Funtap/iStock via Getty Images

Investment thesis

Ellington Financial Inc. (EFC) is slightly undervalued trading 7% below its book value. The management could grow the company’s book value over the last years and they intend to do so in the future with some of the external factors in their favor such as the lower prepayments due to rising interest rates. However, the fair value of the assets will decline in case of an interest rate hike. The management also restructured and tripled its holding in 15-year fixed loans in the last year. They position themselves as a stable monthly dividend payer company with a yield of 10.15%, which is an attractive dividend yield for investors.

Business Model

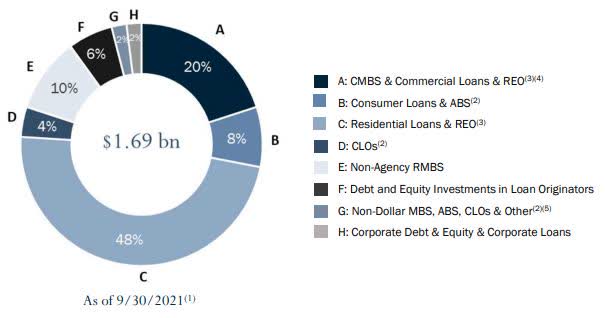

Ellington Financial acquires and manages mortgage-related, consumer-related, corporate-related, and other financial assets in the United States. The company is classified as a mortgage REIT and is one of the small-cap mREITs with a $1.02 billion market capitalization. EFC invests in a wide variety of debt assets, agency RMBS, CMBS, Non-agency assets, REOs, CLOs, etc. The company’s investment portfolio is well diversified with almost half of its portfolio being in residential loans and REO.

Financials & Earnings

Q3 results

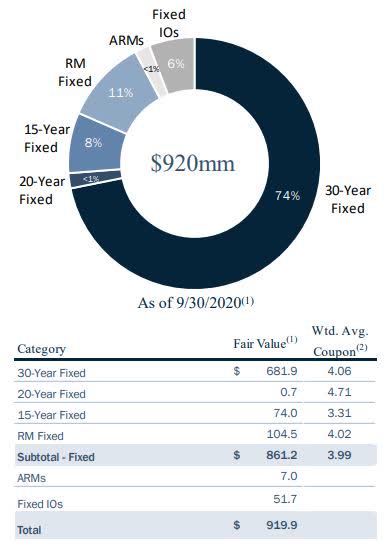

EFC reported good third-quarter earnings with growing total equity, book value, and a growing long credit portfolio. The company will announce its fourth-quarter earnings on February 16, 2022. The company’s total equity was $1.095 billion as of September 30, 2021, compared to $872.3 million as of September 30, 2020. The book value grew by 11.55% from Q3 2020 to YTD 2021. The company could also increase its long credit portfolio from $1.4 billion as of September 30, 2020, to $1.69 billion as of September 30, 2021. The company maintained the majority of its agency portfolio in 30-year fixed; however, in line with a lot of other mREITs, they also started to raise the percentage of 15-year fixed. As of September 30, 2020, the company had $74 million worth of 15-year fixed (fair value) and by the third quarter of 2021, they almost tripled this figure to $229.9 million.

EFC’s management actively adjusted the portfolio to external factors such as the rise of work from home trends. In the third quarter of 2020, the company’s credit portfolio was 43% residential mortgages and 57% commercial mortgages, consumer loans and others, while in Q3 2021, the management increased the residential mortgages to 64% and the management reduced the commercial mortgages, consumer loans and other to 36%. They try to maintain a flexible approach towards capital allocation to the sectors where they see the best relative value as market conditions change. EFC issued 6.303 million shares of common stock through a follow-on common stock offering in July, increasing its total equity by $113.1 million (approximately 12%).

Valuation

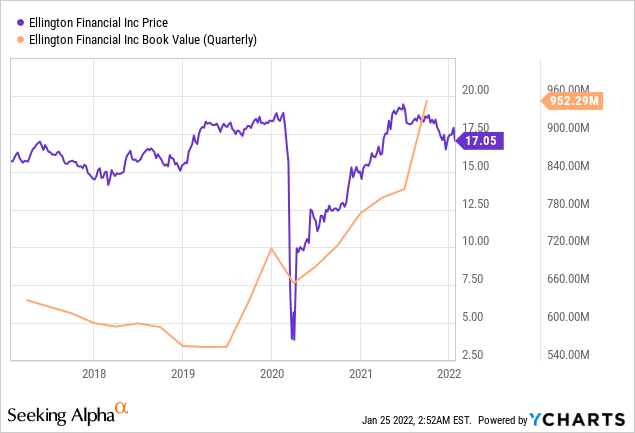

EFC is fairly valued at the moment with the potential to be a bit undervalued. The company trades 7% below its book value and the book value has been on the rise for the past 3 years. In Q3 2020, the company’s book value per share was $16.45 after total dividends declared of $0.27, while as of September 30, 2021, BV per share was $18.35 after total dividends were declared. We also have an estimated book value per share for December 2021, and that is $18.39. I like to see companies that can grow their book value over a long period because that means the management allocates shareholder capital well. EFC has successfully preserved book value over market cycles, such as the pandemic, while producing good results for investors. Based on these numbers and the current portfolio, I calculate 5-10% growth in EFC’s book value per share for the next years. 2022 could be less growth due to the interest rate increases which can hurt the portfolio’s fair valuation and overall book value.

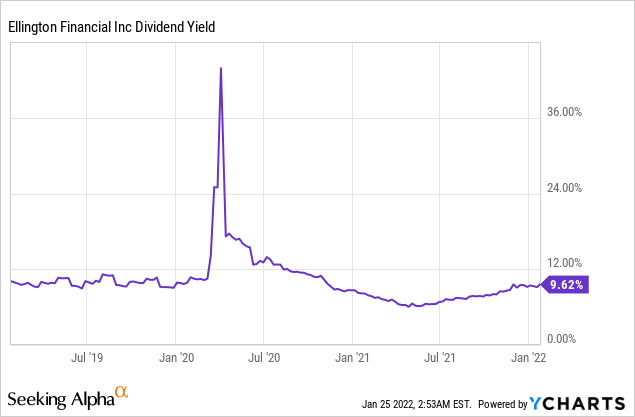

EFC is yielding 10.15%, which is a very attractive figure for income investors. If we look at this number relative to the current valuation, we can see a bit undervalued stock. Based on its dividend yield, the company has returned to the “normal” pre-pandemic dividend yield levels and investors can buy the company with a better yield than in 2021.

Company-specific Risks

The interest rate rise will affect EFC assets’ fair value. However, they hedge along the entire yield curve to protect against volatility, defend book value and more thoroughly control interest rate risk. They are doing it via swaps, U.S. Treasury securities, and other instruments to hedge interest rate risk.

EFC’s portfolio includes non-Agency RMBS which are backed by residential mortgage loans that do not conform to the Fannie Mae or Freddie Mac underwriting guidelines. Consequently, the principal and interest on non-Agency RMBS are not guaranteed by GSEs. Non-Agency RMBS are subject to many of the risks of the respective underlying mortgage loans. Luckily, not a massive portion of the portfolio is in non-agency RMBS, but this risk factor is worth noting. A similar risk is the default rate. Certain securities that they acquire are deemed by rating agencies to have a substantial vulnerability to default in payment of interest and/or principal. Many securities that the company acquires are subordinated in cash flow priority to other more “senior” securities of the same securitization.

Due to the fact that many of the assets are not publicly traded, the values of some of the assets in the company’s portfolio are not readily determinable. They value these assets monthly at fair value, as determined in good faith by the manager, subject to the oversight of the manager’s valuation committee. Prepayment risk rates generally increase when interest rates fall and decrease when interest rates rise. Since many RMBS, especially fixed-rate RMBS, will be discount securities when interest rates are high and will be premium securities when interest rates are low, these RMBS may be adversely affected by changes in prepayments in any interest rate environment. As the FED and many analysts count on 4 interest rate hikes for 2022, this can help reduce the prepayment risk on the company’s portfolio.

My take on EFC’s dividend

Current dividend

EFC has been paying dividends for 10 consecutive years and yielding 10.15%. The management had switched to monthly dividend payments in 2019 and since then they made one cut due to the pandemic. The current dividend has been restored to pre-pandemic levels to $0.15 per share per month. This means that EFC has a 1-year consecutive dividend growth history from 2020.

Future sustainability

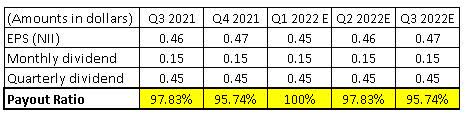

EFC has a payout ratio very close to 100%. In the last years, this payout ratio was changing dynamically between 50-150%. This also means that the management has actively adjusted the dividend payment to the EPS. As they shifted to monthly dividends from quarterly ones prior to 2019, the management had a simple goal: to position the company for income-seeking investors and provide them with a reliable monthly income. I think it will be a difficult task in 2022 due to the high payout ratio but not impossible. The investment portfolio is healthy and diversified towards asset classes that can outperform office and retail REITs.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Summary

For income-seeking investors, a 10%+ dividend yield is more than attractive. The management has all the intentions to keep the monthly dividend stable but I do not expect major increases. The company is trading slightly below its book value and the dividend yield is fair compared to 2021 levels. I think EFC can be a decent part of a portfolio with growing book value and reduced prepayment risk for this year when the interest rates start to rise.

Be the first to comment