metamorworks

Quick Take On eGain

eGain Corporation (NASDAQ:NASDAQ:EGAN) reported its FQ4 2022 financial results on September 8, 2022, beating expected revenue and EPS estimates.

The company provides medium and large enterprises with customer engagement and successful software.

I’m on Hold for EGAN until management can reverse worsening operating losses while growing revenue.

eGain Overview

Sunnyvale, California-based eGain was founded in 1997 to enable businesses to improve their customer-facing results via its integrated offerings.

The firm is headed by co-founder, Chairman and CEO, Ashu Roy, who was previously co-founder of WhoWhere? and of Parsec Technologies.

The company’s primary offerings include:

-

Collaboration

-

Insight

-

Knowledge + AI

-

Services

-

Integrations

The firm acquires customers via its direct sales and marketing team as well as through channel partners and marketplace.

eGain’s Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global market for customer engagement solutions was an estimated $15.5 billion in 2020 and is forecast to reach $30.9 billion by 2026.

This represents a forecast CAGR of 12.65% from 2021 to 2026.

The main drivers for this expected growth are a growth in technology solutions to improve the customer journey via any device they use to connect with businesses.

Also, reduced customer churn rate results in improved business financials and a growing valuation for clients.

Major competitive or other industry participants include:

-

IBM

-

Microsoft

-

Nuance

-

Oracle

-

Salesforce

-

Avaya

-

Calabrio

-

Aspect Software

-

Genesys

-

Verint Systems

-

NICE Ltd.

-

OpenText

-

Pegasystems

-

EngageSmart

eGain’s Recent Financial Performance

-

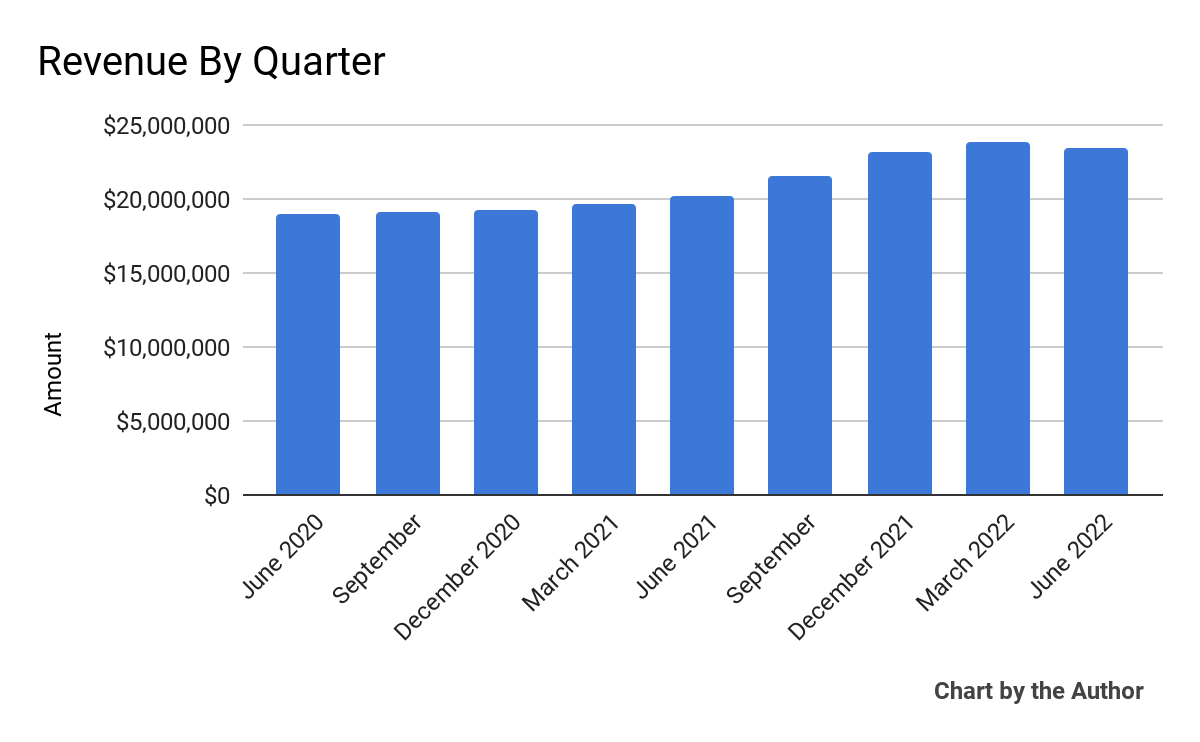

Total revenue by quarter has followed the trajectory as shown below:

9 Quarter Total Revenue (Seeking Alpha)

-

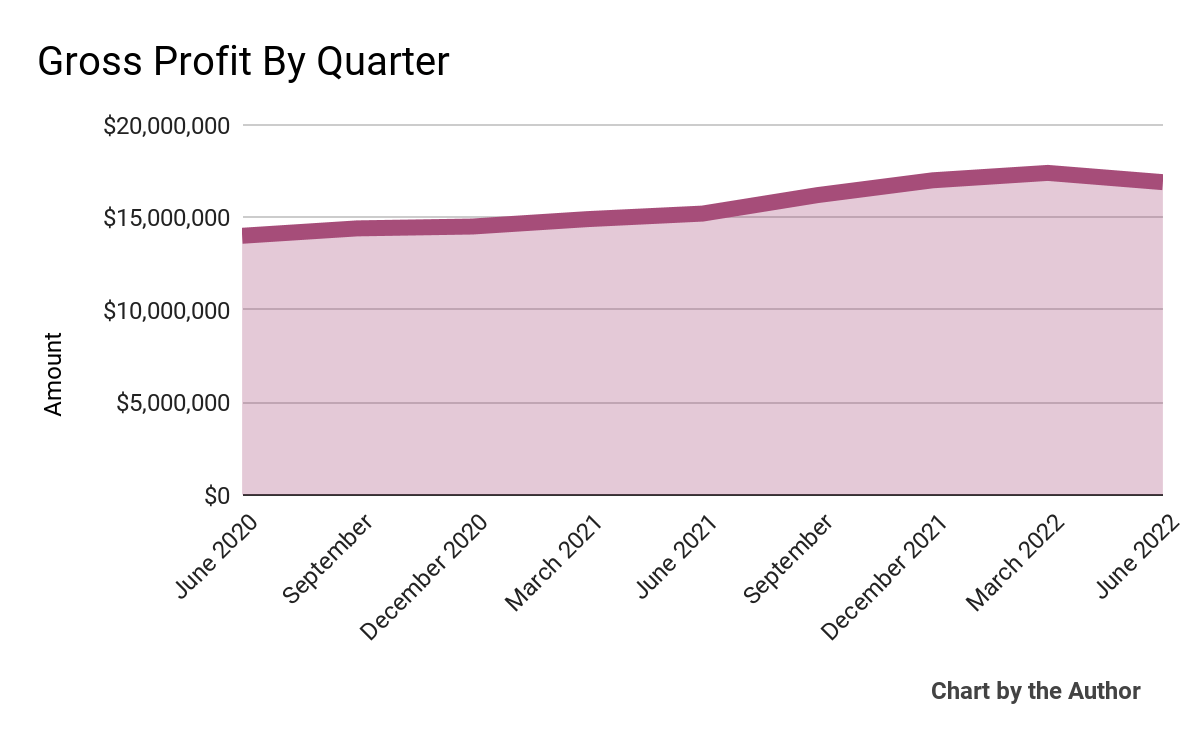

Gross profit by quarter has recently plateaued, as total revenue has:

9 Quarter Gross Profit (Seeking Alpha)

-

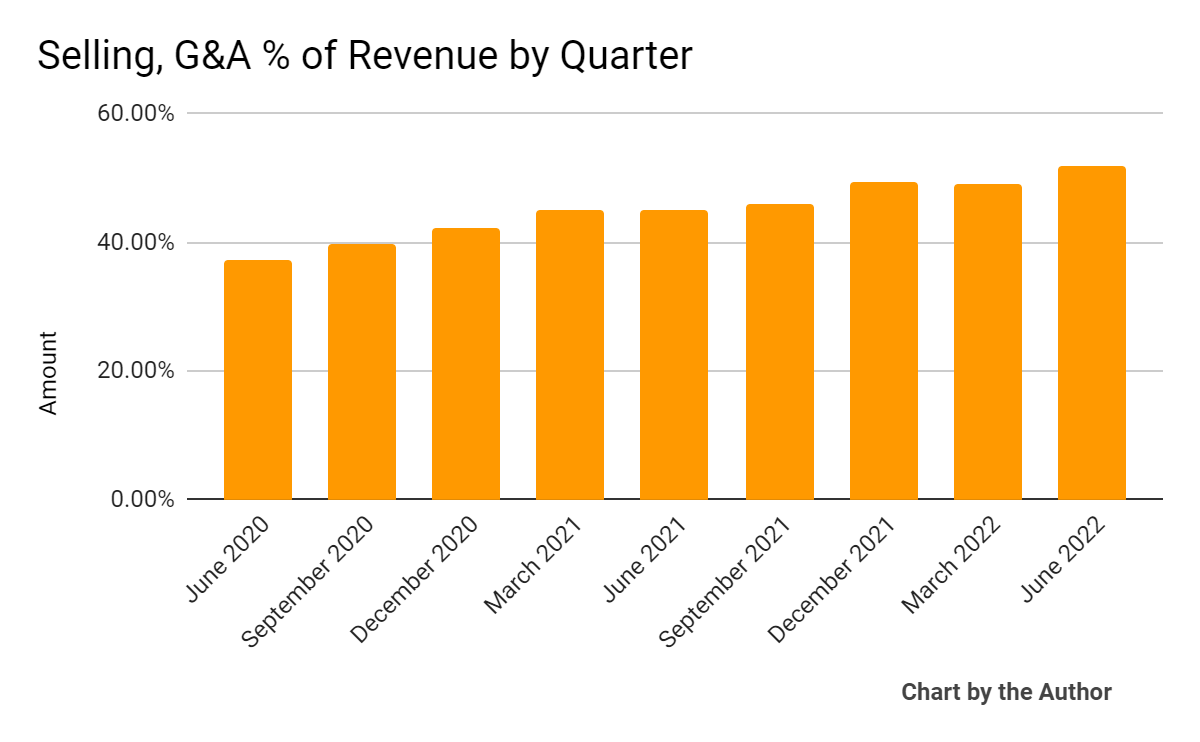

Selling, G&A expenses as a percentage of total revenue by quarter have risen as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

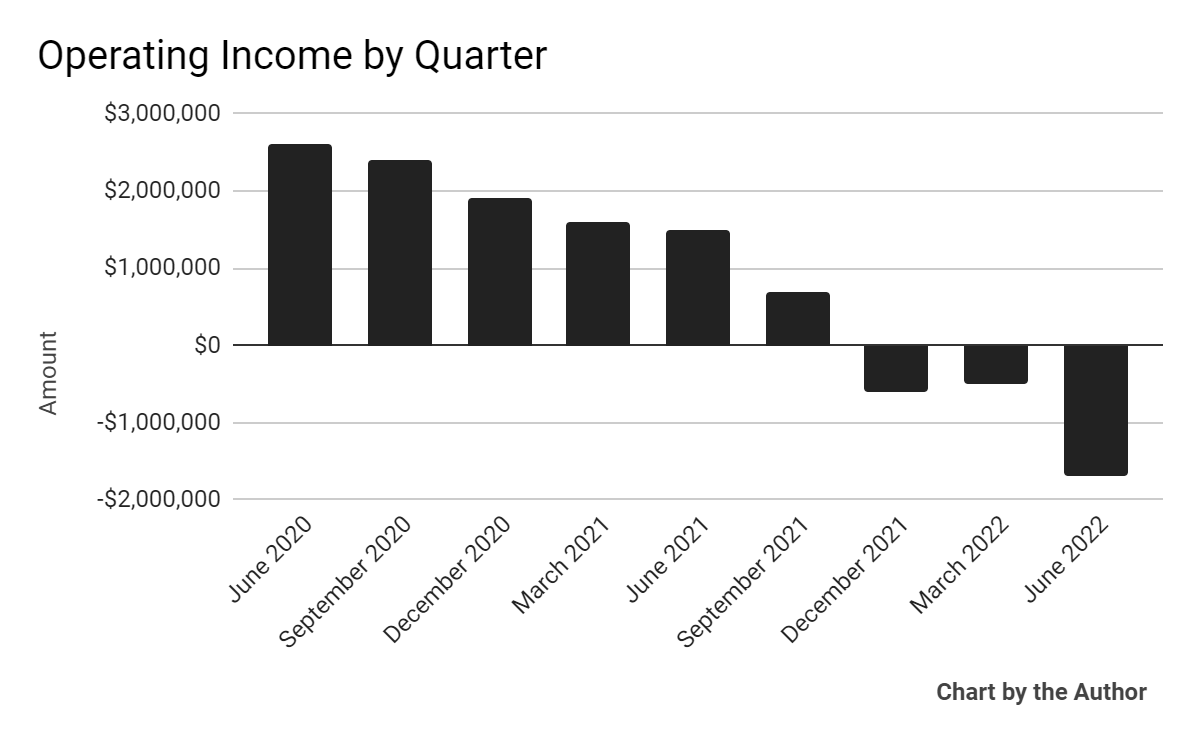

Operating income by quarter has worsened to produce increasing losses recently:

9 Quarter Operating Income (Seeking Alpha)

-

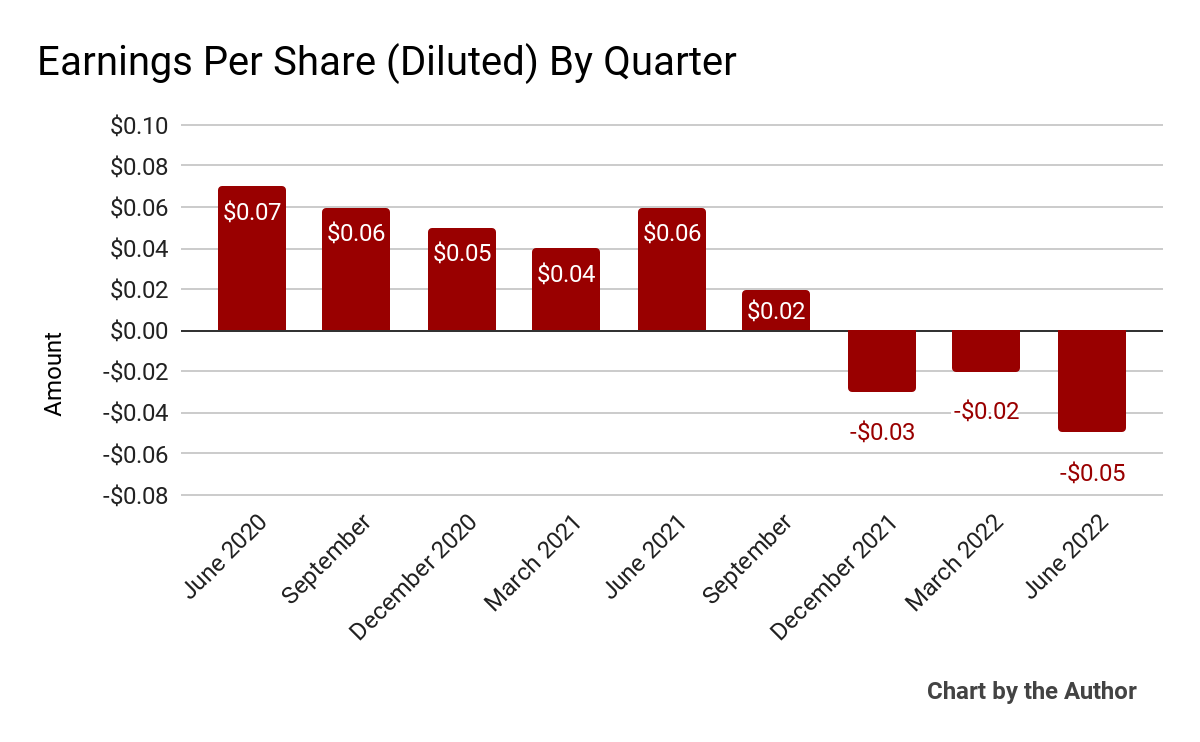

Earnings per share (Diluted) have also turned negative in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

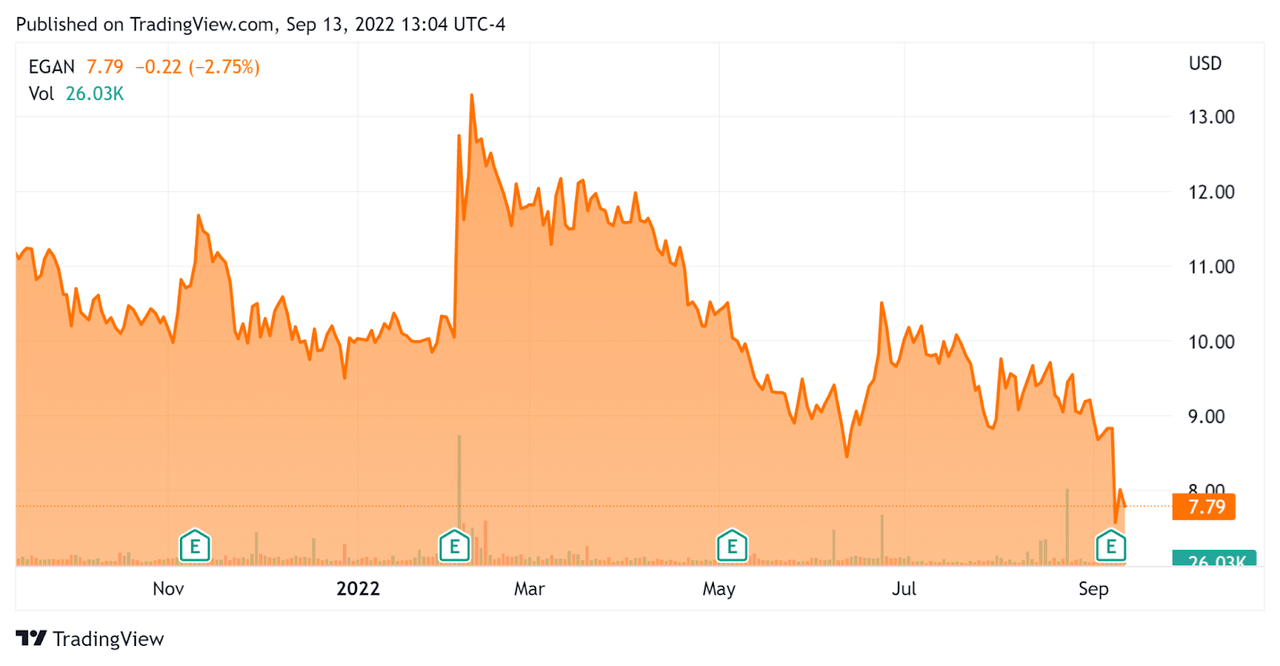

In the past 12 months, EGAN’s stock price has dropped 31.7% vs. the U.S. S&P 500 Index’s drop of around 3.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For eGain

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.87 |

|

Revenue Growth Rate |

17.5% |

|

Net Income Margin |

-2.7% |

|

GAAP EBITDA % |

-1.8% |

|

Market Capitalization |

$240,880,000 |

|

Enterprise Value |

$172,290,000 |

|

Operating Cash Flow |

$14,700,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.08 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be EngageSmart (ESMT); shown below is a comparison of their primary valuation metrics:

|

Metric |

EngageSmart |

eGain |

Variance |

|

Enterprise Value/Sales |

12.50 |

1.87 |

-85.0% |

|

Revenue Growth Rate |

41.0% |

17.5% |

-57.5% |

|

Net Income Margin |

-0.1% |

-2.7% |

2108.3% |

|

Operating Cash Flow |

$30,820,000 |

$14,700,000 |

-52.3% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

EGAN’s most recent GAAP Rule of 40 calculation was 15.6% as of FQ4 2022, so the firm needs improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17.5% |

|

GAAP EBITDA % |

-1.8% |

|

Total |

15.6% |

(Source – Seeking Alpha)

Commentary On eGain

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted a few large customer wins across various industry verticals.

The firm saw new logo-based ARR (Annual Recurring Revenue) grow by 45% year-over-year and RPO (Remaining Performance Obligation) up by 50% year-over-year.

Management is seeing ‘big opportunity in knowledge management and overall customer engagement powered by knowledge.’

The company continues to focus on increasing its sales investment as management believes that in an economic downturn, customers will seek self-service automation and investment in agent experience.

As to its financial results, total revenue rose 16% year-over-year for the quarter and grew by 17% for the full year.

The company’s net dollar retention rate declined from 107% to 105% year-over-year, due to a reduction in volume related to waning COVID-era demand.

EGAN’s Rule of 40 results have been sub-par, with tepid revenue growth and negative GAAP EBITDA.

Gross profit margin was 75% while operating costs rose, ‘primarily driven by investments in product development and sales and marketing.’

GAAP EPS dropped to its lowest level in the past 9 quarters, with the company losing $0.05 per share.

For the balance sheet, the company ended the quarter with cash and equivalents of $72.2 million. For the year, EGAN generated $8.1 million in operating cash flow.

Looking ahead to full fiscal year guidance, management guided as-reported revenue growth to 11% at the midpoint of the range and non-GAAP net income of $4.3 million at the midpoint. (Non-GAAP figures typically exclude stock-based compensation and one-time adjustments.)

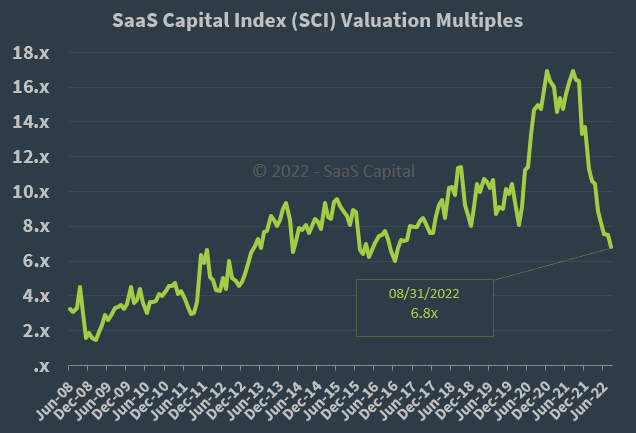

Regarding valuation, the market is valuing EGAN at an EV/Sales multiple of around 1.9x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, EGAN is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its future revenue growth trajectory.

Management sees the potential for an upside catalyst as customers seek more automation in an economic downturn.

However, I’m in a wait-and-see mode. I’m on Hold for EGAN until management can reverse its worsening operating losses while growing revenue.

Be the first to comment