Lukassek/iStock Editorial via Getty Images

Don’t Worry About Inflation – Sales And Margins Are Hitting Records

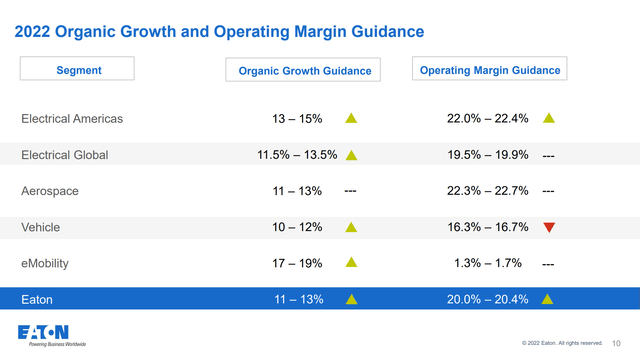

Eaton Corp. (NYSE:ETN) once again delivered record operating margins and non-GAAP EPS in its 2Q 2022 results. The company also raised the organic sales growth forecast for the year to 12% above 2021 levels. This is enough organic growth to make up for both the sale of the Hydraulics segment in 2021 and the foreign exchange hit to sales from a stronger dollar. Of course, in a high inflation environment, strong revenue growth is expected. More notably, Eaton still managed to report record operating margins of 20.1% this quarter, 1.5% above 2Q 2021 levels. The company also raised the operating margin forecast for the year with strength in Electrical Americas more than offsetting a margin decline in Vehicle.

Electrical Americas was the standout segment with 15% sales growth in 2Q, but growth is set to continue with orders up 29% and backlog up 89%. The segment also enjoyed high margin expansion, up 1.9%. Electrical Global also had strong organic growth which more than offset foreign exchange impacts from the strong dollar. The segment also has orders up 19% and backlog up 38%. In addition to the residential and data center markets as key growth drivers, management also called out commercial and utilities as strength areas thanks to the secular energy transition trend to more electrical power. Both Electrical segments delivered impressive growth, but management noted “that growth could have been much better but for persistent shortages of electronic components and COVID-related lockdowns in China.” As China reopens, these constraints should be relieved, improving Eaton’s results even more.

The Aerospace segment continued to benefit from the recovering commercial aviation business but also benefitted from the acquisition of defense supplier Cobham Mission Systems. Orders are up 19% and backlog is up 12%. Looking forward, there is room for more recovery as the commercial aerospace business is still about 10%-15% below pre-pandemic levels. The military business is also growing as most NATO countries are expanding their defense spending. While margins improved to 21.9%, they peaked at around 25% pre-pandemic.

The vehicle segment was the only one where Eaton was not able to raise price enough to counter the impact of cost inflation. The company expects to pass these costs along better in the second half.

Finally, I called out eMobility as the new high growth segment for Eaton in my last article. The company expanded this segment with the purchase of Royal Power Solutions this year. The longer-term goal for eMobility is to create a $2 to $4 billion business with attractive 15% segment margins. This is not all back-end loaded, as management noted earlier this year that they expect the segment to deliver $1.2 billion of revenues and 11% margins by 2025.

Putting it all together, Eaton has transitioned from a traditional cyclical industrial business to an electrical and mobility-oriented company with secular growth.

Earnings Model Update

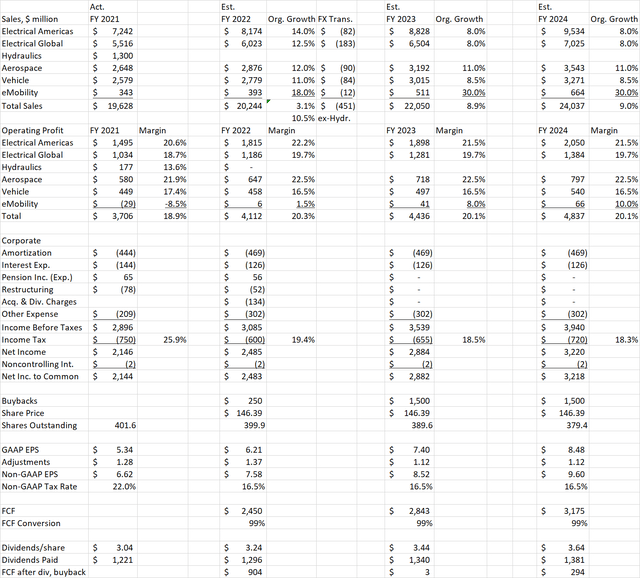

I have updated the earnings model I used in previous articles with the company’s 2022 guidance update and extended it to 2024. Given the company’s YTD performance, I am now comfortable enough to use midpoint organic growth rates and margins from the slide above for all segments in 2022. However, I did reduce sales by $450 million across various segments to account for foreign exchange impacts caused by dollar strength since my last update. I also understated acquisition amortization and other costs in my last update, so these have been revised upward. The resulting EPS of $7.58 falls near the midpoint of the updated company guidance range of $7.36-$7.76.

For 2023, I conservatively took sales growth back down where the 2022 assumptions were at the start of this year. The exception is eMobility, where I assume 30% sales growth to be in line with the company target of $1.2 billion in sales by 2025. I leave margins the same as the current forecast except for a slight trim in Electrical Americas. In eMobility I assume 8% operating margin in 2023 and 10% in 2024 on the way to the company target of 11% in 2025.

In non-operating expenses, for 2022 I am keeping costs consistent with management guidance. For 2023 and 2024, I hold these costs constant except I use zero for pension, acquisition, and restructuring charges. Note that amortization, acquisition/divestment costs, restructuring, and other costs are excluded from non-GAAP earnings.

The company maintained their relatively low share buyback of $250 million in 2022. I show that they have about $904 million available free cash flow after dividends and buybacks, but $600 million of this was already spent on Royal Power Solutions. For 2023 and 2024, I assume no acquisitions, allowing for $1.5 billion of share buybacks. I assume dividend increases of $0.05 per quarter each year, consistent with the actual increase to $0.81/quarter this year.

The resulting non-GAAP EPS projections are $7.58 in 2022, $8.52 in 2023, and $9.60 in 2024. At the closing price on the day of the earnings release, P/E’s on these estimates would be 19.3 times 2022 earnings, 17.2 times 2023, and 15.2 times 2024.

Valuation

In my May article, I calculated a fair value estimate of $185 for Eaton which was a P/E of 24 times 2022 EPS. I also stated that at $150, the stock had pulled back enough. In reality, it pulled back a little more to the $125 level in June and July before rebounding nearly to the same price it was at the time of my last review. Given the increase in interest rates weighing on all equity prices and the outperformance of Eaton stock vs. peers, I want to get a little more conservative with the price target even though I think it is still a Buy.

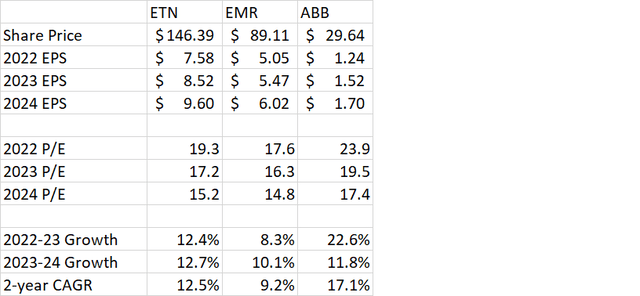

Compared to close peers with similar market caps, Eaton is now more richly valued than Emerson Electric (EMR) after outperforming it since my last article. Eaton is cheaper than Swiss company ABB however. As Eaton’s 2-year growth rate is in between these two peers, I conclude that Eaton is now about fairly valued.

Author Spreadsheet (EMR, ABB earnings from Seeking Alpha company pages)

Conclusion

At $146, Eaton stock looks fairly valued compared to peers. Nevertheless, the company has transformed from a cyclical industrial company to one with more steady growth. Its ability to raise prices and even increase operating margins in an inflationary environment makes Eaton “a wonderful company at a fair price” to use Warren Buffett terminology. With that in mind, I am comfortable leaving a Buy rating on the stock.

Be the first to comment