle, both treasuries and emerging market bonds should rally.

Risks

The risks of a global recession are considerable. While the market has anticipated those risks and the U.S. Dollar has strengthened against most currencies, there is no way to know if the U.S. Dollar has topped. However, emerging market currencies have held up much better than developed market currencies. Inflation is driving interest rates higher, resulting in pressure on emerging market sovereign bonds. The cost of insurance has gone up considerably, as tighter financial conditions may lead to a financial crisis in emerging markets.

The risk to treasuries is from continuing inflation. However, the risk to emerging market bonds is also from deflation, as happened in 2008. This is due to credit spreads widening quickly. The current yields are high and will compensate for the risks taken based on known risks if one has the patience to hold them for the long term. However, the EMB ETF should be considered a higher-risk investment.

Summary

Bond markets around the world are tempering future rate hikes, and if the Federal Reserve indicates a slower pace of increase, major bond markets around the world may top in yields. The iShares J.P. Morgan USD emerging market bond ETF’s future yield is 8.1%, which is a decent yield for patient investors. The drop in price from the high is almost a third, and this has, in the past, marked the bottom in prices and the top in yields. Markets will sniff out a change in the Federal Reserve’s tightening stance, and then the prices for bonds will go up while one is collecting a decent dividend for those with a long-term time horizon.

Be the first to comment