Brandon Bell

The optimism toward Digital World Acquisition (NASDAQ:DWAC) stock has cooled. Digital World stock traded above $100 soon after its merger with President Donald Trump’s Trump Media & Technology Group was announced in October; it neared triple-digits again in early March after TMTG’s Truth Social app was released on the Apple (AAPL) iPhone.

From those March highs, however, DWAC has plunged roughly 70%. The drama surrounding social media rival Twitter (TWTR), a softer market for more speculative stocks, and regulatory drama no doubt all have contributed to the decline.

But the size of the decline alone doesn’t make the stock a buy, a lesson being emphasized over and over in this market, where so many growth names have fallen 70% – and then another 70%. DWAC doesn’t necessarily have to follow that same trajectory, but with valuation still a reasonable concern and the long-term strategy unclear, a cheaper price alone doesn’t make the stock attractive.

DWAC Stock Key Metrics

It’s important to note up front that TMTG still has a hefty implied valuation. Pro forma for the merger, the company has about 213 million shares outstanding:

DWAC/TMTG Pro Forma Share Count

| Class | Number Of Shares |

| Existing TMTG Shareholders | 87.5M |

| DWAC Shareholders | 28.75M |

| Sponsor Shares | 7.9M |

| PIPE | 29.77M |

| Earnout Shares* | 40.0M |

| Warrants** | 15.7M |

| Convertible Notes | 3.16M |

| Total | 212.8M |

* – 15M shares if volume-weighted average price clears $15 for 20 of 30 trading days; 15M more at VWAP of $20; 10M at VWAP of $30. Given current price, worthwhile to model entire earnout

** – figure from S-4, includes sponsor warrants

Post-merger, then, at the current price TMTG would have a market cap of about $6.4 billion, and an enterprise value right at $5 billion (the company is raising $1.25 million in cash and presumably will garner another ~$180 million from warrant exercise).

Why Has DWAC Dropped?

Admittedly, $5 billion is a huge haircut from the ~$20 billion implied when DWAC stock touched $100. That $20 billion figure simply seemed untenable – but that aggressive valuation is far from the only reason DWAC stock has fallen.

Equity market nervousness no doubt is one factor. The NASDAQ Composite has declined 12% since Mar. 1, and more speculative names have performed far worse.

The drama over Tesla (TSLA) CEO Elon Musk’s proposed and (probably) abandoned acquisition of Twitter has buffeted DWAC stock. Much of the commentary has focused on whether Musk would let Trump back on to the platform, ostensibly removing a key competitive advantage for Truth Social, which has tied its branding to the former president. Indeed, DWAC stock soared when Musk walked away from the acquisition.

But it’s also worth noting that the implied value of Twitter no doubt has plunged over the past few months. The $40-plus per share value for Twitter is based in large part on the probability that the company succeeds in its effort to make Musk go through with the deal. A standalone Twitter probably is worth $10 billion to $20 billion, depending on an investor’s perspective. Some of Twitter’s problems are self-inflicted (it infamously is the “clown car that fell into a gold mine”), but social media stocks are down across the board. For instance, Snap (SNAP) shares are down an incredible 80% year-to-date (though, almost as incredibly, the platform still is valued at roughly $25 billion).

Regulatory concerns have hit the stock as well. A series of subpoenas appear to threaten the merger between Digital World and TMTG; well-known short seller Kerrisdale Capital has argued that the tie-up will be blocked, sending DWAC back to $10-plus (its amount of cash in trust).

Each of these factors matters. I argued even at $70 that the implied valuation was far too high. Online advertising weakness means lower revenue once Truth Social ad sales begin, and lower peer valuations as well. The SEC investigation adds downside risk. In the context of everything that has happened, the decline isn’t surprising. The question is whether, at $30, DWAC stock is cheap enough.

Is DWAC A Safe Investment?

There’s a case that the stock isn’t cheap enough. $5 billion remains a hefty valuation for a business that isn’t generating any revenue at the moment, and almost certainly won’t do so until next year. At the very least, $5 billion is not an obviously attractive valuation – particularly in the context of significant risks going forward.

As noted, one key risk is that the merger with TMTG doesn’t actually go through. Digital World has disclosed that it’s been served subpoenas from the Securities and Exchange Commission regarding communications before the merger of the two companies was announced. The New York Times has reported that Trump Media and Digital World head Patrick Orlando were in talks before Digital World’s own initial public offering. That contact ostensibly would violate regulations around SPACs, which must go public without a pre-chosen target.

To be fair, the regulations in this situation aren’t entirely clear. Talks between Orlando and TMTG were held before the DWAC IPO, but as The Times reported (and Digital World confirmed in its S-4, see p. 153) those talks concerned another Orlando-sponsored SPAC, Benessere Acquisition (BENE). (Benessere now has an agreement to take hydrogen play eCombustible public. It too has received a subpoena, which strongly suggests that the nature of pre-merger talks is part of the SEC’s focus.)

Per the DWAC S-4, talks between Benessere and TMTG were held from February to April of 2021, then “stalled”, and were resumed in June before a letter of intent was terminated on Sept. 1. (The Times reported that Benessere, which had raised only $100 million, wasn’t big enough for TMTG’s plans.)

Two days later, DWAC’s IPO closed; per the filing, Digital World got right to work, contacting at least 15 different companies. It would continue discussions with TMTG, and announced the merger the following month. The discussions with TMTG did take some time, with President Trump’s role a key part of the negotiations. (Former Trump aide Jason Miller was aggressively courting Trump for its Gettr platform; the S-4 notes that Miller told the New Yorker he had made an offer with “a whole lot of zeroes.)

There’s a possible version of events here where Orlando indeed launched DWAC to build a larger SPAC for a TMTG deal, and contacted other SPACs simply so that decision wasn’t so obvious. But, again, it’s not clear that contact with TMTG via Benessere necessarily poisons the DWAC deal, and even if that’s what happened (we’ve been given little, if any, evidence that it did), I’m personally skeptical the deal gets scuttled.

Under Gary Gensler, the SEC hasn’t shown much appetite for taking big swings even as the crypto bubble swelled and burst. An agency whose mission is to protect retail shareholders probably doesn’t want to wipe out ~$600 million in paper value (between DWAC stock and warrants) largely owned by retail investors who haven’t done anything wrong.

Trump himself already has argued that the investigation into DWAC and TMTG is driven by political bias. Anything but an absolutely airtight case – ‘airtight’ perhaps defined as including an actual email from an executive saying “yes, this is illegal but we’re going to do it anyway” – is going to elicit similar claims. Even in that scenario, the time the SEC gets a chance to actually deliver its evidence, the outrage cycle will have peaked and moved on. Punishing DWAC shareholders simply doesn’t seem a move that has much logic.

It’s possible there’s a proverbial smoking gun here that leads to regulators blocking the DWAC-TMTG merger. But it appears a big stretch for this agency, under this leadership, to send this stock down 60%-plus. If Orlando stretched or broke the rules, from here the more likely punishment seems a fine and/or the forfeiture of sponsor shares.

But that’s far from the only risk. Political considerations are part of the reason TMTG and Truth Social exist – and a potential roadblock to their success. As Reuters reported last month, Truth Social has had difficulty attracting talent for both political and reputational reasons. Similar headwinds will arise when Truth Social looks for advertisers; those advertisers may face pressure from other groups should they decide to support the platform.

The S-4 notes that Trump himself has a modest form of exclusivity with Truth Social; Trump must post first on the platform and then can post anywhere else six hours later. But there’s an exception for “political messaging,” which presumably gives Trump a lot of leeway should he run for president in 2024 and, particularly, if he should return to the Oval Office.

There’s a way to see Truth Social losing either way. If Trump isn’t elected in 2024 (or if he doesn’t run), his influence perhaps wanes and his value to the site withers. If he is elected, he can return to the wider reach of Twitter (Trump has said he won’t do so, but political considerations could force a reversal of that stance; Twitter was a key part of his 2016 win).

Finally, there’s the nature of the platform itself. So far, Truth Social is small, with daily active user figures appearing to be in the range of 500,000. Cumulative downloads, per data from Sensor Tower via Statista, total about 6 million.

Twitter had 238 million daily monetizable active users in its second quarter. Notably, more than 80% are international – markets where Trump’s brand isn’t as strong and where Truth Social needs to build massive infrastructure to handle ad sales and, importantly, manage complex restrictions concerning user data.

In that context, a valuation that is one-half or even one-fourth that of a standalone Twitter isn’t a steal. Even down 70%, DWAC stock still is pricing in an awful lot of success here.

What Is The Future For DWAC?

But it’s worth considering one of the core points I made earlier this year, one that for whatever reason still doesn’t seem to have permeated the conversation around DWAC stock.

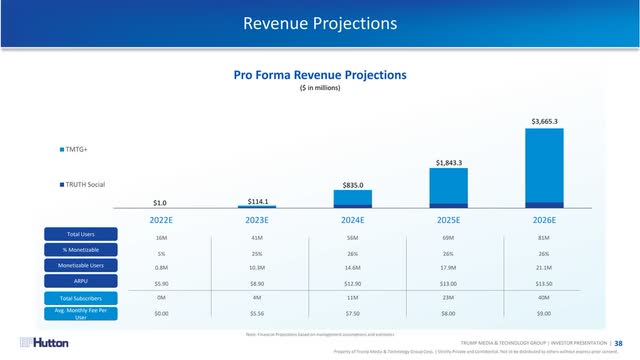

That point is simple: TMTG’s growth does not rely on Truth Social, according to its own projections:

TMTG Investor Presentation, November 2021

Rather, this is a streaming video play. By 2026, TMTG projects 81 million users for Truth Social, about 26% of which are monetizable. (The justification for that projection, which relies in part on polling of potential users in the US, is another reason to believe that the platform’s international reach likely will be relatively limited.) ARPU of $13.50 is a little more than half what Twitter generated in the twelve months ending September 2021 – a period that in retrospect looks like it might have represented a cyclical peak for online advertising demand.

Add it up and TMTG itself sees Truth Social generating less than $300 million in revenue in 2026. That’s a business, even with a premium to peers in the space, maybe worth $2.5 billion, given TWTR and SNAP currently trade at 6x revenue or so. Whatever the specific inputs to the model, barring massive outperformance it’s difficult to get Truth Social to a $5 billion valuation in 2026, let alone $5 billion discounted back to the present.

Some value needs to come from TMTG+, the planned streaming video play. But it’s exceptionally unclear what the company’s edge in the space will be. Per the S-4, the agreement with Trump only gives TMTG a right, essentially, to beat another offer:

If President Trump receives a bona fide offer to be featured in any production intended to be streamed on a different VOD service, TMTG has the right to create a substantially similar video production on terms more favorable than those offered by the other service.

TMTG+ is aiming for a different lane in streaming, admittedly. As the S-4 describes the business model:

TMTG intends for TMTG+ to be a subscription based direct-to-consumer video streaming service that will include unique programming. TMTG+ intends to offer programs including, but not limited to blue collar comedy, cancelled shows, Trump-specific programming, faith-based shows, family entertainment, shows that embrace the Second Amendment, and news. TMTG intends to license, produce, and deliver news, sports, and non-woke entertainment content through this platform. TMTG+ will provide a platform for conservative and/or libertarian views, and otherwise cancelled content from other broadcast television and/or digital streaming platforms. TMTG also intends to create, operate, and commercialize a podcasting platform as a part of its TMTG+ streaming service.

This part of the bull case runs into problems. The first is that this kind of content is going to be expensive. In 2013, Netflix (NFLX) generated ~$3.5 billion in streaming revenue, roughly equal to the projected 2026 revenue for TMTG+. That year alone, Netflix spent $3 billion on streaming content on top of nearly $5 billion in the two previous years combined.

With Truth Social running losses as it grows, the only way to fund the billions required in content spending is to dilute TMTG shareholders significantly. There’s simply no other option: early in their growth cycle, the company’s assets won’t be enough to secure any material amount of borrowing.

The second problem is getting the user base to the point where valuation becomes material. DWAC projects 40 million subscribers in 2026 paying $9 monthly. Paramount Global (PARA) (PARAA) hit that bogey (on a global basis) with its Paramount Plus service in Q1, but it has a massive, decades-old library and spent nearly $17 billion on content last year. Obviously, a good chunk of that content isn’t serving Paramount Plus; for instance, the company is spending billions annually on its NFL deal with CBS. But, again, to support a 40 million-strong base, TMTG is going to have to spend billions and billions of dollars it will not have even after the merger closes.

If TMTG+ can’t get to the 40 million level, valuation becomes a problem on this side of the business as well. AMC Networks (AMCX) closed Q1 with 9.5 million subscribers to its largely niche streaming services; even with a “melting ice cube” business in linear TV still throwing off free cash flow, AMC has an enterprise value under $3.5 billion.

Is DWAC Stock A Buy, Sell, or Hold?

Even at $30, the math surrounding DWAC stock starts to break down. The share count is going to increase, perhaps significantly, over the next few years (unless TMTG+ doesn’t launch, which obviously isn’t good news for the stock). A US-only, or even US-focused, Truth Social has to perform reasonably well to achieve a multi-billion-dollar valuation; at the least, Truth Social has to be a strong second relative to Twitter in the U.S.

TMTG+ needs millions of subscriptions in a crowded market – and it needs to build a streaming platform completely from scratch. That’s something that’s never really been done before; Amazon.com (AMZN) had no media business, but it had a massive existing base of customers. Netflix had its DVD-by-mail offering. Paramount, Disney (DIS), and others have existing libraries that have been built over decades.

There’s a world in which both businesses have success and the stock still declines between now and, say, 2027. 20 million mDAUs and $300 million in revenue for Truth Social suggest a valuation of maybe $2-$3 billion; 10 million subscribers for TMTG+ (not a bad outcome when starting from zero) suggests annual revenue of $1 billion-plus and, based on comps, a valuation perhaps in the $4 billion range.

Assume the share count has risen to 300 million (with equity offerings raising $2.5-$3 billion to fund the launch of TMTG+) and the stock is worth ~$23. This is a back-of-the-envelope model, obviously, but it gets to the idea that both businesses need to be highly successful to drive any upside from here, let alone market-beating returns.

And success isn’t guaranteed. TMTG’s management is not terribly experienced; chief executive officer Devin Nunes was hired after stints as a dairy farmer and a congressman. There are other companies focusing on anti-censorship and/or “non-woke” branding, including Gettr on the social media side and Fox’s (FOX) (FOXA) Fox Nation in streaming.

There are stumbling blocks for the business – and for the stock. The PIPE investment alongside the merger echoes “death spiral financing,” and could pressure the stock post-close. Further pressure on social media and/or streaming companies can further reduce relative valuation; another leg down in the market sell-off adds another source of risk.

To be sure, it’s possible this can work. But there is a long, long way to go and a lot of potholes along the way. For that kind of story, investors should be looking for a fundamental discount. Even with DWAC stock down 70%, that’s not what they’re getting.

Be the first to comment