FG Trade/E+ via Getty Images

Edesa Biotech (NASDAQ:EDSA) is one of the leading pharmaceutical companies in developing treatments for chronic allergic contact dermatitis and acute respiratory distress syndrome in hospitalized COVID-19 patients.

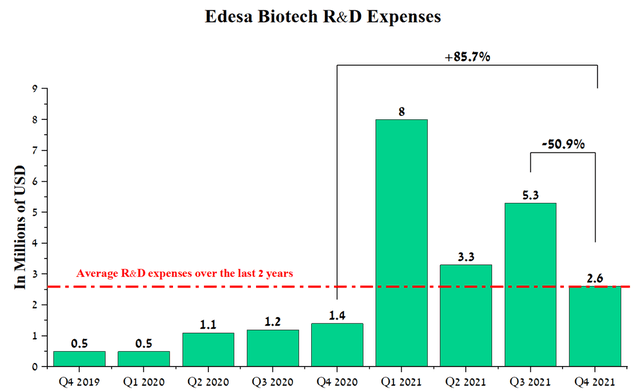

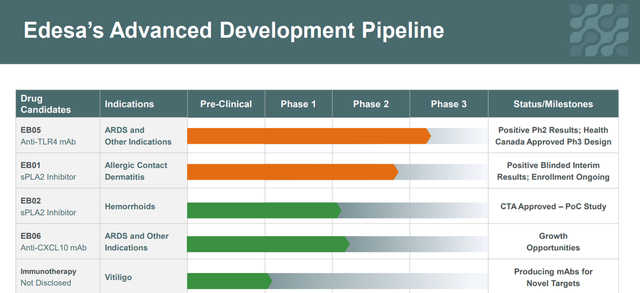

The company has an extensive pipeline of 5 product candidates. To increase shareholder value, the company has focused its financial resources on the development of EB01, which has a novel mechanism of action based on sPLA2 inhibition for the treatment of ACD. In addition, with a $12 million grant from the Government of Canada, Edesa continues to rapidly develop EB05 as a new treatment for ARDS. In the 4th quarter of 2021, the company reported positive results in the treatment of critically ill patients in phase 2, which evaluated the efficacy and safety of this medicine. Edesa continues to effectively manage R&D expenses, which was $2.6 million in Q4 2021, down 50.9% from Q3 2021. In addition, with a recent $10 million capital injection, the company has sufficient cash to keep the company in business for at least another 12 months.

Given the demonstrated effectiveness of company’s product candidates in numerous phase 2/2b trials, it is highly likely that these medicines will reach endpoints in larger trials in areas of high unmet medical need. As a result, Edesa Biotech can be an excellent choice for long-term investors.

Company’s Financial Position

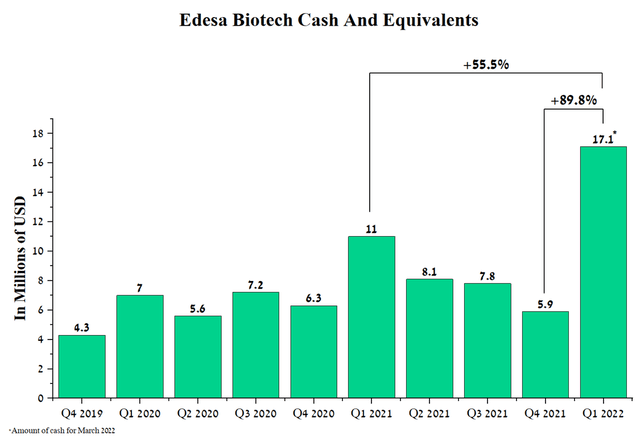

When analyzing pharmaceutical companies that do not yet have approved products or ongoing partnerships with other companies, the sources of clinical trial funding and administrative costs need to be considered. The company has a stable level of cash. As of March 2022, the company had about $17.1 million in cash, up 89.8% from Q4 2021. The increase was driven by $1.2 million in revenue under an agreement with RBC Capital Markets and a $10 million direct offering under which the company sold 2,739,727 shares of the company at $3.65 per share. Thus, the price of the share under the terms of the offering exceeds the current price of the company’s shares by 30%, which is a positive sign, as large investors see prospects in Edesa, buying a stake in the company at a significantly higher price.

Source: Author’s elaboration, based on quarterly securities reports

The company has relatively low R&D spending of $2.6 million for Q4 2021, up only $1.2 million from Q4 2021 due to the start of phase 3 COVID-19 clinical trial. I estimate that R&D expenses will remain stable in the $2-3 million range in the coming quarters.

Source: Author’s elaboration, based on quarterly securities reports

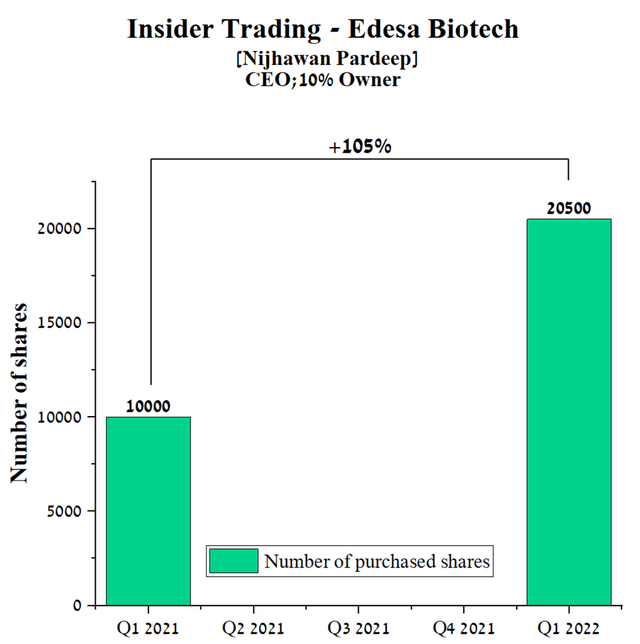

Another important factor is the analysis of insider transactions, which shows the belief of the company’s management in its future. As Peter Lynch said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise”. The CEO of Edesa has about 3.3 million shares, which is 21.3% of the total number of issued companies, which is one of the highest values in the pharmaceutical industry. In addition, he continues to increase his stake in the company by purchasing another 20,000 shares.

Source: Author’s elaboration, based on quarterly securities reports

Thus, I believe that the current amount of cash, no debt, and the early completion of Phase 2b of the clinical trial give confidence in the company’s financial position.

Product Pipeline

Edesa Biotech has several product candidates targeting the treatment of COVID-19 and hemorrhoids, which creates huge commercial opportunities if approved by regulatory authorities.

Corporate Presentation

EB05 – company’s key product candidate

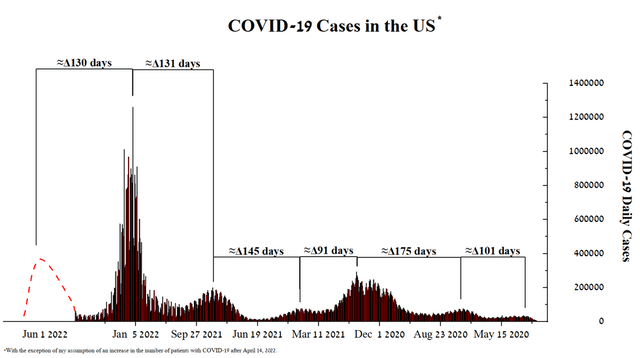

At the beginning of 2020, the global COVID-19 pandemic began and attracted hundreds of millions of people around the world to the infection. This virus can not only lead to inflammation of the lungs, which can later worsen to acute respiratory distress syndrome (ARDS) in people at risk but also causes damage to many organs. At the end of the 4th quarter of 2021, a sharp increase in the number of new cases of COVID-19 began, when more than 800 thousand people fell ill in the United States every day and the situation with the virus was critical for the healthcare system, however, after 2 months, the wave of patients subsided. I analyzed the graph of COVID-19 cases and noted that the interval between the peaks of the waves of the epidemic is in the range of 101-175 days, that is, on average, every 130 days a new wave of coronavirus begins in the United States.

Source: Author’s elaboration, based on CDC

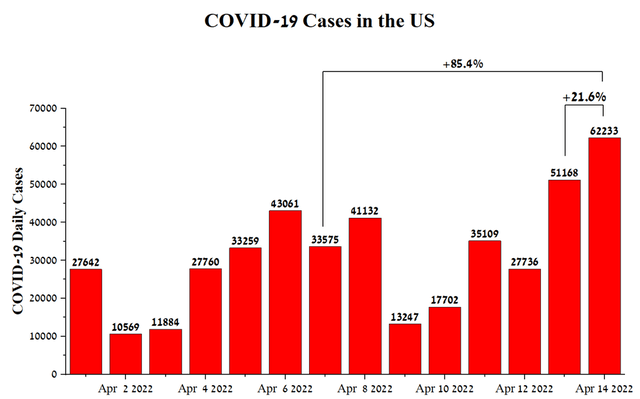

A new wave could occur in the United States due to the rapid spread of a new strain of COVID-19, namely BA.2, which has caused a sharp surge in patients and hospitalizations in Asia and parts of Europe in recent weeks. At the moment, we can see the beginning of an increase in the number of cases in the United States, so on April 14, their number was 62223, which is 85.4% more than the previous week and 21.6% more than April 13, 2022.

Source: Author’s elaboration, based on CDC

In addition, on April 13, the director of WHO emergencies said that Covid-19 could still cause major epidemics around the world and Maria Van Kerkhove, who is one of the leaders of WHO, said the following.

“We’re still in the middle of this pandemic. We all wish that we weren’t. But we are not in an endemic stage.”

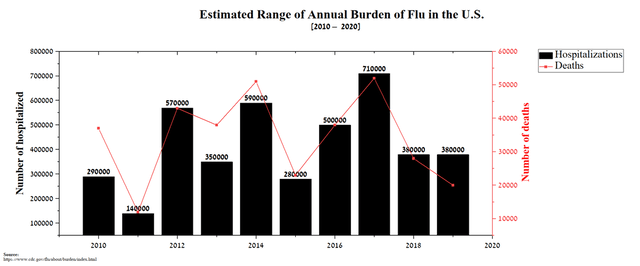

Thus, I believe that a new wave of COVID-19 has begun in the United States, which will accelerate the recruitment of patients for the final stage of the EB05 study and also increase investment in pharmaceutical companies that develop drugs to combat this virus. In the long term, this virus will become endemic, like the flu, which causes hundreds of thousands of patients to be hospitalized each year, setting the long-term prerequisites for commercial success for Edesa’s product candidate if approved by regulators.

Source: Author’s elaboration, based on CDC

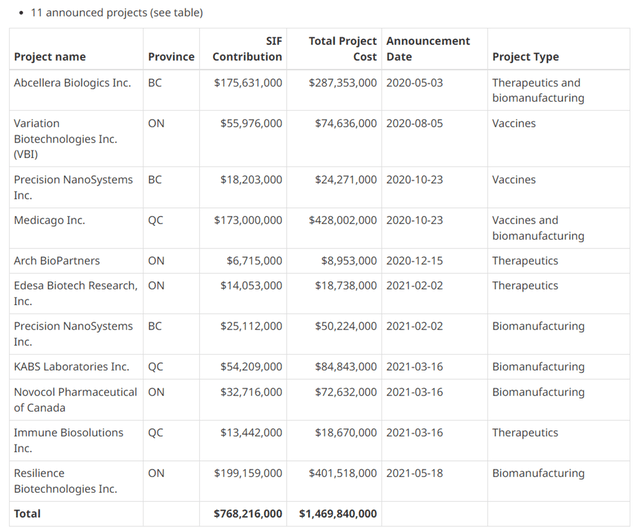

EB05 is a monoclonal antibody that targets the inhibition of the toll-like receptor 4. Efficacy and safety studies of this product candidate in the treatment of COVID-19 began with Phase 2, which was funded primarily by a CAD 14 million grant from SIF. As you can see, Edesa is one of the 4 therapeutic companies that received cash grants, indicating that leading scientists and politicians in Canada considered EB05 to be one of the promising medicines in the Canadian pharmaceutical industry.

Innovation, Science and Economic Development Canada

Scientific prerequisites for the effectiveness of EB05

According to the study, it was noted that critically ill patients with Covid-19 experienced a “cytokine storm”, which is characterized by excessive production of pro-inflammatory cytokines and chemokines, and which led to the attack of the human immune system on cells and tissues of their own body, and as a result, many patients died (TUFAN et al., 2020). Thus, one of the strategies for saving the life of a hospitalized patient is to reduce the negative impact of the “cytokine storm”. TLR4 is one of the key pattern recognition receptors belonging to the innate immune system. It can recognize multiple pathogens, including viruses and bacteria. TLR4 is expressed on the cell surface of immune cells and also in tissues to protect the cells in case of infection. Although TLR4 plays a critical role in initiating inflammatory responses, its overactivation can lead to hyperinflammation. Currently, many studies have shown that TLR4 plays a key role in the development of COVID-19 (Aboudounya et al., 2021).

A study published in Heliyon showed that the SARS-CoV-2 spike protein S1 subunit activates TLR4 signaling, inducing pro-inflammatory responses in mouse and human macrophages, a type of leukocyte that is responsible for defense against pathogens (Shirato et al., 2021). A study published in bioRxiv showed that the S1 subunit of the SARS-CoV-2 spike binds and activates TLR4 to increase ACE2 expression and trigger the release of pro-inflammatory cytokines. It should be noted that elevated levels of ACE2 lead to a significantly more severe course of COVID-19 (Zheng et al., 2022).

The researchers studied the effect of Takeda’s TLR4 inhibitor, TAK-242, on the decrease in S1 activity after binding and also on the levels of various pro-inflammatory cytokines. In addition, overexpression of ACE2 was effectively reduced to baseline, thus reinforcing the hypothesis that a TLR4 antagonist may be an effective product candidate for the treatment of hospitalized patients (Aboudounya et al., 2021). In addition, studies have been published showing that elevated levels of calprotectin, a heterodimer that binds to its primary receptor TLR4, correlate with the severity of COVID-19 (Silvin et al., 2020).

The results of a study in which 121 patients took part, of which 40 were in intensive care units, were published in the journal Nature. A correlation was shown in that higher levels of calprotectin led to worse overall survival. In addition, the level of calprotectin correlated with 12 inflammatory cytokines, some of which are IL-8, MCP-3, β-NGF, IL-7, IL-10, G-CSF, IL-1α, and which are a consequence of the development of a cytokine storm (Chen et al., 2020). In addition, elevated levels of calprotectin have been shown to correlate with elevated levels of a pro-inflammatory cytokine such as interleukin-6, which also plays a key role in the development of hypercytokinemia (Giuffrè et al., 2021). Thus, the above research findings provide strong indications that inhibition of TLR4 signaling will be an effective treatment for critically ill COVID-19 patients.

Results of clinical studies

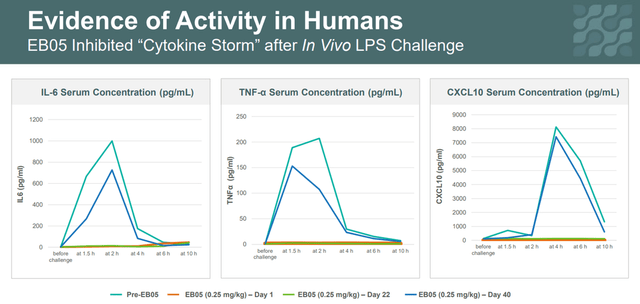

In the phase 1 clinical trial, a group of patients injected with EB05 demonstrated the ability of Edesa’s product candidate to regulate inflammation in these volunteers. They were exposed to LPS, followed by the release of cytokines IL-6, and TNFα, which were inhibited after EB05 infusion. While all patients in this clinical study who received a placebo had a cytokine response to LPS.

Corporate Presentation

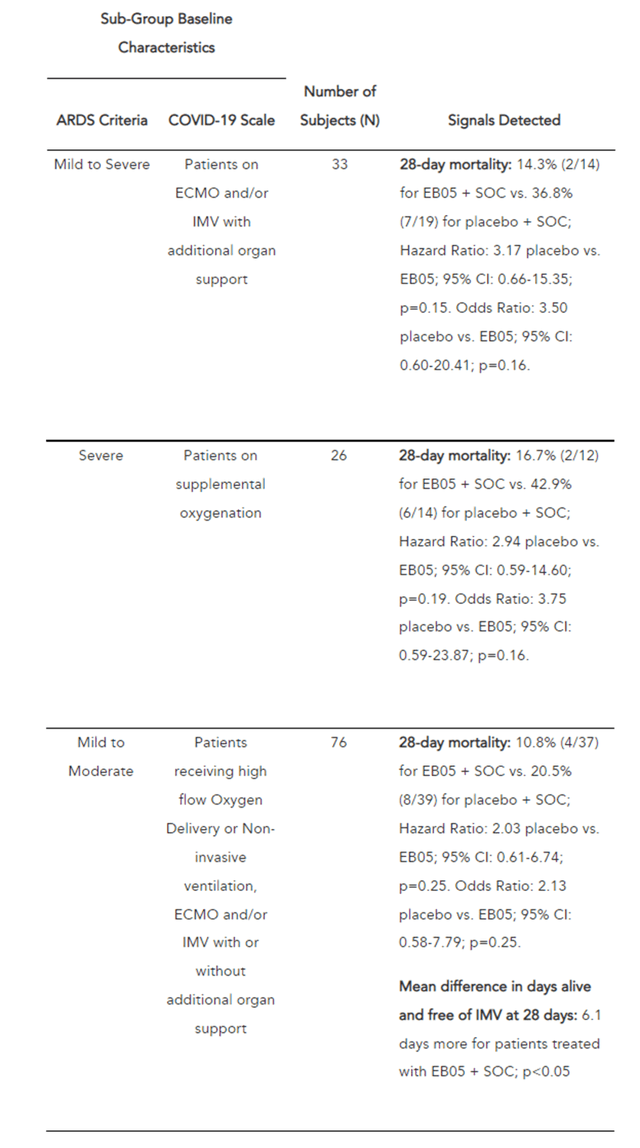

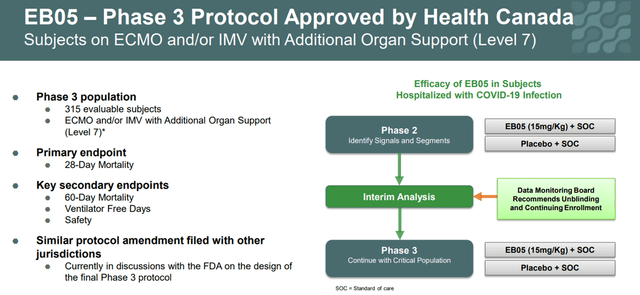

Thus, the results of phase 1 show that EB05 can inhibit key cytokines, which are produced in high concentrations during the “cytokine storm”. On September 20, 2021, the company released positive results from a phase 2 clinical trial that included 360 critically ill COVID-19 patients. This was a planned interim analysis conducted by the independent Data and Safety Monitoring Board (DSMB) and was necessary to determine which patient groups benefited most from EB05 treatment. Members of the DSMB identified an important cross-treatment signal for the key endpoint, namely the percentage of death by day 28 from the start of treatment, and also requested that the study be preemptively unblinded. This request is extremely positive, indicating that the demonstrated efficacy of EB05 outweighs the risks and, as a result, there is no need for randomization of patients. The DSMB recommended that Edesa begin a phase 3 clinical trial. Then, on October 19, 2021, Edesa Biotech announced additional phase 2 results, according to which EB05 showed a reduction in mortality in several patient groups. For example, critically ill hospitalized patients treated with EB05 + SOC had a relative risk reduction of 61.1% compared to the placebo + SOC group.

Edesa press release

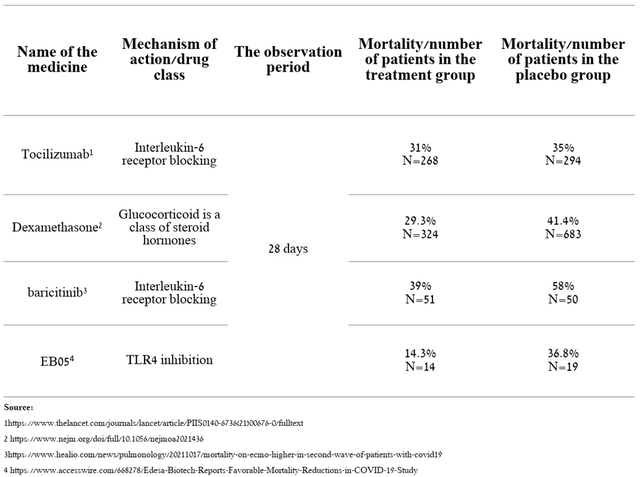

Currently, several drugs are used to treat critically ill patients on ECMO.

Source: Created by author

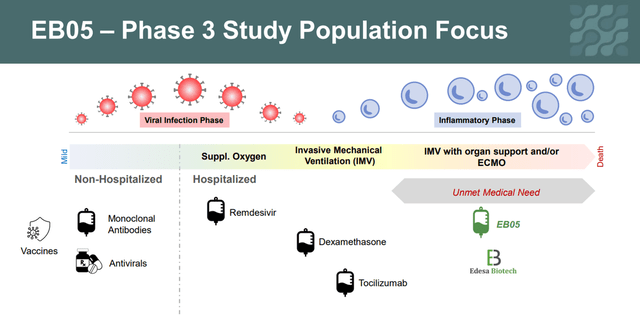

As we can see, in the interim data shown by Edesa, there was a reduction in mortality in the group of patients who took EB05 relative to SOC. In addition, comparing the effectiveness of drugs that received ESA from the FDA for the treatment of hospitalized patients, it can be seen that mortality remained at a high level and ranged from 29.3% to 39%, while in the group of patients taking EB05 only 2 patients or 14.3% of the group died, which gives a strong indication that this candidate product will become the gold standard in the treatment of critically ill patients. In addition, based on the results shown, the company’s management decided to recruit patients who are in critical condition (7th place on the WHO COVID-19 severity scale) for the phase 3 clinical trial. In my opinion, this decision also increases the chances of showing statistically significant results in phase 3 and reduces the risk of unexpected results, since there is a group of patients that showed the most favorable results in terms of efficacy.

Corporate Presentation

On January 13, 2022, the company announced that Health Canada has approved the start of phase 3. This study will recruit 315 critically ill patients and the primary endpoint will be mortality on day 28 after the start of treatment.

Corporate Presentation

On February 17, 2022, the company announced that more than 25% of patients had already been randomized according to the trial protocol, leaving the company to recruit about 236 more patients. In my opinion, the key events for this program should occur within the following time frames.

Source: Created by author

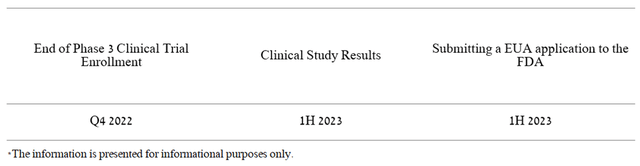

EB01

EB01 is a cream containing a non-steroidal anti-inflammatory compound whose mechanism of action is based on the inhibition of pro-inflammatory enzymes, namely secretory phospholipase 2. These enzymes are formed by activated human immune cells and produce arachidonic acid, which starts inflammatory processes. Thus, sPLA2 inhibition may be an effective way to combat inflammatory skin diseases.

Corporate Presentation

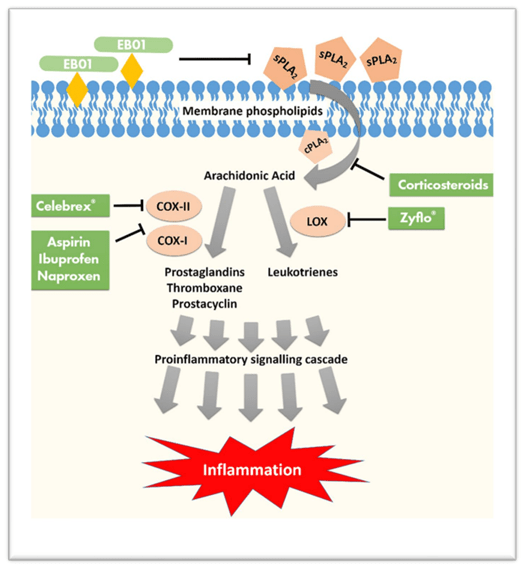

According to the company’s analysis, there are no drugs approved specifically for the treatment of ACD. Thus, doctors use drugs that have been approved to fight other dermatological conditions. So at the beginning of the course of treatment, corticosteroids are used, which have limited effectiveness and also a large number of side effects, such as acne, nosebleeds, burning and dry skin, etc. In addition, physicians may prescribe calcineurin inhibitors, which are less effective than corticosteroids, and also carry an FDA “black box warning” due to the risk of malignancy. In general, one of the main algorithms for the treatment of allergic contact dermatitis is presented below.

SCHEDULE 14A

The current situation provides an opportunity for the company to create a treatment for chronic ACD and improve the quality of life of about 1.2 million patients in the US alone if EB01 proves effective in the final stages of clinical trials.

Results of clinical studies

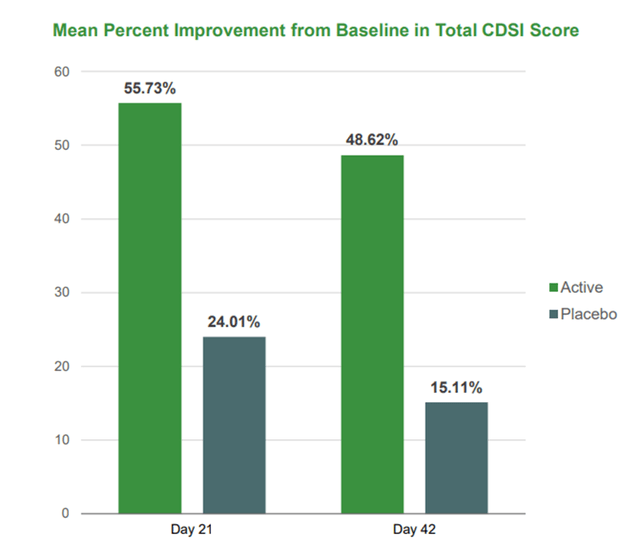

EB01 was shown to be effective and safe in phase 2 in 30 people with ACD. The primary endpoint was reached, which measured the percentage improvement in total CDSI score from baseline between the EB01 2.0% cream group and the placebo group. The median improvement was 58% in the group using the candidate product, which is significantly higher than the placebo, where this value was only 24%. EB01’s effectiveness persisted even after 21 days from the end of treatment, which gives the prerequisites for the persistence of the therapeutic effect.

Corporate Presentation

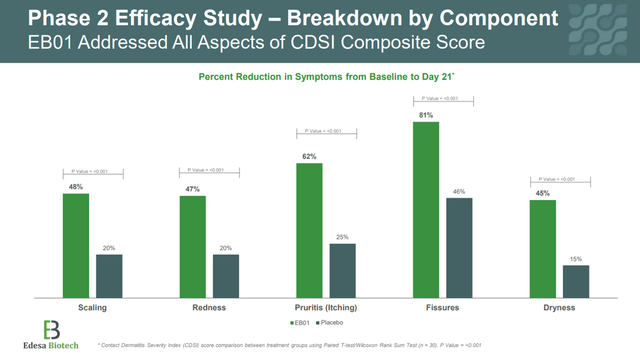

In addition, secondary endpoints were also achieved, such as improvements in key PVA parameters, which include assessment of dryness, flaking, redness, and itching of the skin.

Corporate Presentation

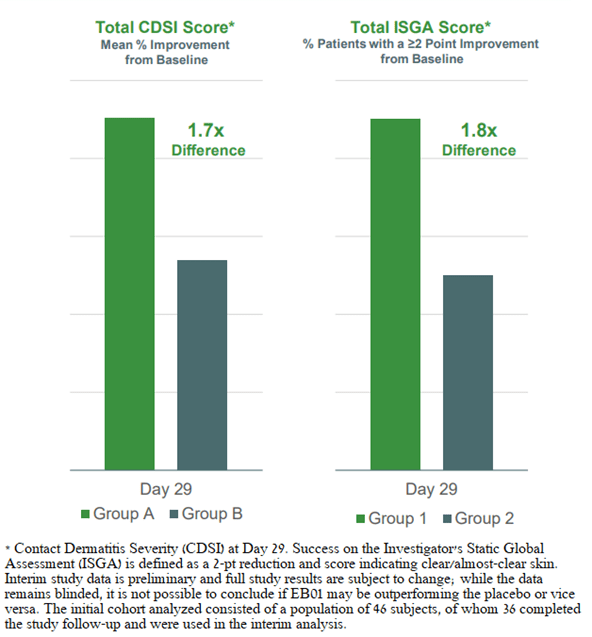

The company is currently conducting a phase 2b clinical trial involving 170 patients with moderate to severe allergic contact dermatitis to evaluate the efficacy and safety of EB01 in the treatment of this disease. An important development that increased the likelihood that the Edesa candidate product is effective was the interim analysis of the DSMB. The company reported that in the interim data, based on treatment evaluations of 46 patients, there was an approximately 1.7-fold difference between treatment groups for the primary efficacy endpoint. Also, DSMB reported that there was a 1.8-fold difference between treatment groups on the secondary endpoint.

Corporate Presentation

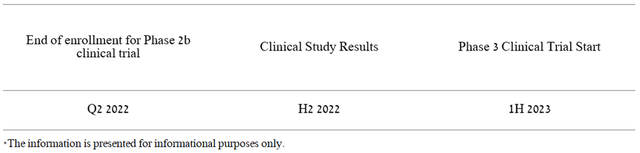

At the beginning of December 2021, the company had 43 patients left to enroll for this clinical trial, and in my estimation, the key events for this program should occur in the following time frame.

Source: Created by author

Technical analysis

On the daily chart, we see the completion of corrective wave 2, in which wave C corrected 61.8% from wave A, which is a typical value according to Elliott wave theory. Also, a bullish divergence was formed on the chart, which predicts an early price reversal upward. In addition, the gap formed as a result of the news about the start of the COVID-19 study was closed, which is also a positive factor in terms of TA. The company’s shares are currently at the upper limit of the bearish trend and, taking into account the Elliott theory and the bullish divergence, this gives signals about the imminent beginning of the 3rd impulse wave. If it starts, then the length of this impulse wave should be at least 1 impulse wave, which was formed in the range of $1.6-19 per share, which gives, from the point of view of TA, a huge potential for the growth of Edesa shares.

N_Aisenstadt — TradingView

Risks

Stock Dilution

Currently, Edesa Biotech is a loss-making company. In March 2022, the cash balance was about $17.1 million and the quarterly net loss was about $2-3 million. Thus, Edesa Biotech currently has enough cash to finance the company’s activities over the next 15-18 months. However, the company’s management may decide that an offer and convertible bonds are required to commercialize candidate products in the event of successful phase 3 clinical trials. Thus, this risk has a medium impact on the company’s stock price because positive phase 3 clinical data will contribute to a significant increase in investment interest, however, the subsequent dilution of the investor may lead to a fall in Edesa Biotech shares.

Risks associated with the clinical development of a company’s product candidates

Edesa Biotech is developing two product candidates aimed at improving the quality of life of ACD patients and also saving the lives of thousands of hospitalized patients suffering from COVID-19. The process of developing new drugs takes an average of 7-10 years, and the total cost of clinical trials is tens of millions of dollars. As already described in this article, EB05 showed positive efficacy and safety data in phase 2 clinical trial in critically ill COVID-19 patients. However, it is possible that a portion of the primary and secondary points in the ongoing Phase 3 study will not be met, preventing the company’s management from requesting an expedited approval review for this product candidate. In addition, the company is conducting a phase 2b clinical trial to determine the efficacy and safety of EB01. And even though in all previous studies all endpoints were achieved, however, due to the relatively small number of patients, it is possible that the study currently ongoing will not be positive. This risk may lead to a negative impact on the financial position of the Edesa Biotech business and a significant decrease in investor interest.

Risks associated with the commercialization of a company’s product candidates

If the company receives regulatory approval, there is a possibility that the demand from attending physicians is below the expectations of the company’s management. As a result, the net profit from sales will be lower than the costs that were spent on the development and commercialization of the drug, which will result in the inability to achieve a positive cash flow for Edesa Biotech. This risk may lead to a decrease in interest from investment funds.

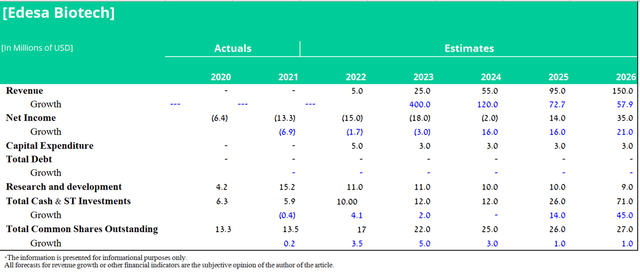

Edesa Biotech Forecast and Price Target

To determine the target price of Edesa Biotech, I used a discounted cash flow model until the end of 2026, using the Revenue ratio to estimate the value of the company. This took into account several criteria, namely the ratio of enterprise value to Revenue, equal to 10x, calculated based on data from pharmaceutical companies. For EB05, I believe that the phase 3 trial will end in early 2023 and the ESA application will take place in the first half of 2023 with possible approval in mid-2023. Given the clinical evidence shown and the huge medical need to rescue critically ill COVID-19 patients, there is a 68% chance of approval for this product candidate. In addition, I estimate that the company will receive another grant from the Government of Canada as part of the 2022 budget.

Budget 2022

I predict peak EB05 sales revenue of $150 million by 2026. For EB01, I believe the company will start a phase 3 clinical trial in 2023 and the NDA filing will happen in 2025. Given the limited amount of funds, I believe that the management of Edesa will enter into partnership agreements for the commercialization of this drug. At the same time, royalties from net sales will amount to 12%. Based on the clinical data shown and also the lack of a gold standard in ACD treatment, there is a 75% chance of approval for this product candidate. In addition, I expect annual R&D spending over the period 2022-2023 to average around $11 million per year. However, in the period 2024-2026, the spending rate will start to decrease due to the completion of the COVID-19 study. Thus, my forecast for the main financial indicators of Edesa Biotech, taking into account the above assumptions, is as follows.

Source: Created by author

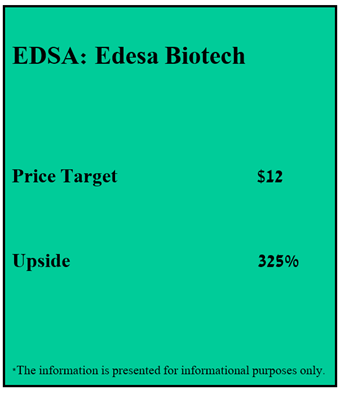

Based on the DCF Model and the progress made in the development of clinical programs over the past 2 years, and also taking into account the risks associated with the company’s business, my target price is $12 per share by 2026.

Source: Created by author

Conclusion

The company has an extensive pipeline of 5 product candidates. To increase shareholder value, the company’s CEO has focused its financial resources on the development of EB01 for the treatment of ACD and EB05 as a new therapy for the treatment of ARDS. In the 4th quarter of 2021, the company reported positive results in the treatment of critically ill patients in phase 2, which evaluated the efficacy and safety of this drug. In addition, with a recent $10 million offering, the company has sufficient cash to keep the company in business for at least another 12 months. In the 1st quarter of 2022, I continued to invest in the company, due to the above facts, increasing the share by about 0.7% in the portfolio. I think Wall Street is underestimating the company. Given the efficacy and safety data of the company’s product candidates in numerous studies, it is highly likely that Edesa’s drugs will reach the endpoints in larger studies in areas of unmet medical need. As a result, Edesa Biotech can be an excellent choice for long-term investors. I will sell the company’s shares when the target price of $12 per share is reached.

Be the first to comment