Imgorthand/E+ via Getty Images

Investment Thesis Part 1 – Lilly Stock Defies Revenue And Alzheimer’s Doubts As Stock Keeps Gaining

When I last covered Indianapolis based Pharma giant Eli Lilly (NYSE:LLY) back in late January, I cautioned investors about a potential downward correction in the company’s share price, but instead, across the past six months Lilly stock has increased in value by an additional 27%.

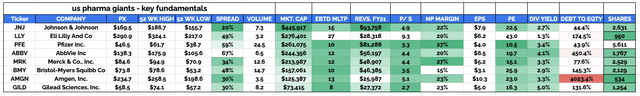

My reasoning in January was based on a couple of important factors. First of all, compared to the other seven members of what I refer to as the “Big 8” US Pharmas – Johnson & Johnson (JNJ), Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD) – Lilly stock looks fundamentally overvalued.

That thesis certainly hasn’t changed. Lilly is now the second largest of the “Big 8” Pharmas by market cap, which is pretty astonishing when you consider that its FY21 revenues were $28bn, which is nearly 3x less than Pfizer’s $81.3bn, 2x less than AbbVie’s $56.2bn, and >1.5x less than Merck’s $49bn, and BMY’s $46bn.

Lilly’s price to sales (“P/S”) ratio in FY21 was 9.3x, compared to the rest of the Big 8’s average score of ~4x, and it’s price to earnings (“P/E”) ratio was 43x, compared to the rest of the Big 8’s average of 19x. Lilly announced a quarterly dividend of $0.98 in May – the same as in December 2021 – meaning it also has the lowest dividend yield in this sector, of 1.3%, compared to an average of 3.5% amongst the others.

Big 8 US Pharma companies – key investment fundamentals. (my table)

Source: my table using data from TradingView, Google Finance.

Looking ahead, Lilly is guiding for total revenue in FY22 of $28.8-$29.3bn, which reflects a year-on-year gain of 3.3% at the midpoint, and GAAP EPS of $7.30-$7.45 – a year-on-year gain of 19% at the midpoint, and representing a forward PE ratio of 42.5x. For context, Pfizer reported revenues of $25.7bn in Q122 alone, is guiding for revenues of $98bn – $102bn in FY22, and has a forward PE ratio of ~8x, based on expected EPS of $6.45.

In most ordinary circumstances any investor would conclude that Pfizer – or AbbVie, Merck, or BMY – would be the correct horse to back, and that it would be almost inconceivable for Lilly to be the more valuable pharmaceutical by market cap, but this is no ordinary industry.

The second reason I gave in my last note why Lilly stock would experience a correction was the hype surrounding its Alzheimer’s drug in development, Donanemab. When the FDA approved Biogen’s (BIIB) AD drug Aduhelm in June last year, it seemed as if a market was opening up with an addressable population of ~5.8m patients, meaning hundreds of billions of dollars in revenue was in play, and in Donanemab, which has a similar mechanism of action (“MoA”) to Aduhelm, Lilly looked set to cash in.

Aduhelm has been an unqualified disaster for Biogen, however, and the Pharma has all but pulled the plug on its AD drug, after the Centers for Medicaid and Medicare (“CMS”) refused to provide reimbursement for Aduhelm at the national level, leaving Biogen with no market to target. Why should things be any different for Donanemab?

Lilly management initially thought an accelerated approval – like the one handed to Aduhelm – would be possible based on its Phase 2 TRAILBLAZER data, but that has not proven to be the case, although management still believes a Phase 3 study will deliver the data required. On its Q122 earnings call, Chief Scientific and Medical Officer Dr. Dan Skovronsky commented:

We believe it would be beneficial for donanemab to obtain accelerated approval proximal to the TRAILBLAZER-ALZ 2 Phase III readout in mid 2023, which would enable parallel discussions with CMS regarding outright coverage and expedited review time for full FDA approval.

We believe that given the thoughtful and robust design of TRAILBLAZER-ALZ 2, if the study is positive, it should meet the high level of evidence criteria set forth by CMS in the NCD decision. At that time, we will advocate for CMS to reconsider outright coverage of donanemab.

As we have stated previously, it’s inconceivable to us that one substantial evidence of clinical benefit has been established for any Alzheimer’s medicine, people with the disease won’t have access to it. Our view of the mid- and long-term opportunity to help patients with donanemab remains unchanged.

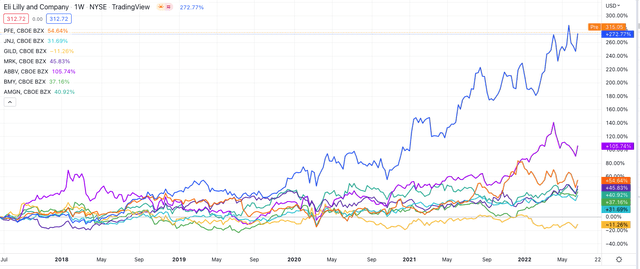

This bullish sentiment appears to be shared by the stock market, given how buoyant Lilly stock has been compared to its Big Pharma rivals, as we can see in the chart below.

Eli Lilly share price performance vs US Pharma rivals – past 5 years. (TradingView)

Source: TradingView.

Nevertheless, it still seems strange to me that such a controversial drug can command such optimism – analysts had pegged Donanemab to garner $6bn in sales by 2026, but the same analysts forecast an approval in 2022 which will no longer happen, and the amyloid beta reduction thesis was dealt a further blow this month when Roche reported that its amyloid targeting drug Crenezumab had failed to meet endpoints in a Phase 2 study.

Investment Thesis Part 2: Diabetes and Weight Loss Drug Takes Centre Stage

Amazingly, in Lilly’s Q122 earnings presentation, Donanemab is mentioned only once, in a footnote discussing pipeline assets in Phase 3 studies. Taking centre stage instead is an apparently much more sure fire drug – Tirzepatide – with blockbuster (>$1bn per annum) sales potential – analysts expect the drug to make anything from $4bn, to $20bn in sales by 2026.

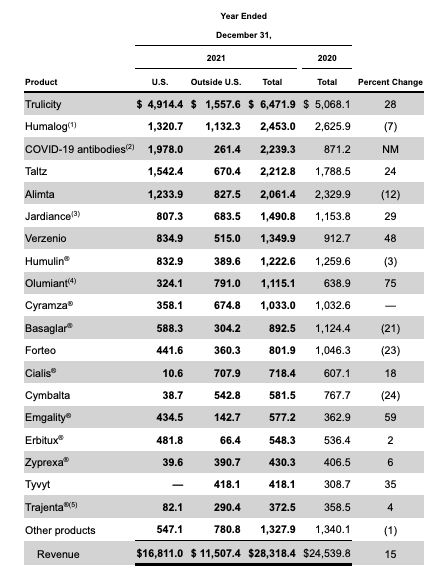

Before taking an in depth look at Tirzepatide, it’s worth reminding ourselves that Lilly is already a diabetes powerhouse, as we can see by looking at performance of its biggest selling drugs in FY21.

Lilly’s drug sales in FY21 (10K )

Source: 10K filing.

Trulicity is approved to treat Type 2 diabetes, and made ~$6.5bn in sales in FY21. Jardiance is approved for Type 2 diabetes also, as well as heart failure, making $1.5bn sales in FY21. Humalog, not shown above, is approved to improve glycemic control in children with diabetes, earning $2.5bn in FY21, whilst Basaglar – and insulin glargine injection – earned ~$1.1bn.

Trulicity will lose its patent exclusivity in 2027, but Tirzepatide looks likely to shatter its predecessor’s sales volumes. The drug has now won its first approval, as a 6-injection regime marketed and sold as Mounjaro. Its clinical data marks Mounjaro out as potentially superior to what is likely to become its biggest rival – Novo Nordisk’s Ozempic, which has a peak sales forecast of $10bn.

Mounjaro proved superior to Ozempic in a head-to-head trial, helping patients lose more weight and maintain blood sugar levels better, and Lilly ought to have few problems marketing the drug given its established presence in the diabetes field. Even more excitingly for Lilly, however, there is an opportunity for Tirzepatide in treating obesity that is almost as large as the Type 2 Diabetes opportunity, and the drug has delivered outstanding late stage data in this indication also.

According to Lilly, obesity is the leading factor for Type 2 diabetes, and is a contributing factor of 1 out every 5 deaths. 40% of the US population is living with obesity, and its economic impact is estimated to be >$1 trillion.

Tirzepatide met its co-primary endpoint of at least 5% body weight reduction for its 10 and 15mg doses, with all tirzepatide treatment arms demonstrating statistically superior and clinically meaningful weight reduction compared to placebo, whilst improving all prespecified cardiometabolic key secondary endpoints, such as waist circumference, blood pressure and lipid control, with only 5% of patients withdrawing from the trial owing to adverse gastrointestinal events.

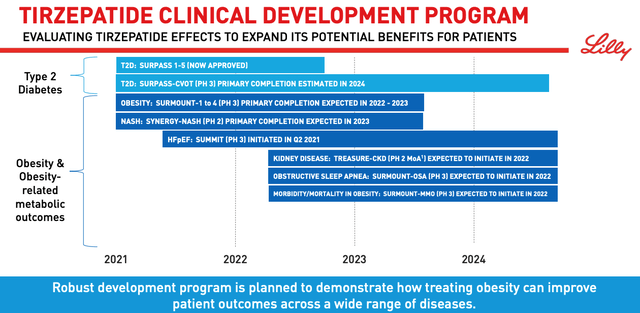

Tirzepatide clinical development program. (presentation)

Source: Earnings Presentation.

As we can see above, Lilly’s ambitions for Tirzepatide stretch far and wide across the healthcare landscape. Kidney disease, sleep apnea and even Non-alcoholic steatohepatitis (“NASH”) – an ambitious target given its huge addressable market and the number of biotechs who have failed with late stage therapies – are all in play.

This is the kind of versatility rarely seen in a drug, but in some ways it is reminiscent of AbbVie’s Humira, which is approved in a wide-range of autoimmune conditions and was dominant in most of them for a decade, racking up peak sales >$20bn.

Tirzepatide is part of a drug class known as a dual glucose-dependent insulinotropic polypeptide (GIP) and GLP-1 receptor agonist. According to Medical News Today:

GLP-1 and GIP are gut hormones called incretins, and the intestines release them when we eat. Incretins stimulate the secretion of insulin from the pancreas’ insulin-producing cells, which are called beta cells.

People with type 2 diabetes do not respond as strongly to incretin hormones as other people. Tirzepatide addresses this deficit by activating the GLP-1 and GIP receptors in the body.

Lilly already has the data it needs to be confident of success in a range of disease indications, and it will have long-term patent protection in place, potentially leading to an entirely new drug franchise, and dominance of the diabetes/obesity market akin to AbbVie’s dominance of the autoimmune markets over the past decade. That, at least, seems to be what the market believes.

The long term safety profile of Tirzepatide has not yet been established – a potential stumbling block for Lilly, whilst rivals such as Novo Nordisk will remain a long-term rival for market share – the company also markets Ozempic as an obesity therapy, under the brand name Wegovy. The fact that Lilly is based in the US could be seen as a competitive advantage, however.

A Pipeline Ready To Burst With New Candidates Plus Strong Ex-Diabetes Assets

Besides Tirzepatide, Lilly has recently won approvals for Jardiance to reduce the risk of cardiovascular death and hospitalization for heart failure in adults, widening its addressable market and for Bebtelovimab, helping it grow COVID-19 antibody revenues from $810m in Q121, to $1.5bn in Q122.

Olumiant, Lilly’s JAK inhibitor has now been approved in alopecia areata to add to its approval in Rheumatoid Arthritis (“RA”) – alopecia severely affects nearly 1m people worldwide – and Mirikizumab may shortly be approved for Ulcerative Colitis, and a possible shot at blockbuster sales, some analysts believe.

I have barely touched on Lilly’s oncology division, which includes blockbuster assets like Alimta in non-small cell lung cancer (“NSCLC”), and Verzenio in metastatic breast cancer. Verzenio could be a $4.5bn peak seller as it looks set to challenge Pfizer’s Ibrance, although Alimta will soon go off patent, and Tyvyt (sintilimab) – a immune checkpoint inhibitor co-developed with Chinese Pharma – looks unlikely to make it to market in the US.

In pivotal stage trials there are assets targeting 1st line NSCLC – the largest market in oncology – prostate cancer, chronic lymphocytic lymphoma (“CLL”), and Atopic Dermatitis – in summary, Lilly’s oncology and autoimmune divisions are strong too, and could potentially add $5 – $10bn to Lilly’s top line, plus there is a thriving neuroscience division too, growing sales steadily in the US.

Conclusion – Lilly Is Strong In All Areas But I Still Can’t Give The Pharma A Buy Recommendation Given Commercialisation Risks

In the first half of this post I have discussed why I believed Lilly stock was significantly overvalued, based on its revenue and profit generation in comparison to its much cheaper rivals (in share price terms), and based on a high-risk shot at tackling Alzheimer’s Disease – a treacherous illness that resists all attempts at treatment.

In the second half, I have considered the Tirzepatide diabetes/obesity opportunity, which looks a genuine $15 – $20bn revenues p.a. market opportunity, plus label expansions for Jardiance, Verzenio, new drug Mirikizumab, Olumiant in alopecia and numerous other approval shots, and I must admit I am torn as to whether Lilly truly deserves its current valuation and share price, and whether investors ought to expect upside or downside going forward.

We know that Pfizer’s revenues are highly likely to drop in 2023, as its COVID drugs Comirnaty and Paxlovid will not be in such high demand, so as Pfizer’s revenues fall, can Lilly’s grow strongly enough to justify its higher valuation?

In an optimistic scenario in which Donanemab is approved and becomes the drug that Aduhelm wanted to become, and we assume there is a $10bn p.a. market, and Tirzepatide becomes a mega-blockbuster and generates $15bn p.a. and there is a $5bn contribution from other assets (and ignoring any patent cliffs that might see sales of e.g. Jardiance fall) we can add $30bn to Lilly’s top line so that the Pharma is close to generating $60bn p.a. by the end of the decade.

In a previous note on Pfizer, I have forecast the company to be generating ~$75bn p.a. by the end of the decade, so to answer my own question, even though Eli Lilly drives the greater operational efficiency – it’s EPS matching Pfizer’s, thanks to Pfizer’s astonishing 5.6bn outstanding shares – Pfizer has banked $20bn of cash, made a rash of acquisitions to bolster its pipeline, and will likely bank another $20bn cash this year. Surely, Pfizer deserves the higher valuation?

Of course, it is not only about Pfizer and Lilly, but the likes of AbbVie, Bristol Myers Squibb, Merck and others. The large Pharma sector has performed well across the past five years, and even in the past year valuations have grown during a prevailing bear market. Lilly has led the way, but having studied the investment cases behind BMY and AbbVie, for example, am I convinced that Lilly is worth $30bn more than AbbVie, and $120bn more than BMY?

These two pharmas are heavily indebted, so perhaps a case can be made, but much will have to go right for Lilly for the company to challenge either on revenue generation, price to earnings, dividend yield, and risk management.

As such the best recommendation I can award Lilly is a HOLD – Tirzepatide is a huge opportunity but physicians still need to be convinced that diet pills are better than lifestyle adjustments when it comes to treating obesity or even diabetes, and the risks of buying Lilly stock in expectation of a Donanemab approval are self-evident.

This is a good company with a strong pipeline, and little debt, with a share price that is +39% over a 12m period, and +293% across the past five years. I would consider a buy and hold, but I just can’t quite believe the fairy-tale gains can continue much longer.

Be the first to comment