William_Potter

Overview

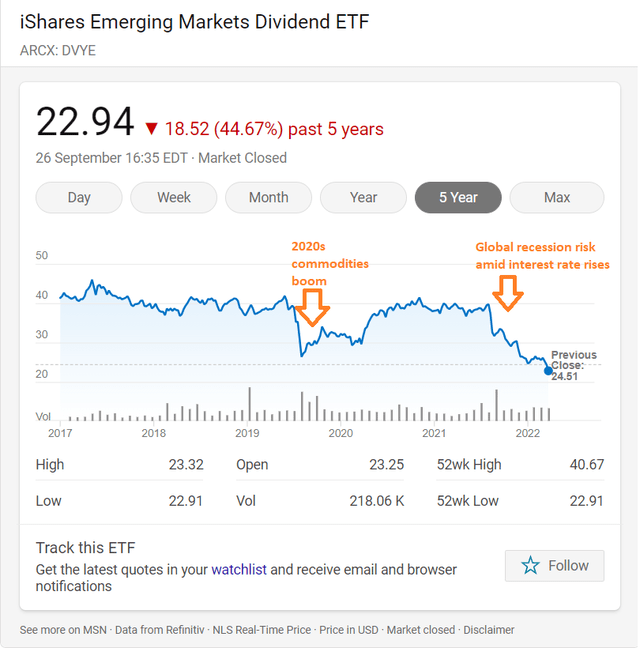

The iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE) (“the fund”) provides exposure to a broad range of established companies in emerging markets countries.

The fund is invested in approximately 100 stocks and is predominantly exposed to Brazil and China, which represent nearly 40% of the fund.

The fund has a total expense ratio of 0.49% per annum (7th cheapest among similar ETFs) and pays a dividend yield of 6.83% (1st among similar ETFs).

The fund is managed by BlackRock (BLK), which is one of the largest asset managers in the world. BlackRock is known for providing better liquidity than other asset managers due to higher assets under management and therefore higher trading volume in its exchange-traded funds (“ETFs”).

Liquidity is an important factor to consider when investing in foreign assets. The ability to cash out in times of stress without a massive discount is key to protecting your portfolio gains.

Analysis of sector exposures

The fund is predominantly weighted towards the Materials, Utilities and Energy sectors, which represent nearly 45% of the exposures.

Materials have been a beneficiary of the 2020s commodities boom. Excess demand combined with a supply chain crisis created a commodity super cycle which was beneficial for the fund.

However, the risk of a global recession threatens to derail this commodities boom.

Similarly, the Energy and Utilities sector have capitalized on the 2022 Russian invasion of Ukraine although it is expected that oil and gas will moderate with the risk of a global recession.

Impact of macroeconomic uncertainty on the fund

The Federal Reserve has been continuously changing U.S. interest rate projections for 2023.

On September 2021, the average FOMC participant projection for the Federal funds rate was approximately 1% for 2023. Projections have been revised to 4.25% in September 2022.

The Federal Reserve is determined to fight inflation and there is further upside risk to the above projections.

U.S. interest rate projections have been constantly revised over the past year and there is a strong possibility it will change again.

Therefore, there is strong re-pricing risk for the iShares Emerging Markets Dividend ETF.

Increases in the federal funds rate to 4.25% will increase the risk-free rate for equity investments and will trigger a re-assessment of the required rate of return for investors.

As long as the Federal Reserve keeps tightening monetary policy, this will create downside risk for the fund.

Investors will regain confidence in emerging markets when the Fed stops tightening and the macroeconomic uncertainty subsides. It might be wise to wait for more clarity before investing in emerging markets.

The fund has generated a total cumulative loss of –15% since its inception in 2012 and is, therefore, heavily dependent on the dividend yield for returns.

It currently pays a dividend yield of approximately 7%, which might no longer be suitable if the Federal funds rate goes higher.

The macroeconomic uncertainty caused by monetary policy tightening in the U.S. and the war in Ukraine will also continue to widen equity risk premiums for emerging markets.

Investors will continue to demand better risk-reward to invest in emerging markets as long as the macroeconomic uncertainty continues.

Conclusion

The iShares Emerging Markets Dividend ETF is the highest dividend payer among similar ETFs, and the total expense ratio is moderately expensive.

The macroeconomic environment is unkind to emerging markets at the moment.

It might be wise to wait before investing in the fund. I believe there will be better opportunities to invest when we are closer to the end of monetary policy tightening.

If you enjoyed the post, please like, comment and subscribe to receive my latest articles!

Be the first to comment