PeopleImages/iStock via Getty Images

Ecovyst (NYSE:ECVT) is now expecting revenue of $810-$830 million for the year 2022, and recently sold some business segments to reshape its balance sheet. Management seems very optimistic. In my opinion, if the company signs, from 2022, new partnership agreements, and more large conglomerates become clients, free cash flow will likely trend north. Supply chain issues and raw materials inflation could damage the company’s stock valuation. However, my discounted cash flow model implied a valuation that is significantly higher than the current stock price.

Ecovyst Increased Its Outlook For The Year 2022

Ecovyst Inc., a global provider of specialty catalysts and services, claims to have a nearly 200-year history of innovation in its most recent annual report.

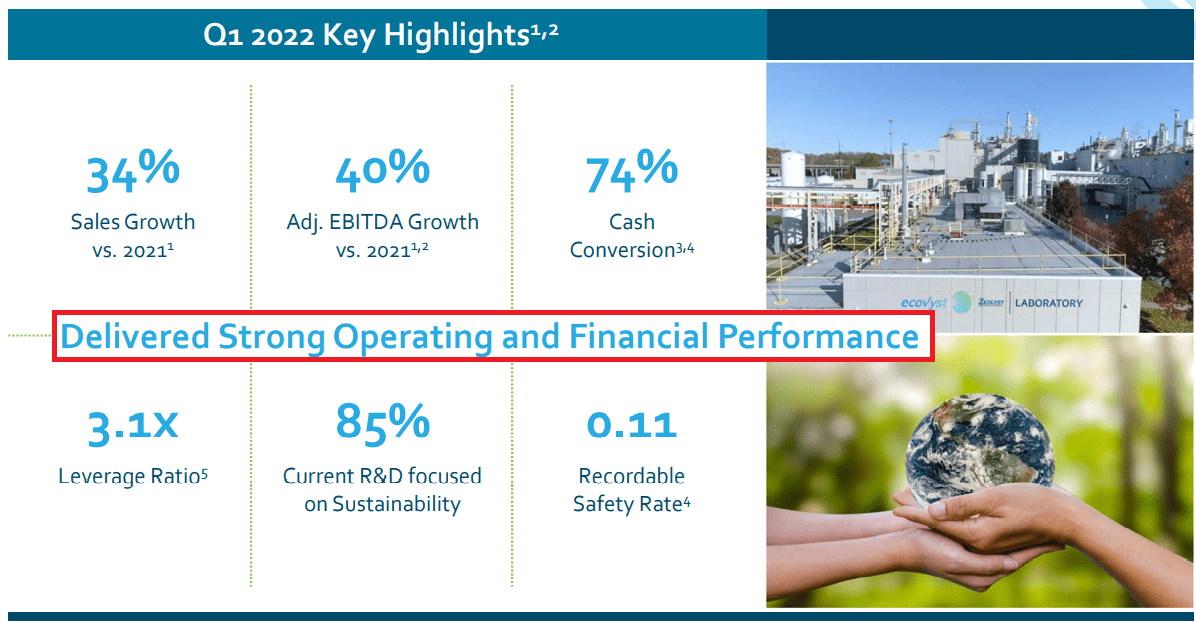

Considering the most recent quarterly report, in my view, Ecovyst recently became an interesting stock to follow. In Q1 2022, management delivered double digit sales growth and adjusted EBITDA margin of 40%. The company enhanced its outlook for the year 2022.

Presentation

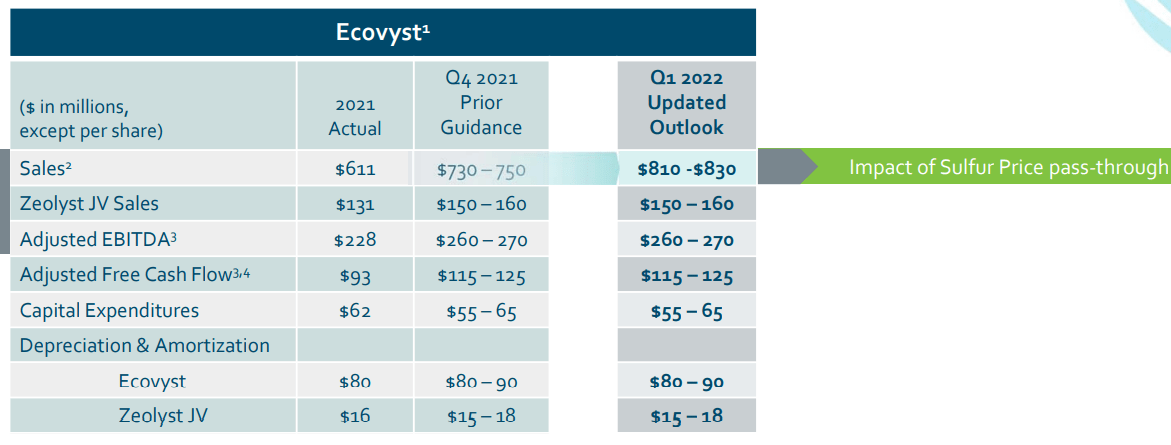

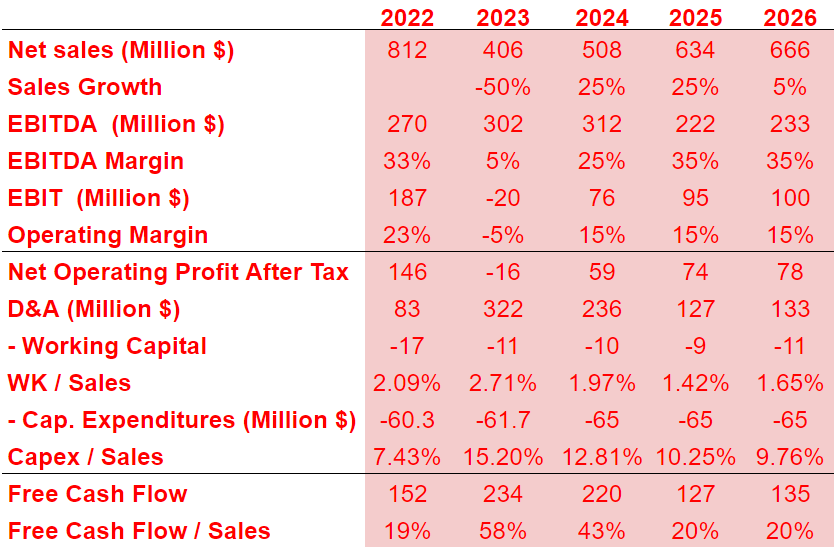

Ecovyst is now expecting revenue of $810-$830 million, an adjusted EBITDA of $260-$270 million, capex close to $65 million, and FCF around $115 million. My financial models used some of the optimistic figures delivered by management. Please have a look at the image below.

Presentation

With the improvement of guidance, Ecovyst is selling certain business models in exchange for cash, which may lead to stock appreciation in the long term. The largest transactions recorded include the Performance Materials business for $650 million and Performance Chemicals business for $1.1 billion. Some of the dollars received for the sale of businesses were used to reduce Ecovyst’s long-term debt:

On December 14, 2020, we completed the sale of our Performance Materials business to Potters Buyer, LLC, an affiliate of The Jordan Company, L.P., for a purchase price of $650 million, which was subject to certain adjustments for indebtedness, working capital, and cash at the closing of the transaction.

Effective on August 1, 2021, we completed the sale of our Performance Chemicals business for $1.1 billion, subject to certain adjustments set forth in the agreement. We used a portion of the net cash proceeds to repay the entire Senior Secured Term Loan Facility due February 2027 of $231.4 million and the 5.750% Senior Notes due 2025 of $295.0 million. Source: 10-k

Further Customer Partnerships And More Large Clients Could Imply A Valuation Of Almost $24

In my view, if Ecovyst successfully signs new long-term contract agreements and product supply arrangements with partners, revenue growth will continue. In this regard, it is especially relevant noting that many of the current contracts expire at the end of 2022 or beyond. Under this case, I assumed that Ecovyst will successfully sing new agreements with new or existing partners:

In our Ecoservices segment, approximately 40% of our production capacity serves customers with staggered five to ten year “take or pay” contracts with potential for value pricing resets and cost pass-through for our regeneration services product line that enhances sales and margin predictability and stability.

Excluding contracts with automatic evergreen provisions, approximately 50% of our sulfuric acid volume for the year ended December 31, 2021 was under contracts expiring at the end of 2022 or beyond. Source: 10-k

I also expect that management will successfully find new international clients willing to buy catalysts. Considering that management signed agreements with massive conglomerates in the United States, Ecovyst will likely be able to partner with other clients elsewhere. Keep in mind the large amount of know-how accumulated by Ecovyst:

Our customers include large industrial companies such as Exxon Mobil (XOM), BASF (OTCQX:BASFY), and Unilever (UL), and global catalyst producers such as Albemarle (ALB) and W.R. Grace. We also supply catalysts to leading chemical and petrochemical producers such as BASF, Dow Chemical, Lucite, LyondellBasell, and Shell (SHEL). Source: 10-k

Under this case scenario, I envision an eventual increase in the number of clients, which would be very beneficial. As a result, management may have more power in the negotiation of catalysts prices:

We have long-term relationships with our top ten customers, based on 2021 sales, that average more than 50 years. In addition, our customer base is diversified, with our top ten customers in 2021 representing approximately 41% of our sales for the year ended December 31, 2021. Source: 10-k

The global catalyst market is expected to grow at a CAGR of 4.4% according to market experts. I believe that Ecovyst will most likely grow close to the target market:

The global catalyst market size was valued at USD 33.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2020 to 2027. Source: Catalyst Market Size & Share | Industry Report, 2020-2027

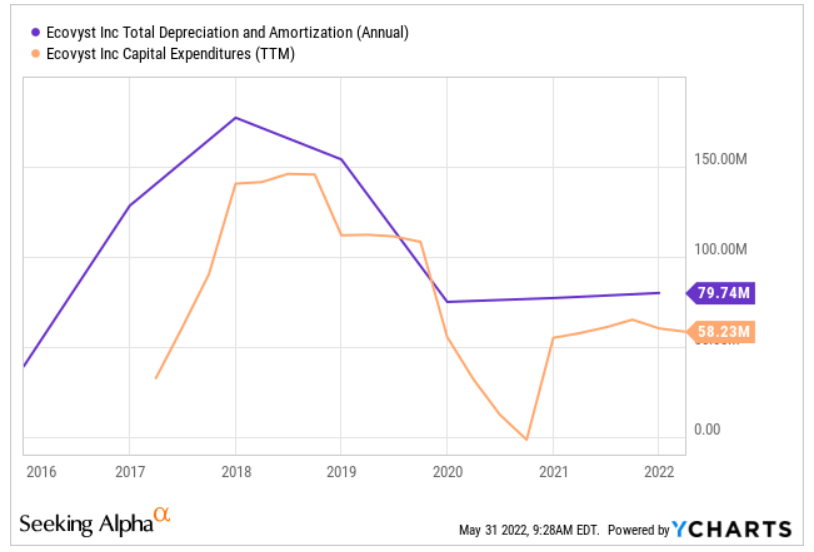

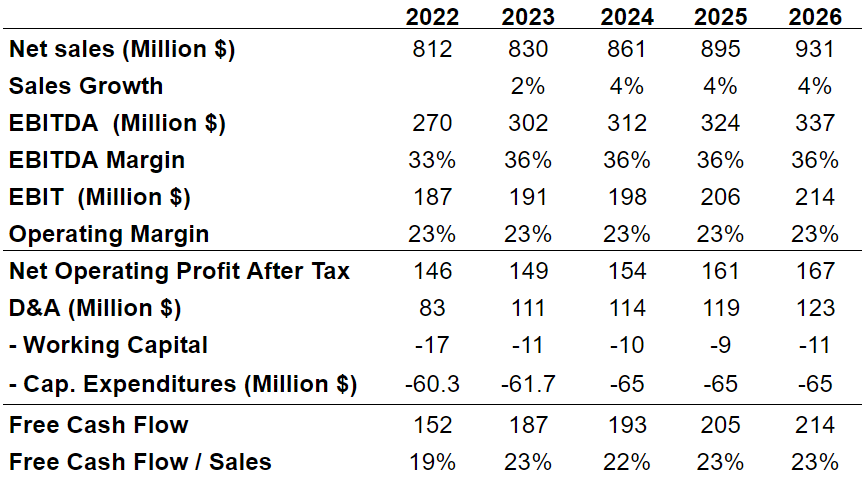

With the previous assumptions, I obtained 2026 net sales of $931 million and 2026 EBITDA of $337 million. If we also assume an operating margin close to 22%-23%, the net operating profit after tax in 2026 stands at $167 million. Finally, assuming changes in working capital close to $11 million and capital expenditures of around $65 million, 2026 free cash flow would stand at $214 million. Let’s note that my capital expenditures figures and D&A are not far from previous stats reported by Ecovyst.

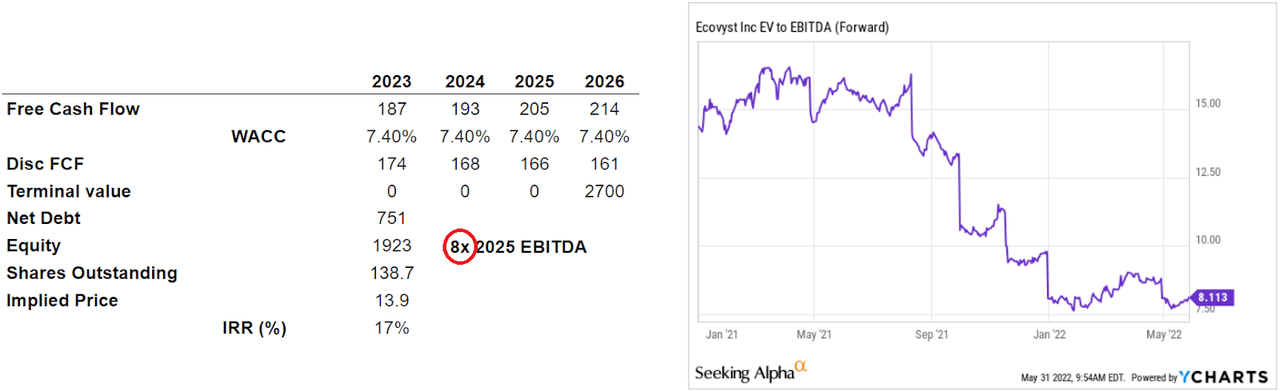

Ycharts Author’s DCF Model

In the past, Ecovyst traded between 15x and 8x EBITDA, so I believe that the exit multiple shouldn’t be far from these figures. If we assume an EV/EBITDA multiple of 8x and a discount of 7.4%, the implied fair price would be equal to $13.9.

Author’s DCF Model and Ycharts

If we remain a bit more optimistic, with an exit multiple of 13x, the implied equity valuation would stand at more than $3 billion, and the implied price would be almost $24.

Author’s DCF Model and Ycharts

Under Bearish Circumstances The Stock Price Could Fall To $7.5

Ecovyst could suffer significantly from a drastic reduction in the use of fossil fuels. The company’s zeolite catalysts would bring less revenue, which would lead to a reduction in the company’s valuation:

Shifting consumer preference could result in a significant reduction in the future use of fossil fuels, which would have a negative impact on our zeolite catalysts and Ecoservices businesses. If we are unable to respond appropriately to such new developments, such changes could seriously impair our ability to profitably market certain of our products. Source: 10-k

Ecovyst invests in research and development to launch new products. In this case, I assumed that Ecovyst’s new products may not be as successful as expected. Their contribution to the company’s EBITDA margin may not be significant, which would lower Ecovyst’s financial results. If a sufficient number of journalists do write about the detrimental results, Ecovyst’s stock price would decline:

Additionally, for any new product program, there is a risk of technical or market failure, in which case we may need to commit additional resources to the program and may not be able to develop the new products needed to maintain our competitive position. Moreover, new products may have lower margins than the products they replace or may not successfully attract end users. Source: 10-k

Ecovyst buys sulfur, natural gas, and other raw materials. In the future, Ecovyst could suffer from supply chain issues or raw materials inflation. The results could include significant decrease in Ecovyst’s free cash flow, which would lead to a decrease in the stock price:

We purchase significant amounts of raw materials, including precursor products in our Catalyst Technologies business and sulfur in our Ecoservices business, and we purchase significant amounts of natural gas to supply the energy required in our production process. The cost of these raw materials represents a substantial portion of our operating expenses and our results of operations have been, and could in the future be, significantly affected by increases in the costs of such raw materials. Source: 10-k

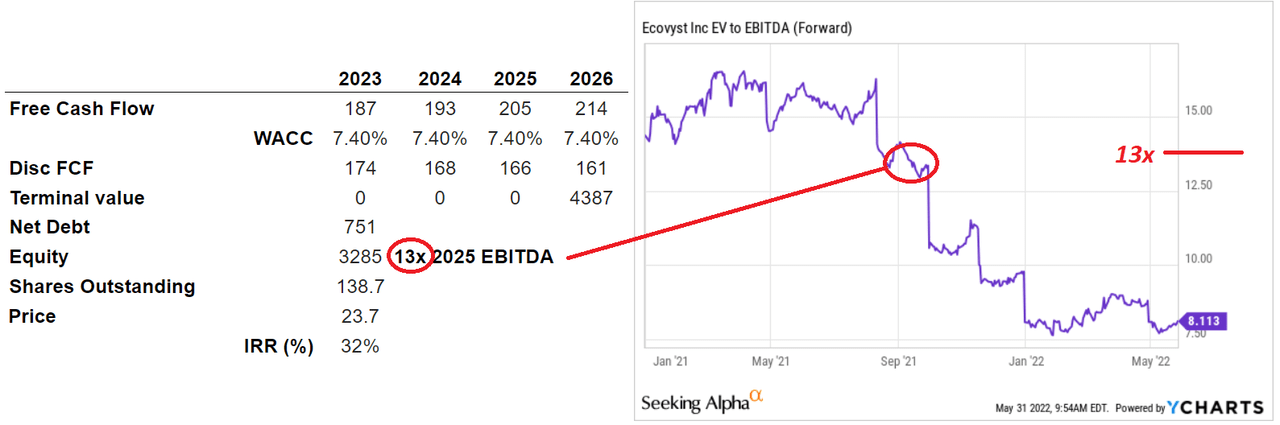

In the past, Ecovyst suffered decline in sales close to -40% and 50%. In this case, I assumed that management could see similar revenue volatility soon. With sales growth of -50% in 2023 and 25% sales growth in 2024 and 2025, I obtained net sales of more than $650 billion in 2026. Also, with a significant decline in the EBITDA margin in 2023 and operating margin close to 15% in 2026, 2026 NOPAT would stand at $78 million. Finally, with a working capital/sales ratio close to 2% and capex/sales between 7% and 5%, 2026 free cash flow would stand at $135 million.

Author’s DCF Model

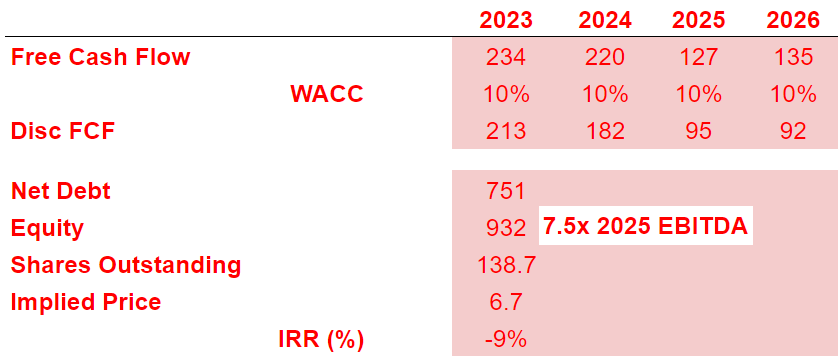

Summing everything up, with a weighted average cost of capital of 10% and an exit multiple of 7.5x, the implied price would be close to $6.5.

Author’s DCF Model

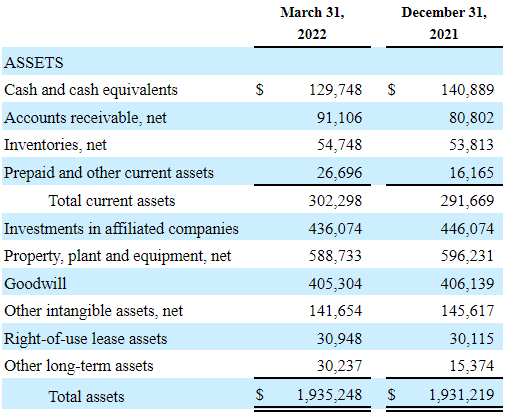

Balance Sheet

As of March 31, 2022, Ecovyst reports $129 million in cash and an asset/liability ratio close to 1.9x. I believe that the company’s financial situation appears stable.

10-Q

Ecovyst’s long-term debt is close to $871 million. It is not a small amount. In the worst-case scenario, I believe that Ecovyst could pay its debt using the free cash flow for the next three to four years. The company operates in a stable industry with fat free cash flow margins, so I am not worried about the debt.

10-Q

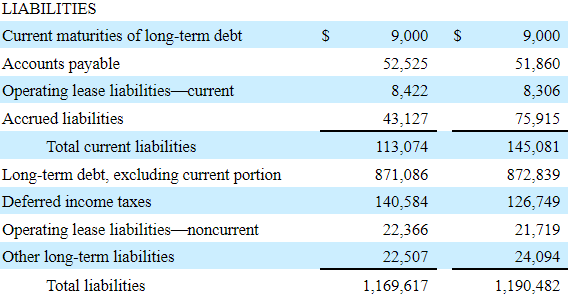

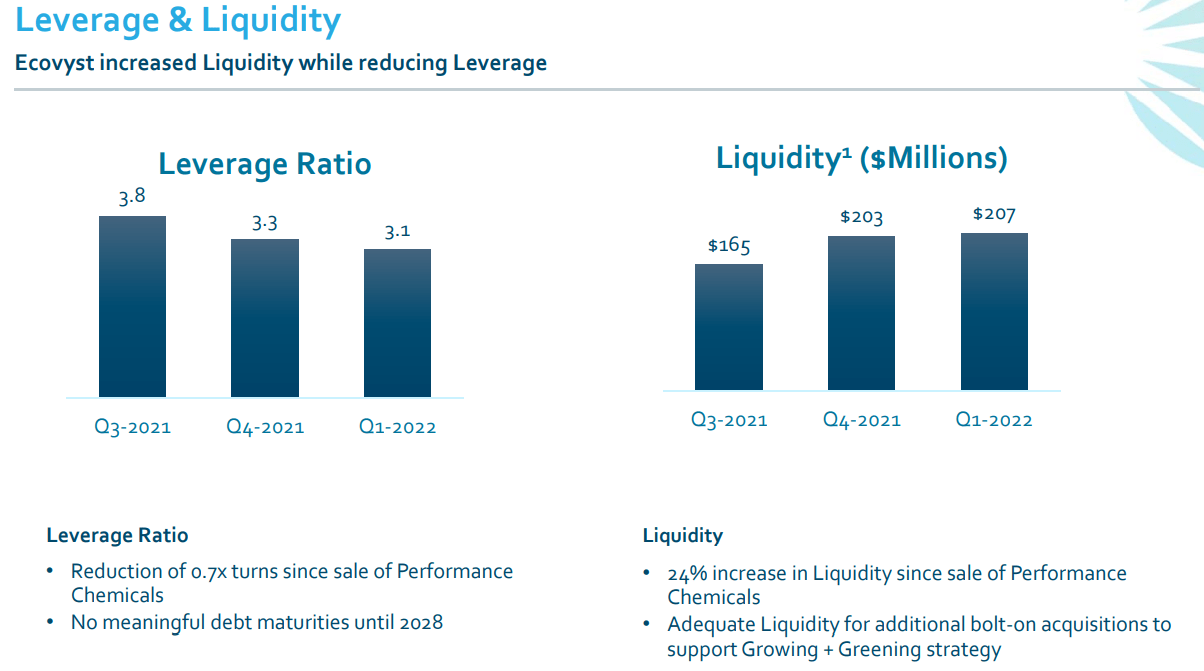

In this regard, it is worth considering that the leverage ratio decreased as compared to that in the year 2021. If the debt continues to decrease, I believe that more investors will be looking at Ecovyst, and the demand for the stock would increase.

Presentation

Takeaway

Ecovyst recently increased its outlook for the year 2022 and is decreasing its leverage through selling business segments. If the company signs new agreements with partners, and works with other large conglomerates, I would expect free cash flow growth. I do believe that raw materials inflation and unsuccessful new products could also damage the free cash flow. With that, the results of my discounted cash flow model implied significant upside potential in Ecovyst’s valuation. If you don’t worry about the total amount of debt, the company is a buy.

Be the first to comment