yorkfoto

iShares MSCI Indonesia ETF (NYSEARCA:EIDO) is an exchange-traded fund that invests in companies based in Indonesia. While Indonesia is a relatively undeveloped country, ranking 64 among 127 countries globally for economic complexity (lower rankings indicate higher complexity), EIDO had $546 million in assets under management as of November 25, 2022, with 93 holdings in total. The dividend yield (calculated on a 30-day SEC yield basis) was 1.67% as at the end of October 2022. Indonesia’s equity market would therefore appear to be relatively well developed as compared to the local economy.

However, generally speaking, Indonesia is a small pocket for emerging markets investors. A popular emerging markets equity fund, iShares MSCI Emerging Markets ETF (EEM) had a 2.02% position in Indonesia as of November 24, 2022, with the bulk of the fund invested in China (29.22%), India (14.87%), Taiwan (14.67%), and South Korea (12%). EIDO is an alternative fund with a single-country focus on Indonesia. The fund’s benchmark index, whose performance it seeks to replicate, is the MSCI Indonesia IMI 25/50 Index.

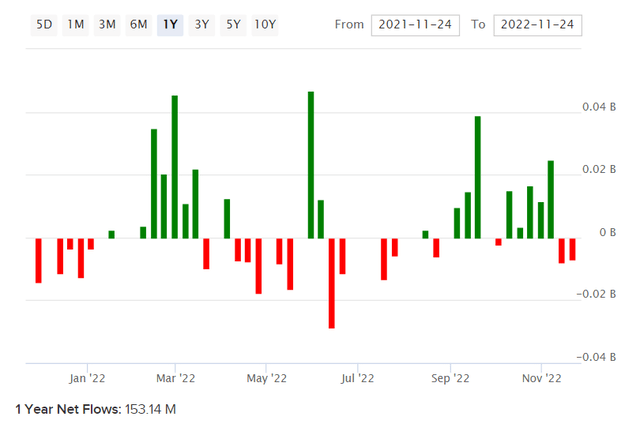

Net fund flows into EIDO over the past year have been broadly positive: +$153 million as at the time of writing (see chart below). However, flows have also been somewhat volatile throughout the year, as global equity markets have trended lower.

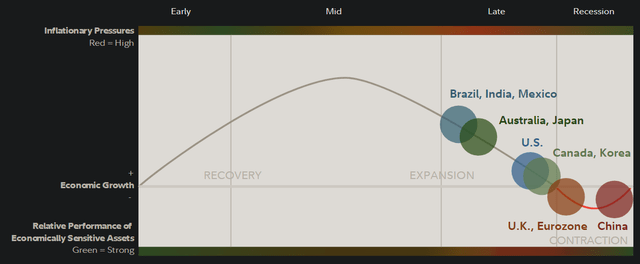

Lower equity markets this year have been pulled down by various concerns, including geopolitical risk (e.g., Russia and Ukraine; China and Taiwan), as well as cyclical recessionary risks (see chart below as of Q4 2022), and elevated commodity prices/inflationary pressures.

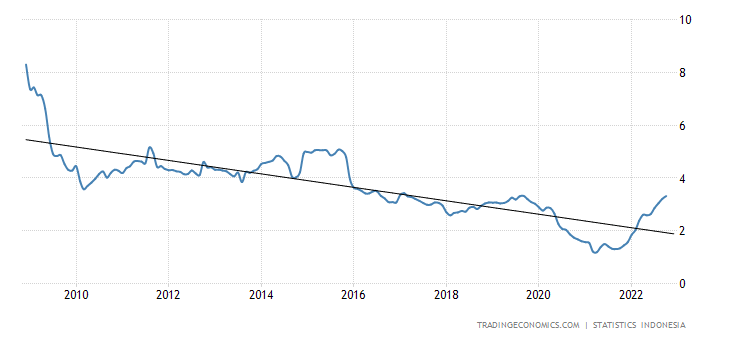

The core inflation rate in Indonesia has actually been encouragingly moderate this year. The chart below shows the core year-over-year inflation rate trending higher toward 4%, however this level has not yet been reached, and the long-term trend is still negative.

TradingEconomics.com

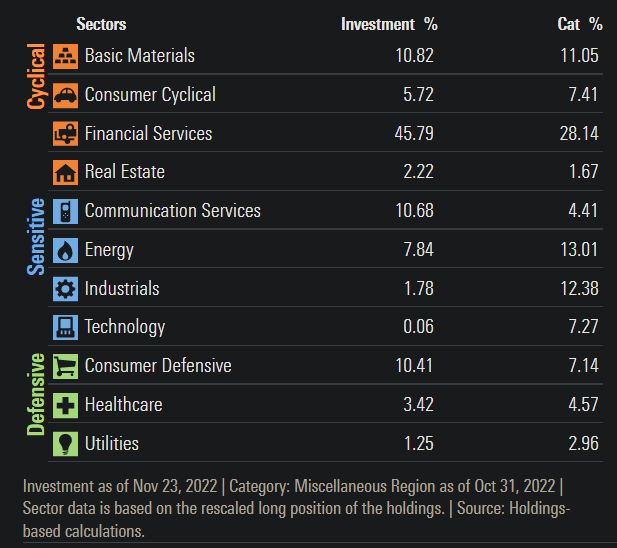

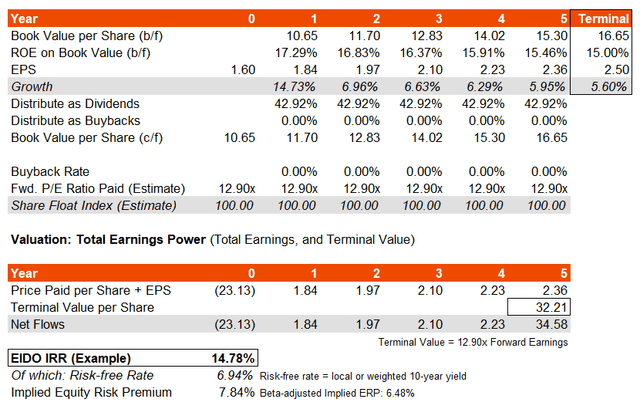

Using the most recent factsheet for EIDO’s benchmark index, MSCI indicate trailing and forward price/earnings ratios of 14.80x and 12.90x, respectively, with a dividend yield of 2.90% (trailing) and a price/book ratio of 2.23x. These figures imply a forward return on equity of 17.29%, and a dividend distribution rate of circa 43%. That is a high distribution rate, and the table below from Morningstar provides a strong indication as to why. The fund is heavily invested in mature sectors such as financial services, telecommunications, and consumer staples.

Morningstar.com

Morningstar also offer a consensus analyst estimate for three- to five-year average earnings growth for EIDO’s portfolio of 11.42% at the time of writing. If I assume that our return on equity for EIDO falls from over 17% in year one to about 15% by year six, and hold most other factors constant, the three- to five-year earnings growth rate would average between 8.06-9.38%. This is apparently just below consensus, which seems like an acceptable estimate.

Using the figures above, I have generated the model below, making reference also to the fact that the Indonesian 10-year bond yield currently offers 6.943%, which is relatively high.

The implied IRR is strong at 14.78%, based on the total underlying earnings power of EIDO’s portfolio. The local 10-year yield, a proxy for the fund’s risk-free rate, is 6.94%. If we used EIDO’s moderately elevated beta of 1.21x to scale back the equity risk premium (or ERP) to find a beta-adjusted ERP, that would take us to 6.48% (implied). That is higher than what I would expect for mature markets (circa 4.2-5.5%). Therefore, it seems like EIDO is most probably undervalued.

I have also held the forward earnings multiple constant in the above model at 12.90x. This offers a forward earnings yield of 7.75%. One could argue that on a 10-year yield of 6.94%, and long-term earnings growth of say 2-4%, would take your multiple to somewhere around a peak of 9.98-12.47x. However, the 10-year yield is, in my opinion, too high for the country. With core inflation rates at sub-4%, they indicate positive real rates, which in the long run are likely to edge closer to 0-2% at most (real rates). At a minimum, I can imagine long-term risk-free rates falling at least two percentage points, say to 5% from 6.94%. That would take our fair value estimate for the long-term earnings multiple to the 12-16x range. While the current multiple is on the higher side, it seems to fairly capture likely long-term monetary easing.

As the world possibly heads into a recessionary phase, the next phase will be the beginning of a new business cycle. Indonesian stocks are positive equity beta and will likely benefit from this resurgence, while they currently remain undervalued per my estimates. Therefore, I would have to take a constructive view on Indonesian stocks, especially as markets tend to lead the real economy by up to 12 months or so.

Be the first to comment