RafaPress/iStock via Getty Images

Investment Thesis

Investment portfolios generally reflect the investing ideology of the investors, with risk-averse investors formulating low-risk, low-return portfolios and risk-tolerant investors formulating high-risk, high-return portfolios.

However, the secret to an optimized investment portfolio is an optimal mix of the two, achieved through portfolio diversification. The key is to maximize returns without exposure to unacceptable risks, and investing in international stocks is one of the many ways to do that.

Investing in emerging markets like Brazil has a potential for high growth, but the potential is countered by political instability, currency deterioration, and other economic risks. To cover the risks of investing in such an environment, some mitigating factors that could be considered are the company size, role in the economy, and stability and sustainability.

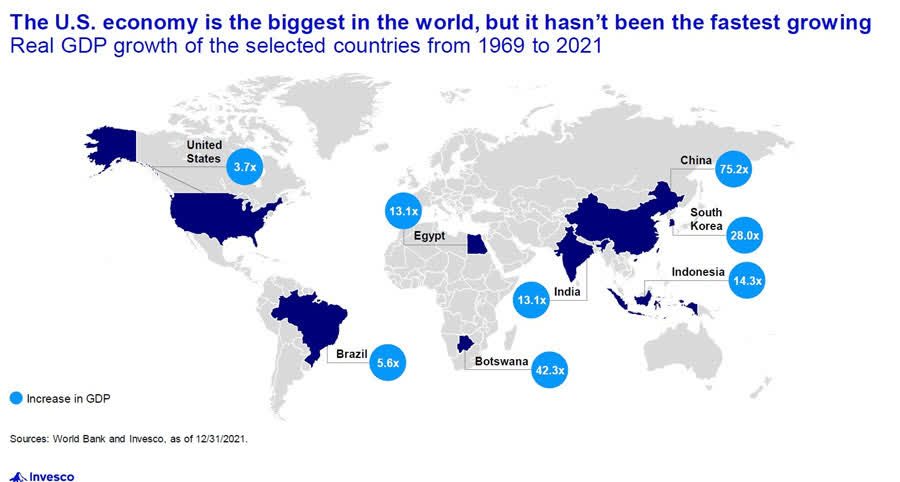

Invesco

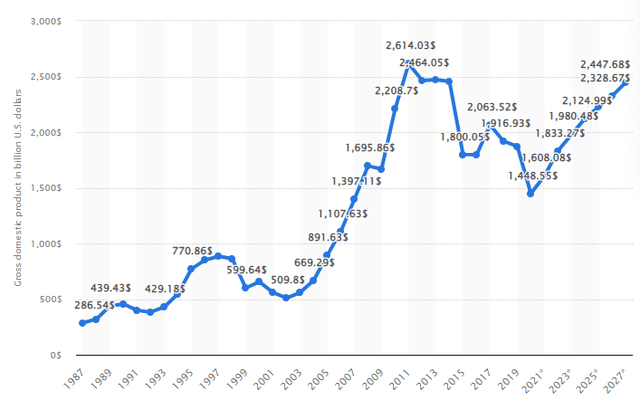

Accordingly, it appears to be a great time to invest in the Brazilian economy. It’s the 12th largest global economy with a GDP of $1.6 trillion in 2021, up 11% from 2020, and is expected to reach $1.83 trillion in 2022. While the United States is entering a recession, Brazil has just exited with its lowest inflation numbers since Dec 2021 and its stock market at the highest since April 2022.

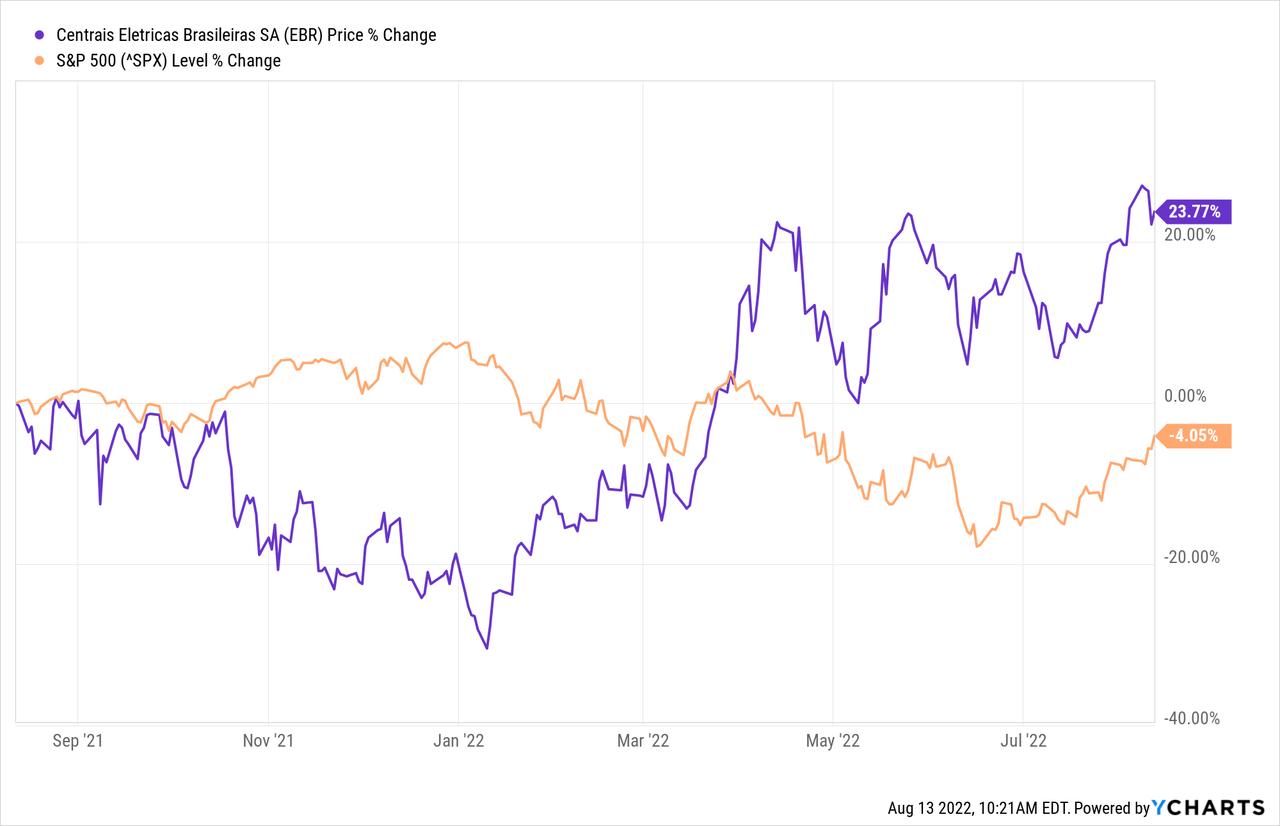

Centrais Elétricas Brasileiras S.A. – Eletrobrás (NYSE:EBR) is Brazil’s largest electricity producer and transmitter, which has outperformed the S&P 500 in the previous year and YTD. The significant size of the company, its indispensable role in the country’s operation, and strong government ties make it a safe bet.

Eletrobras is currently ranked 1002 on the Forbes Global 2000 list, based on a combination of revenue, assets, profits, and market value. The company has recently been privatized, highly incentivizing it to improve its operational and financial performance, to generate substantial shareholder returns through dividend distributions and capital appreciation.

I am bullish on the stock because of its significant post-privatization growth prospects, attractive valuation, role as a portfolio diversifier, and Brazilian economy.

Company Overview

Eletrobras is the largest integrated utility company in Brazil’s electric sector, accounting for about one-third of its total generation capacity and 44% of transmission lines in the country. Generation accounted for 59% of 2021’s revenue, transmission for 39%, and other sources for 2%.

Recently, the company carried out a public offering, issuing common stock in Brazil and ADS in the US, issuing over 802 million common shares for R$69.81 (~$13.75 billion). This effectively limited the Brazilian government’s control of the company by diluting its ownership to about 43% and lowering voting rights to 10%. Analysts expect this transaction to result in a turnaround as the privatization incentivizes the company to cut costs, improve its balance sheet, and grow.

Privatization in Brazil

Brazil is undergoing the most elaborate privatization period in its history, with over 100 state-owned assets privatized since 2019 to liberalize the economy, attract new investors, and promote competition.

It has privatized its largest distributor and marketer of petroleum derivatives and biofuels (ethanol) in Brazil and Latin America, BR Distribuidora, and the largest natural gas transportation company in Brazil, TAG. However, Eletrobras is the country’s largest privatization of the 21st century.

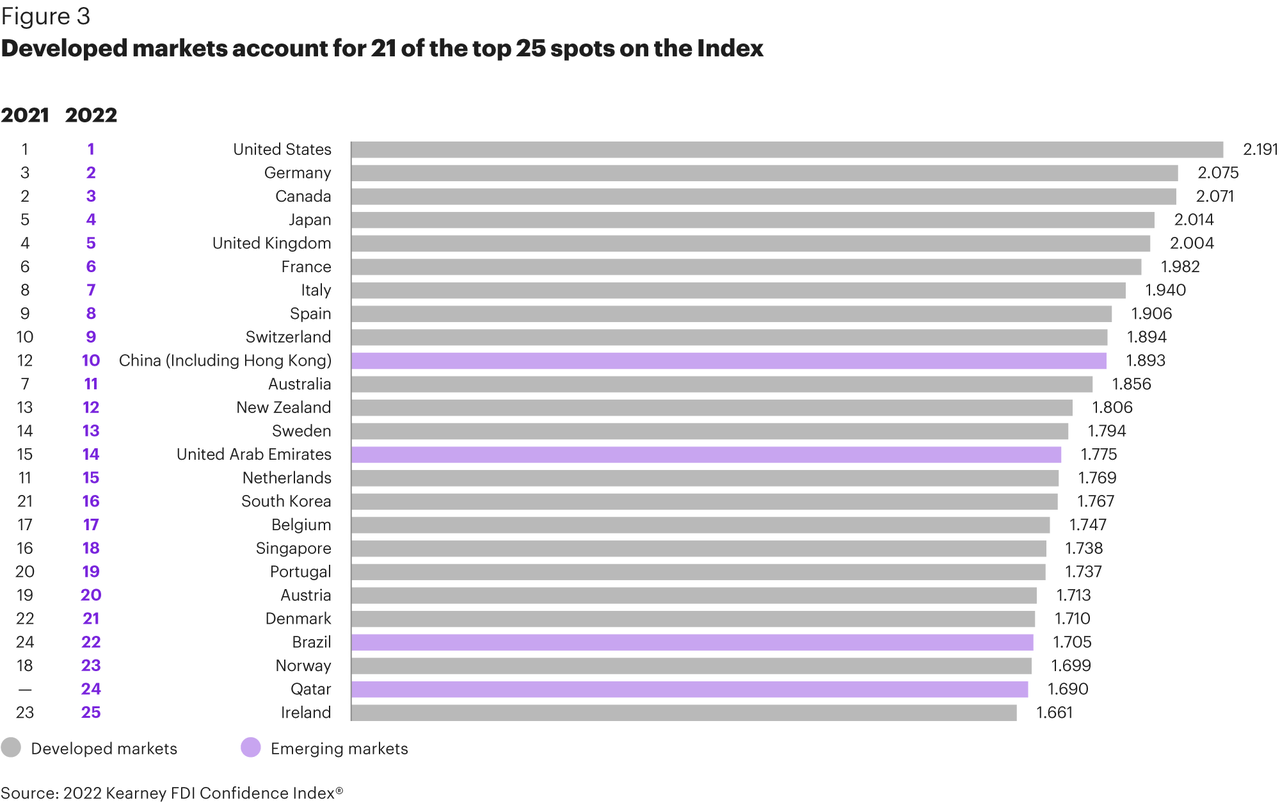

These initiatives are paying off as Brazil was among the only 4 non-developed markets in 2021 with high investor confidence, ranking 22nd in Kearney’s FDI Investor Confidence Index, up from 24th in 2020.

Kearney

Political risks have always been the country’s biggest drawbacks in attracting foreign investment. Therefore, the privatization of its corporations, including the planned privatization of Petrobras (PBR), limits government control over these companies, raising investor confidence.

According to Daniel Gewehr, portfolio manager at São Paulo-based WHG Asset:

Brazil is trading at a 30% discount to historical averages (in 2021), while the rest of the world is at a 5% premium. There should be positive equity returns on a 12 to 24-month view.

Brazil’s Electricity Sector

Brazil’s electricity sector is the largest in Latin America, with its installed capacity growing by an average of 5.8% per annum over the last 5 decades, reaching 181.5 GW in 2021. This capacity has now surpassed 184 GW with over 58 GW planned additions, including 13.6 GW already under construction.

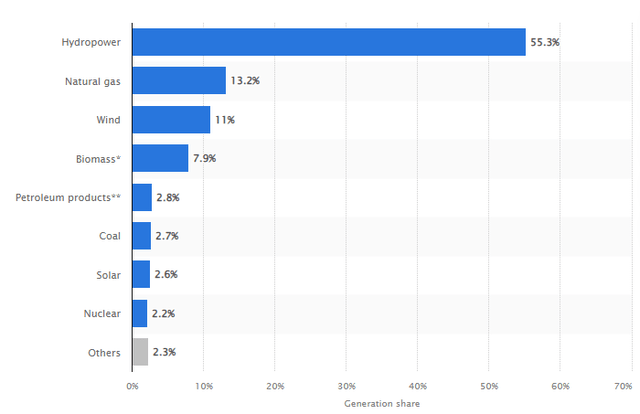

Since the country has one of the largest water storage capacities, 66% of its electricity was hydro-powered in 2020. Wind and solar generation accounted for 11%; Biomass accounted for an 8% share, Fossil fuel plants accounted for 12%, and nuclear power accounted for 2% of its total generation capacity.

EIA

The country is addressing this huge dependence on a single energy source as it improves the energy source mix by facilitating the gas-powered plants and strengthening its commitment to photovoltaic sources.

Reuters reports that Eletrobras has the potential to invest R$15 billion ($2.95 billion) per year, mainly focused on renewable energy generation, to become the world’s largest clean energy generating utility.

Brazil Electricity Generation by Source – 2021 (Statista)

Eletrobras’ Financial Augmentation

Despite a 19% increase in the adjusted net operating revenues, the company reported a 45% lower profit than Q2 2021 because of the R$890 million losses on investments and the R$625 million negative exchange rate variation during the quarter.

The newly privatized business will intensify its focus on achieving operational efficiencies, expanding its margins, and deleveraging itself. The company is set to migrate from the quota regime to the free market in the next 5 years with increments of about 20% per annum, significantly improving its revenue and profitability, as the average energy price under the quota regime is lower than prices negotiated in the free market.

The company has some upcoming debt maturities, including an immediate R$5 billion ($0.98 billion) payment as part of the R$25 billion ($4.92 billion) grant fee payment for the new concession agreements and R$32 billion ($6.3 billion) of contributions to the CDE account. The remainder is payable during the next 25 years in installments.

However, with an interest cover ratio of 2.6x and a current ratio of 1.4x, the company has ample resources to cover its short-term liabilities, including cash and restricted cash of R$5.8 billion ($1.14 billion). Additionally, Eletrobras has also recently reduced its financial leverage from 27% at the end of 2021 to 15% in the MRQ, with a Net Debt/TTM-EBITDA of 0.7x.

| Millions Brazilian Real (R$) | 30 June 2022 | 31 December 2021 |

| Total Loans, Finances, and Debentures | 35,263 | 44,015 |

| Marketable Securities | (14,261) | (15,874) |

| Cash and cash equivalents | (2,427) | (193) |

| Net Exposure | 18,574 | 27,949 |

| Total Shareholders’ Equity | 107,021 | 76,416 |

| Total Capital | 125,596 | 104,365 |

| Financial Leverage Ratio | 14.79% | 26.78% |

**Data from Q2 Reports

Further, Eletrobras will consolidate Santo Antonio Energia S.A’s (SAESA) net debt of R$19.8 billion in Q3 2022, following an indirect capitalization that will boost Furnas’ (an Eletrobras subsidiary) ownership of SAESA to about 72%. The company estimates that it would raise the proforma net debt of Eletrobras to R$34.9 billion and a pro forma net debt/Adjusted EBITDA ratio of 1.6x.

Even in the case of financial distress, the company’s integral role in Brazil’s electricity sector would result in support from the federal government, which is precedented to facilitate the company through cash capital injections, dividend payment deferrals, debt guarantees, & loans from public banks. The Brazilian government already guarantees 10% of the company’s debt, and 20% of its funding is through public banks.

Valuation

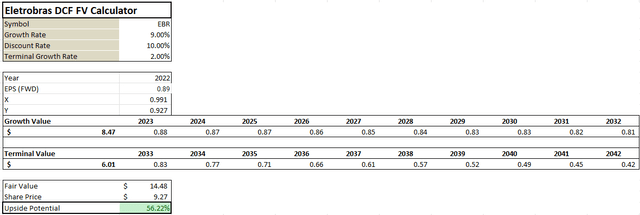

The stock is currently trading at a P/E multiple of almost 11x, P/S of 1.87x, and P/B of 0.92x, much lower than US-based utilities, most likely to account for the additional risk that comes with a newly-privatized Brazilian stock. If the stock was traded at relative valuation metrics of its sector median, then the average churns out a price tag of almost $18 per share, almost double the current price.

Similarly, using an EPS-based DCF model outputs a fair value of $14.48 per share, exposing an over 56% upside. I used a conservative growth rate of 9% despite a forward 3-5 years EPS CAGR of over 20% for the company and a 10% discount rate to account for additional risks.

It declared a dividend of $0.15 per share in April 2022, yielding 1.6%, amply covered by its cash dividend payout ratio of 35%, FCF yield of 5.52%, and an operating earning’s yield of 17.95%.

Since the privatization, the company’s core priorities will drastically shift toward generating investor returns. With sufficient leeway in its liquidity, I expect the company to show noticeable dividend growth in the upcoming quarters, especially considering that the company will be working to improve its cash conversion cycles.

Conclusion

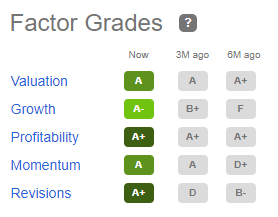

Investors looking to diversify their portfolios through international stocks will love Eletrobras, a winning stock at a discount. Wall Street and Seeking Alpha currently rate the stock as a Strong buy, probably because of its potential to generate future shareholder returns.

Seeking Alpha

The company’s integral role in the Brazilian economy makes it a safe bet for risk-averse investors. Its potential for dividend growth makes it a good investment for investors looking to generate some income while waiting for noticeable capital appreciation.

During the economic recession in the US, the Brazilian economy is well-suited to counter the effect as the country re-emerges as one of the fastest growing economies in the world.

I rate the stock as a Strong Buy because of its post-privatization shift, leading to an undervalued stock with a potential for significant capital appreciation.

Be the first to comment