peakSTOCK/iStock via Getty Images

The art of conversation is the art of hearing as well as of being heard.”― William Hazlitt

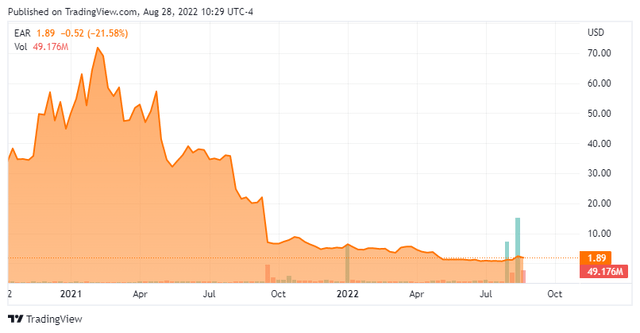

Today, we put Eargo, Inc.(NASDAQ:EAR) in the spotlight for the first time. This company has a variety of issues recently that have caused the stock to nosedive deep into ‘Busted IPO’ territory. Are brighter times on the horizon? An analysis follows below.

Company Overview:

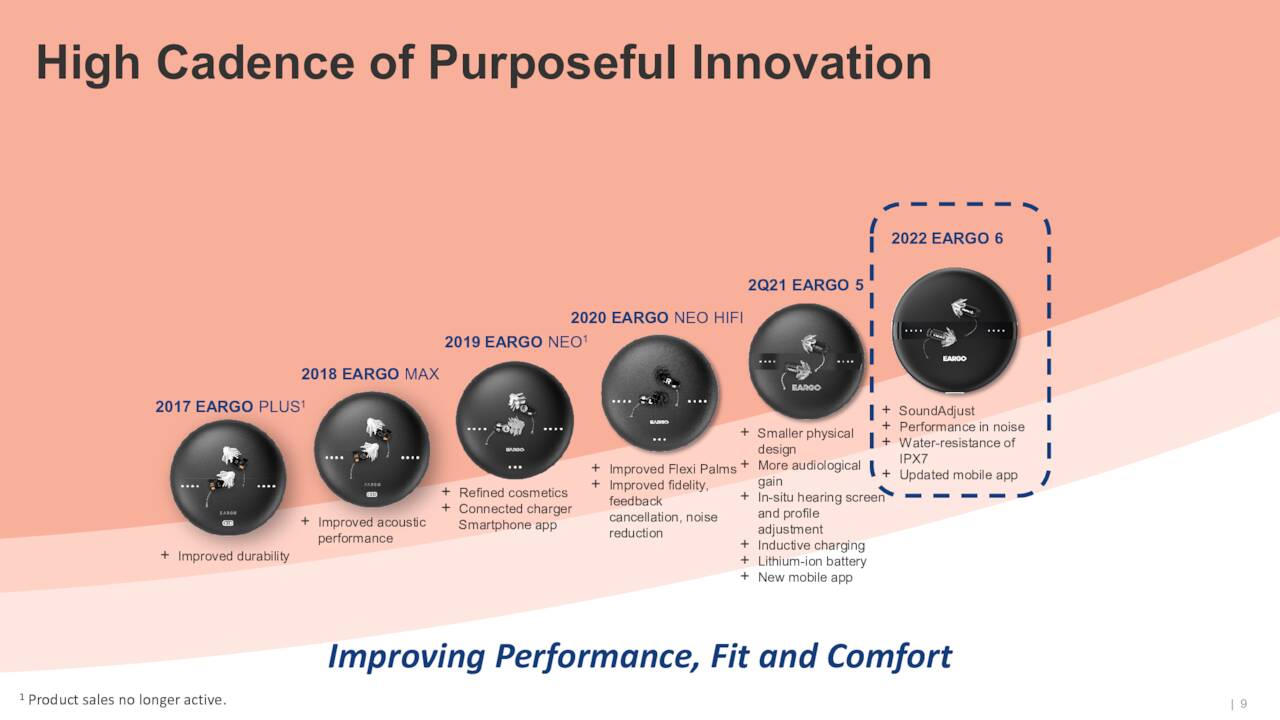

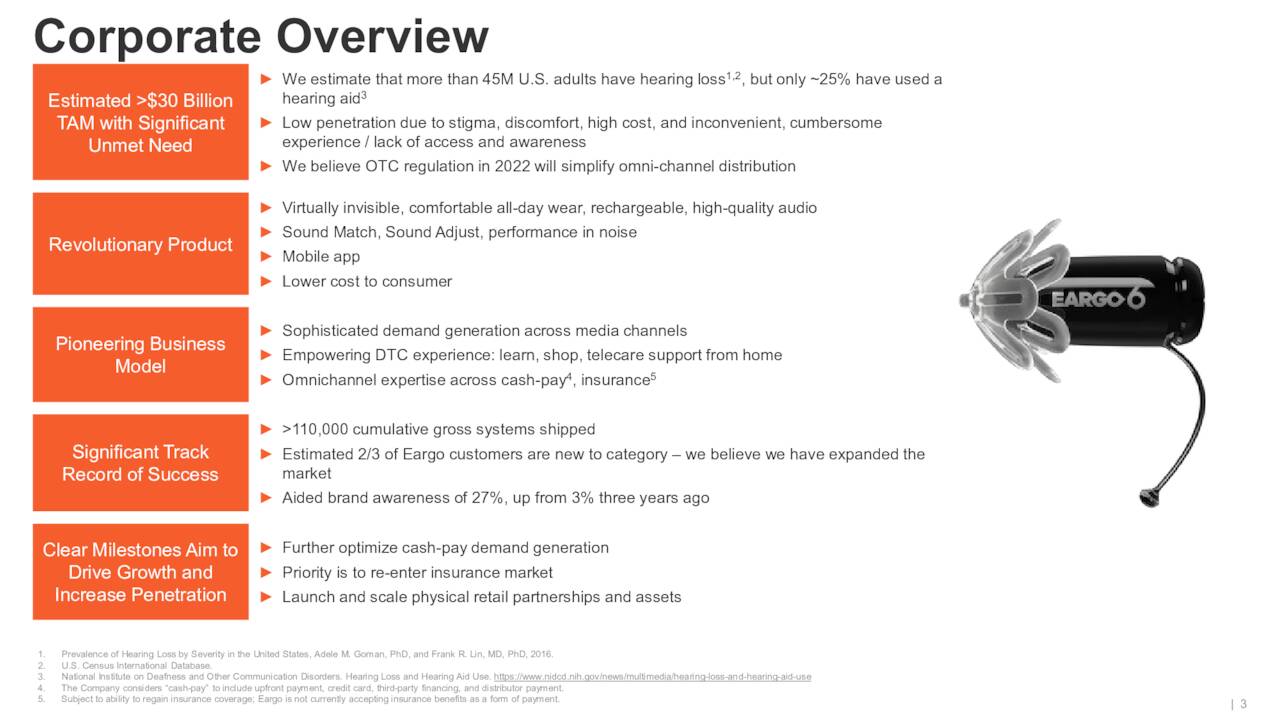

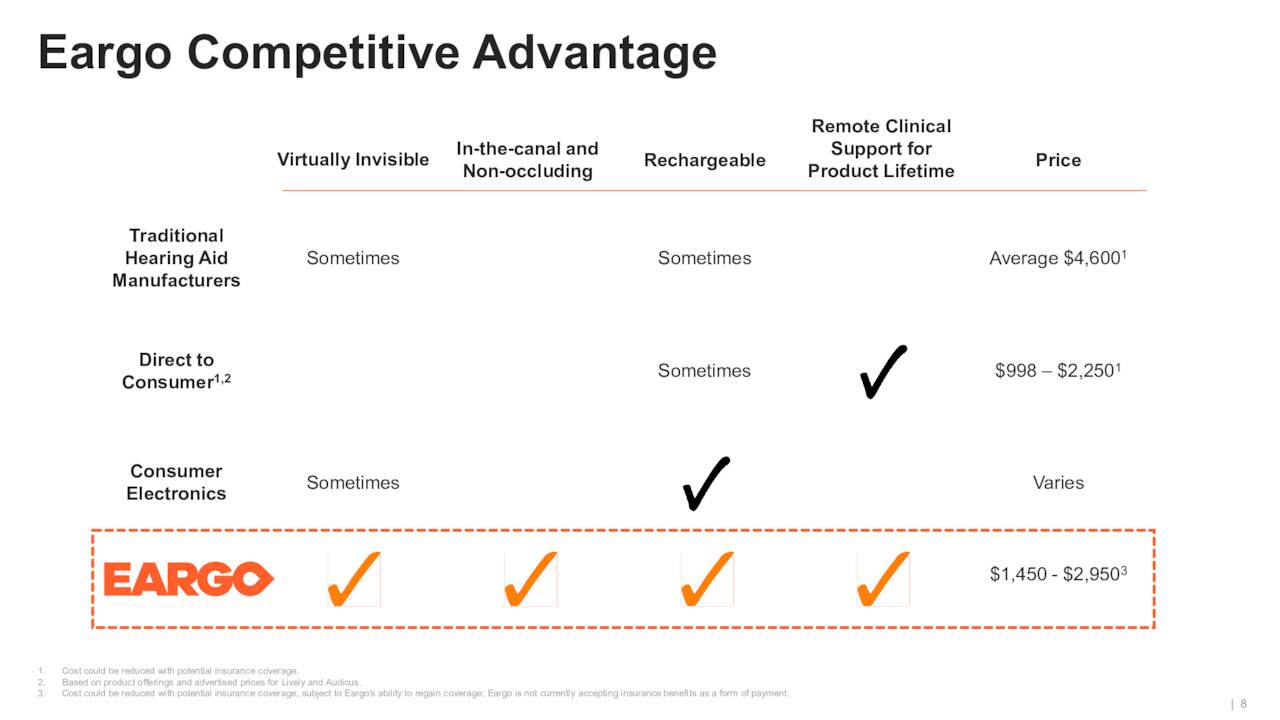

Eargo, Inc. is a small medical device maker headquartered in San Jose, CA. The company markets and sells hearing aids through direct-to-consumer and through omni-channels. The stock currently has an approximate market capitalization of $75 million. The company launched the latest version of its hearing aid line, the Eargo 6 in January of this year. The Eargo 6 is an FDA Class II exempt hearing device featuring Sound Adjust technology that automatically optimizes the soundscape as the user moves between environments.

June Company Presentation

The company has been dogged by two major issues since it went public. The first was a criminal investigation initiated by the U.S. Department of Justice related to insurance reimbursement claims submitted by the company on behalf of its customers covered by the Federal Employee Health Benefits (FEHB) program. Management denied wrongdoing but settled this issue for $34.4 million in the Spring of this year.

June Company Presentation

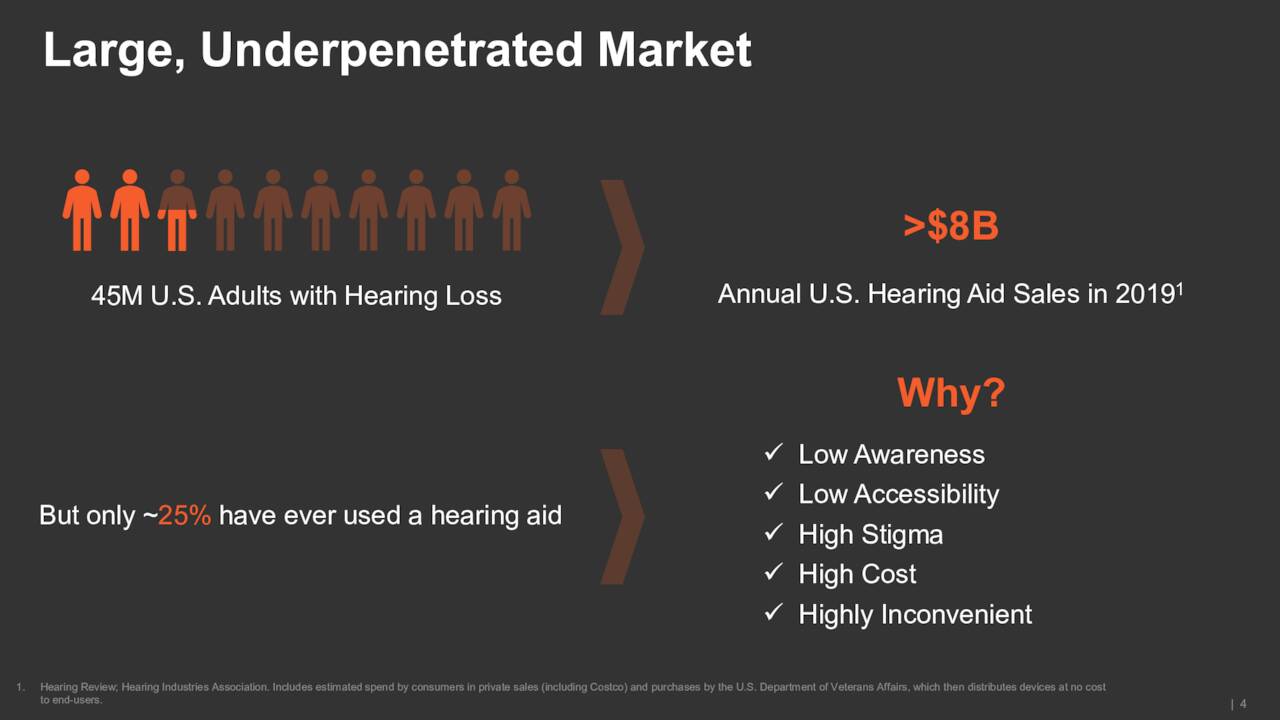

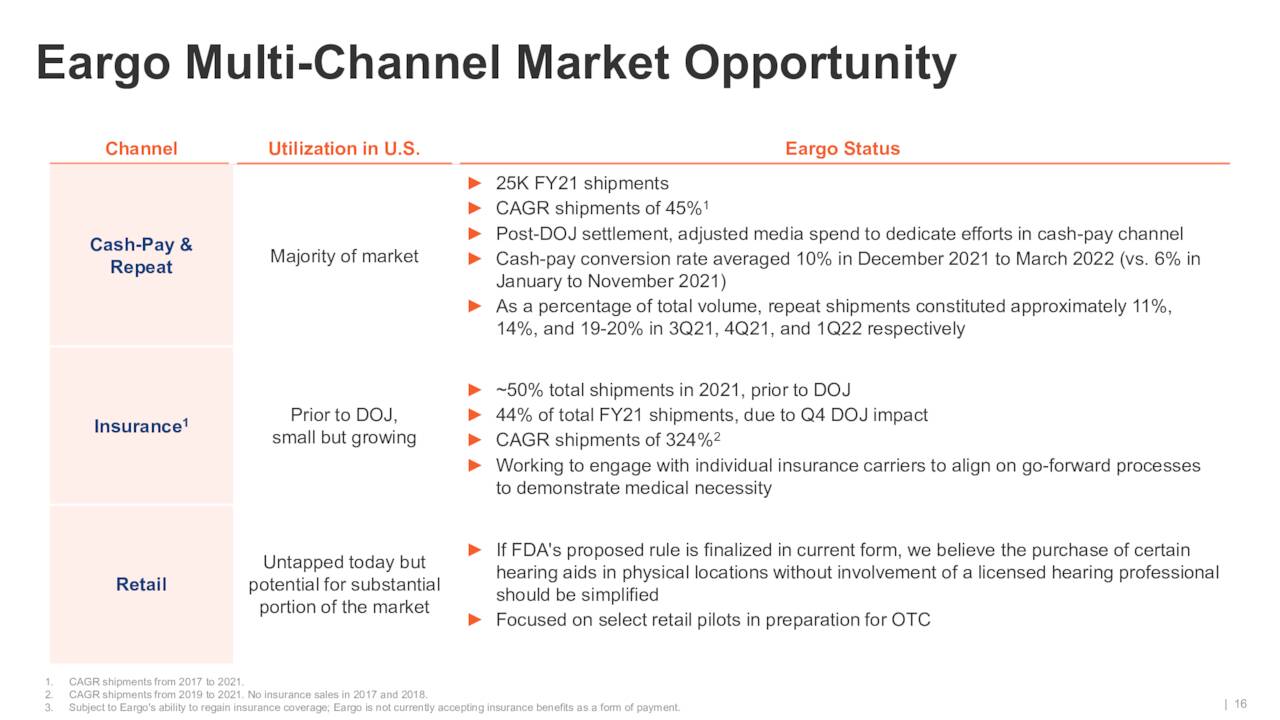

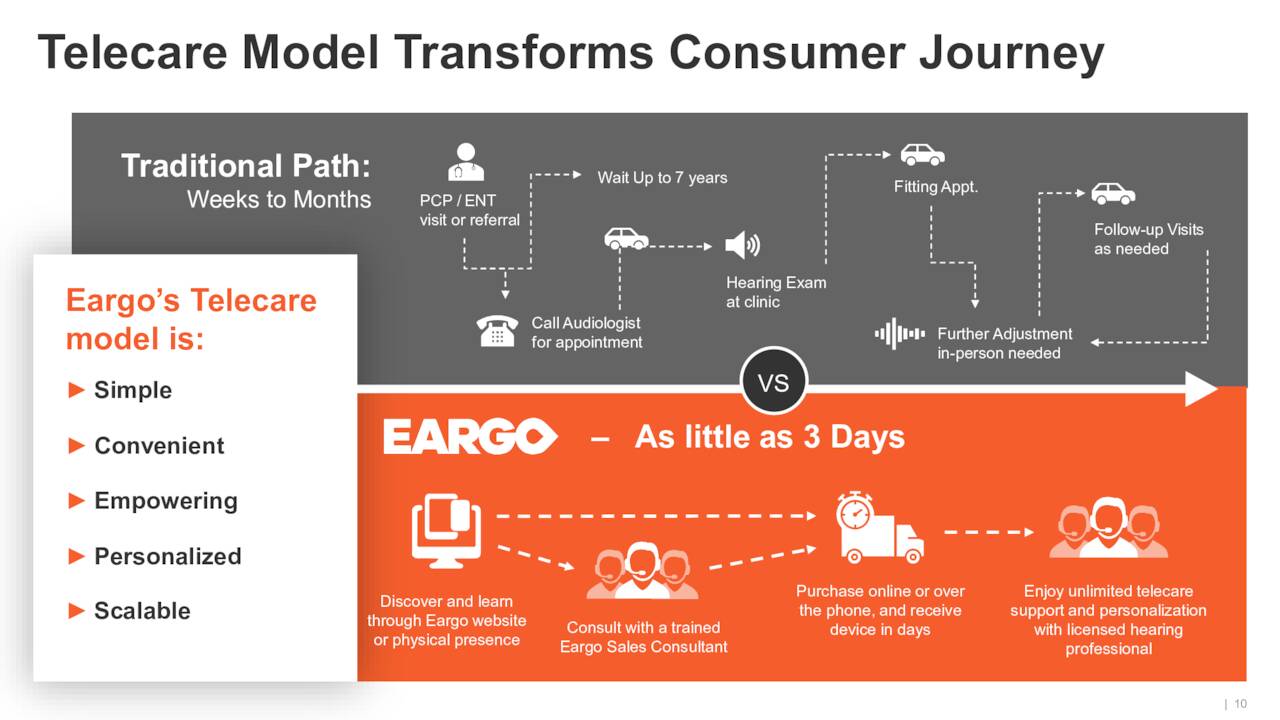

Eargo also no longer accepted insurance as a method of direct payment in late 2021. In the second quarter of this year, Eargo operated on a cash-pay only basis which tanked sales (see section below). The company did get some very good news on this front two weeks ago as the FDA disclosed it would allow the sale of some hearing aids over the counter beginning in October.

June Company Presentation

The company has shipped over 110,000 hearing aid devices in its history and believes the market is significantly underpenetrated especially for its in-ear devices that offer several advantages to traditional hearing aids.

June Company Presentation

Second Quarter Results:

On August 8th, the company posted second quarter numbers. The company had a GAAP loss of 78 cents a share as revenues plunged nearly 70% on a year-over-year basis to $7.25 million. Both top and bottom lines missed expectations badly.

Returns rose to a third of sales from just less than a quarter in the same period a year ago. GAAP gross margin was 34.7%, compared to 71.8% in 2Q2021. Management stated via its earnings press release, the company would be focused on four key areas going forward.

- Eargo’s omni-channel growth strategy

- Potentially regaining insurance coverage of Eargo for government employees under the FEHB program

- Refining and expanding the company’s physical retail strategy

- Optimize the cash-pay business while continuing to invest in innovation.

June Company Presentation

Analyst Commentary & Balance Sheet:

Wells Fargo ($10 price target), JPMorgan ($11 price target) and William Blair either maintained or downgraded Eargo to a Hold in the fourth quarter of 2021, but no analyst firms I can find have issued any ratings on Eargo so far in 2022.

Just over one out of every ten shares are currently held short. Two insiders sold just over $40,000 in aggregate earlier this month. Another insider sold less than $15,000 worth of equity in March. That has been the only insider activity in Eargo’s shares so far in 2022.

The company ended the second quarter of the year with just over $106 million in cash and marketable securities on its balance sheet. This is almost entirely due to an issuance of $100 million senior secured convertible notes that occurred late in June. This is the core tranche of a $125 million strategic investment from Patient Square Capital. $16.2 million of these proceeds were used to pay off a previous debt obligation. Management will seek stockholder approval to increase the number of authorized shares and issue full potential amount of note conversion shares at its annual meeting in October of this year. If approved, this will consist of new shares of common stock created by a rights offering.

The company posted a net loss of $32.4 million on a GAAP basis in the second quarter. $3.8 million of this was related to legal and other professional fees driven by activities related to the DOJ investigation and $5.7 million was incurred due to issuance costs related to the recent Note Purchase Agreement. Leadership stated that cash burn would be in the $20 million to $25 million range for each of the two quarters remaining for the rest of this fiscal year.

Verdict:

The current analyst consensus has the company printing nearly $2.50 a share in losses in FY2022 and revenues fall slightly for the overall year to just over $31 million. They project mid single-digit sales growth in FY2023 and net losses get cut by a buck a share.

June Company Presentation

The FDA decision this month should help bolster sales in the quarters ahead. To what extent is hard to project until investors see a full quarter of results. This won’t happen until the fourth quarter of this year, although management should provide some color on how the landscape is changing when it releases third quarter numbers in November.

June Company Presentation

It is easy to see why this stock has declined 90% over the past year given the recent decline in sales, the litigation cloud that hung over the company for the first four months of this year, Eargo’s cash burn, increasing product returns and even the recent stepping down of the company’s chairman.

Until investors see sales traction for a quarter or two and the company completes its proposed rights offering, Eargo is probably a stock to avoid. However, Eargo is a company worth circling back on sometime in 2023 to see if management is successful in starting to right the ship.

Words are often lost on dead ears.”― Anthony T. Hincks

Be the first to comment