IgorSPb

Investment thesis

Dynagas LNG Partners (NYSE:DLNG) continues to reduce debt and increase equity. Its 6 LNG carriers are fully employed on period charters, with the Arctic Aurora on charter to Equinor (EQNR) becoming available only in the 3rd quarter of 2023.

Europe’s dependence on Russian gas, which 83% of DLNG’s fleet is employed transporting, will take time to switch to other sources.

Before DLNG finally releases its Q2 and FH 2022 results, it is a good time to assess its status and also look into the ethical issue of being invested in DLNG.

Financial results

Why it takes the management almost three months to prepare a simple financial report is beyond my comprehension. As of writing this article on the 16th of September, it is still not released.

After all, the company only has 6 vessels fully chartered out, so there are very few variables.

All the net profit is going towards building equity and servicing debt and paying dividends on the preferred shares.

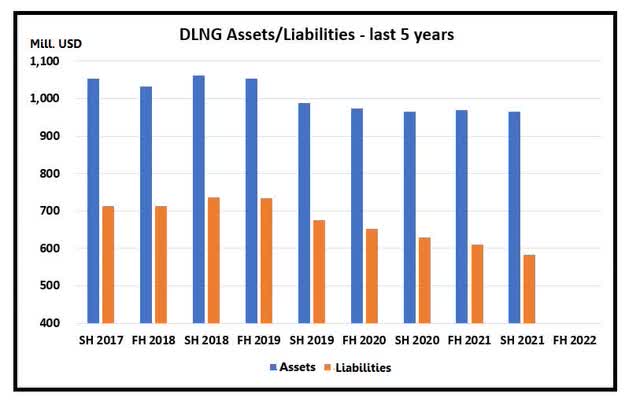

DLNG assets and liabilities over the last 5 years (Data from DLNG. Graph by author)

DLNG has certainly been able to reduce its liabilities, but we must also consider that the “pie” is shrinking as the book value of the assets is also going down. The ratio of assets to liabilities has gone from 1.48 five years ago to 1.65 as of the end of 2021.

From its Q1 results, we know that DLNG’s quarterly breakeven daily rate, including all operating G&A expenses, debt service payments and class survey costs, amounted to $55,300.

The company managed to earn an average of about $62,200 per day per vessel.

Fleet growth and renewal

During the Q1 2022 results, DLNG’s CEO Tony Lauritzen came out with the following statement:

We continue our strategy of using our cash flow generation to deleverage our balance sheet and reinforce our liquidity so as to build equity value. This, we believe, will enhance our ability to pursue future growth initiatives. (Highlight by author)

Herein lies the dilemma that the company faces. It is a small company with only 6 vessels. These vessels do need to be renewed over time. LNG vessels generally have a longer life than run-of-the-mill dry or wet bulk carriers. They should as they cost USD 240 million when they are new.

The average age of DLNG’s fleet is now 11.8 years, with half of the fleet being 15-year-old. These do still have another 10 years of life, at least.

However, even though they can trade, there are already more efficient vessels owned by competitors, and just like your own computer and car gets old, so do ships.

New and more efficient propulsion systems keep being invented. These may enable lower fuel consumption, lower pollution and lower operating costs and higher earnings from more cargo carried. One example of this is the recent collaboration between Siemens (OTCPK:SMEGF), Moss Maritime, Fearnley LNG, and DNV. The development is planned to have a hybrid combined-cycle power and propulsion plant called Ocean Green.

Ocean Green concept LNG Hybrid vessel (Siemens Energy)

To add or even just renew the fleet is expensive.

This can only be done by adding equity to DLNG.

This is also one reason why I believe that owners of the common units should not expect much dividend from 2024 when the company technically will be in a position to resume paying a dividend.

An ethical dilemma

I do understand that DLNG is not breaking any laws, as it is in compliance with applicable U.S. and EU sanctions. As of now, the current U.S. and EU sanctions regime have broadly exempted LNG shipping.

Nevertheless, DLNG is trying to distance itself from the Russian companies that in effect control the money stream that gets into DLNG’s bank account from the charter hire payments.

Yes, we all know that even DLNG is registered in Marshall Islands, and Gazprom uses its trading company in Singapore, but it changes nothing.

The gas comes from Russia and that is where the money ultimately goes. Money that is bankrolling Putin’s regime’s war against Ukraine. A war that most people can agree was started by them and is tragic on so many levels.

DLNG was quick to point out that Gazprom Marketing and Trading of Singapore, is owned indirectly by Gazprom Germania. Gazprom Germania, including its subsidiaries, has been under the German government’s control. Are they trying to say that the German government has any control over where the ships sail and where the gas can be exported?

On 2nd September, DLNG’s largest customer Gazprom decided to shut down the Nord Stream 1 gas pipeline indefinitely. European Commission chief spokesman, Eric Mamer, said:

Gazprom’s announcement this afternoon that it is once again shutting down Nord Stream 1 under fallacious pretenses is another confirmation of its unreliability as a supplier.

Germany presently does not have any LNG import facilities. German LNG Terminal plans to build an import and distribution facility at the North Sea port of Brunsbuettel near Hamburg. It will have a capacity of 8 billion cbm. per year. The plan is to start operating latest by 2026.

As a temporary solution, before the LNG terminal is ready, they have chartered 4 FSRUs on period charters, 2 of which come from DLNG’s sponsor and main investor, the privately owned company Dynagas Ltd.

It is becoming a “do as I say, not as I do” policy these days.

One good example of this is Sweden which has a clear mandate from the Swedish people and an earlier announcement from the Parliament to stop importing Russian energy. Despite this, the country continues its imports. It just took a cargo of LNG from Russia being shipped on a small LNG vessel called “Coral Energy”, owned and operated by the Dutch company Anthony Veder.

As Ice-classed vessels, their target market was always going to be the export of LNG from the Russian Arctic and the Far East, as their competitive advantage would be that there is a limited number of Ice-classed vessels.

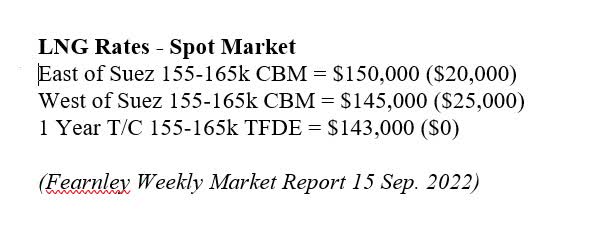

But should they look at regular trading – the spot and 1-year time-charter market are considerably higher than what they are earning.

LNG transportation spot and 1 year TC (Fearnley Weekly Market Report 15 Sep. 2022)

A potential cancellation of the charter with Gazprom, and Yamal for that matter, would not hurt DLNG’s earnings at this moment.

Conclusion

Over the last year, I have posted three articles with sell calls on DLNG.

After my March article, the share price did, indeed, go up by 42% as I wrote in June. It has since gone down, but the movement in the price is for me immaterial at this point.

If you own or want to buy a piece of DLNG, you have to be fully aware that you want to take part in helping Russia wage a war against Ukraine. No matter how small your part is.

There are in my opinion better alternatives out there where you as an investor can take part in the production and transportation of LNG. Why choose DLNG?

For me, the ethical issues, alongside the limited chance of DLNG returning to the distribution of a meaningful dividend on its common equity makes it a less attractive investment.

We all have to make decisions on who we want to do business with and who we invest alongside.

I was once a shareholder in DLNG, but what has happened over the last year precludes me from returning to its list of shareholders. This is purely my personal opinion and you will surely have your own.

I maintain my sell stance.

Be the first to comment