OlegAlbinsky/iStock via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 21st.

Real Estate Weekly Outlook

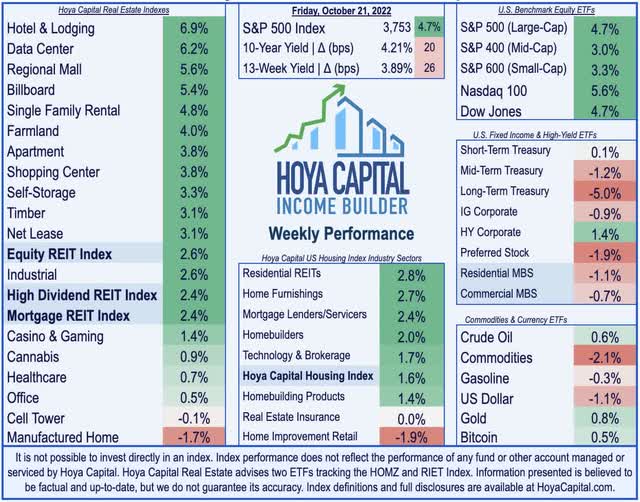

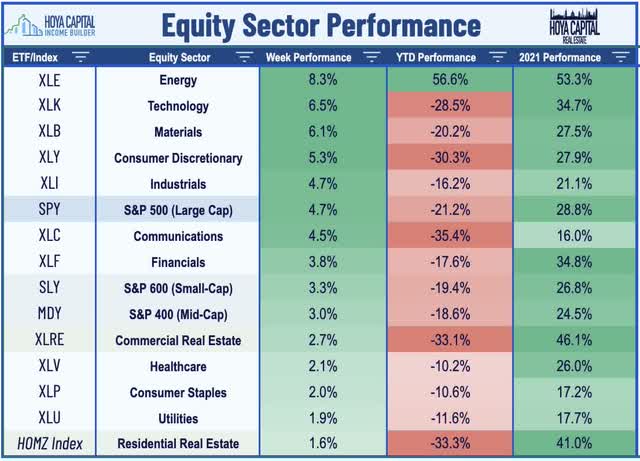

U.S. equity markets rebounded with their best weekly gains since July after a decent start to corporate earnings season eased the seemingly relentless selling pressure even as interest rates pushed to multi-decade highs. Political and economic instability in Europe and Asia remained a focus this week with the abrupt resignation of the U.K. Prime Minister and another emergency intervention by the Bank of Japan, but inventor attention turns back to the domestic political arena with midterm elections just two weeks away. Recent polling trends point towards a divided government in Washington, which would likely remove the potential for large-scale inflationary fiscal expansion.

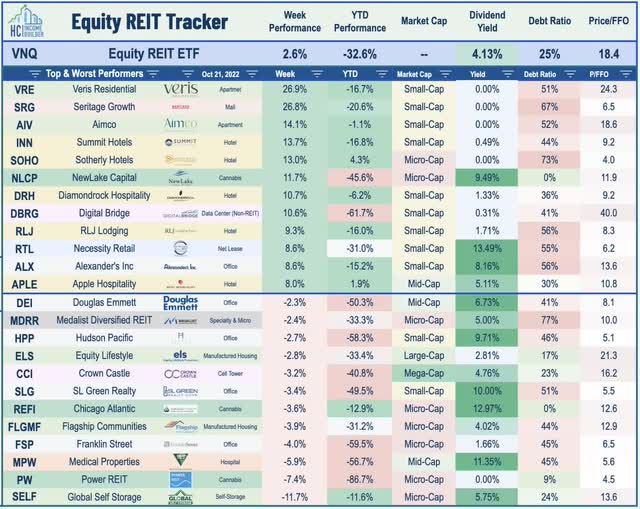

Rebounding from two-year lows and gaining for just the third week in the past ten, the S&P 500 advanced 4.7% on the week while the tech-heavy Nasdaq 100 rallied nearly 6% to trim its drawdown to under 30%. The gains came despite another rough week for bond markets as the benchmark 10 Year Treasury Yield climbed to the highest levels since before the Great Financial Crisis. Lifted by a solid slate of earnings reports and a flurry of dividend hikes, the Equity REIT Index rebounded by 2.6% on the week while the Mortgage REIT Index advanced 2.4%. The beaten-down homebuilders advanced 2% despite reports confirming the sharp contraction in residential construction activity in recent months amid the historic surge in mortgage rates.

As the Federal Reserve entered its “quiet period” before its November FOMC meeting, officials indicated that it plans to raise rates by another 75 basis points next month, but will “debate whether to approve a smaller increase in December.” The combination of hawkish Fed rhetoric and hotter-than-expected inflation data in the U.K. and Canada kept downward pressure on bonds this week with the 10-Year Treasury Yield rising another 20 basis points to close the week at 4.21% – the highest since 2007. Crude Oil and Gasoline prices were little-changed this week despite plans from the Biden administration to sell more oil from the U.S. Strategic Petroleum Reserve. The U.S. Dollar Index dipped 1% on the week, pulling back from its highest-levels in two decades. All eleven GICS equity sectors finished higher on the week, led on the upside by Energy (XLE) and Technology (XLK) stocks.

Real Estate Economic Data

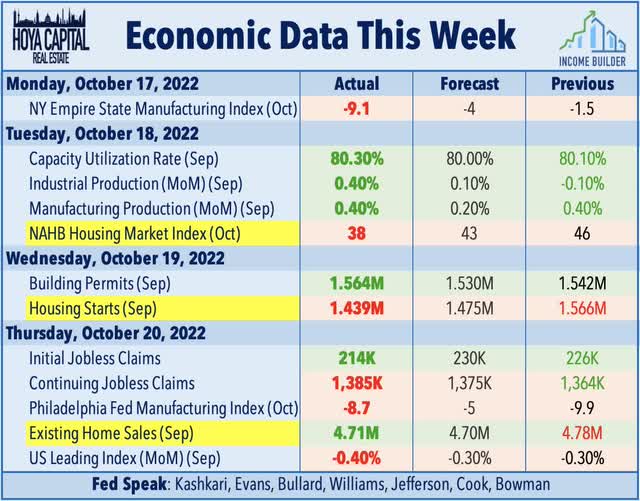

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

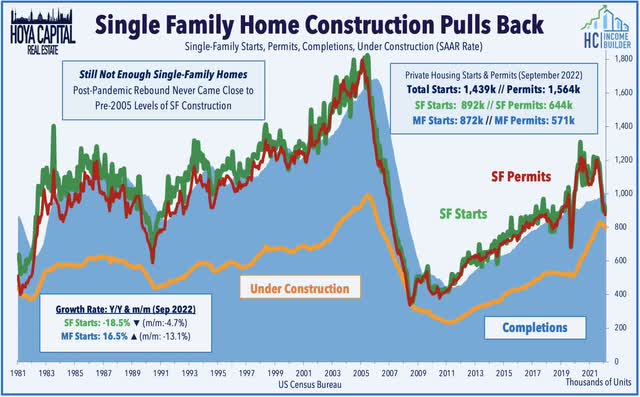

The U.S. housing market was in focus this past week – the industry shouldering the brunt of the burden of the historic surge in interest rates this year as multi-decade-high mortgage rates have rapidly turned the single-family market from red-hot to icy-cold. Gross Domestic Product data in the coming week is expected to show that the U.S. economy just barely avoided a third-straight contraction in the third quarter, but Residential Fixed Investment – which took 14 years to recover to its pre-GFC level – is likely to again be a significant drag on GDP growth. Housing Starts and Building Permits data this week showed that new groundbreakings for single-family homes tumbled to the lowest level in more than two years in September while the NAHB’s Housing Market Index fell to the lowest level for homebuilder confidence since September 2012 excluding the brief dip during the “shutdown months” in April and May 2020.

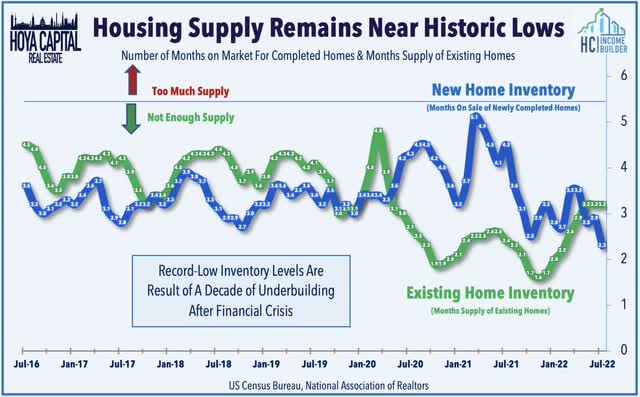

Spotlighting a paradox in modern central bank theory which holds that raising the cost of borrowing results in lower inflation, the monthly mortgage payment required to buy the average-priced home in the United States has nearly doubled over the past twelve months, and the resulting slowdown in the pace of new home construction is likely to exacerbate longer-term inflationary pressures in housing markets, which continue to face lingering supply shortages. Existing Home Sales data this week shows the result of this lingering undersupply of housing as that inventory levels actually declined in September – remaining near historic lows – despite the rate-driven housing cooldown. Remarkably, despite an eight straight monthly decline in home sales, the housing inventory level declined to just 1.25 million homes for sales at the end of September – down 1% from last year, representing just 3.2 months of supply at the current sales rate.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

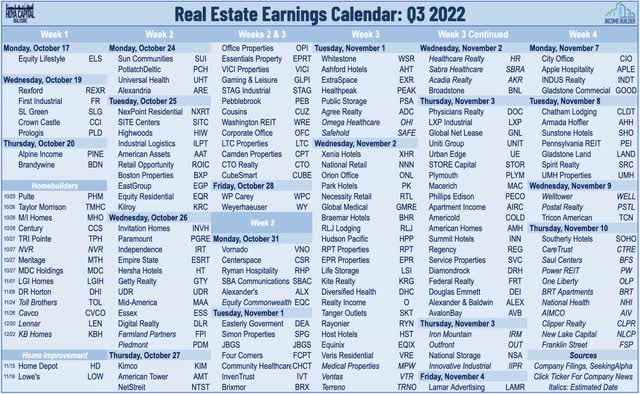

As discussed in our Real Estate Earnings Preview, REIT earnings season kicked off this week and over the next month, we’ll hear results from 175 equity REITs, 40 mortgage REITs, and dozens of housing industry companies. Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest valuations – and highest dividend yields – since the Financial Crisis. How REITs are responding to this higher rate environment – both on the acquisitions and the financing side – will be closely watched, as will commentary on movement in asset prices. We’re not yet seeing “distress” in the private real estate markets, but the heat has certainly been turned up to an uncomfortable degree for many more highly-levered players which could facilitate some attractive opportunistic M&A for more well-capitalized REITs.

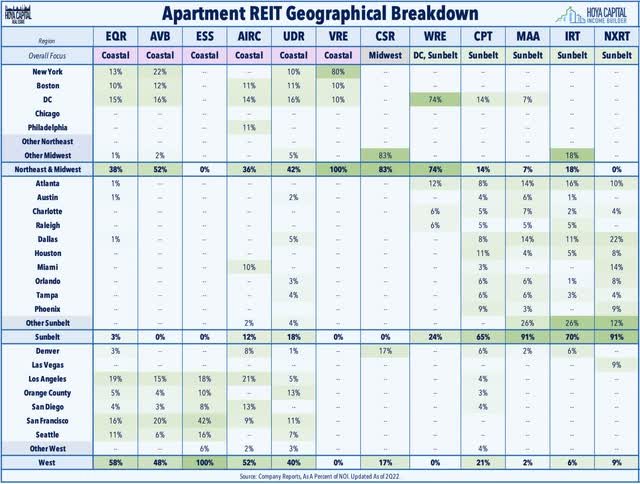

Apartment: We didn’t expect M&A to be a major theme this quarter given the latent “animal spirits” in recent months, but dealmaking was certainly a theme this week as Veris Residential (VRE) – which recently completed a strategy shift from an office REIT into a pure-play multifamily REIT – surged nearly 30% this week after an unsolicited takeover bid from Kushner Companies to externally manage the company or to acquire the company for $16/share – a premium of nearly 30% from its close on Thursday. The takeover bid comes after Veris – formerly known as Mack Cali – announced last week that it reached an agreement to sell its last remaining office assets. Since early 2021, Veris has closed on roughly $1.4B in office sales while adding approximately 1,900 units to its residential portfolio, which is now comprised of roughly 7,700 units – primarily in the NYC metro area. Multifamily now represents 98% of Veris’ Net Operating Income, up from 39% in early 2021.

Sticking in the theme of office-to-multifamily transitions, Washington Real Estate (WRE) – the other former office REIT that has shifted its focus to the multifamily sector over the past two years – announced that it has changed its name and rebranded as Elme Communities reflecting its “ongoing commitment to elevating the value-living experience for its residents.” The company is now trading on the NYSE under its new symbol ELME. The state of the U.S. housing market will be a critical focus throughout earnings season. The latest report from Zillow (Z) showed that while rent growth has indeed cooled from the double-digit rates seen earlier this year, the month-over-month rent growth in September – the slowest growth in nearly two years – was still triple the average rates seen from 2015-2019. We’ll again be watching rent growth trends on new and renewed leases – and expect the Federal Reserve will be listening closely as well.

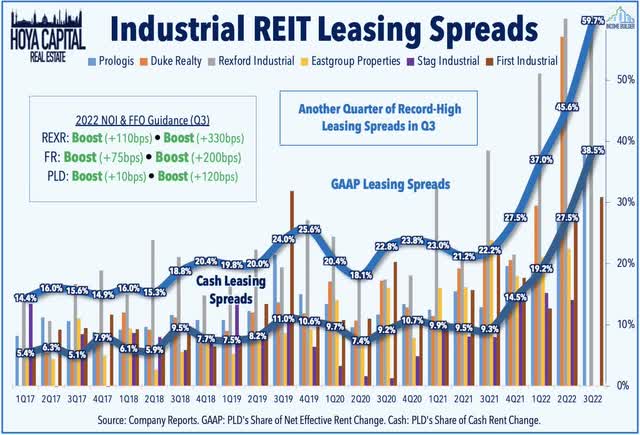

Industrial: Three for three. Industrial REITs have been upside standouts early-on in earnings season with a trio of “beat and raise” reports this past week. Sector stalwart Prologis (PLD) rallied nearly 4% on the week after reporting a record-high effective leasing spread of 59.7% and record-high cash same-store NOI growth at 9.3%. While the company raised its comparable 2022 FFO growth target by 120 basis points to 11.1% and its same-store 2022 NOI target to 8.6%, investor redemptions in its third-party asset management resulted in downward revisions to several 2022 targets. First Industrial (FR) was also among the better performers this week after reporting record-high cash leasing spreads of 30.9%, driving a boost to its NOI outlook by 75 basis points to 9.5% and its FFO growth outlook by 200 basis points to 13.2%. Rexford (REXR) slumped despite reporting similarly solid results highlighted by incredible cash rental rate spreads of 88.6% GAAP / 62.9% cash in Q3.

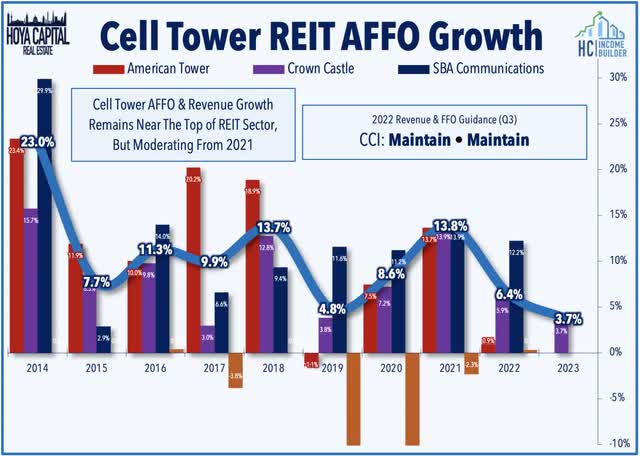

Cell Tower: Crown Castle (CCI) finished lower by about 3% this week despite reporting solid results powered by strong organic “same-tower” growth metrics and hiking its quarterly dividend by another 6.5% to $1.565/share. The third-largest REIT by market capitalization maintained its full-year outlook calling for FFO growth in 2022 of roughly 6% while also providing 2023 guidance which calls for growth of 3.7% at the midpoint of its range, noting that it expects higher interest expense to be offset by an expected acceleration of same-tower billings to 6.8% in 2023 from 5.0% this year. Last week in Cell Tower REITs: 5G’s Killer App, we analyzed why we’re increasingly upbeat on the long-term prospects for the sector, which has been slammed over the past three months amid concern over disruptive threats from emerging satellite internet providers including SpaceX’s Starlink service. We’ll hear the results from American Tower (AMT) this coming Thursday.

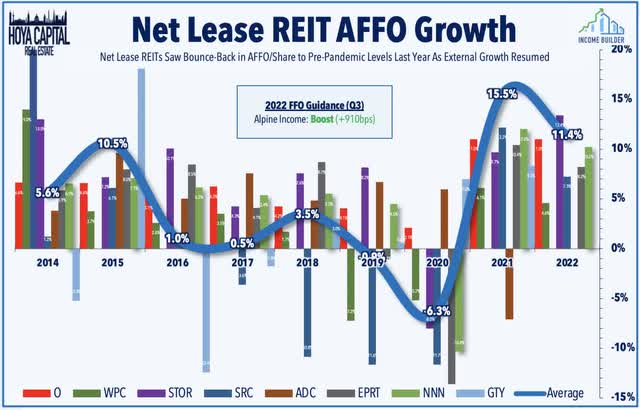

Net Lease: Small-cap Alpine Income (PINE) surged nearly 8% on the week after it reported better-than-expected results and raised its full-year FFO outlook. The first net lease REIT to report third-quarter results, PINE raised its full-year FFO growth target due primarily to a lower share count as the company also scaled back its acquisitions target. PINE now sees FFO growth rising 10.1% this year – up 910 basis points from its prior outlook. Acquisitions are targeted to be $170M-190M this year, down from $215M-235M in the previous guidance while dispositions are expected to be $150M-170M compared with $125M-175M in the prior target. The largest triple-net REITs don’t report results until the back-half of earnings season in November, but we’ll next week from several mid-sized names including Getty Realty (GTY), Essential Properties (EPRT), and Netstreit (NTST).

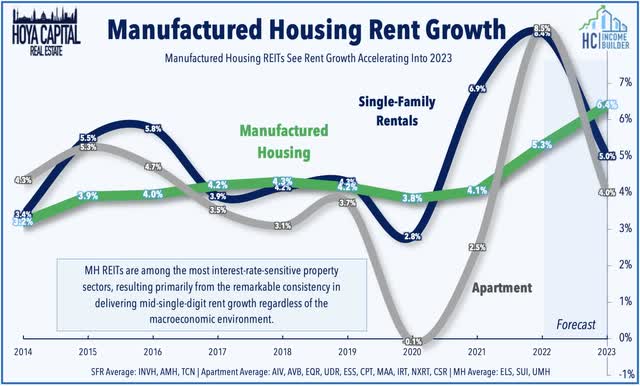

Manufactured Housing: Equity LifeStyle (ELS) finished lower by about 3% on the week after reporting decent results, but revised its full-year FFO guidance lower by about 2% due to the effects of Hurricane Ian. ELS noted that six of its Fort Myers properties – four RV parks and two marinas – remain closed and are expected to reopen by year-end. It did not record any storm-related expenses in Q3, but did record a $3.7 million write-down in the carrying value of these assets and revised its full-year Core FFO outlook to $2.67 at the midpoint – down about 2% from its prior outlook of $2.73. While ELS did not provide formal guidance for 2023, it did note that it plans to send out rent 2023 increases on its MH properties in the range of 6.2%-6.6% – up from the roughly 5.3% rate increase in 2022 – and increases on its RV properties in the range of 7.6% to 8.0% – up from the roughly 6.6% rate increase in 2022. These record-high pace of rent increases are consistent with our expectation that MH REITs will leverage the record-setting cost-of-living adjustment (COLA), which should result in a roughly 9% rise in benefits to a significant percentage of MH REITs’ resident base.

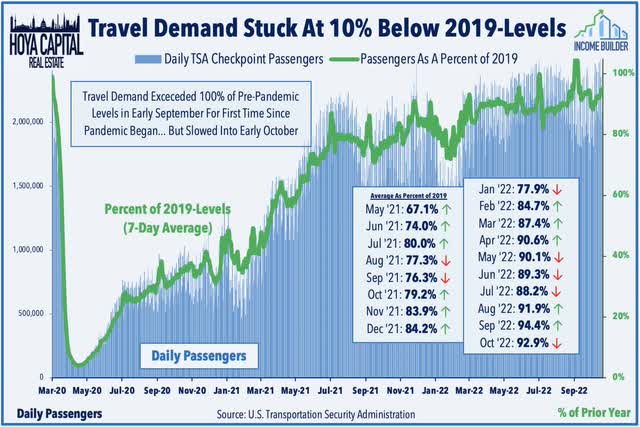

Hotel: DiamondRock (DRH) rallied more than 10% on the week after reporting solid preliminary third-quarter metrics, noting that its Revenue Per Available Room (“RevPAR”) in Q3 was 8.7% above comparable 2019-levels while September was 9.8% above pre-pandemic levels. Pebblebrook Hotel (PEB) advanced nearly 8% after reporting that its RevPAR in the third quarter was 1% above comparable pre-pandemic levels with the strongest month coming in September, which was about 5% above 2019-levels. Recent TSA Checkpoint data has shown that domestic travel has held up in recent months as an uptick in business travel has offset a moderation in leisure demand. Also of note this week, Apple Hospitality (APLE) – which we own in the REIT Dividend Growth Portfolio – hiked its monthly dividend by 14% to $0.08/share, representing a forward yield of 5.8%.

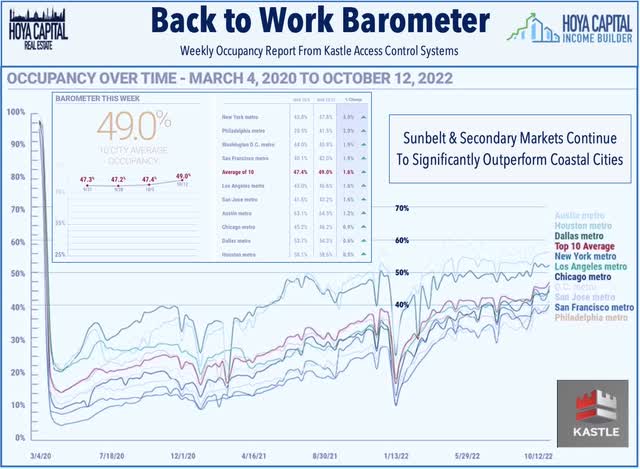

Office: A pair of office REITs reported mostly in-line results this week. NYC-focused SL Green (SLG) finished off by about 3% on the week after reporting mixed results highlighted by decent leasing volumes which indicated that corporate tenants haven’t yet completely given up on the physical office in the hybrid work-from-home era. Positively, occupancy rates in its Manhattan same-store office portfolio increased 10 basis points to 92.1%, but rental rates remain under pressure with spreads that were 10.4% lower for the first nine months of 2022 than the previous fully escalated rents on the same spaces. Of note, SLG announced a new partnership with Caesars Entertainment (CZR) to pursue a gaming license for the planned Caesars Palace Times Square at 1515 Broadway. Elsewhere, Brandywine (BDN) advanced 1% on the week after reporting solid results and maintaining its full-year FFO outlook as strength in its Sunbelt markets drove a 6.9% increase in rental rate spreads.

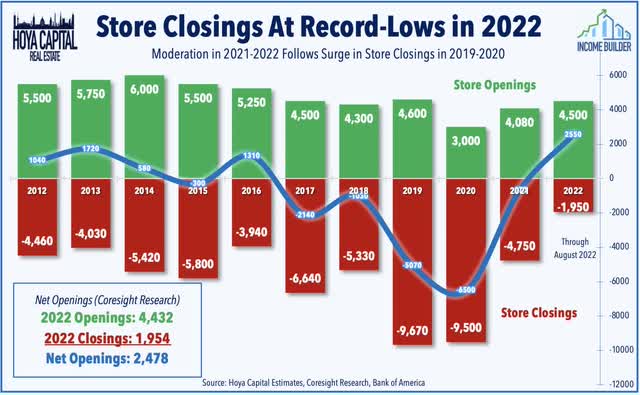

Shopping Centers: This week, we published Shopping Center REITs: Bargain Hunting. We discussed why the versatility and larger footprint of the strip center format have been a winning formula for shopping center REITs as retailers have increasingly utilized their brick-and-mortar properties as hybrid “distribution centers” in last-mile delivery networks. Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since 2021 with particular strength in well-located strip centers. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are stronger than before the pandemic. We’ll hear results this coming week from Kimco (KIM) and SITE Centers (SITC).

Mortgage REIT Week In Review

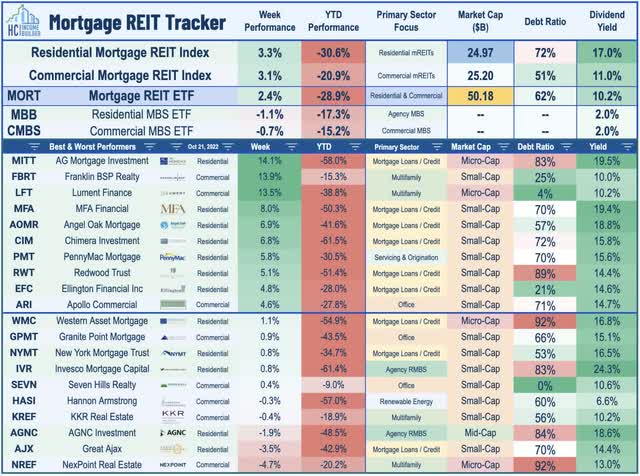

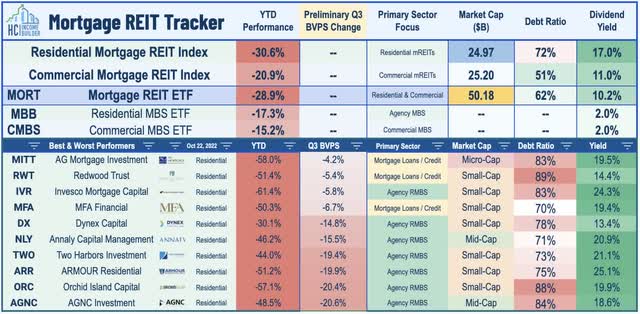

The rebound continued this week for Mortgage REITs as well after several additional residential mREITs provided decent preliminary third-quarter results ahead of the formal start of earnings season in the week ahead. AG Mortgage (MITT) soared nearly 15% after reporting that its estimated Book Value Per Share (“BVPS”) was $10.68 at the end of Q3 – down just 4% during the quarter – a significantly more-muted decline than expected. MFA Financial (MFA) also rallied 8% after reporting that its BVPS at the end of Q3 was $15.33 – down just 6.7% in the quarter – also significantly better than feared. Ellington Financial (EFC) advanced nearly 5% after it reported that its BVPS was $15.22 at the end of Q3 – down just 5.8% during the quarter.

As noted in our REIT Earnings Preview, over the past two weeks, we’ve heard preliminary results from ten mREITs which showed BVPS declines ranging from 4-20% in Q3 – not quite as catastrophic as feared amid the worst year of returns for credit markets in history and as interest rate volatility remains near the highest levels since March 2020. Book Value Per Share declines have been more muted for credit-focused mREITs compared to pure-play agency-focused mREITs. We’ll hear results from 15 mortgage REITs next week including AGNC Mortgage (AGNC) on Monday, Rithm Capital (RITM) on Tuesday, Annaly (NLY) and Blackstone Mortgage (BXMT) on Wednesday, and Arbor Realty (ABR) on Friday.

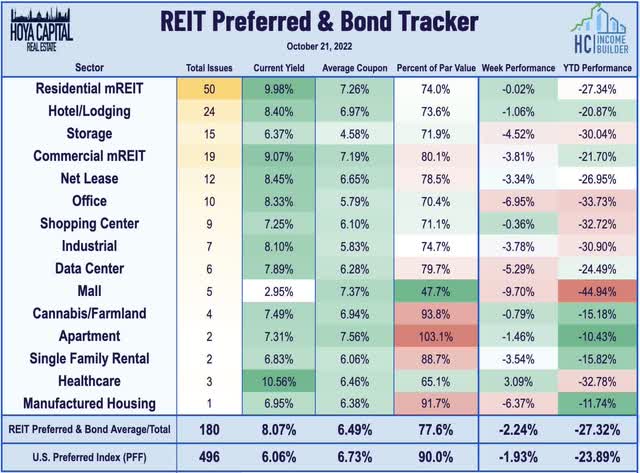

REIT Capital Raising & REIT Preferreds

The REIT Preferred Index (PFFR) dipped roughly 2.2% this week – slightly outperforming the broader iShares Preferred ETF (PFF) which ended the week off by 1.9%. We again observed significant dispersion between otherwise similar securities – symptomatic of disruptions caused by the clashing of large passive and/or programmatic fund flows with relatively illiquid individual securities. Some examples this week included the roughly 6% performance spreads within the Annaly (NLY), AGNC Investment (AGNC), and MFA Financial (MFA) preferreds. Other notably moves included the 8-10% declines across the preferred series from commercial mREIT Arbor Realty (ABR) and office REIT Vornado (VNO) while we also saw double-digit weekly price declines from Hudson Pacific (HPP), Gladstone Commercial (GOOD), and Pennsylvania REIT (PEI).

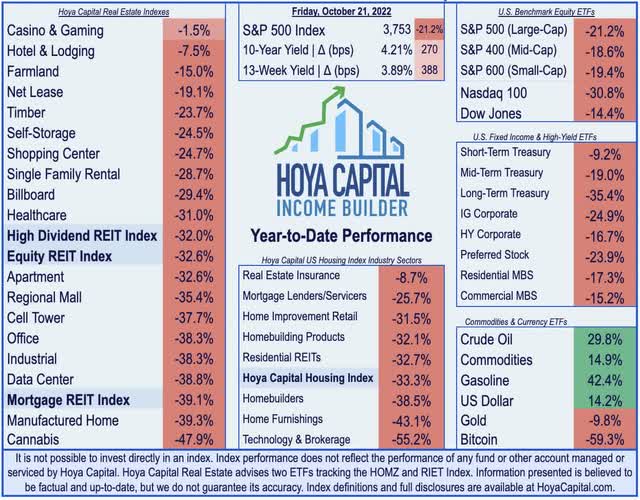

2022 Performance Check-Up

Now three weeks into the fourth quarter, Equity REITs are now lower by 32.6% on a price return basis for the year – the worst YTD performance for the REIT Index on record through this date – while Mortgage REITs are lower by 39.1%. This compares with the 21.2% decline on the S&P 500 and the 18.6% decline on the S&P Mid-Cap 400. Within the real estate sector, all eighteen property sectors are now in negative territory for the year including ten that are lower by more than 30%. At 4.21%, the 10-Year Treasury Yield has surged 270 basis points since the start of the year to the highest weekly closing level since May 2010 – and well above its prior ten-year highs of 3.25% seen back in late 2018. As a result, the US bond market is on pace for its worst year in history with a loss of 16.2% on the Bloomberg US Aggregate Bond Index, which is 5x larger than the previous worst year back in 1994 (-2.9%).

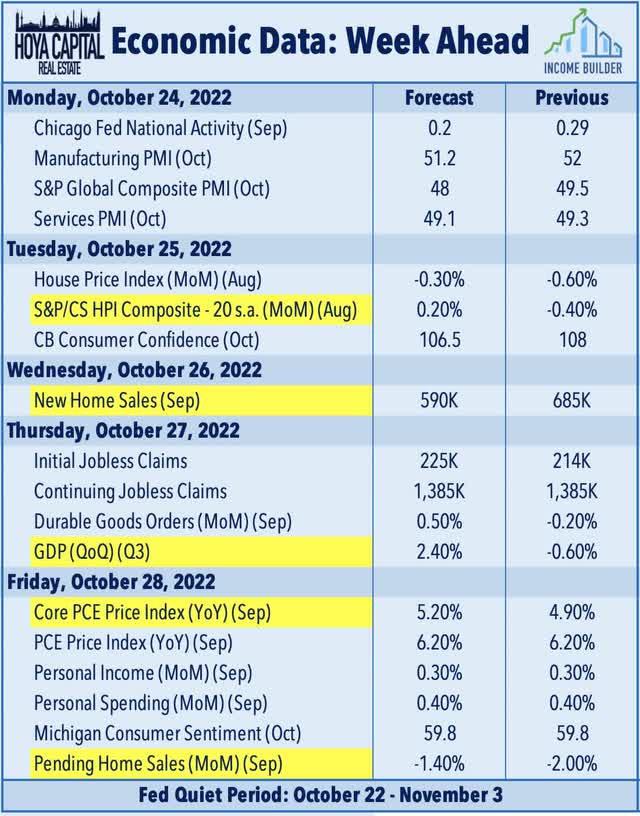

Economic Calendar In The Week Ahead

It’ll be another jam-packed week of housing data, inflation reports, and corporate earnings results in the week ahead. The main event of the week comes on Thursday with third-quarter Gross Domestic Product data which is expected to show that the U.S. economy just barely returned to expansion during the summer after a first-half recession. The Atlanta Fed’s GDPNow model forecasts growth of 2.9% from the prior quarter as the significant drag from residential fixed investment is expected to be offset by a short-term boost from higher net exports – a boost driven primarily by lower imports. On Wednesday and Friday, we’ll see New Home Sales and Pending Home Sales data for September which are expected to echo the continued slowdown seen in Existing Sales and Housing Starts data this past week. We’ll also see home price data on Tuesday with reports from Case Shiller and the FHFA which last month showed the first monthly decline in home prices since 2012. Finally, on Friday, we’ll see another critical inflation report with the Core PCE Index – the Fed’s preferred gauge of inflation – which has been one of the early indicators showing signs of peaking price pressures in recent months.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment