Daniel Balakov/E+ via Getty Images

Due to the recent week’s stock price performance, here at the Mare Evidence Lab, we have decided to partially shift our portfolio towards a mix between value and growth from a pure dividend player. We already provided an initiation of coverage of Air Products and Chemicals (APD) and today marked the day for Ecolab (NYSE:ECL). The company is engaged in providing water, hygiene, and infection prevention solutions and services across the globe. Ecolab was founded in 1923 and is headquartered in Minnesota. More in the specific, the company develops and markets services for a broad range of industries that goes from hospitality to the foodservice, passing on to the healthcare and the industrial markets. The company currently operates with four business segments: Global Industrial, Global Institutional & Specialty, Global Healthcare & Life Sciences, and others.

What’s going on?

First of all, we suggest to our readers to go deeper into our latest publication of Dow Inc. (DOW). Here, we provided a deep-dive analysis of basic chemical players in which we emphasized a new revenue recognition model and some disruption in economies of scale. Ecolab develops a broad range of solutions, but it still needs basic chemical components. In the latest quarter, sales growth was not sufficient to cover cost pressure. We know that Ecolab’s clientele is starting to push back some of its latest price increases. This jet lag between higher cost and not sufficient pricing power has led the company to decrease its profitability and consequently, the stock price was impacted.

Going deeper in the analysis, we note that Ecolab’s large exposure is back in hospitality, demand for its products declined strongly during the pandemic outbreaks, and now it is gradually recovering. The same can be said for business travel, a significant driver of cleaning chemicals/hygiene is related to the travel & leisure sector which is recovering at a slower rate if compared to what Wall Street analysts anticipated. Harder to say it’s the ESG premium that Ecolab has enjoyed over the years; we may affirm that ESG investors are looking for other companies with improving ESG scores and not just the best performers.

Why are we positive?

Given the company’s strong track record, we are confident in the management’s ability to increase the price over the medium term (in our estimates already in Q2). This would give to the investor community the right confidence to rebalance Ecolab implied valuation. Being Ecolab the CLEAR world leader producer and provider of cleaning and water treatment chemicals, we have no doubt on its pricing power.

Ecolab is uniquely positioned as an ESG pure player. The long-term opportunity is not due to population growth but also the global attention on water scarcity.

Ecolab ESG player

Source: Ecolab Corporate Overview

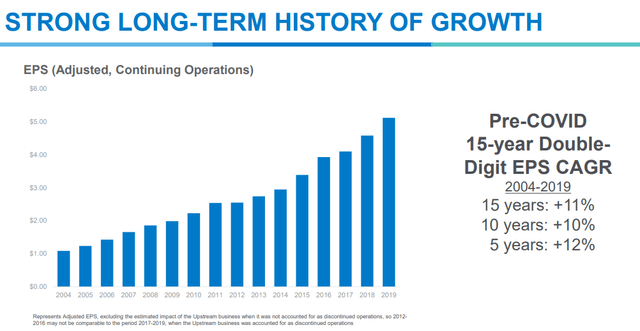

Aside from the macro-trends, the company has constantly delivered higher profitability compared to its peers.

Ecolab revenue growth

Source: Ecolab Corporate Overview

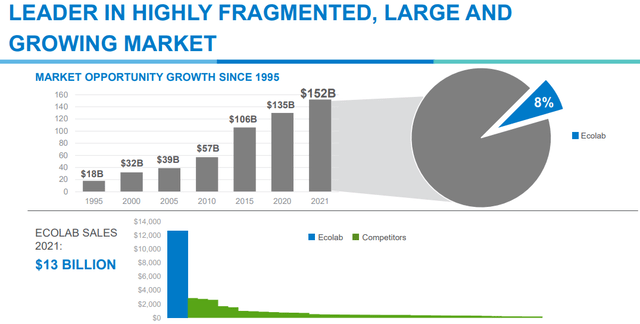

As we can see from the snap below, the water market is pretty fragmented, and Ecolab’s financial capability will be required for further M&A targets.

Ecolab market opportunity

Source: Ecolab Corporate Overview

Our internal team is confident in a more pronounced demand post-COVID-19 due to the increased use of hand and surface sanitizers.

Conclusion

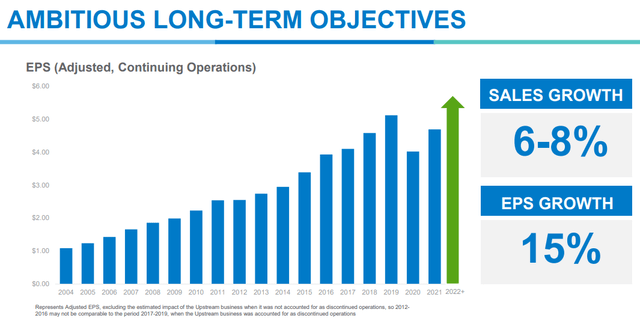

The Q1 was impacted by activities slowdown but more important by higher raw material costs. Our twelve-month price target is $185 which is based on ~29x NTM with an EPS of $6.4. This is still below with respect to its latest 5-year historical average multiple ranges.

Ecolab EPS

Source: Ecolab Corporate Overview

Risks to our target price include the lag between price and cost changes, and pandemic impacts on Ecolab product offerings from travel to hospitality customers. The company is also exposed to FX and currency depreciation.

Be the first to comment