stockstudioX/E+ via Getty Images

~ By Tim Murphy, Marketplace Success Manager

Thank you to all readers of our Tech and Growth and Dividends, REITs and Income earnings roundtables. Today we end the Roundtable series with the remaining areas coverage – value, commodities, and macro. Once again, we asked the open-ended question – What are you monitoring with your subscribers this earnings season?

Enjoy reading! Links to the author’s profile and service are included. All services have either a two-week free trial or a limited one-month money-back guarantee.

*Note for non-Premium readers: If the author provides a link to an article, we have included a dollar symbol ‘($)’ to indicate it is behind the paywall. Articles from this account, SA Marketplace, are not paywalled.

VALUE

Thomas Lott of Cash Flow Compounders: Will be monitoring everything! We run and recommend for subscribers a diversified growth / reasonable price portfolio. These have tilted to far more value names given the bubble in tech/growth we saw in 2020 and 2021. We only buy companies that generate free cash flow, for the simple reason that in the long run, FCF generating stocks outperform.

As for earnings, banks kicked off the season last week. We note how well bank earnings are holding up right now. Well, Investment banks, not so well. Delinquencies are near record lows. Unemployment remains at record lows too. Sure, in a recession these will move higher, but an inflation/Fed induced recession is far different from a credit induced recession.

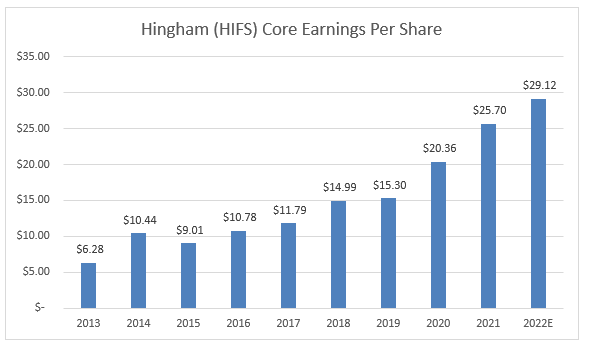

We are seeing the former. And right now consumer and corporate balance sheets are very strong and can endure several rate hikes. Net interest margins (NIMs) likely improve more than loan loss provisions go up, which equals banks continuing to grow nicely. In fact, Hingham (HIFS) reported last Friday, with no defaults, EPS up 10.5% year over year, ROEs over 16% and their efficiency ratio at 22%. They have some NIM pressure, but when the Fed is done raising, growth will revert higher, probably back to 15-20%. They grew their loan book 33% yoy, and yet the stock trades at 11x forward earnings. We are also excited to see energy companies’ earnings. We wrote up VET recently here ($).

Thomas Lott (HIFS financials)

Disclosure: Long HIFS and VET

Ranjit Thomas, CFA of Stock Scanner: In 2020 and 2021, companies got a pass on delivering cash flow for their investors. Unprofitable growth stocks soared as stimulus money found its way into the market. However, many profitable companies were also generating poor cash flow as they saw their inventories and receivables climb, with supply chain issues being blamed.

It is now time for company managements to show owners the cash. There’s no new money coming into the market, and for a stock to hold its own, the company has to generate cash and return it to shareholders through dividends and buybacks or at least repay debt.

We know there are a lot of stocks at cheap multiples – homebuilders at 3x EPS, for instance. It is time for them to stop investing in inventory, slow down production and generate cash. So this earnings season, I will be laser focused on cash generation. No excuses! If a company is not generating cash in line with its reported net income, I will be questioning whether those profits are sustainable. I am positive on the US chemicals sector as Europe faces gas woes. I will be looking at how these companies are doing. LyondellBasell (LYB) recently got a new CEO who paid out a special dividend. Good start, but they also need to sell their refinery and cut capex running in excess of depreciation. Read my article on it here ($).

Disclosure: Long LYB

COMMODITIES

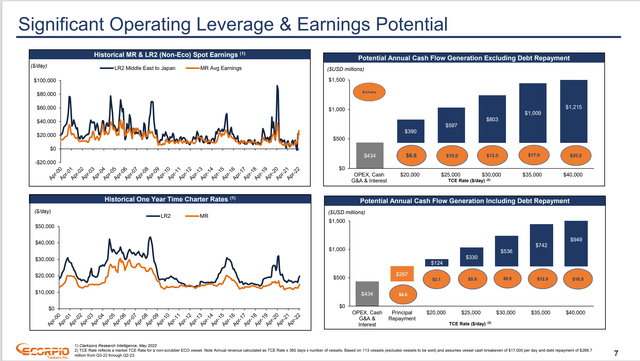

Michael Roat of Tri-Macro Research: Scorpio Tankers is a pure-play product tanker company, while International Seaways also owns a large product tanker fleet.

STNG has captured an average daily rate for 85% of bookings for Q2 at $35k per day according to the latest company update as of June 8, 2022. This puts STNG on pace for around $12.5 per share in operating cash flow or around +$742M in operating cash after debt repayment annualized over the next 12 months. Product tanker rates have risen significantly YTD and are among the highest since pre-2008.

In this environment, Scorpio for example is poised to earn as much as in 2014-2015 when the share price was around $100. It has also launched a $250M share buyback program which is slightly above 10% of its market capitalization. Product tanker stocks have reacted upwards though I feel the magnitude of the rise in earnings is not yet reflected in share prices.

Are product tankers leading the overall tanker market with crude tankers soon to follow?

In a panel with Marine Money Week in New York via Trade Winds News, DHT Holdings CEO, Svein Harfjeld, said “Something is going to give. I have a hard time trying to analyze why the product tankers should give. There will be more feedstock moved to the refiners. You cannot have a dislocation where product tankers on average are earning $50,000 per day and the crude market is weak. If you really see what’s going on in products, and I think it’s all credible analysis behind it, I think crude will move next.”

Disclosure: Long call option position on STNG, INSW, DHT

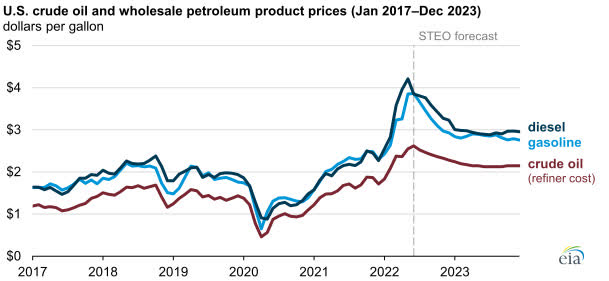

Laura Starks of Econ-Based Energy Investing: Unhedged/less hedged producers’ earnings (Marathon Oil or MRO), uplift from any European LNG sales (majors) and how they flow through to smaller US gas producers like SilverBow Resources (SBOW) and those in the Haynesville, extra returns to shareholders, factors that will continue the next few quarters, and especially, what is expected to be a blowout quarter for refiners like Marathon Petroleum (MPC) and Valero (VLO). Check my article Valero’s Marked Upswing Continues ($).

– (U.S. Energy Information Administration, STEO)

Disclosure: SBOW, MPC, VLO

MACRO

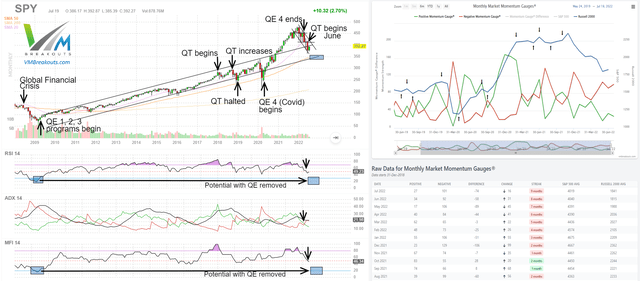

JD Henning of Value & Momentum Breakouts: We are closely monitoring key technical and economic indicators, including:

1. Market Momentum Gauges® – delivered our first positive daily signal in 25 days on July 19th but still awaiting both positive weekly and monthly gauge signals.

2. Sector Momentum Gauges® – Healthcare sector positive since June 23rd and (LABU) +40.3%. Six more sectors turned positive this week.

3. Fed rate hike and QT program – the last time Fed fund rate topped 2% and QT exceeded -$50 billion/monthly balance sheet reduction the market corrected in October 2018. This signal, tracked in my QT articles poses high risk.

4. VIX volatility index has spiked above the 30 level every month since November but not yet in July. Q2 earnings and FOMC meeting next week could induce a spike to this VIX level.

Members are moving to the new mid-year long term value portfolios up sharply to start July: Piotroski-Graham up +10.1%, Positive Forensic +7.6%, Negative Forensic +20.2%. Top long term stocks across the July portfolios include: (GTHX) up 61.5%, (ITOS) +26.1% and (BYND) +46.4% covered in the weekly video report here ($).

These active signals direct 10 different value & momentum model portfolios. We expect more downturns through 2022 while the Fed remains committed to a $1 trillion balance sheet reduction through 2023.

Disclosure: None

KCI Research Ltd. of The Contrarian: Two things. First, the bifurcation of earnings, earnings surprises, and guidance between the value and growth camps. Undoubtedly, the ongoing bear market has opened up a host of opportunities, however, many are glossing over the fact that there is a huge performance gap this year, and really since 2020, between the new “Have’s”, think energy equities, and the new “Have Not’s”, think interest rate sensitive and inflation sensitive equities.

For example, and on this note, as of Friday, July 15th, 2022, the Energy Select SPDR Fund (XLE), was up 26.2% year-to-date in 2022, while the SPDR S&P 500 ETF (SPY), was down 18.3%, the Invesco QQQ (QQQ) trust was down 26.4%, the ARK Innovation ETF (ARKK) was down 53.4%, and the iShares 20+Year Treasury ETF (TLT) was down 20.9% YTD. Clearly, an inflationary bust is occurring, something many market participants have never experienced. There will be ebbs and flows to this inflationary bust, with countertrend rallies, however, to be successful on a relative basis in the markets, I think you have to get the macro right. On this note, this brings me to my second point, and I think that the stickiness of inflation is being underestimated, particularly over the next decade. This is going to drive investment narratives, and remember, narrative follows price.

Disclosure: Long XLE, Short SPY, Short TLT. Previously short ARKK and the QQQ’s. Positions can change at any time.

The Macro Teller of Macro Trading Factory: Inflation at a record high. Fed is hiking 75-100 bps per meeting. ECB is likely to hike by 50 bps. Recession probability at record high. Russia-Ukraine war still running. Low Chinese growth. Atlanta Fed’s GDP Now forecasts -1.5% US Q2 GDP growth. BoA expects a recession in the US in 2H/2022 and into Q1/2023. Lowest approval rating for a US president in 15 years.

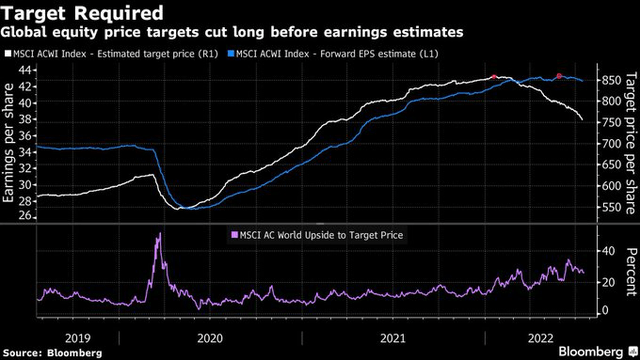

Midterms in four months. Price targets have fallen by ~20%. And yet, analysts still expect record earnings, both globally as well as in the US.

Until forward earnings estimates are adjusted down, reflecting the current economic slowdown and many risks, we remain cautious, i.e. under-invested, as we’ve been for quite some time now.

Disclosure: None

Be the first to comment