jetcityimage

Investment Thesis

Eli Lilly and Company (NYSE:LLY) has been ascending at a rapid pace and is among the largest pharmaceutical companies in the world, second only to Johnson & Johnson (JNJ). The ascent has been something to behold, although many market participants have been ringing the bell on overvaluation for months.

While several potential blockbuster drugs are set to hit the market in the coming years, much of this growth has already been priced into the stock. The hype surrounding these drugs has left little room for hiccups and setbacks, and the market seems to be ignoring the many risks associated with controversial Alzheimer’s drugs, obesity drugs, and caps on insulin and other drug pricing pushes by both sides of the political spectrum.

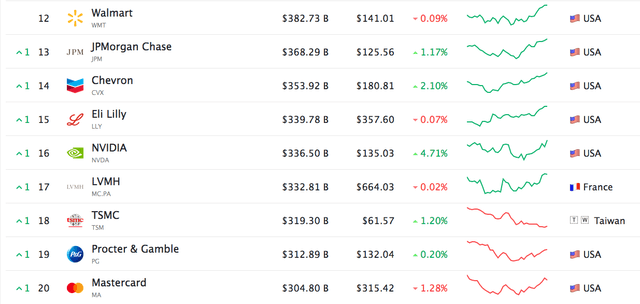

At this moment in time, the market capitalization of Eli Lilly is approximately $340 billion, making the company larger than juggernauts Nvidia (NVDA), as well as counterparts such as Taiwan Semiconductor (TSM) and other massive companies, including Mastercard (MA) and Procter & Gamble (PG). Eli Lilly is now the 15th-largest company in the world by market capitalization, which seems unbelievable given the company’s historical financial performance.

The market is always forward-looking, however, and Eli Lilly has an extremely bright future ahead of it, if donanemab and tirzepatide become the blockbuster drugs they are forecast to be. The big problem is that the market has taken the recent developments as a sure thing, and not priced any uncertainty into future revenue and earnings potential. In this article, I will shine a light on some of the potential risks that Eli Lilly could be facing in the future, as well as a discussion of the valuation and multiple expansion. I am an Eli Lilly shareholder and am bullish on the long-term prospects of the company, but I can finally say that a correction seems highly likely from this point onward, and there will be better opportunities to add to a long position after a multiple contraction has taken place.

Introduction – Alzheimer’s And More

Eli Lilly has been a fantastic investment, even before the FDA granted donanemab Breakthrough Therapy designation in June of 2021. While this development in the business has been met with much praise, there has also been much controversy, as Biogen’s (BIIB) Alzheimer’s drug was criticized heavily by scientists and analysts alike when it was approved by the FDA. Several scientists said that the drug should have never been approved at all, while financial analysts focused more on drug pricing and the high cost to patients. Until new data was revealed just last month, Biogen was in the dog house, so to speak, and lost nearly 50% of its value since the FDA approval in June 2021.

Eli Lilly has side-stepped most of this controversy, but there are still unknowns when it comes to donanemab coming to market. Perhaps the unknown nature of this is the very reason that Eli Lilly has remained unscathed, as the stock has reacted positively to every recent development from Biogen, as if the two drugs were one and the same.

Not to mention Cassava Sciences’ (SAVA) Alzheimer’s treatment scandal, during which scientists claimed manipulated images were used in testing of their drug. This cast doubt on many Alzheimer’s treatments altogether, and while scientists still debate whether clearing amyloid plaques in the brain actually leads to a reduction in cognitive decline, these drugs are being touted as major breakthroughs in the field. The emergence of the claim that potentially decades of Alzheimer’s research was based on fraudulent images has gone on deaf ears, meanwhile hype continues to push valuations of such companies higher. While the point of this article is not to question or speculate on the effectiveness of each of these company’s drugs, or the complexities of treating a devastating disease such as Alzheimer’s, the point is rather to highlight the differences in market sentiment surrounding these companies, bring up potential risks, and show that forward-looking assumptions should not be given so much weight.

The appearance versus reality theme is present here, as Biogen seems to have finally won praise from analysts on the back of newly released data, but has been completely eclipsed by Eli Lilly is terms of stock performance, despite donanemab not being on the market yet (supposed rollout in early 2023). The assumption is that because Biogen’s drug was approved and is now finally starting to be accepted by investors, Eli Lilly’s drug is almost certain to be approved and be just as big of a success, or possibly bigger, than the competition, without all of the controversy that was directed originally at Biogen. As a shareholder in Eli Lilly, this all sounds great to me, but I am cautiously optimistic and well aware that things could change in a heartbeat once more information becomes readily available.

On top of this assumption, the focus of investors has shifted from donanemab towards tirzepatide and the promise of a blockbuster obesity drug. The narrative around the stock has also shifted to not one, but two potential blockbuster drugs on the horizon, with massive revenue and earnings growth in the years ahead from these two drugs alone. The main problem with this narrative is that it is built around assumptions, forward-looking estimations, and lacks any room for hiccups or setbacks. All of the recent developments for Eli Lilly assume that the company will deliver with flawless execution for years to come, and the market seems to be ignoring the many risks which have been bubbling up to the surface over the last year – from insurance approvals to drug pricing reform, which I will cover later in this article.

Valuation – Price Still Matters

In this tumultuous market, the valuations of many large companies have seen dramatic multiple contractions on the back of higher interest rates, as well as declining earnings as the U.S. economy heads for a slowdown and a potentially ugly recession. Two prominent sectors that have been generally immune to rising interest rates this year have been oil & gas (energy), and big pharma. Investors have been flooding into these sectors as they are seen as somewhat recession-proof, fairly priced, and with macroeconomic trends on their side.

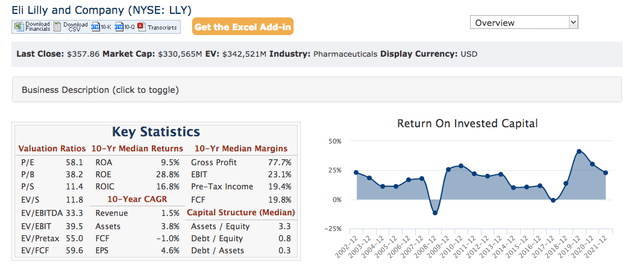

While many large-cap and mega-cap pharmaceutical companies remain in normal P/E ranges, Eli Lilly is a major standout based on current valuation metrics. The multiple has expanded to a whopping 58x this year’s earnings, and has placed the company into the top rankings as the 15th largest by market capitalization.

Companies Ranked By Market Cap (companiesmarketcap.com)

As we can see from data taken from companiesmarketcap.com, Eli Lilly has surpassed companies such as Mastercard, Procter & Gamble, Taiwan Semiconductor, Louis Vuitton (OTCPK:LVMUY, OTCPK:LVMHF), and even Nvidia. If this current trend continues into the future, Eli Lilly could soon be pushing its way into the top ten companies in the entire world. The question now becomes, is this current trend sustainable?

Looking more at valuation metrics, Eli Lilly trades at 38x book value, with a current price-to-sales of 11.4. Compare this to another highly valued company, such as Apple (AAPL), which trades at 41x book value and roughly 6x sales, and it becomes crystal clear that the market is valuing Eli Lilly quite richly based on future growth prospects.

LLY Valuation Metrics (quickfs.net)

A general rule I follow is to never pay more than 10x sales for a company. Sometimes this rule should be broken, however, based on the future growth prospects of the business. In this case, it is difficult for me to evaluate if Eli Lilly is currently being priced fairly by the market, or if the hype surrounding drugs like donanemab and tirzepatide has distorted the valuation to the point that it is getting egregiously overvalued. To err on the side of caution, I believe that investors who wish to add to a long position should wait until the stock price corrects before buying more shares.

An important point to bring up is that these valuation metrics are based off of current numbers, which leads one to try and estimate the forward P/E and make assumptions about revenues going forward. It could be that two-to-three years from now, revenues will have grown to the point that the forward price-to-sales multiple is actually a lot less than 10x sales. Since Eli Lilly is such a well-covered stock by analysts, the company has historically traded near its intrinsic value and has been efficiently priced until very recently, when the market started to take dramatic revenue growth into account.

Seeking Alpha has estimated that Eli Lilly’s forward P/E is 45, which is still glaringly high and shows that the company will remain a standout among other mega-cap pharmaceutical companies in terms of the multiples it trades at for the next year, apart from some unforeseen event taking place. In the current market environment of rising interest rates and multiples contracting across many sectors, Eli Lilly is a standout with an expanding multiple, something that cannot last forever in this new market environment. While it is impossible to know when interest rates will stop rising, the assumption should be that this will catch up to stocks such as Eli Lilly eventually, and when the multiple inevitably contracts, the stock will be worth a buy.

Further Risks – Insurance Approvals And Drug Pricing

In addition, there are many other risks for Eli Lilly that the market seems to be ignoring. One big question on many investors’ minds is tirzepatide’s approval and the willingness of insurance companies to cover the drug for weight loss. Tirzepatide is being heralded as a major blockbuster drug, but this type of drug is not novel. The hype surrounding tirzepatide stems from data showing that it is best-in-class when compared to Novo Nordisk’s (NVO) Ozempic in terms of reducing blood sugar levels and body weight. The market share for these drugs is foreseen to be tipped in Eli Lilly’s favor, based on a higher efficacy to side-effect ratio at lower doses of the drug. However, Novo Nordisk is seeking approvals for a 2.4 mg version of Ozempic as an obesity treatment to counter the 15 mg dosage of tirzepatide, which has shown the highest efficacy in terms of weight loss. Apart from concerns about tirzepatide cannibalizing demand for Eli Lilly’s own drug Trulicity, the real uncertainty and risk stems from insurance companies and their willingness, or rather unwillingness, to cover these drugs.

While much of the focus on tirzepatide’s weight loss efficacy has been overstated, the bottom line is that this drug is intended to treat diabetes, and weight loss is more of a secondary action. Many insurance companies have not, or will not cover these drugs for weight loss, as they argue “that obesity is not a disease but a behavioral problem.”

There are many individuals who would like to take these drugs which demonstrate significant weight loss, but without insurance approval, they will likely not be able to afford them. The oversimplification and ongoing narrative that tirzepatide is a ‘magic pill’ solution that people can take in order to lose weight with no changes to diet or exercise is blatantly misleading. While the drug has been shown to cause weight loss, it is not a pill at all, but rather an injection, and one that many cannot afford without insurance. The assumption that hordes of people will be taking this drug solely for weight loss in the near future is sadly not the case, and could spell trouble for Eli Lilly’s future revenue growth.

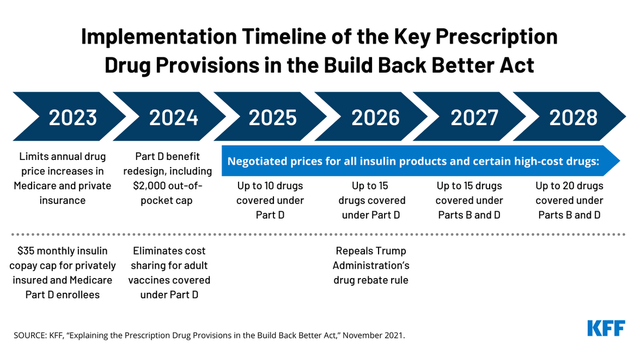

Another big topic that has been bubbling up to the surface over the last year is capping insulin prices, as well as lowering drug prices in general. The public opinion on this matter is clear, and it is an issue that both sides of the political spectrum actually agree on. So why has the market not taken this into account when it comes to valuing big pharma stocks such as Eli Lilly?

On one side of the argument, lower drug prices mean that more people can afford treatments, which is undoubtedly good for society as a whole. On the other side of the argument, however, lower profits for pharmaceutical companies could mean less investment in innovation, and less chance for the discovery of unique therapies. The public remains steadfast on this issue, as one poll by KFF found that “93% of Americans and 90% of Republicans said they believe that drugmakers would still make enough money to develop drugs if prices were lowered.”

While some progress has been made on capping insulin prices, the market is not yet taking it seriously, as much of the progress from President Biden’s Build Back Better plan is seen as too little, too late. Starting in 2023, the out-of-pocket cost for insulin is to be capped at $35 for a 30-day supply of insulin, but only for Medicare beneficiaries. As it currently stands, the government will identify “100 high cost medicines and choose 10 for price negotiation annually, with those prices first taking effect in 2025.” The catch is that it could only negotiate on drugs that have been in the market for “at least nine to thirteen years” and, as of yet, no drugs have been specifically identified.

Much of this risk to big pharmaceutical companies bubbling up is being pushed back, downplayed, and ultimately not taken seriously at the moment because of the delayed adoption of these government policies. The market is valuing Eli Lilly and other companies based on their future prospects over the next several years, but the year 2028 is still just a distant thought for the majority of investors and Wall Street analysts. However, with midterm elections right around the corner, uncertainty on this matter could begin to rear its head as the possibility of a shake-up in the House or Senate might start to change investors’ sentiment on the matter. It is unlikely that major drug pricing reform will gain traction in the near-term, but in the long-term it is a risk that should not be overlooked.

Conclusion – My Strategy For Investing In Eli Lilly

I have been an investor in Eli Lilly for years, and only up until recently did the valuation begin to worry me. Seeing that the company has now skyrocketed to become the 15th-largest company by market capitalization, I would expect that a correction in the stock price seems highly likely from here, especially when compared to others such as Mastercard, Procter & Gamble, and Nvidia. The stock has defied the bear market of 2022, and has actually experienced a multiple expansion in the face of rising interest rates, geopolitical turmoil, and a forecasted economic slowdown.

The multiple expansion phenomenon cannot last forever, no matter how great the future revenue and earnings prospects may be for the company. At this time, Eli Lilly’s stock seems priced for perfection, and the market seems to be focusing solely on tirzepatide and donanemab and overlooking many risks and uncertainties associated with these drugs and their upcoming rollouts. Politics, drug pricing reform, and insurance approvals are also being downplayed as legitimate risks, as hype and an insatiable appetite for the shares of the company continue to drive the price higher.

Now that Eli Lilly has reached $340 billion market cap, my strategy for investing in the company has changed. Earlier this year, I set a year-end price target range for the shares between $320 and $360. Just this week, LLY stock hit an all-time high of $361.48, which prompted me to review the valuation and determine if the stock was worth buying at all-time highs.

I have not added to my long position since early 2022, when the shares were below $300, and continue to see the range between $235 and $275 as a realistic valuation for adding shares to my long position. I currently view the shares of Eli Lilly as a Hold, as the company continues to be a best-of-breed pharmaceutical stock, but a correction in terms of the share price is needed before the stock can once again be considered a Buy.

Be the first to comment