Artur Nichiporenko

Investment Thesis

Imagine being able to own a company, which is regulated to earn profits no matter what the market situation is.

While inflation is still out of control and the market has fallen more than 20% year to date. Investors are looking for a safer harbor for their money.

Energy distributors and producers are the perfect examples of such investments. Especially when you are an income investor. As the market falls, investors should focus their attention on the dividend yield, because when the market will flourish again these dividend yields will only be a far fetched dream.

That is exactly what Edison International (NYSE:EIX) offers to its investors – safe and growing dividends. While the S&P 500 yields around 2%, EIX has a yield of over 4.5% today. Even when considering the risk of wildfires, it is undervalued. So, I rate the EIX a BUY at these valuations.

Let’s take a closer look at EIX’s business.

Introduction to Edison International

Edison International is a parent company of Southern California Edison Company (SCE) and Edison Energy. Edison Energy is engaged in the competitive business of providing integrated decarbonization and energy solutions to its customers.

Right now, EIX revenue comes wholly from SCE and the investments in Edison Energy are not material to be reported as a business segment. So, the SCE needs a deeper dive into its business model.

Southern California Edison Company

SCE is a wholly-owned subsidiary of Edison International. The mission for SCE is to deliver and supply electricity for over 5 million customers in a 50,000-square-mile area of southern California. SCE clientele is divided into 5 groups – residential, commercial, industrial, public authorities, agricultural and others.

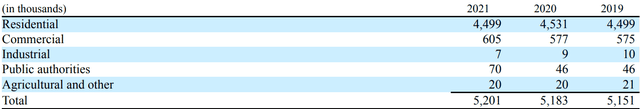

Total number of customers by class (Edison International 10-K)

Commercial customers form the biggest part of the revenue. In 2021, commercial customers gave 41.6% of the revenue, while residential customers constitute 40.3% of the revenue.

A closer look into how the business works, and how the rates are being set by the regulators.

California Public Utility Commission (CPUC) is authorized to regulate the revenue through general rate case. The revenue should be enough for SCE to earn some profits and recover costs. CPUC takes into consideration operation and maintenance cost, depreciation, taxes and returns, while making up the revenue for the next four years.

What this means for an investor is that the base case revenue is given by the authorities and profit is guaranteed. If the rate is too low to maintain the electricity network or to earn profits, then the rates are recalculated.

When looking at the earnings of SCE, the third quarter stands out every year. That’s because usually, people try to cool their living and office spaces due to hot weather during the summer months, which gives SCE bigger operating revenue.

The one key thing to keep in mind when investing in a company is to understand what it does. And the perfect way to make sure of it is to try to explain the company’s operations to a five-year-old. Simply put, Edison International is responsible for the delivery of electricity to homes in southern California.

Dividend Safety and Growth

As an income investor, I take a deeper look into the dividends and try to value how safe and at what rates they are growing. But before I even take a closer look at the dividend yield, I will make sure that the dividends are sustainable.

And how do I do that – first of all, I look at the 5-year payout ratio and the company’s policy. The Board of Directors has said that the EIX long-term target payout ratio is 45% – 55%.

As we can see from the picture above, the payout ratio has been between 53% – 62% for the last 5 years. Which is slightly above the long-term payout ratio strategy. Despite that, I consider it a safe payout ratio since the sector median is 10% higher and Seeking Alpha quant rating gives EIX a dividend safety grade of A-.

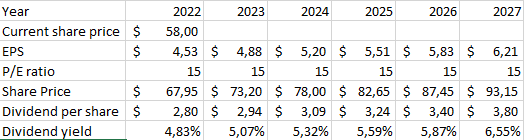

Another method to rate dividend safety is to look at the growth of EPS. From 2022 to 2026, analysts expect the EPS to grow 7% annually. If we take that into consideration, then the earnings per share will grow to 6.23$ by 2026 and we can say with certainty that EIX will be able to payout or even grow its dividends.

Now, when we have declared that the dividends are safe and EIX can pay them, we want to make sure that the dividends will keep growing. Especially in a market where we are today where inflation is eating away at our purchasing power before our very own eyes.

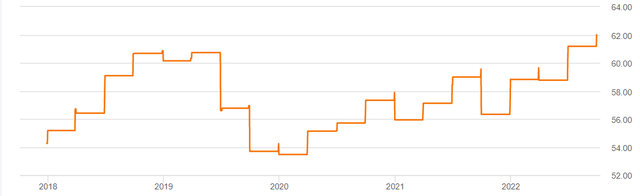

Let’s take a brief look at the history. EIX has paid out continuously growing dividends since 2004, which means the company has given out 18 years’ worth of dividend growth. Compared with peers the sector median is 8 years. Which gives a bonus point to EIX. To make it even sweeter, the dividend yield has grown 5.8% per year on average, which beats the average inflation by more than 2X. Therefore, the last 5-year growth rate is lagging slightly behind, with 5.23%, but still beats the inflation.

Let’s make an assumption that the dividends will grow at the same 5.23% rate for the next 5-years. In this scenario, the annual dividend payout would be 3.8$ per share. And this gives us a 6.6% dividend yield with today’s share price.

Now that we are familiar with EIX’s business, and we know that their dividends are safe and growing at a reasonable rate. Let’s take a look at valuations, is EIX a buy with the current prices?

Valuation of Edison International

The S&P 500 has fallen more than 20% year to date, while EIX has fallen slightly less – 13% this year. Common sense tells us that, utility companies transfer the inflation costs onto their customers usually quicker than most other companies and because we cannot live without electricity, the demand for their service does not fall either.

It is really easy to start the valuating process by looking at the quant ratings. Seeking Alpha quant rating grade for EIX is B, but let’s take a deeper look at EIX valuation.

Let’s start with the P/E ratio.

EIX trailing 12-month price-to-earnings ratio is 12, while the sector median is 17.75. The S&P 500 historical P/E ratio stays between 13X to 15X earnings.

If we assume that EIX’s share price will return to the same level as its peers, then EIX would be approximately 47% undervalued. But let us be more conservative and assume that EIX will return to 15X earnings. This would mean that EIX would still be 24% undervalued.

Return of EIX (Excel)

As we can see from the table above, when buying EIX today we lock over 4.8% dividend yield for the years to come. Also, the share price should see an appreciation of over 7% in the next 5 years. This would give total return of at least 10% – 12% in the long-term.

While the P/E ratio is not always the greatest tool to value companies, I will use the Discounted Dividend model for valuing EIX. We can use this valuing method here because we made sure, the dividends are safe and growing.

With discounted dividend method the formula to find the price we want to pay for the company is: buying price equals dividend per share divided by the required rate of return minus dividend growth rate. The dividend per share today is 2.8$, I use the required rate of return of 12%, and the dividend growth rate for EIX is 5%.

With these assumptions, we get the buying price of 40$ for EIX. Which implies that EIX is overvalued. But if we modify our assumptions, taking the required rate of return of 10%. Then we get the buying price of 56$ for EIX, which is around the price that shares are trading today.

Now that we know what we want to pay for the company, let’s take a look at the competition.

How the Competitors are Doing

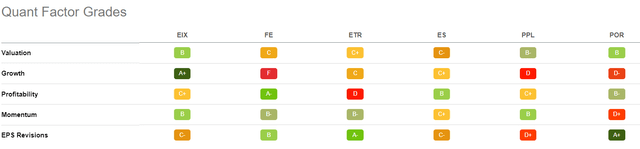

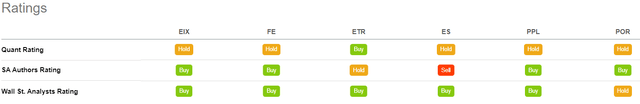

In this section, I will take a brief look at how the competitors are doing. For the research, I am using Seeking Alpha Quant Ratings. The Quant ratings show the unemotional evaluation of each stock. Quant Ratings use company’s financials, stock performance, and analysts’ estimates and compare them with other stocks in its sector. In this context, the sector we are looking at is utilities.

I will compare EIX with 5 other companies such as FirstEnergy Corp (FE), Entergy Corporation (ETR), Eversource Energy (ES), PPL Corporation (PPL), and Portland General Electric Company (POR). ES is ranked 25 out of 40, which is the lowest rank in the comparison, in the Electric utility industry. ETR is ranked 7th, POR 11th, EIX 17th, FE 18, and PPL 24th.

While the quant rating gives only ETR a “Buy” grade, the others fall in the “Hold” grade category. The SA. Authors on the other hand have given ETR a “Hold”.

So how are the competitors valued within the industry?

Quant Factor Grades (Seeking Alpha)

What stands out for EIX is that the grades are rather green or yellow, while the peers have a grade of “D+” or lower. Exception is ES, who has mainly yellow grades. Also, EIX stands out with its valuation and growth grades, which are “B” and “A+”. With this in mind, EIX gives the best growth and valuation according to quant ratings.

To get to know the peers better, I have written an article about Portland General Electric Company.

As we have cleared that EIX is a better choice than its peers, we should take a look at the risks concerning EIX when investing in it.

Risks

Edison International is a holding company, who does not have a material operation on its own. So, EIX depends fully on SCE, if SCE does not upstream distributions to EIX, then the company does not have money to pay dividends.

As I have brought out before, the regulations are great on one hand but may bring some risks with them as well. As for the SCE, the financial results depend on how the rates are regulated. This shows the company’s ability to earn a reasonable return and recover its costs. If the decisions from CPUC delay or the assumptions are wrong the revenue and profit may suffer.

Another big risk is demographic, the wildfires in California have risen in recent years and the cost of repair is up a lot. Also, SCE will face a higher likelihood of catastrophic wildfires in its service territory if it cannot effectively implement its plan against the wildfire. SCE has replaced its overhead transmission lines with covered conductors. These wires are covered with insulation which helps to eliminate sparks when lines come into contact with tree branches.

Conclusion

EIX is undervalued compared with its peers and P/E ratio analysis. The main reason for that is the higher risk associated with its location and service area which are situated in California as CA is suffering from wildfires which have become more frequent. For me, the company is a buy, because EIX is one of the biggest electrical utility companies in the area. If they manage to lessen the costs resulting from wildfires by covering their lines with insulation and that in return helps to lessen the severity of wildfires (no new sparks from uncovered lines), EIX will rise past its peers.

The dividend yield is also the cherry on the cake. I want part of the rising dividends and for me, the risk-reward ratio is promising. So, I will rate EIX a “BUY” for now.

Be the first to comment