valio84sl/iStock via Getty Images

Investment thesis

Dynatrace (NYSE:DT) is one of the leading companies in the rapidly growing IT observability market and is well positioned for capturing further market share. The company has a large base of enterprise customers who drive stable revenue growth and belongs to those few growth stocks who have a proven profitable business model. Even in the current uncertain macroeconomic environment this doesn’t seem to change. Despite strong fundamentals the valuation of shares experienced a significant backdrop this year reaching quite pessimistic territories. I think this provides a good entry opportunity for those long-term investors who are seeking exposure to quality growth names with a lower level of volatility.

Observability plays a critical role in cloud transition

After going on for several years the transition of IT infrastructure and applications to the cloud is still one of the most important trends in IT. This journey is characterized by decentralization and modularization with all its benefits and complexities. On the one hand, this results in a much higher degree of flexibility when dealing with these systems. However, on the other hand, this also results in the rapidly increasing number of connections and interrelations between these systems, leading to a much higher probability of error. Observability provides the key to prudently monitor these complex relationships and ensures that everything works as planned.

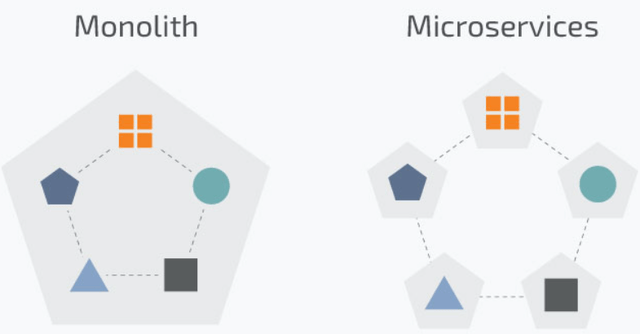

A good example for the increasing complexity of IT systems as part of a cloud transition is the replacement of traditional monolithic architectures with microservices. Within the traditional monolithic framework softwares are built as a single, indivisible unit, resulting in simpler, but less flexible systems. These are usually easier to develop and install, but it’s much harder to implement changes or make extensions, especially after they reach a certain size. In contrast to this, the microservices approach splits the entire architecture into different modules, which interact with each other:

This built-in modularity results in a system with high degree of flexibility, better scalability, and an easier understanding of the underlying building blocks. No wonder, that the market for cloud microservices is expected to grow at a CAGR of ~25% in the upcoming years. However, all this comes with increased complexity due to the numerous interactions between different modules and standalone applications that must work smoothly.

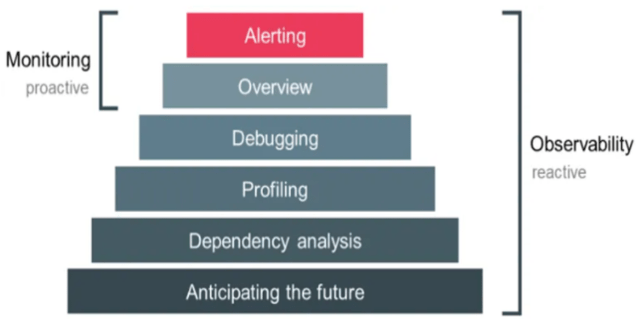

This is the point, where observability comes into play as an indispensable service for the frictionless operation of these systems. By definition, observability is the ability to determine the internal state of a system by examining its external outputs. It takes the traditional monitoring approach several steps further, which was mostly about checking whether predefined KPIs have been met. Observability provides a much deeper visibility into systems focusing on finding the root cause of different issues and providing a solution for them:

The process is based on analyzing telemetry data like metrics, logs, and traces and providing actionable insights based on these observations. The changes implemented based on these feedback loops can be automated party or entirely depending on their complexity, which can make to whole process more efficient.

Two groups of observability companies

There are several well-established public companies in the observability space, which can be divided broadly in two different groups. One group is made up of those companies who focus (or originally focused) on observability from a top-down view, so from an application or infrastructure perspective. These companies specialized in application performance monitoring and infrastructure monitoring ensuring that monitored systems are available, respond within time, etc. They analyze patterns in metrics, logs, and traces to determine whether systems work as intended and provide solutions to fix possible issues. Dynatrace belongs to this group, together with New Relic (NEWR) and Cisco’s (CSCO) AppDynamics. Also, the roots of Datadog (DDOG) can be traced back to this group.

The other group of observability companies focuses on log analysis and management, which is rather a bottom-up approach to observability. These solutions enable a deep dive into the logs produced by different systems, which data afterwards can be used for company specific purposes. Splunk (SPLK) and Elastic (ESTC) are two of the most well-known public companies in this group.

It is quite common that a company uses solutions from both groups. Typically, services from the first group identify the root cause of a problem, while log analysis and management help to fix the given problem. As an example, Dynatrace has integrations with Splunk, while Splunk has an app dedicated to Dynatrace and several companies use the services of the two companies as a complement to each other.

With the rapidly growing importance of observability, companies of both groups began to develop services typical for the other group. Currently, Dynatrace and Datadog are those companies, who managed to build a successful end-to-end observability stack, which has a broad acceptance in the market. I think this serves as a strong competitive advantage as nowadays companies tend to consolidate IT vendors to decrease costs and mitigate additional risks.

Dynatrace has an excellent product

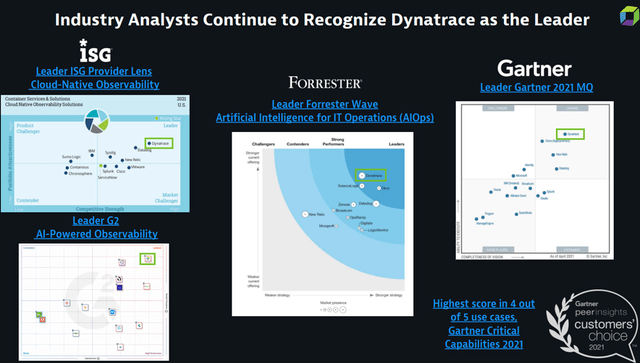

The end-to-end observability solution of Dynatrace is powered by its AI-assisted next generation Software Intelligence Platform, called Davis. This platform lends the service several automation features making it a useful tool even for less tech-savvy professionals. Based on several 3rd party research firms the technology of Dynatrace is currently the leader in the market:

Dynatrace Investor Day presentation

Looking at the opinion of IT professionals on TrustRadius reveals that the ease of implementation, the ease of use, the richness of features, the high quality of customer support and the professionality of salespeople make Dynatrace clearly a superior solution, when compared to two of the largest (and closest) competing products on the market, Cisco’s App Dynamics and New Relic.

The comparison with the services of Datadog is a fiercely debated topic among IT professionals, which could be evidenced in the comment section of my previous article on the two companies. Dynatrace focuses solely on larger enterprise customers typically with lot of legacy infrastructure in a hybrid cloud environment, while Datadog’s solution is best for a cloud-native environment. I think both solutions are very competitive, and there is enough space to grow for them for several years. As Datadog CEO, Olivier Pommel put it on a recent earnings call: “We mostly compete against customers building it themselves or being on the tool and starting in the cloud without idea what’s going on.”

Dynatrace: A unique operating model among SaaS companies

Compared to a typical company in the SaaS space Dynatrace has a unique operating model. The company balances growth and profitability now for several years by targeting 25-30%+ revenue or ARR growth coupled with a 25-30% FCF margin. A good example that the company always keeps an eye on profitability is their current guidance for FY23 after Q1 FY23 earnings. Due to macro uncertainties and elongated sales cycles Dynatrace cut back its ARR growth guidance for FY23 by 2%-points. However, at the same time they kept their prior non-GAAP operating margin guidance of 22.5-23% unchanged, by planning to reduce variable expenses and hiring to the extent, that their previously set profitability goal will be met. This shows that the company takes its commitment to profitability seriously, which is very important in the current high inflationary environment in my opinion.

Another important feature of the companies’ operating model is its subscription-based revenue model. Subscription contracts with customers are negotiated uniquely and are billed typically annually in advance. These revenues make up more than 90% of total revenues and lend stability and predictability to the business. In contrast to usage-based models (e.g.: Datadog or Elastic) this results in a lower level of revenue volatility.

Finally, Dynatrace is focusing on larger enterprise customers, targeting the top 15,000 globally. As it is evidenced by other SaaS companies this customer cohort is characterized by exceptionally strong net expansion rates and is more resistant to possible economic downturns than their smaller peers.

Recent earnings and fundamental trends have been encouraging

Analyzing the companies’ most recent earnings release (Q1 FY23 quarter ended at 30st of June) reveals, that the current uncertain macroeconomic environment had some modest negative effect on revenue growth, but in my opinion much smaller than many have feared.

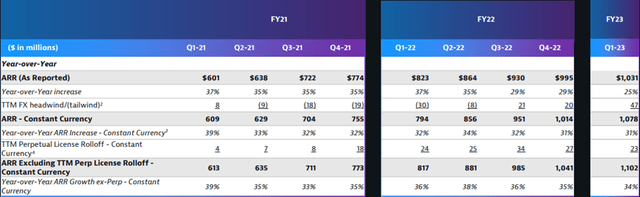

There is a very helpful slide in the companies’ earnings presentation, that helps investors getting a clear picture of underlying revenue growth trends:

Dynatrace Q1 FY23 earnings presentation

In the first row we can see that Dynatrace reached an ARR of little more than $1 billion in Q1 FY23 growing 25% YoY. For the first sight this seems quite a deceleration from the 35-37% growth levels seen in FY21 and the first half of FY22. However, if we look at the constant currency growth rate, which strips out the effect of the strengthening dollar the Q1 FY23 growth rate jumps to 31%, showing only minimal deceleration from recent quarters.

Finally, the best gauge for the companies’ underlying revenue growth momentum can be found at the bottom, which also strips out the effect of perpetual license roll-offs. Dynatrace sold perpetual licenses before transitioning to a subscription-based model, which were invoiced upfront and recognized usually over three years. As these licenses roll off and the affected customers switch to the subscription model with annual invoicing this has a small negative effect on ARR, which is rather technical and doesn’t impact underlying fundamentals. Looking at these adjusted numbers we can see that the 34% YoY ARR growth rate is still quite impressive after the 35-38% growth in the preceding 4 quarters.

Tempered expectations for FY23

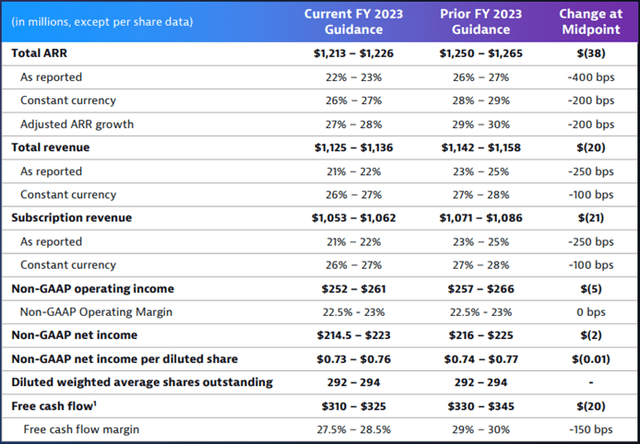

Although the first half of the calendar year turned out to be quite strong, Dynatrace began to see a slowdown in business activity in last two weeks of June. Based on management comments on the Q1 earnings call this has lasted also into July and based on the comments of some other SaaS companies it lasted into August as well, however without further material deterioration. Managements’ observations led them extrapolate the slight slowdown experienced recently for the entire financial year and decrease guidance accordingly. In the table below we can see how these changes translated into financial figures:

Dynatrace Q1 FY23 earnings presentation

The prior 29-30% YoY adjusted ARR growth rate has been decreased by 2%-points to 27-28%, which is far from a material slowdown in my opinion. According to management’s comments expansion at current customers is still tracking well as the company recorded its 17th straight quarter with a net expansion rate above 120%. Much of the expected slowdown should come from new logo acquisitions, which management expects to be flat when compared to FY22.

Looking at the growth rate of remaining performance obligations – which include the total dollar amount of contracted business – we could see a deceleration from 33% YoY growth in Q4 FY22 to 27% in Q1 FY23. This shows that new business activity has slowed down somewhat indeed. The question is, how this slowdown will play out during the rest of the year. Currently, I haven’t discovered any news that business conditions in the SaaS space have gotten materially worse since the summer.

As I have noted before operating margin expectations have been kept unchanged, which is a good proof for responsible cost management at the company. Free cash flow margin expectations have been decreased by 1.5%-points as they are impacted by the lower ARR expectations to a larger extent because subscriptions are billed typically annually at the beginning of a contract. Still, the company had $571 million in cash at the end Q1 FY23 after an increase of $108 million in the quarter. Long-term debt amounts only to $244 million, so the balance sheet of Dynatrace is quite strong.

In conclusion, fundamentals are holding up well, there is no sign of materially deteriorating business conditions. I think Dynatrace will be able to operate as a Rule of 50 to 60 company in the upcoming years.

Attractive valuation within the IT space

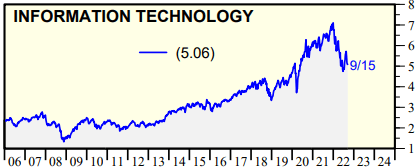

Looking simply at the historical valuation of Dynatrace shares shows, that based on the TTM EV/Sales ratio shares are valued around their historical lows:

This has nothing to do with the companies’ fundamentals as these showed improvement during the previous years. The compression of the valuation has been the result of the increasing interest rate environment that impacted stock market valuations all around the globe.

I think the shares of Dynatrace have been punished disproportionally within the IT sector, especially that the company is a “positive exception” among growth stocks with its a proven track record of profitability. Currently, the shares of Dynatrace trade at a forward P/S ratio of ~8 compared to the multiple of ~5 characterizing the S&P500 IT sector:

Yardeni Research

After taking the divergence in growth prospects into account I think the shares of Dynatrace are undervalued compared to the IT sector in general. Based on FactSet consensus S&P500 IT sector revenues are expected to grow 9.2% in CY22 and 6.4% in CY23. In the meantime, Dynatrace revenues are expected to grow around 22-23% annually over the same time horizon having much more upside to current forecasts in my opinion. If share prices would remain constant this would mean that the current valuation gap of ~3 (Dynatrace forward P/S of 8 vs IT sector forward P/S of 5) would narrow to ~1.75 within one year. Even with forecasting 10% revenue growth for the IT sector in CY24 the valuation gap would narrow further to ~1 in two years, or it could even close, if Dynatrace manages to grow revenues in the 30-35% range.

Taking into consideration that Dynatrace operates in the most profitable, Systems Software subsector of the IT sector with a far above average gross profit margin of 80-85%, I think its shares are deeply undervalued within the IT space. A good example for this is, when we compare the valuation of shares to that of Microsoft (MSFT):

Looking at TTM EV/Sales we can see that currently the market values the shares of Dynatrace almost equally to Microsoft, although a significant valuation gap existed for the past three years. I think the shares of Dynatrace are a much better investment for the same price as the company is one of the leading players in one of the hottest markets in IT, where transformation is only in the early innings. Microsoft is also present in some of these segments but is mostly exposed to more mature markets with significantly smaller growth opportunities.

Conclusion

In conclusion, I think investors got overly pessimistic towards Dynatrace shares because the stable, long-term growth prospects and the strong free cash flow generating ability of the company are not reflected in the current valuation properly. Even in the current high interest rate – low growth environment the shares of the company are a good investment in my opinion, because if growth in many other sectors diminishes, Dynatrace will grow revenues and profits still nicely due to its unique operating model and the mission critical business the company operates in. This has been already evidenced during Covid in 2020, where top line growth of the company suffered only a few percentage-points deceleration with the bottom line significantly improving thanks to cost savings.

I think if inflation begins to decelerate this year and the rise in long term interest rates comes to an end, Dynatrace shares should rise more than 50% from current levels to trade at a TTM EV/S of ~15 instead of the current ratio of 9.4. This would be a reasonable valuation between the current negative extreme of ~10 and the positive extreme of ~25 evidenced at the end of 2021 in my opinion.

Be the first to comment