PM Images/DigitalVision via Getty Images

The VanEck Durable High Dividend ETF (BATS:DURA) seeks established, resilient players capable of delivering durable dividends, which is obviously of value in the raging bear market.

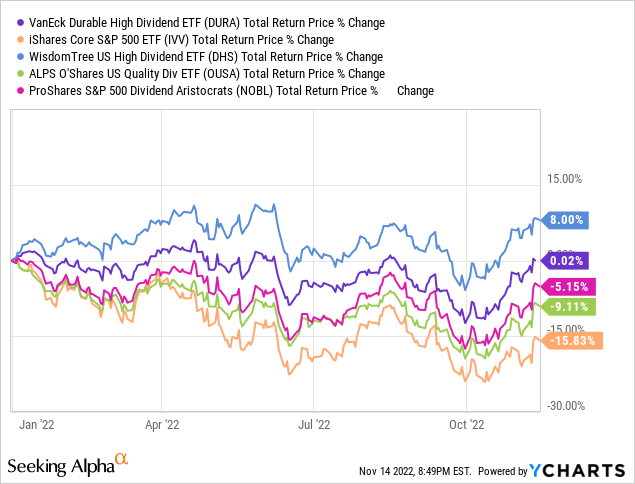

Amid the triumph of value investing, DURA’s growth-light dividend portfolio has been chugging along this year, with a 2 bps total return. For the selected peers ProShares S&P 500 Dividend Aristocrats (NOBL), WisdomTree U.S. High Dividend ETF (DHS), and ALPS O’Shares U.S. Quality Dividend ETF (OUSA) the year has been more challenging, let alone for the iShares Core S&P 500 ETF (IVV).

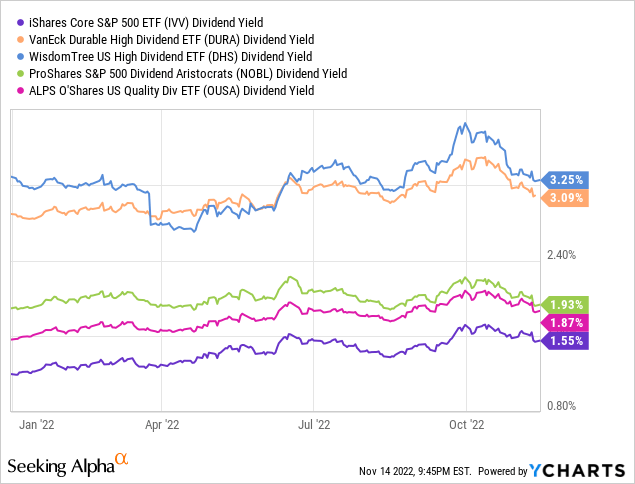

Its dividend yield has almost not changed this year, sitting at a competitive level of ~3%.

That said, I assign DURA a Hold rating for a few reasons.

First, on the positive side, the ETF has an appealing mix of comparatively attractive performance YTD (including moderate volatility), reasonable fees, competitive yield, and exemplary quality intimately intertwined with the mega-cap factor.

Nevertheless, this is a mega-caps-heavy portfolio, with valuation issues inherent to that echelon, which adds to difficulties as interest rates are climbing higher, magnifying the risk of a recession that could trigger a new wave of multiples compression. More on that is below in the article.

DURA: looking under the hood

DURA has been tracking the Morningstar US Dividend Valuation Index since 30 October 2018. The Morningstar US Market Index is the selection universe, from which only qualified dividend payers (REITs are shown the red light) covered by analysts (have a fair value estimate) can compete for inclusion. To whittle the list down to the fittest names, the provider focuses on the TTM dividend yields and proprietary measures like the distance to default and the star score.

Its weighting schema brings together a float-adjusted market cap and “a trailing 12-month dividend yield multiplier,” which should slightly tilt the portfolio toward the value factor. More details on the process are available on the Morningstar Indexes website.

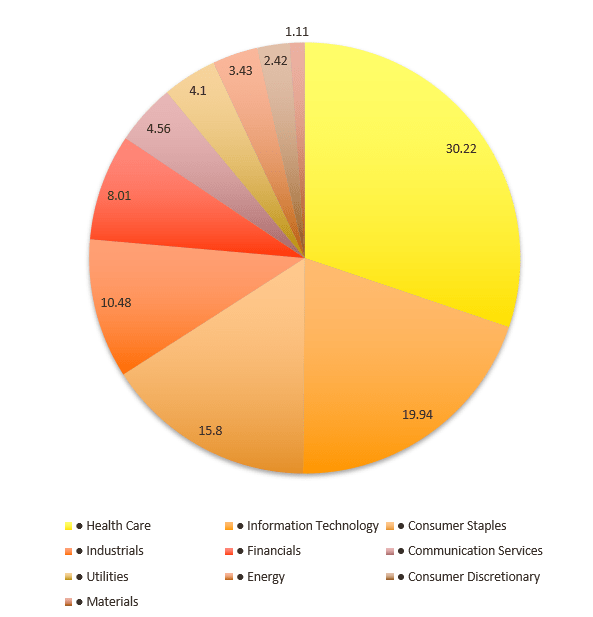

The current version of the portfolio (reconstituted in September) features 63 equities, with the top ten accounting for 47.8% of the net assets. DURA favors healthcare, IT, and consumer staples, being expectedly skeptical about energy, consumer discretionary, and materials, the sectors than are more closely connected to the economic cycle (e.g., commodity prices which could easily hamstring any dividend story, even the seemingly most reliable one, cemented by a decades-long reputation, as we saw in 2020).

Created by the author using data from VanEck

The fund has little faith in mid-caps, with just 2.2% allocated to the echelon (sub-$10 billion in market value), while there are no small-caps in the mix, at all. This is consistent with the ETF favoring resilient dividend payers, and smaller-size companies typically have weaker margins and volatile cash flows, which is barely supportive of sustainable dividend stories. Overall, as per my calculations, the weighted-average market capitalization is $141.6 billion, which is a mega-cap territory, mostly owing to 66% of the fund’s net assets being allocated to over $100 billion companies.

The reasonable question worth asking here is whether this mix has passable value characteristics. And the fact is, the fund has relatively successfully amalgamated value, quality, and dividend factors; unfortunately, at the expense of growth, but it is close to impossible to balance the previous trio with the appealing expansion stories. Yet there is also something disappointing.

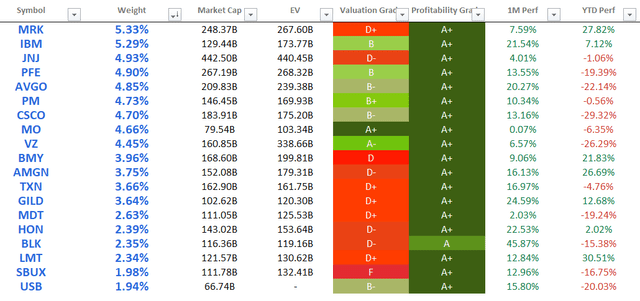

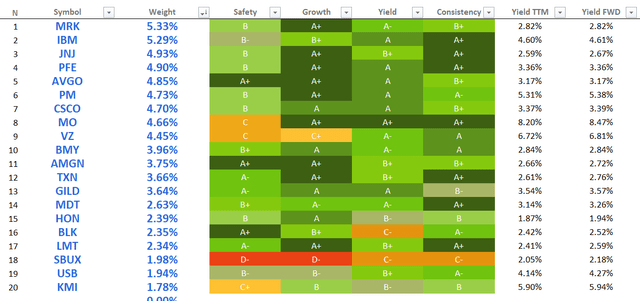

As of my analysis, about 41% of the holdings have an at least B- Quant Valuation grade, a result fairly rare amongst the portfolios tilted towards the largest companies in the world. The fly in the ointment here is that the share of stocks with passable valuation (a C rating) is too small, at just ~8%, with the rest being seemingly overvalued, with ratings of D- and worse. The table below combines data from the top 20 holdings, and most of them are valued horribly.

Created by the author using data from Seeking Alpha and the fund

However, what should also be of interest is that the earnings yield (E/P) an investor would get on this mix is around 5.4% compared to IVV’s of ~5.2%. This is not an ideal level, yet it illustrates that DURA is slightly undervalued. The debt-adjusted yield (EBITDA/EV) for the non-financial stocks, as per my calculations, is around 8.4%. The cash flow yield (again, ex-financials) is approximately 8.2%, which is an acceptable result. In sum, this is completely adequate for a mega-cap basket.

Delving deeper, we see its robust quality is a plausible reason for DURA’s earnings yield being only slightly lower than IVV’s. Only two stocks, namely utilities Entergy Corporation (ETR) and Hawaiian Electric Industries (HE) have seemingly soft profitability compared to the sector, with D (+/-) ratings. However, please do note that 1) both are EBITDA-, cash flow-positive, and profitable, and 2) both a forecast to deliver EBITDA growth next year.

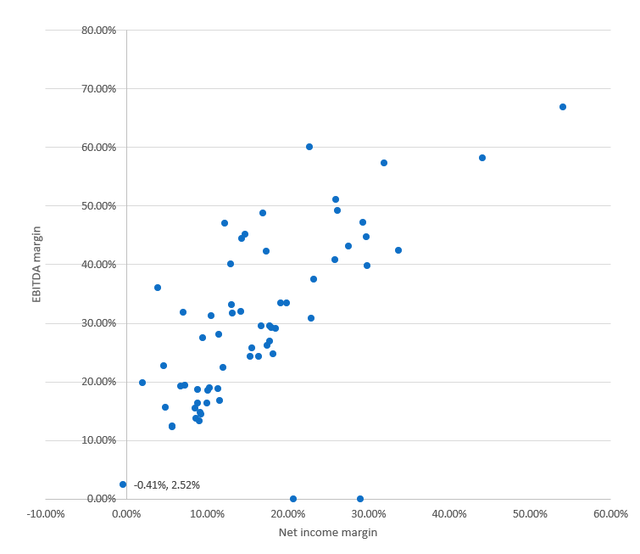

At the same time, 98.4% of the portfolio has a B- rating or better, a phenomenal result supporting the point the fund clearly succeeded in the selection of only top-notch quality names. Next, the median EBITDA margin is over 29%, while the median net earnings margin is above 14%. The scatter plot below is supposed to provide some context.

Created by the author using data from Seeking Alpha and the fund

The only loss-making company is The Allstate Corporation (ALL), which has a 78 bps weight; zero EBITDA margins are shown for two financial sector stocks.

Next, debt, which is a factor not to ignore in the era of capital scarcity, is also on an acceptable level, as ~73.4% of the holdings have a Total debt/EBITDA ratio at or below 3x.

Finally, speaking of the growth factor, investors seeking strong expansion stories should look elsewhere. Just two holdings are forecast to deliver over 20% forward revenue growth, namely Analog Devices (ADI) and Pfizer (PFE), while only seven names (16.7%) are anticipated to achieve over 10% EBITDA growth.

Dividend credentials

The table below combines Quant Dividend grades and yield data for the top 20 holdings. As you can see, most have exemplary safety, growth, yield, and consistency ratings, with the only exception being Starbucks (SBUX).

Created by the author using data from Seeking Alpha and the fund

The minor disappointment is that the ETF does not appeal to investors seeking generous yields, with a median DY of only 3.2%, which is the direct consequence of the quality premia.

A brief look at the performance

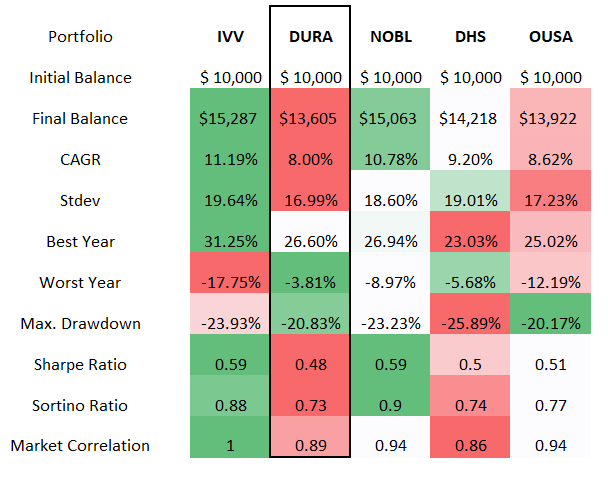

Incepted in October 2018, the fund has delivered an 8% CAGR during the November 2018 – October 2022 period, the worst result in the peer group, and also more than 3% lower than IVV’s rate despite the fact the S&P 500 is down in double digits YTD; unfortunately, the risk-adjusted returns (the Sharpe, Sortino ratios) are also the worst.

I believe this is mostly the consequence of the value factor; in 2020, DURA demonstrated performance typical for portfolios of cheaper old-economy companies that fell out of favor with investors who were flocking to the frothier corners of the market chasing appealing growth stories. Back then, it advanced by 8 bps, while IVV was up 18.4%. The reason why it also failed to beat NOBL, OUSA, and DHS over that period is that its holdings did not fully benefit from the tailwinds of the 2021 capital rotation, which was not the case for the peers.

Created by the author using data from Portfolio Visualizer

Conclusion

DURA’s equity mix is tilted towards high-quality, mostly adequately valued (as illustrated by the debt-adjusted yield), slowly growing U.S. heavyweights. This is a basket dividend-focused investors might find appealing. Yet the presence of too-expensive stocks is still a major risk. Its past performance is also far from being convincing, even though this year the ETF has been chugging along, defying bearish pressure.

Summing up, DURA did a fairly solid job balancing the value factor and the quality premia. Yet I do not see a completely safe profile that could secure a Buy rating. For now, DURA is a Hold.

Be the first to comment