Juan Jose Napuri

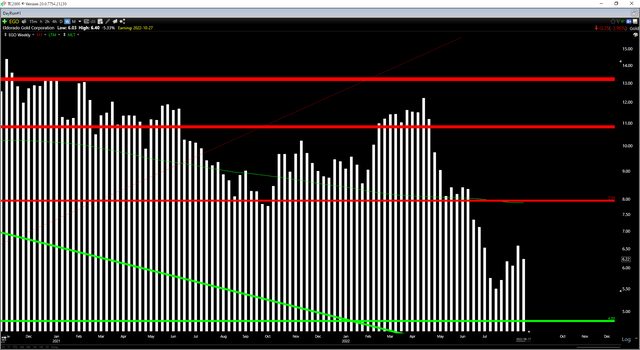

It was a mixed Q2 Earnings Season for the Gold Miners Index (GDX). This is because while most miners performed well operationally, we saw negative cost guidance revisions due to inflationary pressures. Eldorado (NYSE:EGO) is in the same boat but had a softer than expected H1, leading EGO to guide towards the lower end of production and revising its cost guidance higher by $100/oz. While much of the cost issues are out of the company’s control, it’s no surprise that the stock has struggled to make progress following the report. That said, at 0.38x P/NAV with one of the sector’s best projects in its portfolio (Skouries), I would view pullbacks below $5.40 as a buying opportunity.

Lamaque Operations (Company Presentation)

Q2 Production

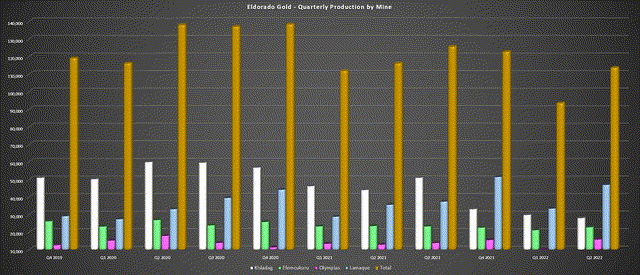

Eldorado Gold had a solid quarter in Q2 operationally, with a phenomenal quarter from Lamaque (~46,900 ounces) and a better quarter at Olympias (~15,800 ounces) offset by lower output from its Turkish mines. Unfortunately, the sharp drop in production at Kisladag (~28,000 ounces) more than offset the better production at Lamaque and Olympias, leading to a 2% decline in gold production in the period. Given the softer H1 2022 performance, production guidance was maintained, but Eldorado guided towards the low end of the range (460,000 to 490,000 ounces).

Eldorado Gold – Quarterly Production by Mine (Company Filings, Author’s Chart)

Digging into the operations a little closer, Lamaque was the shining star, producing ~46,900 ounces at all-in sustaining costs (AISC) of $985/oz. Unit costs were down on a year-over-year basis (Q2 2021: $1,065/oz), but they were well below the industry average (~$1,320/oz), despite 20% higher sustaining capital. Moving to Kisladag, costs also came in at respectable levels despite the much lower production and higher sustaining capital, with costs of $1,090/oz in the period. That said, unit costs were up over 40% year-over-year.

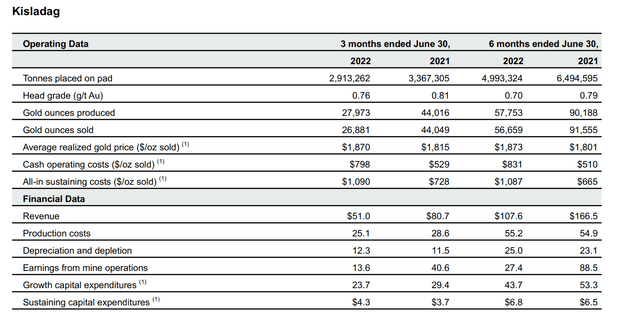

Kisladag Operating Metrics (Company Filings)

While this is certainly disappointing, the operation struggled in Q1, with fewer tonnes placed on the leach pad due to a government-mandated power outage, severe weather, and COVID-19-related absenteeism. Due to the leach times, the fewer tonnes stacked impacted Q2 production, with a 36% decline in production year-over-year. However, with 40% higher tonnes placed on the leach pad in Q2, we should see a much stronger Q3 and more respectable costs at the operation in the back half of the year as production increases.

Kisladag Operations (Company Website)

Moving to Efemcukuru, production was down 4% year-over-year due to lower head grades (5.96 grams per tonne gold). This impacted all-in sustaining costs when combined with negative provisional pricing and inflationary pressures due to the lower sales volumes. The result was all-in sustaining costs of $1,180/oz, up from $917/oz in the year-ago period. Eldorado called out electricity costs in Turkey and Greece as impacting costs, with Kisladag also being affected by higher fuel and reagents costs, consistent with what we’ve seen sector-wide.

Finally, Olympias had a better quarter operationally, benefiting from higher gold, silver, lead, and zinc grades, which offset the fewer tonnes milled in the period. This led to the production of ~15,800 ounces of gold and a sharp increase in silver, lead, and zinc tonnes produced. However, despite higher production, costs rose to $2,346/oz (Q2 2021: $1,893/oz), impacted by 50% higher sustaining capital and inflationary pressures. A 13% VAT import charge also impacted gold revenue levied on customers importing Olympias into China, with no option to ship to Russia due to the Russia-Ukraine war.

Eldorado Gold Pour (Company Website)

It’s easy to be negative about the weaker results from a headline standpoint, and this has certainly put a major dent in cash flow estimates for the year ($1.30 vs. $1.80 previously). That said, the weaker quarter was more due to one-time headwinds and inflationary pressures than any deterioration in Eldorado’s business. For this reason, I believe it makes sense to look past the Q2 results and instead look ahead to much higher production (520,000+ ounces) in 2024 at much lower costs, assuming energy prices have seen their peak (crude oil: ~$125.00/barrel), and electricity costs don’t worsen in Europe.

Costs & Margins

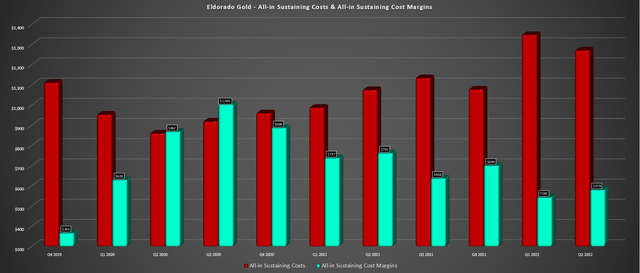

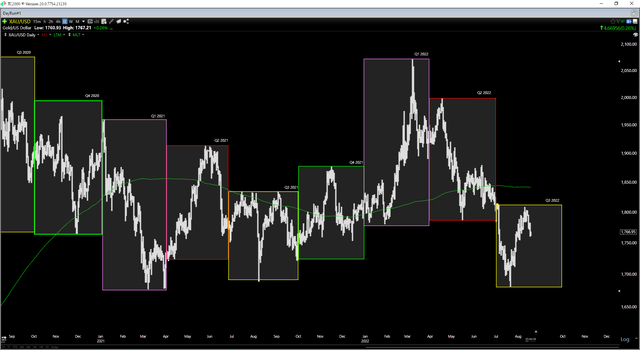

Moving over to costs and margins, Eldorado reported all-in sustaining costs of $1,270/oz on a consolidated basis, a significant increase from the $1,074/oz reported in the year-ago period. This was partially impacted by lower revenue due to negative provisional pricing and the VAT impact at Olympias and also related to higher sustaining capital in the period ($32.3 million vs. $24.2 million). However, when combined with the lower gold price ($1,849/oz), AISC margins plunged to $579/oz vs. $766/oz in Q2 2021, a 24% decline. Given where the gold price is currently sitting, I wouldn’t expect much margin improvement sequentially, with lower costs to be mostly offset by a ~$70/oz headwind from the gold price (~$1,780/oz in Q3 vs. $1,849/oz in Q2).

Eldorado Gold – All-in Sustaining Costs (Company Filings, Author’s Chart) Gold Futures Price (TC2000.com)

As discussed earlier, the sector was impacted by inflationary pressures in the period, pushing unit costs up across the producer group. Hence, these higher costs are not company-specific to Eldorado, and it was affected more than some peers that ended up spending less on sustaining capital in the period. Still, the company didn’t do a great job guiding for costs in 2022, in my view, given that it’s having to revise cost guidance higher to $1,180/oz-$1,280/oz (previous: $1,175/oz to $1,175/oz), despite benefiting from a lower Canadian Dollar and Turkish Lira as partial offsets.

That said, as production increases and we lap one-time issues, I expect costs to dip below $1,210/oz in FY2023 and fall further to sub $1,125/oz in FY2024. At the mid-point of FY2022 guidance, costs will come in at $1,230/oz. Let’s take a look at the valuation to see if the weaker FY2022 outlook is priced into the stock:

Valuation

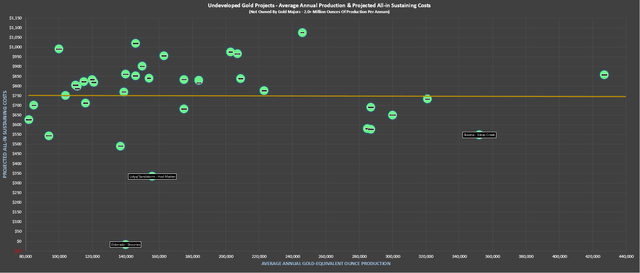

Based on ~184 million shares and a share price of US$6.05, Eldorado trades at a market cap of just ~$1.14 billion, less than the NPV (5%) of its two main assets combined (Kisladag, Lamaque). Even if we put a 0.90x NPV (5%) multiple on these two assets to reflect Turkey being a Tier-2 jurisdiction offset by Lamaque as Tier-1 (Canada) and subtract out estimated corporate G&A, investors are getting its other assets for free. This might not seem like much of a statement with Olympias being a small higher-cost mine in Greece for the time being and Efemcukuru also being a smaller mine with industry average costs in Turkey. However, Skouries is a major deal and one of the lowest-cost mines sector-wide if it goes into production.

This is based on its potential to produce 182,000 ounces of gold in its first five years (140,000 ounces average of mine life) at negative all-in sustaining costs due to copper by-product credits. Even if we assume some upwards revision in upfront capex, this project has an estimated After-Tax NPV (5%) of $1.2 billion at $1,550/oz gold and $3.75/lb copper, which I would argue to be very conservative figures for the 2025-2044 period. So, if Eldorado can successfully fund this project and it’s green-lighted by the board, I would expect a re-rating for the stock once in production.

The one risk worth noting is the potential for minor share dilution if construction costs come in higher than expected, assuming the company doesn’t go with a joint-venture partner. Also, if the company goes with a joint-venture partner, the risk of share dilution decreases, but its attributable NPV (5%) would decline slightly, with its ownership dropping. I think these risks are more than priced into the stock, with Eldorado trading at 0.38x P/NAV based on an estimated net asset value of ~$3.0 billion.

Technical Picture

Looking at the technical picture, Eldorado has strong support at $4.80 and no meaningful resistance until the $7.95 level. This leaves EGO near the middle of its expected trading range and translates to a reward/risk ratio of 1.25 to 1.0. Generally, I prefer a minimum 5 to 1 reward/risk for small-cap producers, meaning that EGO would need to decline below $5.40 to enter a low-risk buy zone. So, while I was bullish in my most recent article with the stock trading at $5.50, I am neutral on the stock short-term given that it’s up more than 10% and closer to the mid-point of its expected trading range. That said, the valuation here remains quite compelling for patient investors, even at $6.20.

Summary

Eldorado Gold might not be the lowest-cost miner and doesn’t operate out of the best jurisdictions globally. That said, it has one of the sector’s best gold projects in its portfolio, which sports negative all-in sustaining costs and an attractive 20-year mine life. If approved, this would boost Eldorado’s production profile while pulling consolidated AISC below the industry average. Skouries’ production profile is shown below, with all-in sustaining costs expected to be well below that of other high-grade projects like Skeena’s (SKE) Eskay Creek in British Columbia and Lidya’s Hod Maden in Turkey.

Undeveloped Gold Projects – Projected Production & All-in Sustaining Costs (Company Filings, Author’s Chart)

So, with a transformative project like Skouries in its portfolio and a path towards higher production at lower costs at its Tier-1 jurisdiction Lamaque Mine, I don’t see much value in measuring Eldorado against its most recent quarterly results. That said, the key will be green-lighting Skouries and successfully funding the project. This is the one stand-out attribute for Eldorado, with it otherwise being an average producer in mediocre jurisdictions. Given that I see a decent probability of Skouries being green-lighted, I would view any pullbacks below $5.40 as buying opportunities.

Be the first to comment