LIKE HE/iStock via Getty Images

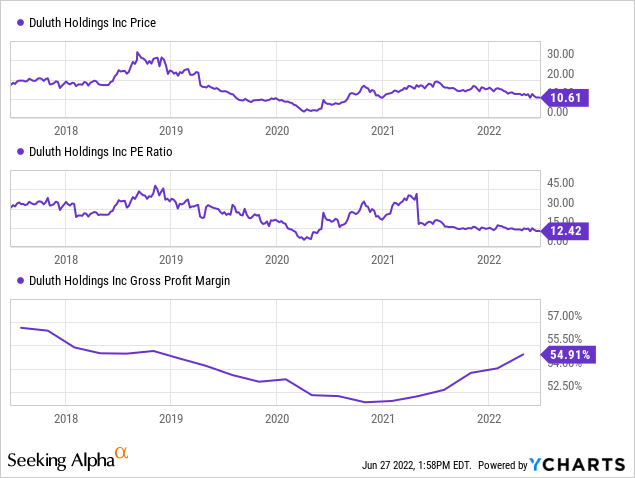

Duluth Holdings (NASDAQ:DLTH) has had a tumultuous run as a public company since its IPO in 2016. The maker of quality outdoor clothing with a strong brand presence hasn’t been the stock many predicted. The company has had strong runs in both 2016 and 2018 as the share price swung to as high as $35.25 in the past. However, execution struggles amid its omnichannel expansion have led to a very volatile stock over the past six years. The stock price has languished with shares currently trading at $10.61 – a 12.4 x PE for a company with growth potential. It hasn’t helped that small-cap companies have been largely ignored over the past year in favor of more stable large companies in an uncertain environment. Other reasons why include several missteps by management in implementing the dual store and online model, as well as issues with shrinking margins from excessive markdowns. However, the company has made strides recently since the pandemic, and the stock valuation has disconnected from the improving fundamentals.

Margins matter

The company sells a premium priced product direct to consumers, with the advantage of structurally high margins as a result. The good news is while the company saw margins decline from 57.64% in 2016 to a low of 51.82% in October 2020, they have rebounded lately. Margins have increased now for six straight quarters to 54.91%. This is important because the company has been expanding and running at a low operating margin level, meaning every few percentage points of gross margin has a large impact on the underlying profitability of the business. A big part of this was clearance inventory being down a staggering 70% over last year, allowing for a big portion of the 470 basis point margin gain. This is also due to a higher portion of first-time buyers that tend to buy full-priced items, and more repeat purchases from that segment of buyers.

One concern many apparel companies have seen is inventory build-ups, which can often precede markdowns. You want your inventory lean so as to prevent SKUs that proved less popular to not hurt your margins. However, this is partially due to companies ordering more upfront due to supply chain issues and air freight. The company is comfortable with current inventory levels of $152 million up around 25% from $122 million last year at this time. This is something to watch going forward as more increases in inventory could be received negatively by the market with the consumer weakening over time.

On the less positive side, the company saw a decline in sales over last year with $122.9m in sales, down from $133.4m in Q1 2021. This is comparing to a quarter that had $1400 stimulus checks which were a boost to the prior year. The big question is looking towards the later part of this year, can DLTH regain sales momentum with these improving margins? The company called out specifically not having as much promotional activity and more stable pricing which is a bullish signal. In-store sales were actually slightly higher over the prior year at 0.4%, with most of the lost revenue in the quarter coming from online at -12.1%. The company did also note that it laid off some advertising as they were waiting for inventory to arrive at points during the quarter. After the quarter in April and May sales were up high single digits, showing a promising rest of the year.

Investments to pay dividends… eventually

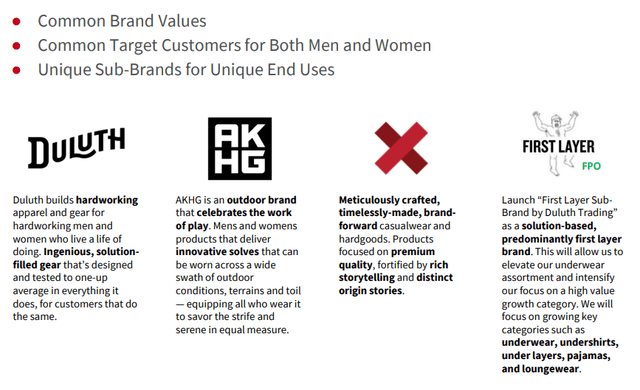

Duluth has been consistently investing in the underlying business in the past several years without much credit from Wall Street. The company has recently rebranded their popular Alaskan Hardgear brand to AKHG and ‘Duluth’ is now the company’s core workwear item known for durability and quality. These kinds of changes often pay dividends over time as they increase brand awareness and segmentation for companies. Digital advertising is more effective when the company has a more laser-focused marketing message which the new rebranding has allowed. The more affluent outdoorsman demographic has increased in recent years, with a significant boost with the pandemic in camping, hiking and hunting. One of the other recent additions is ‘Best Made’ products which had a 30% revenue growth rate from a small base. These brand initiatives are things that lacked several years ago when the company was more focused on simply opening additional stores. Now the company is firmly focused on the nitty-gritty of margins, branding and of course fulfillment. The costs for these marketing changes were only 10% of total sales. It will have benefits in both customer acquisition as well as increasing avenues for future growth.

Duluth Brands (Duluth Q1 presentation)

Fulfillment has become a larger focus at Duluth in recent years after overhauling of systems. CEO Sam Sato pointed out on the Q1 conference call, “The investments we are making in merchandising toolsets will ground our capability to continue driving efficiencies on how we plan, buy, and seamlessly move from one season to the next. The enhanced systems will allow for quicker and more insightful assortment decision.” The fulfillment facility in Salt Lake City was implemented in 2021 and will see dividends over the coming years as the company ramps sales. Software investments of $40 million this year, largely to increase the quality of data gained on customers to adapt to the realities of modern business. These investments are all necessary as the competition will continue to improve efficiencies, and you need those advantages to compete. The past year the upfront cost has lowered the profitability of Duluth which will be paid back in time.

Conclusion

While on the surface the results may not seem exceptional, under the hood DLTH has made good progress on upscaling the business. The company is leaner with a supply management system capable of scaling into a $1 billion revenue business and beyond. The stock has been punished due to its consumer cyclical nature, but it is due for a significant rebound in the second half of 2022, and I am buying shares on recent weakness. Positions under $15 should be happy with their purchase in the future, when small-cap and consumer companies come back into favor.

Be the first to comment