GlobalP/iStock via Getty Images

We may have pets, but when it comes to unconditional love, they are the masters.”― Donald L. Hicks

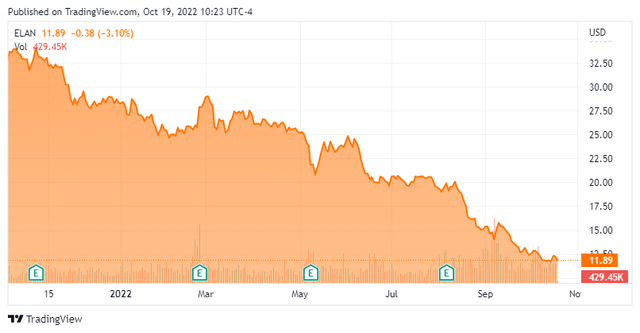

Today, we put Elanco Animal Health Incorporated (NYSE:ELAN) in the spotlight. As you can see below, the stock has fallen sharply primarily as a result of analyst downgrades’ concern about growth prospects for this leader in animal health. Can the shares rebound in the year ahead? An analysis follows below.

Company Overview:

Elanco Animal Health Incorporated is based just outside of Indianapolis. The company develops, makes and markets a wide variety of products for pets and farm animals. These include items such as vaccine products that protect pets from worms, fleas, and ticks, pet health therapeutics for pain, osteoarthritis, ear infections, cardiovascular, and dermatology indications in canines and felines and nutritional health products, including enzymes, probiotics, and prebiotics; and a range of vaccines, antibiotics, implants, parasiticides, and other products used in ruminant and swine production. The stock currently trades at just under $12.00 a share and sports a market capitalization of approximately $5.8 billion.

August Company Presentation

Second Quarter Results:

August Company Presentation

On August 8th, the company posted second quarter numbers. Elanco had a non-GAAP profit of 36 cents a share. This was more than a dime a share than expected. However, sales fell nearly eight percent on a year-over-year basis to $1.18 billion.

August Company Presentation

The stock also took a major hit as management reduced full year 2022 guidance significantly citing its ‘current assumptions related to economic, environmental and company-specific factors impacting the business‘. The company reduced FY2022 sales guidance by approximately $150 million at its midpoint compared to its previous projections and the analyst firm consensus that existed at that time.

August Company Presentation

Leadership went into significant detail on what is causing this reduced forecast (below).

August Company Presentation

August Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community has turned decidedly negative on the company’s prospects in recent months. Since second quarter results were posted, four analyst firms, including Piper Sandler (PIPR) and JPMorgan (JPM), have reiterated or downgraded to Hold ratings on the stock. Price targets proffered range from $18 to $21 a share. Notably, all of these price targets are considerably above the current trading levels of the stock.

On August 18th, Morgan Stanley (MS) downgraded the stock to a Hold and slashed its price target from $37 to $23 a share. The analyst there believes Elanco faces ‘bleak prospects amid macro and company-specific headwinds‘ which included ‘slower innovation ramp, greater rivalry in the parasiticides market, and potential pricing impact in 2023.’ Two weeks ago, Morgan Stanley reissued that Hold rating with a $21 price target.

Approximately two and a half percent of the outstanding float in the shares is currently held short. Several insiders have bought just over $1.7 million worth of shares in aggregate via several purchases in March, May and September. There has been no insider sales in the shares so far in 2022. Activist investor Sachem Head Capital Management disclosed a six percent stake in Elanco in early September.

August Company Presentation

At the end of the second quarter, the company held approximately $525 million in cash and marketable securities against just over $6 billion in long-term debt. During the second quarter, the company’s net leverage ratio fell to 5.3x adjusted EBITDA and leadership projects a reduction to ~5.0x adjusted EBITDA by year-end 2022. Operating cash flow for the second quarter was just north of $310 million.

Verdict:

The current analyst firm consensus has the company earning $1.09 a share in profits in FY2022 even as revenues fall just over five percent to $4.5 billion. They expect revenues to rise $90 million in FY2023 and profits to improve to $1.23 a share.

Obviously, Elanco has some current growth concerns. It is also facing both macro and company-specific headwinds. The company also has a good slug of debt on its balance sheet. On the bright side, some growth is projected to return in FY2023, and there has been some insider buying and activist interest in the stock recently. Elanco is also using operating cash flow to reduce debt and leverage.

In addition, spending on animal health tends to be more inelastic than most consumer spending. I consider this a positive as the country looks headed into recession. After a nearly 65% sell-off in the shares over the past year, the stock sports a reasonable valuation at 11 times this year’s profit estimates and is also under the pessimistic analyst community’s price targets by a significant margin. The stock pays no dividend, unfortunately. Therefore, I am going to initiate a small ‘watch item‘ position in this leader in animal health via covered call orders today.

Dogs are like kids. Cats are like roommates.”― Oliver Gaspirtz

Be the first to comment