Maria Vonotna/iStock via Getty Images

Intro

In less than two weeks, elections will be held in France. If we forget about the ongoing horrors of the war in Ukraine, this can be considered a key event in the first half of the year. And this event carries its own risks and opportunities.

Is the result predictable?

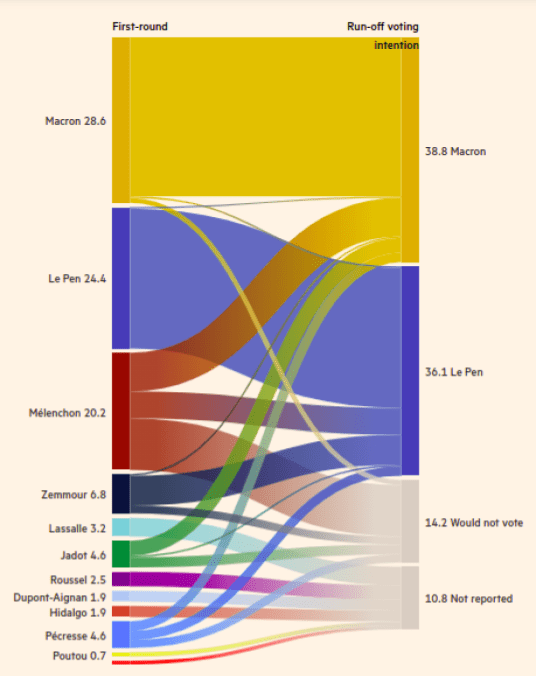

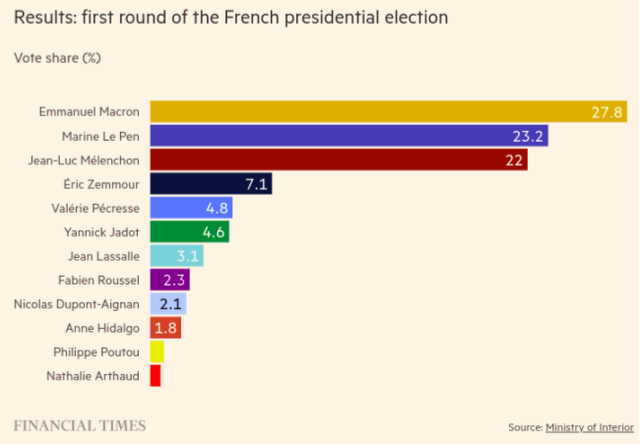

According to the results of the first round of elections, Macron scored 27.8%, and Marine Le Pen 23.2%:

This gap cannot be called significant. Moreover, the redistribution of the votes of outsiders potentially leads to almost equal chances of candidates in the second round of elections:

ft.com

Also, do not forget that no one seriously predicted Trump’s victory in the presidential election. It is very possible that here we will encounter a similar situation. Thus, in my opinion, the outcome is not yet clear.

What does the victory of each candidate promise the market?

The general rule is that the market always likes stability. In this sense, Macron’s victory is highly likely to be positively perceived by the market. It’s obvious. But the victory of Marine Le Pen can be a real shock…

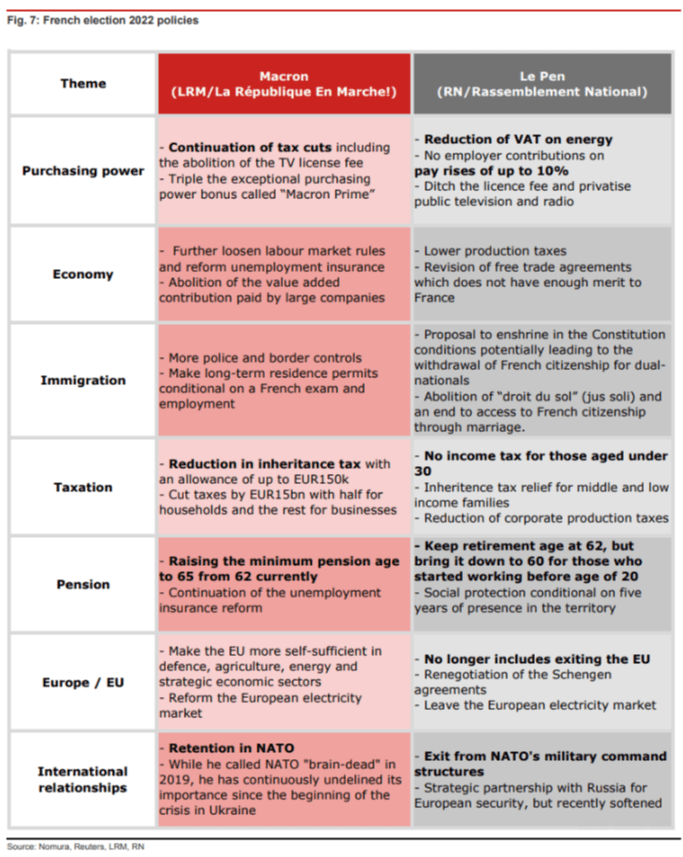

ft.com

For key positions, Marine Le Pen promises a policy of protectionism, restrictions on migration and withdrawal from NATO. In my opinion, this can lead to conflicts with the EU. In other words, this could be a difficult test for European relations, the result of which could at least be parity between the dollar and the euro. But, this is in general, and now let’s talk about particulars.

Defense industry

Despite the fact that both candidates see the attitude of France and NATO differently (Le Pen wants France out of NATO), they promise to increase defense spending; which, however, is logical with an eye to Ukraine.

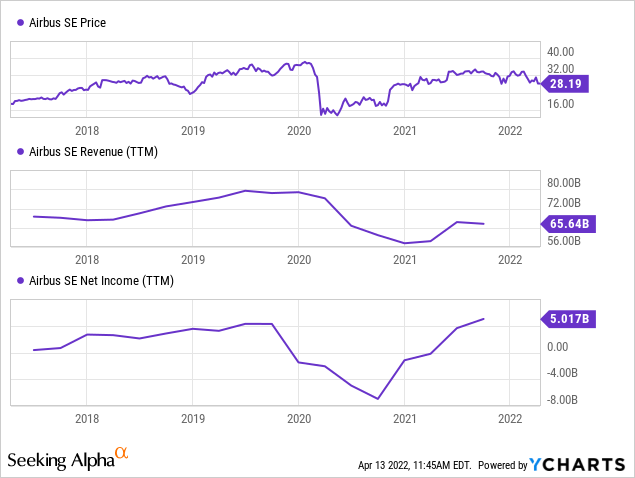

I confess that I am not very familiar with this branch of the French economy, but the first thing that comes to mind is that Airbus (OTCPK:EADSF; OTCPK:EADSY) has its own production facilities here. I am sure that this concern will be among the beneficiaries.

Green energy

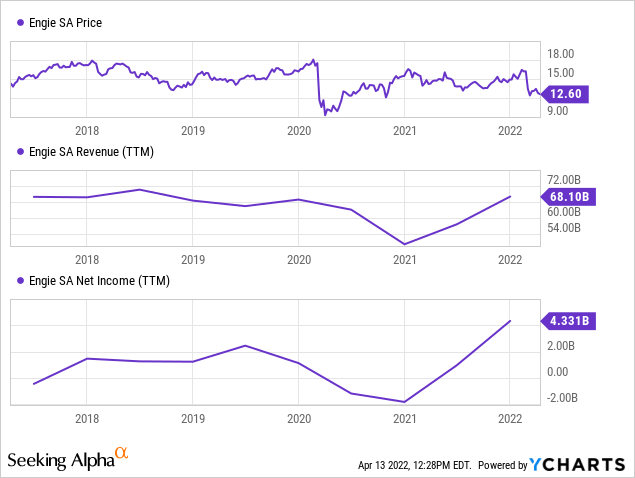

Marine Le Pen is an opponent of wind turbines and promises to take down them if she wins:

Wind and solar, these energies are not renewable, they are intermittent. If I am elected, I will put a stop to all construction of new wind parks and I will launch a big project to dismantle them…

Source: Reuters

If Le Pen’s statements are not populism, then for a company like ENGIE (OTCPK:ENGIY) this is a direct risk. By the way, this is probably already reflected in the price of the company:

Financial sector

As I have already noted, the market loves stability and predictability. Therefore, Macron’s victory may have a positive impact on price, for example, of the financial group Société Générale (OTCPK:SCGLF, OTCPK:SCGLY).

On the other side, in the economic aspect, Marine Le Pen promises production tax cuts and a revision of free trade agreements that are not beneficial to France. Le Pen’s current election program no longer includes France’s exit from the EU, but promises to revise the Schengen agreements. In my opinion, in general, Le Pen is aggressive towards the established rules within the EU. It is even possible that Le Pen’s reforms will lead to lawsuits against France for violating EU rules.

All this should lead to a review of long-term risks for the French economy, which is likely to increase the yield of French government bonds. And this will negatively affect the entire financial sector: from banks to insurance companies.

Bottom Line

The phase of complex challenges and trials on the European continent continues. And at the same time, there is a clear trend that not the most probable scenarios are being implemented.

This is a purely subjective opinion, but the likelihood of Le Pen winning is higher than it seems. In a sense, this is in line with the spirit of the times and the public demand for radical changes. Investors should be prepared for this.

Be the first to comment