Sundry Photography

DuPont de Nemours (NYSE:DD) delivered an earnings beat for the third quarter of 2022. Adjusted earnings came in at $0.82 per share, on revenue of $3.3 billion. This compared favorably to the consensus forecast for adjusted EPS of $0.79 and revenue of $3.2 billion.

The latest set of results came amid the rising value of the dollar, which acted as a headwind on revenues. With nearly three-quarters of its revenues generated from outside the United States, DuPont has a high exposure to foreign currency movements.

Organic sales increased 11% against the third quarter last year, with double-digit growth seen in semiconductor technologies, shelter, water solutions and safety. However, currency headwinds knocked off 4% of its dollar revenue, while divestitures resulted in a further 3% reduction. As such, net sales in dollar terms were just 4% higher on Q3 2021.

Rogers Acquisition Terminated

Earlier this month, DuPont announced that it terminated its $5.2 billion acquisition of Rogers Corporation (ROG), after the merger failed to win Chinese antitrust approval before the November 1 deadline. Arbitrage investors were caught off guard, as they had expected it had been highly likely that DuPont would seek an extension to the timing of the deal.

When it announced the deal in November last year, DuPont said the Rogers acquisition would give it greater exposure to the fast-growing electric vehicle market. The inability to gain timely regulatory approval, however, convinced the board to abandon the deal. DuPont expects to pay a termination fee of $162.5 million.

Rogers’ stock has more than halved since the announcement, reflecting the scale of the surprise. In contrast, investors reacted more positively to DuPont. Its stock climbed 3.1% on the day following the announcement, reflecting investors’ preference that the company would instead return more capital to shareholders.

DuPont sold its former Mobility & Materials business to Celanese (CE) for $11 billion in cash, in order to fund the Rogers acquisition. As such, the company is now in a substantial excess capital position, given the absence of suitable alternative acquisition targets.

$5 Billion Increase For Stock Buybacks

Today, the company confirmed that it would indeed return more capital to shareholders, with the announcement of a new $5.0 billion share repurchase program and a reduction of $2.5 billion in long-term debt. This comes on top of its already announced $3.25 billion share repurchase plan, which brings the total value of stock buybacks from the M&M sale to $8.25 billion. DuPont stock climbed as high as 11% in trading on Tuesday morning, reflecting investors’ delight.

Year-to-date, DuPont has already returned $1.63 billion to shareholders via dividends and share repurchases – equivalent to 97% of net income during the first nine months of 2022.

Technology Trends

DuPont’s remaining operations continue to demonstrate resilience despite the challenging macroeconomic environment. It already has strong exposures to fast-growing markets, including semiconductors, EV, and water infrastructure.

DuPont Q3 Earnings Call Presentation

Technology transition drivers in many key end-markets underpin DuPont’s potential for growth. In the semiconductor sector, demand growth is supported by long-term trends in AI, high-performance computing, and improved connectivity via 5G and the increasing prevalence for the internet of things (IoT). As chips become more advanced, they also require enabling technology, which increases demand for the kind of high-performance materials which DuPont manufactures.

Elsewhere, the water business is poised to benefit from growing demand for clean water and wastewater treatment solutions due to trends in health and wellness, regulation, urbanization, and climate change. A high replacement base for many products, such as filters, membranes, and resins also reduces DuPont’s business cyclicality.

Operating Environment

Against inflationary cost pressures and foreign currency headwinds, margins have held up well – operating EBITDA margin climbed 30 basis points in the quarter, from a year ago. This reflected price increases, which were enough to offset the broad-based surge in commodity prices. And despite this, volumes have held up well too. The year-on-year organic sales growth of 11% was driven by a 3% increase in volumes, while price increases attributed to 8% of sales.

Price increases reflect strong underlying demand in key end-markets, as well as the wide economic moat of DuPont’s specialty chemicals business. This is underpinned by its leading market position in much of what it does and its innovation-led differentiation which enables it to offer reliable, high-performance solutions.

However, the operating environment could get tougher still. The company updated its full year guidance today, with revenue, EBITDA and EPS now expected to come in at the lower ends of its previous targets. Guidance for net sales in FY 2022 has been revised to around $13.0 billion, from its previously guided range of $13.0 – $13.4 billion. Meanwhile, operating EBITDA is now expected at around $3.25 billion, compared to $3.25 – $3.35 billion, and adjusted EPS is guided at around $3.30, from $3.27 – $3.43 previously.

DuPont Q3 Earnings Call Presentation

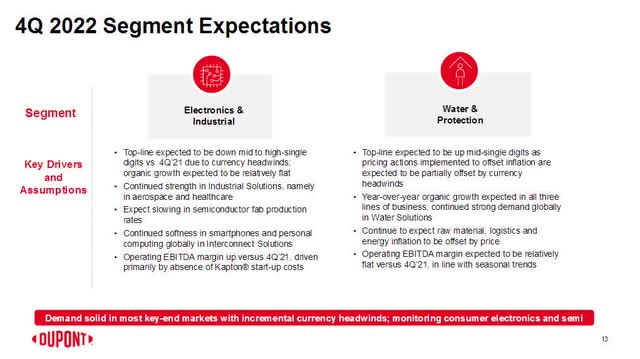

“For the fourth quarter, we expect demand to remain strong in most end-markets, notably water, industrial and auto adhesives, but do anticipate continued softness in consumer electronics globally and some expected slowing in customer semiconductor fab production rates. Further, we plan to reduce our production rates to realign working capital in anticipation of a more normal supply chain environment. Lastly, we expect incremental currency headwinds to further impact both top and bottom-line results.”

Chief Financial Officer Lori Koch, DuPont Q3 Earnings Call

Incremental currency headwinds are expected to have a further impact on the company’s financial performance, with the company expecting to take an additional $150 million hit due to the strong dollar.

The weaker earnings outlook for Q4 2022, however, did little to dampen the mood – today’s stock price performance largely focused on the announcement of a new share repurchase program. With a market capitalization of around $33 billion, a further buyback of $5 billion worth of DuPont stock would reduce its share count by roughly 15%. As such, it would give EPS a big boost when completed, and eventually more than offset its currency headwinds. At which point, cost pressures may begin to subside – there are already early signs that commodity prices are beginning to normalise.

Final Thoughts

Despite headwinds from mainly macroeconomic factors, DuPont still has an attractive franchise in the specialty chemicals sector. Softness in smartphones and personal computing sales will likely dampen expectations in the short term, but underlying fundamentals remain largely intact on secular growth trends in a number of key end-markets.

Be the first to comment