Aigars Reinholds/iStock via Getty Images

Elbit Systems Ltd. (NASDAQ:ESLT) is an overlooked, undervalued $8.77B defense contractor based in Israel. Our average price target over the next 12 months is in the $250 per share range; that’s an upside of 25% from the current price.

Our bullish position extends back to my article about ESLT two years ago, when I characterized Elbit as firing on all cylinders. You can subscribe to SA here if you want to read other articles about ESLT.

Killer Weapons Innovation

Defense expenditures flew past the $2T mark in 2021. Military expenditures on average are 5.9% of world gross domestic product. Elbit is well-positioned to build revenue in the growing essential defense industry.

War is now a high-tech event, with ground soldiers hiding in forests using computerized mobile weapons to shoot down enemy aircraft. Nary a rifle was fired in 2021 between Israel and Gaza or since then. Guided missiles are the tactical weapons of choice, countered by the notable Iron Dome missile defense umbrella.

Elbit is a leader, developing the next defense technology, laser systems for military defense. The market is enormous, in part because it costs $50K for each Iron Dome Interception missile compared to the $2 per laser-fired defense beam.

Elbit Systems Ltd. develops airborne, land, and naval systems. On the commercial side, Elbit has products for homeland security and commercial aviation applications. The company is expanding its portfolio of innovative technologies in unmanned aircraft systems, advanced electro-optics, electro-optic space systems, signal intelligence systems, data links and communications systems, radios, cyber-based systems, munitions and equipment for cyber intelligence.

Its defense protection products and systems cover the world from underwater to outer space. Elbit sells training and support services. The company markets its systems and products as a prime contractor or subcontractor to various governments and companies. Elbit Systems was incorporated in 1966.

Elbit Systems Businesses (elbitsystems.com/media/Elbit_Sustainability_2021.pdf)

Business Results

The U.S. had to replace $7B worth of military equipment in Afghanistan. The war in Ukraine has consumed an estimated $60B the West has sent or committed from stockpiled arsenals, that’s without factoring in what Russia has spent on equipment.

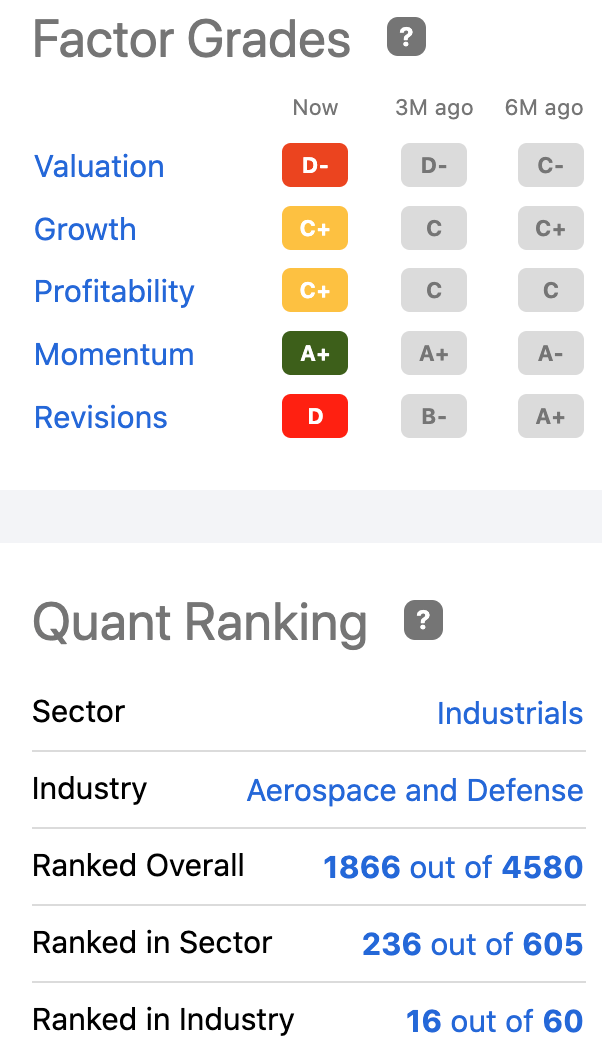

Yet, defense industry stocks are stagnating or down over the past year. SPDR S&P Aerospace & Defense ETF (XAR) share price is -25% over the past year, -15.6% year-to-date, compared to +42% over 5 years. Seeking Alpha authors and the SA Quant Rating recommend selling shares. ESLT shares, by contrast, are +46.5% over the last 12 months, are +14.3% year-to-date, and are +60% over 5 years. The signing of the Abraham Accords opened new markets among the Arab Gulf States, African, and Asia nations for Elbit.

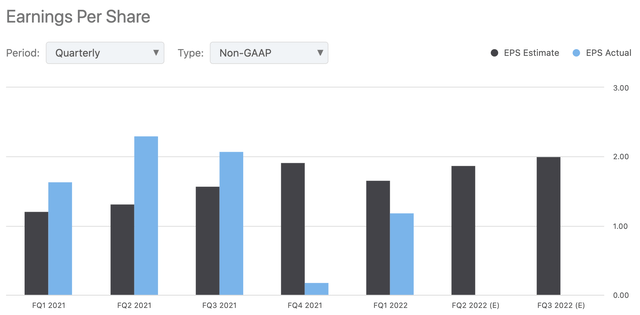

In May ’22, the company reported quarterly earnings for Q1. Its Non-GAAP EPS was $1.22 on a 21.6% increase in revenue Y/Y. Q1 Non-GAAP gross profit amounted to $333.3M, which is 24.6% of revenues compared to $286.2M (25.6% of revenues) in Q1 ’21. Order backlogs near $14M. Management scheduled ~ 55% of the order backlog to be performed this year and next.

Seeking Alpha Factor & Quant (seekingalpha.com/symbol/ESLT)

In Q1 ’22, Elbit spent a hefty 7.4% of revenue on R&D (over $100M); that is about $16M more than it spent in the same quarter of ’21. General and administrative expenses were also higher because of the pandemic and the rising cost of goods.

The financial outlook is good. The P/E is 24.84. There is virtually no short interest. The shares are not volatile, and we do not foresee any serious risks to the stock. Growth and profitability appear they will stay positive. Shares are undervalued. Interest and debt payments are covered. An Israel rating agency announced in June ’22 that ESLT has “a stable outlook.”

On the downside, ESLT shares are down since March ’22 ($236). Share price slipped to $199 at the time I wrote this article, and the stock market dived. The dividend yield forward is a paltry 0.93%. The stock is lightly traded. News coverage about ESLT is light. Earnings were weak in Q1 ’22, and we expect that will be the case in Q2 ’22 when the company reports on August 17th; we forecast EPS at $1.80 compared to $2.15 in the same quarter last year.

Elbit Systems Earnings (seekingalpha.com/symbol/ESLT)

Outlook

Elbit Systems is an innovator in the growing defense industry. R&D is its lifeblood. South Korea and Israel are the biggest R&D spenders worldwide. Each spends 4.6% of its GDP on it. Both are innovators in business technology, but also both countries live under the existential threat that ups their defense spending. ESLT is a growth opportunity. The company is profitable, financially well-off, and has an impressive but manageable backlog of orders.

The stock is undervalued. The company’s revenue increased, is essential to its nation’s survival, and operates on the cutting edge of new defense technologies that are commercialized for worldwide sales. We do not expect any rockets to lift Elbit Systems stock, but it is expected to climb past its 52-week high.

Be the first to comment